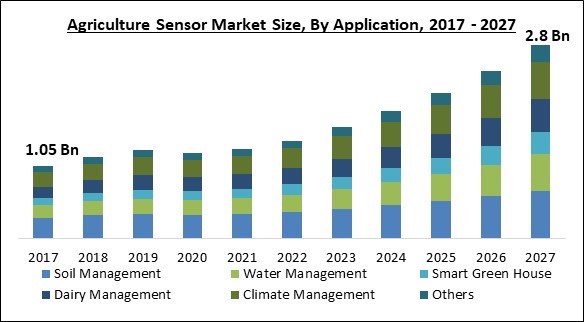

The Global Agriculture Sensor Market size is expected to reach $2.8 billion by 2027, rising at a market growth of 13.7% CAGR during the forecast period.

Agriculture sensors are mainly used in the smart farming. These sensors provide data that helps the farmers in monitoring & optimizing crops by knowing about the environmental condition & making changes accordingly. Agriculture sensors are installed on drones, robots and weather stations in the agriculture sector. These sensors are controlled through mobile apps designed for this specific purpose.

These sensors are also known as active sensors as they emit their light to the plant canopy along with measuring the percentage of light reflected by the canopy onto the sensor. The sensor enables the farmer to maximize their yields with the use of minimal resources. Agriculture sensors help the farmers to know about the plant in a detailed manner in order to reduce the use of resources & reduce environmental pollution.

Moreover, these sensors are used for various purposes like yield monitoring & mapping, irrigation & water management, soil monitoring and disease control & detection. The yield monitoring technologies provide data regarding yield ability that may vary within the field. Various farming equipment use these technologies to increase productivity by incorporating them into their harvesters. The agriculture sensors reduce the need for human efforts as it automate the critical processes which include information sharing, real time farm monitoring. Also, these sensors are used to know about nutrient deficiencies by managing & monitoring soil health.

The IoT technology has improved the industry has improved many industries by providing real time insight, data collection & automation of various activities. The IoT based agriculture sensors enable the farmers to know when the crop is going to ripe, the quantity of water being used & whether the crop requires more fertilizers or any other input.

The outbreak of the COVID-19 pandemic has adversely affected the world. Various restrictions on the movement of goods along with the complete lockdown imposed by the government of different countries to restrict the growing number of COVID-19 cases had caused disruptions in the supply chain. The pandemic had a negative impact on the agriculture senor market. The disruption in the supply chain has resulted in a lack of equipment and a decline in demand for the agriculture sensors.

Although, the remote sensors & farm management tools are expected to be in high demand post COVID-19 period, various companies are trying to adopt innovative ways to interact with farmers & other stakeholders by technology. Companies are focusing on providing innovative products such as wireless platforms for crop health monitoring, field mapping, crop management & irrigation planning.

Continue fluctuating climate conditions & less availability of skilled labor force has compelled farmers to adopt advanced solutions and thus, surge the demand for new farming techniques to overcome these challenges in indoor farming. The agriculture sensors with small scale control systems have strong functionality that allows the farmers to automate various activities in order to enhance production. Also, the drones are equipped with sensors & cameras with the purpose of mapping, imaging & surveying the crop.

The adoption of agriculture sensor may reduce the need of labor force. The large sized industrial indoor farms are adopting agriculture sensors that are capable of sensing water combination, pesticidal residues, etc. The sensors are integrated with water pumps which further helps in sprinkling water based on the data provided which reduces the need of labor to firstly detect the quantity of water required to the crop.

Smart farming is gaining immense popularity in both service & product perspectives. The continuous changes in the organizational changes and business model transformation are increasing the adoption of smart farming technologies such as the agriculture sensor. Also, the enhanced software & hardware technology like robotic automation and the introduction of smart sensors is providing an innovative way to perform agricultural activities.

Furthermore, the government of different countries is collaborating with agro processing organizations, financial institutions and food & beverage manufacturers for the growth of smart farming activities and technologies. Also, the adoption of precision farming technologies is growing continuously in order to get the economic benefits by reducing the amount to be spent by controlling the use of agricultural inputs.

The agriculture sensors are capable of reducing the amount to be spent on the resources by reducing their consumption, but the adoption of these sensors involves a large amount to be spent initially. There is a requirement of skilled staff in order to operate the sensors. Also, proper maintenance of hardware as well as software will involve cost, which will ultimately result in increased amount requirement to use agriculture sensors. Moreover, the agriculture industry consists a large number of small & middle class farmers with less income. This less income and relatively poor financial condition of these groups do not allow them to invest to such a high amount in advanced technologies such as agriculture sensors.

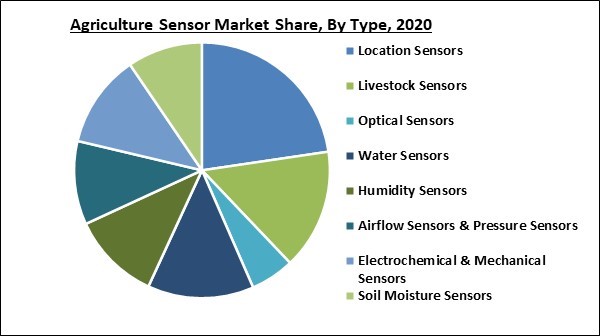

Based on Type, the market is segmented into Location Sensors, Livestock Sensors, Optical Sensors, Water Sensors, Humidity Sensors, Airflow Sensors & Pressure Sensors, Electrochemical & Mechanical Sensors, and Soil Moisture Sensors. Further, Soil Moisture Sensors are divided on the basis of Tensiometers, Granular Matrix Sensors, Capacitance Sensors, Probes, and Time-domain Transmissometry (TDT) Sensors & Gypsum Blocks. The livestock sensors segment acquired a significant revenue share in the agriculture sensor market in 2020. These are the IoT enabled sensors that help in tracking & monitoring the health of livestock. The stakeholders are able to know the location, blood pressure, heart rate & blood pressure of animals & wirelessly by using a wearable tag or color.

Based on Application, the market is segmented into Soil Management, Water Management, Smart Green House, Dairy Management, Climate Management, and Others. In 2020, the soil management segment recorded the maximum revenue share in the agriculture sensor market. The major factors driving the growth of this segment are the availability of enhanced monitoring systems, and the rising focus of government towards water conservation to enhance the quality of crops.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 1.05 Billion |

| Market size forecast in 2027 | USD 2.8 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 13.7% from 2021 to 2027 |

| Number of Pages | 275 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the North America region dominated the agriculture sensor market with the highest revenue share. This can be attributed from a large number of soil moisture manufacturers present in the United States. Furthermore, the growing adoption of precision farming & yield monitoring activities is another factor responsible for the market growth in North America region.

Free Valuable Insights: Global IoT in Agriculture Sensor Market size to reach USD 2.8 Billion by 2027

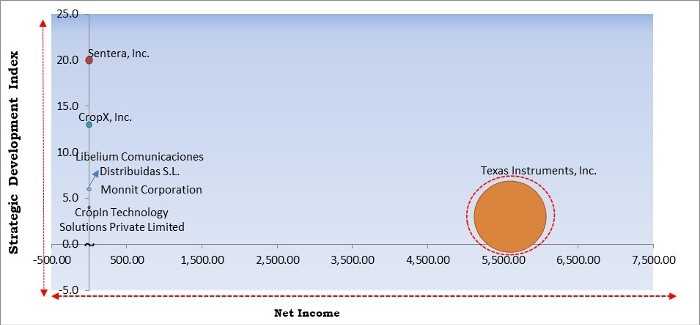

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Texas Instruments, Inc. is the major forerunner in the Agriculture Sensor Market. Companies such as CropX, Inc., Sentera, Inc. and CropIn Technology Solutions Private Limited are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include CropIn Technology Solutions Private Limited, CropX, Inc., dol-sensors a/s, Sentera, Inc., Monnit Corporation, Texas Instruments, Inc., Glana Sensors AB, Libelium Comunicaciones Distribuidas S.L., Pycno Agriculture, and Sensaphone.

By Type

By Application

By Geography

The global agriculture sensor market size is expected to reach $2.8 billion by 2027.

Growing trend of smart farming are driving the market in coming years, however, high initial Investment have limited the growth of the market.

CropIn Technology Solutions Private Limited, CropX, Inc., dol-sensors a/s, Sentera, Inc., Monnit Corporation, Texas Instruments, Inc., Glana Sensors AB, Libelium Comunicaciones Distribuidas S.L., Pycno Agriculture, and Sensaphone.

The Location Sensors segment is leading the Global Agriculture Sensor Market by Type in 2020; thereby, achieving a market value of $558.2 million by 2027.

The North America is fastest growing region in the Global Agriculture Sensor Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.