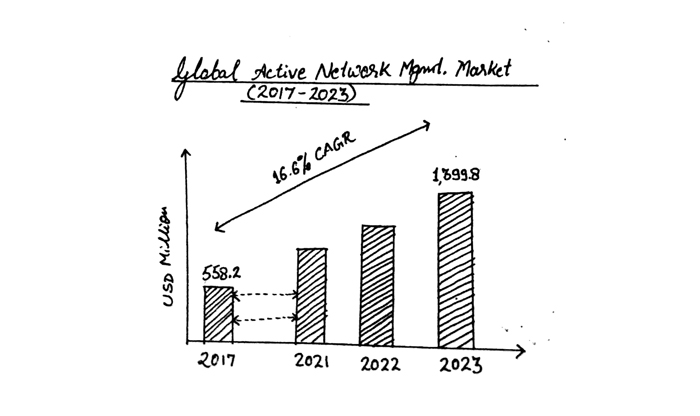

The Global Active Network Management Market size is expected to reach $1.3 billion by 2023, rising at a market growth of 16.6% CAGR during the forecast period. Active network management provides advanced power distribution capabilities by monitoring and controlling several energy infrastructure components such as renewable energy generation, power storage devices, generators, and some others. Automation and grid asset monitoring are the primary applications of the active network management system. Active network management has been in trend and has been a top priority for many industries, primarily due to its ability to optimize energy distribution management. The active network management market would witness unprecedented growth due to growing demand for high grid stability, real-time evaluation, and need for automation in power management solutions. Future energy networks should be flexible and accessible, resulting in very efficient and reliable power delivery with open access to the members of the network and optimal use and asset management.

The increase in demand for active network management is anticipated to drive the global expansion of active network management market among end users industries through enhanced uptime, reliability, and alarm monitoring and active notifications. Active network management is a trend and is a top priority for many industries, mainly because of the ability to optimize management of energy distribution.

The solutions currently in place and proposed are generally a combination of ANM and protection systems, but under certain conditions, they can render every independent system vulnerable to incorrect operation because of the nature of the other.

Market Segments

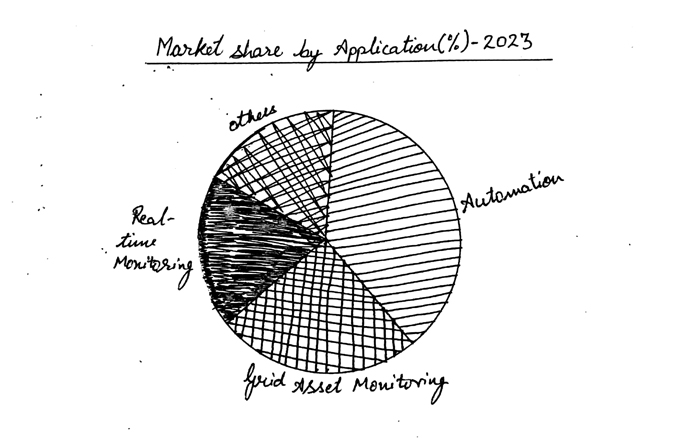

Based on Types, the market report segments the market into Software and Services. Based on Applications, the Global Active Network Management market segments the market into Grid Asset Monitoring, Real Time Monitoring, Automation, and Others. Based on Verticals, the market report segments the market into Energy & Utility, Government, Transportation, and Others. Based on Regions, the Global Active Network Management market segments the market into North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

The market research report covers the competition analysis of key stake holders of the Global Active Network Management Market. Key companies profiled in the report include BB Ltd., Chemtrols Industries Pvt. Ltd., Cisco Systems, Inc., General Electric Company, IBM Corporation, Kelvatek Ltd., Oracle Corporation, Schneider Electric, Siemens AG, and Smarter Grid Solutions.

What is Active Network Management?

Active networking is a communication pattern that allows packets to dynamically modify the network operation flowing through a telecommunications network. Active network architecture consists of execution environments, an operating node system that supports one or more execution environments.

It also includes active hardware that can route or switch as well as execute code within active packets. This differs from the traditional network architecture that seeks robustness and stability by trying to remove complexity from underlying network components and the ability to change its fundamental operation. One way to implement the concept of active network management is through network processors.

Active network management provides advanced power distribution capabilities by monitoring and controlling several components of energy infrastructure such as the generation of renewable energy, power storage devices, generators, and others. The main applications of the active network management system are automation and grid asset monitoring. It creates an intellectual energy infrastructure that automatically controls different energy network components and provides information to ensure optimal control of all systems.

Why do we need Active Network Management?

Due to high grid stability, real-time evaluation, automation options, and intuitive operation, the active network management growth is expected to sprout at a significant rate. Furthermore, easy detection of faults, prevention of breakdowns and increased need to automate devices are driving the developments in active network management market space.

The increase in demand for smart energy management solutions and the increase in ICT expenditure are expected to increase growth potential. The prominent economies within developed nations provide the global active network management industry with growth opportunities. In addition, growth in the adoption of real-time grid monitoring is anticipated in the near future to fuel the growth active network management

Where do we see Active Network Management?

Active Network Management (ANM) has emerged as a separate group of various application areas and solution architectures for DER control and management. The emerging, deployed state of the art is more closely defined as a direct and autonomous control method to be applied to the distribution grid that does not require system-wide monitoring and data issues to be resolved, but rather involves the gradual layering of modern information and communications technology (ICT) to implement autonomous control of distribution grid components.

Related Reports:

North America Active Network Management Market (2017-2023)

Europe Active Network Management Market (2017-2023)

Asia Pacific Active Network Management Market (2017-2023)

LAMEA Active Network Management Market (2017-2023)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.