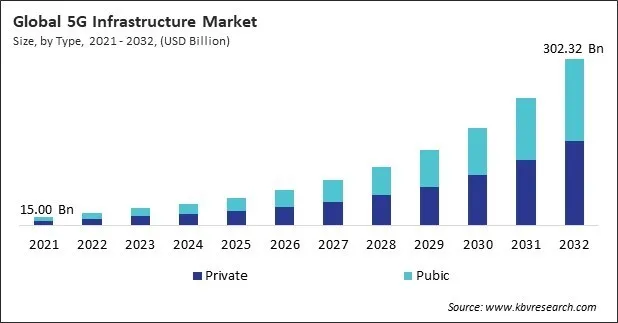

“Global 5G Infrastructure Market to reach a market value of USD 302.32 Billion by 2032 growing at a CAGR of 29.2%”

The Global 5G Infrastructure Market size is expected to reach $302.32 billion by 2032, rising at a market growth of 29.2% CAGR during the forecast period.

Private segment is particularly attractive to industries such as manufacturing, logistics, mining, energy, and healthcare, where low-latency, ultra-reliable, and high-bandwidth communications are essential for mission-critical operations, industrial automation, and IoT deployments. The growth of the private 5G segment is further fueled by the availability of unlicensed and shared spectrum (such as CBRS in the U.S.), regulatory support, and advancements in network slicing, edge computing, and open RAN.

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2024, Nokia came into partnership with Taiwan Mobile to launch an enhanced 5G network and upgrade 4G infrastructure. The collaboration includes deploying AirScale, Massive MIMO, and Carrier Aggregation technologies, aimed at improving capacity, coverage, and sustainability for Taiwan Mobile's 10 million customers. Moreover, In November , 2024, CommScope partnered with the Cleveland Cavaliers to enhance 5G connectivity at Rocket Mortgage Fieldhouses using its ERA DAS system. This all-digital solution supports all 5G spectrum bands, improving fan experiences with seamless mobile connectivity and reducing operational footprints.

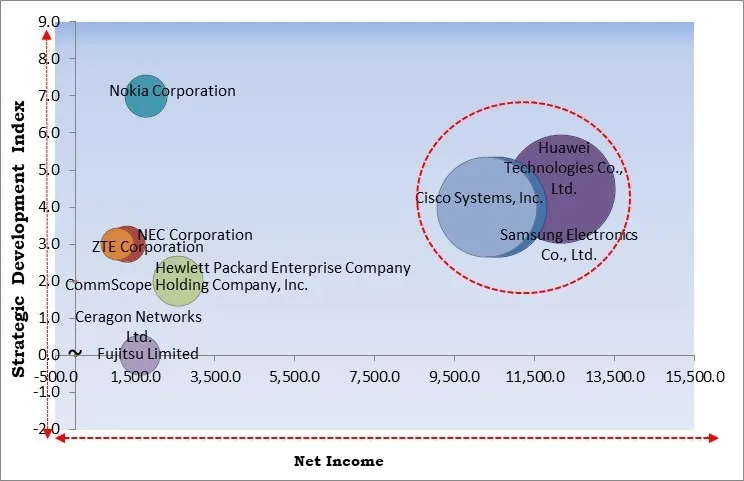

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd. and Cisco Systems Inc. are the forerunners in the 5G Infrastructure Market. In January, 2025, Huawei Technologies Co., Ltd. came into partnership with MTN and China Telecom to deploy Africa’s largest 5G private network for a South African mining company. This collaboration enhances connectivity, supports automation, and advances 5G infrastructure, driving digital transformation while ensuring environmental sustainability and industry innovation. Companies such as Hewlett Packard Enterprise Company and Nokia Corporation are some of the key innovators in 5G Infrastructure Market.

Governments worldwide are crucial in accelerating 5G deployment by allocating spectrum, funding research, and easing regulations to facilitate network expansion. By providing financial incentives and regulatory support, they ensure faster, more efficient rollouts of 5G infrastructure. Spectrum allocation is critical for enhancing connectivity, reducing latency, and supporting emerging technologies like IoT, AI, and edge computing. Hence, as global demand for high-speed, ultra-reliable connectivity continues to rise, government-backed 5G initiatives will be crucial in shaping the future of digital transformation, enabling advancements in autonomous vehicles, AI-driven automation, telemedicine, and industrial IoT.

Additionally, The rapid expansion of the Internet of Things (IoT) is transforming industries and everyday life by enabling a vast network of interconnected devices that communicate in real-time. According to the World Bank’s Digital Progress and Trends Report 2023, in 2022, more than 13 billion IoT devices were in use. Driven largely by the real-time connectivity of 5G technology, these devices are expected to more than double between 2023 and 2028. Thus, as IoT continues to grow, the demand for 5G infrastructure will surge, enabling a future where seamless connectivity and intelligent automation drive innovation across every industry.

However, Unlike previous generations, 5G relies on a dense network of small cells rather than large cell towers, requiring extensive investments in infrastructure. Telecom operators must deploy thousands of small cell stations on streetlights, buildings, and utility poles to ensure seamless connectivity, significantly increasing capital expenditures. Additionally, fiber-optic cables play a crucial role in providing high-speed backhaul for data transmission, but many regions lack the necessary infrastructure, forcing providers to invest in laying new fiber networks. Hence, these cost constraints may impede the expansion of the market.

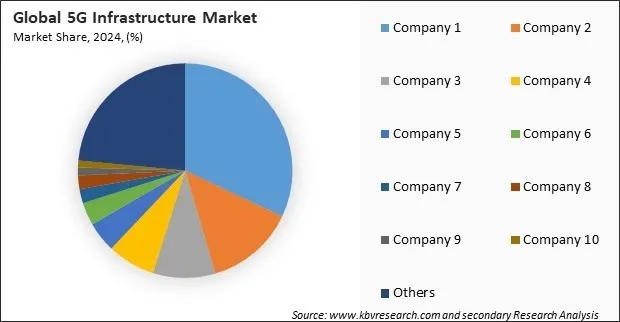

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Free Valuable Insights: Global 5G Infrastructure Market size to reach USD 302.32 Billion by 2032

On the basis of type, the market is classified into public and private. Telecom providers invest heavily in 5G rollouts, aiming to provide nationwide coverage for smart cities, mobile broadband, and digital services. The adoption of 5G-enabled devices, streaming services, online gaming, and cloud-based applications is fueling the expansion of public 5G networks, allowing users to experience seamless, ultra-fast internet connectivity.

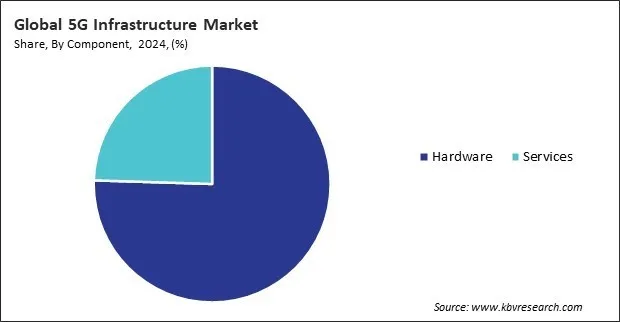

Based on component, the market is bifurcated into hardware and services. With the complexity of 5G networks requiring software-defined networking (SDN), network slicing, and cloud-native architectures, service providers played a crucial role in consulting, integration, and managed services. The rising demand for private 5G networks in manufacturing, healthcare, and smart cities also created opportunities for service providers to offer customized solutions and support.

By spectrum, the market is divided into sub-6 GHz and mmWave. mmWave, which operates in 24 GHz to 100 GHz frequency bands, delivers multi-gigabit speeds and extremely low latency, making it ideal for autonomous vehicles, AR/VR, high-speed broadband, and ultra-HD video streaming applications. Additionally, fixed wireless access (FWA) services, which provide fiber-like speeds without extensive infrastructure investment, gained traction, contributing to mmWave's revenue growth.

Based on network architecture, the market is segmented into standalone and non-standalone. SA networks operate on a dedicated 5G core, making them ideal for industries requiring high security, automation, and real-time data processing. Sectors such as healthcare, automotive, smart cities, and industrial automation are increasingly adopting SA networks to support applications like AI-powered analytics, autonomous vehicles, and remote surgery.

On the basis of vertical, the market is further classified into residential, enterprise/corporate, smart city, industrial, transportation & logistics, public safety & defense, healthcare facilities, retail, agriculture, energy & utility, and others. Consumers increasingly rely on 5G home broadband and fixed wireless access (FWA) for buffer-free video streaming, cloud gaming, and seamless connectivity across smart home devices. The growing penetration of 5G-enabled smartphones, smart TVs, and AI-powered voice assistants is accelerating demand for residential 5G services.

The 5G Infrastructure Market sees intense competition among regional telecom vendors, startups, and niche technology providers. These companies emphasize innovation in small cells, open RAN, and edge computing to meet localized demands. The absence of dominant players creates space for collaboration and experimentation, driving agile deployments and diverse solutions across industries, though challenges in scalability and standardization persist.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed 41% revenue share in the market in 2023. Countries like China, South Korea, Japan, and India have aggressively deployed 5G networks with substantial investments from telecom operators and governments. China leads in base station installations, spectrum allocation, and industrial 5G applications, while South Korea and Japan have pioneered smart city initiatives and 5G-enabled consumer technology.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 39.48 Billion |

| Market size forecast in 2032 | USD 302.32 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 29.2% from 2025 to 2032 |

| Number of Pages | 487 |

| Number of Tables | 743 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Spectrum, Component, Network Architecture, Vertical, Region |

| Country scope |

|

| Companies Included | Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Samsung Electronics Co., Ltd. (Samsung Group), ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Fujitsu Limited, CommScope Holding Company, Inc., Ceragon Networks Ltd., and Hewlett Packard Enterprise Company |

By Type

By Component

By Spectrum

By Network Architecture

By Vertical

By Geography

This Market size is expected to reach $302.32 billion by 2032.

Increasing Government Support And Spectrum Allocation are driving the Market in coming years, however, High Infrastructure, Spectrum, And Maintenance Costs restraints the growth of the Market.

Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Nokia Corporation, Samsung Electronics Co., Ltd. (Samsung Group), ZTE Corporation, Cisco Systems, Inc., NEC Corporation, Fujitsu Limited, CommScope Holding Company, Inc., Ceragon Networks Ltd., and Hewlett Packard Enterprise Company

The expected CAGR of this Market is 29.2% from 2023 to 2032.

The Non-standalone segment led the maximum revenue in the Market by Network Architecture in 2024, thereby, achieving a market value of $158.7 billion by 2032.

The Asia Pacific region dominated the Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $126.3 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges