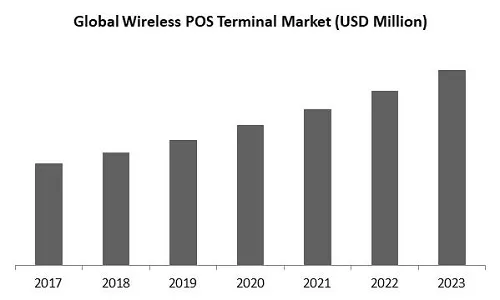

“Global Wireless POS Terminal Market to reach a market value of USD 25.24 Billion by 2032 growing at a CAGR of 8.7%”

The Global Wireless POS Terminal Market size is expected to reach $25.24 billion by 2032, rising at a market growth of 8.7% CAGR during the forecast period.

The wireless point-of-sale terminal market had developed substantially, supported by the rising preference for cashless, digital transactions, and technological advancements. Wireless POS devices leverage cellular networks, Bluetooth, Wi-Fi, and NFC technology to facilitate transactions anywhere, improving convenience for customers and merchants. Initially adopted in niche applications like unattended kiosks, and vending machines, wireless POS systems have expanded largely because of smartphone penetration, mobile connectivity, and contactless payment adoption. Modern wireless POS devices now integrate with digital wallets, business management tools, NFC payments, cloud-based payment processing, mobile wallets, supporting chip-cards, and providing functionalities such as CRM, real-time analytics, and inventory tracking. The expansion is also supported by rising focus on hygienic, contactless, and fast payment methods across transportation, retail, hospitality, and healthcare industries.

Recent market trends highlight a transformation towards mobile POS solutions, especially among mobile vendors, SMEs because of their affordability, portability, and ease of deployment. Wireless point-of-sale systems are largely integrated into wider ecosystems, offering loyalty programs, omnichannel commerce capabilities, and data-driven business intelligence, making them crucial to operations. Leading market players maintain competitiveness through integration of advanced connectivity, diversified hardware portfolios, omnichannel partnerships, SME-focused strategies, and robust security compliance. The market seems to be intensively competitive with agile fintech startups and software-enabled solutions emphasizing on integration, convenience, and secure digital payments.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2025, VeriFone Holdings, Inc. announced the partnership with PayPal, a financial technology company to offer enterprise merchants a comprehensive omnichannel payment acceptance solution, integrating Verifone’s in-person payment assets with PayPal’s e-commerce capabilities. Moreover, In January, 2025, VeriFone Holdings, Inc. announced the partnership with FreedomPay, a Platform as a service company, combining Verifone’s payment engine with FreedomPay’s security features to enhance transaction experiences and operational efficiency for merchants.

Based on the Analysis presented in the KBV Cardinal matrix; U.S. Bancorp is the forerunner in the Wireless POS Terminal Market. In January, 2025, U.S. Bancorp teamed up with Magwitch, a fintech company, to expand its point-of-sale lending offerings. This collaboration integrates U.S. Bank Avvance into Magwitch's lending-as-a-service platform, providing merchants with flexible financing options to meet consumer demand. Companies such as Fiserv, Inc., Square, Inc., and NCR Corporation are some of the key innovators in Wireless POS Terminal Market.

The Global Wireless POS Terminal Market was greatly affected by the COVID-19 pandemic, especially in early 2020. Factory closures, labour shortages, and logistics problems made it hard to get supplies and slowed down production. Retail, hospitality, transportation, and food services are some of the end-use sectors that saw fewer operations. This caused many businesses to put off planned POS upgrades because they weren't sure how their finances would be. Travel restrictions that made it hard for technicians to get to commercial sites also made it hard for them to install and deploy projects, which caused delays. Also, investment sentiment dropped across the payments ecosystem, which slowed down fintech projects and temporarily stopped people from using advanced wireless POS solutions. All of these things together caused a significant slowdown in market growth during the early stages of the pandemic. Thus, the COVID-19 pandemic had a negative impact on the market.

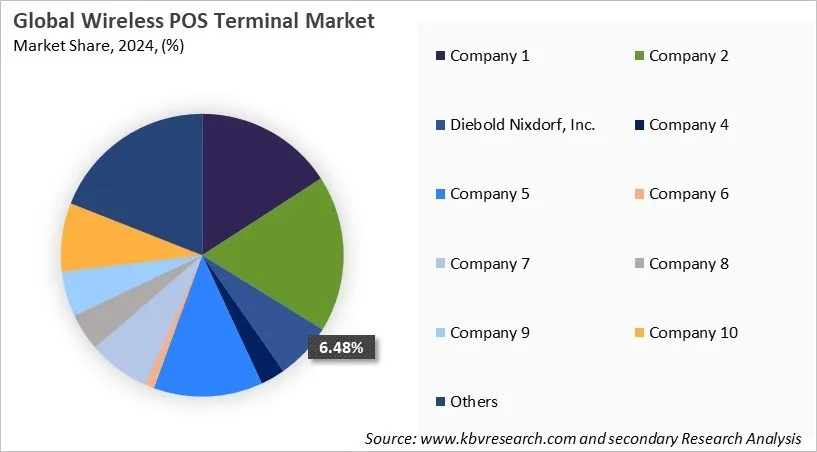

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Wireless POS Terminal Market size to reach USD 25.24 Billion by 2032

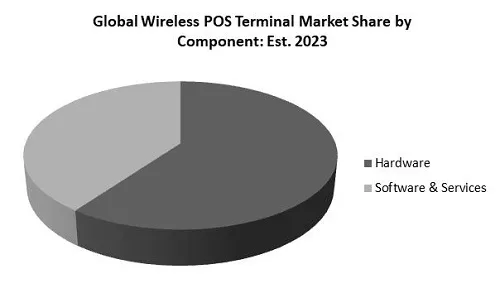

Based on Component, the market is segmented into Hardware and Services. The services segment attained 32% revenue share in the wireless POS terminal market in 2024. The services component in the wireless POS terminal market represents a wide spectrum of support offerings that help organizations effectively deploy, manage, and optimize their payment systems. This includes installation services, software updates, maintenance, technical support, training, and other value-added services that enhance system performance and ensure continuous operational efficiency.

Based on Type, the market is segmented into Portable Countertop & PIN Pad, mPOS (mobile POS), Smart POS and Other Type. The mPOS (mobile POS) segment recorded 30% revenue share in the wireless POS terminal market in 2024. The mPOS segment is characterized by handheld, mobile-driven payment solutions that operate through smartphones or tablets. These systems emphasize mobility and flexibility, making them suitable for businesses requiring on-the-go payment capabilities. They help streamline operations by allowing transactions to occur anytime and anywhere within a commercial setting, supporting quick service environments, small vendors, and field-based operations.

Region-wise, the wireless POS Terminal market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the wireless POS terminal market in 2024. In North America and Europe region, the wireless point-of-sale terminal market is projected to capture prominent share in the upcoming years. The market is shaped by consumer behaviour, infrastructure maturity, and technology adoption. In North America, the wireless POS terminal market is expanding due to widespread adoption of mobile wallets, contactless cards, and advanced digital-payment infrastructure. Wireless POS systems are largely integrated across hospitality, retail, healthcare and SMEs, with an emphasis on cloud integration, mobility, and improved security compliance. Moreover, Europe market is experiencing strong adoption, especially in nations with large cashless transactions penetration such as Germany, France, and the UK. European merchants largely leverage wireless POS for omnichannel and mobile commerce, deploying inventory management, analytics, and CRM.

The wireless point-of-sale terminal market is estimated to gain substantial growth in Asia Pacific and LAMEA. The growth in Asia Pacific is propelled by increasing smartphone penetration, government initiatives for financial inclusion, and booming retail and e-commerce industries. Wireless POS adoption is expanding among street vendors, mobile merchants, and SMEs, with mPOS devices offering mobile, di cost-effective, and digital wallet-enabled solutions. Furthermore. LAMEA wireless POS terminal market is witnessing rapid adoption backed by mobile payments, urbanization, and fintech expansion. Across Asia Pacific and LAMEA, providers focus on portable, low-cost POS systems that allow merchants to shift towards digital payments, along with providing cloud-based business management and value-added services with aim of supporting expansion.

There is a lot of competition in the market for wireless POS terminals because technology is changing quickly, merchants' needs are changing, and more industries are using them. Providers compete on how reliable their services are, how secure they are, how customizable they are, and how well they work with other payment systems. New companies often compete with established ones by offering new, flexible, or low-cost solutions. Established companies, on the other hand, focus on improving their software's features and adding value through services. As digital payments become more popular, competition is focusing more and more on providing a smooth user experience, being able to grow, and following changing rules and security standards.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 14.08 Billion |

| Market size forecast in 2032 | USD 25.24 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 8.7% from 2025 to 2032 |

| Number of Pages | 477 |

| Number of Tables | 383 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Type, Industry, Region |

| Country scope |

|

| Companies Included | VeriFone Holdings, Inc. (Francisco Partners), PAX Global Technology Limited, Diebold Nixdorf, Inc., U.S. Bancorp, Ingenico, Cegid Group, NCR Corporation, Stripe, Inc., Fiserv, Inc., and Square, Inc. (Block, Inc.) |

By Component

By Type

By Industry

By Geography

This Market size is expected to reach USD 25.24 Billion by 2032.

The wireless POS terminal market is projected to grow at a CAGR of 8.7% between 2025 and 2032.

Rising adoption of digital and contactless payments alongside mobile-first commerce, retail modernization, and on-the-go transactions.

VeriFone Holdings, Inc. (Francisco Partners), PAX Global Technology Limited, Diebold Nixdorf, Inc., U.S. Bancorp, Ingenico, Cegid Group, NCR Corporation, Stripe, Inc., Fiserv, Inc., and Square, Inc. (Block, Inc.)

The Portable Countertop & PIN Pad segment led the maximum revenue in the Global Wireless POS Terminal Market by Type in 2024, thereby, achieving a market value of $10.5 billion by 2032.

The North America region dominated the Global Wireless POS Terminal Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $8,294.4 million by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges