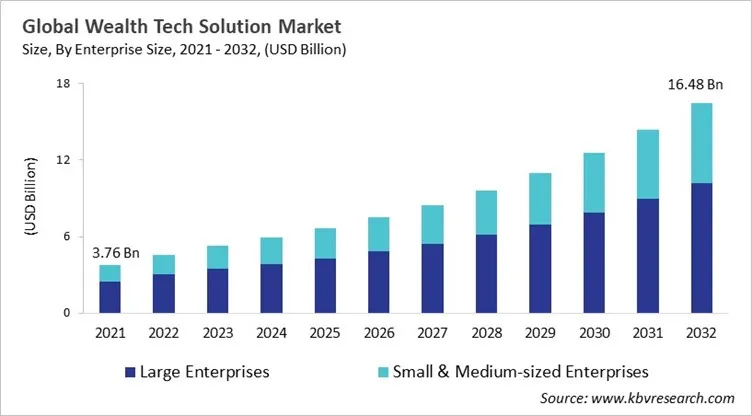

“Global Wealth Tech Solution Market to reach a market value of USD 16.48 Billion by 2032 growing at a CAGR of 13.9%”

The Global Wealth Tech Solution Market size is expected to reach USD 16.48 billion by 2032, rising at a market growth of 13.9% CAGR during the forecast period.

The wealth tech market has evolved into a digitally-driven ecosystem built on analytics, AI, and automation. Early adoption emphasized digital advisory tools, robo-advisors, and portfolio-management platforms as enterprises are seeking to reduce cost and cater to evolving customer expectations. With the expanding market, providers expanded into automated rebalancing, goal-based planning, mobile access, unified data aggregation, API-driven architectures, and cloud-native. The market has widened rapidly, with the increasing number of wealth-advisor technology firms. The key elements supporting the market growth are automation of advisor and back-office workflows, and deployment of digital assets, ESG, and tokenised investment options driven by cybersecurity, stronger governance, and compliance frameworks.

Key market players are transforming from point solutions to modular, integrated platforms that unify investment modelling, portfolio management, analytics, investment modelling, digital client experiences, and reporting. Data Analytics, and AI are utilized to accelerate advisor productivity, automate routine processes, and personalise recommendations, while tech-driven models are extending wealth management to a wider client segment through robo-advisory, mobile apps, and platform-as-a-service offerings. Acquisitions, partnerships, and ecosystem collaborations help enterprise expand capabilities and adapt to segmented legacy systems, with regulatory readiness and cybersecurity are main priorities. The market competition is intensifying with key fintech players and specialised start-ups positioning themselves by their capabilities to deliver seamless integration, end-to-end platforms, superior digital experiences, and scalable infrastructure.

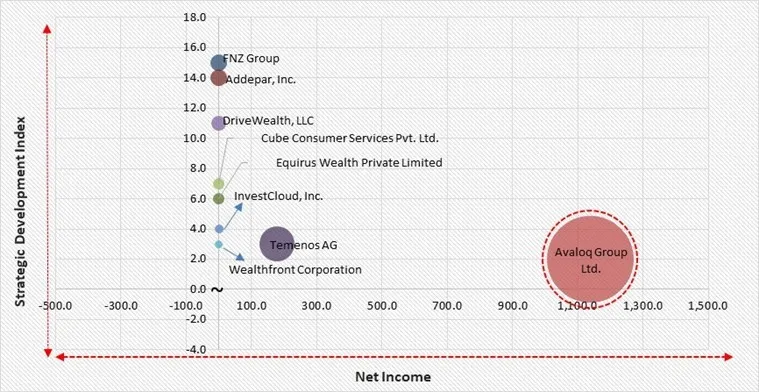

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In 2025, September, FNZ Group teamed up with AJ Bell, aiming to enhance digital investment services across the U.K. wealth management industry. The collaboration focuses on providing scalable, technology-driven wealth solutions that improve operational efficiency and client experience through FNZ’s integrated wealth management platform. Additionally, In 2025, March, DriveWealth, LLC partnered with Sharegain to offer securities lending solutions designed to comply with UK and EU financial regulations. The integration of Sharegain’s technology allows brokers and investors to participate in securities lending, aiming to increase transparency, ensure regulatory compliance, and improve efficiency in global wealth tech and capital markets.

Based on the Analysis presented in the KBV Cardinal matrix; Avaloq Group Ltd. is the forerunner in the Wealth Tech Solution Market. Companies such as Temenos AG, FNZ Group, and Addepar, Inc. are some of the key innovators in Wealth Tech Solution Market. In September 2025, Temenos AG unveiled its AI-powered “Money Movement & Management” platform, combining payments, accounts, risk, and treasury modules into a unified offering to help financial institutions streamline money flows, lower costs, and accelerate digital investment services. This opens new opportunities for wealth-tech firms to integrate advisory and money-movement capabilities.

At the height of the pandemic, the wealth-tech market slowed down quickly because investors and institutions put off making decisions about how to manage their wealth because of the increased economic uncertainty. Lockdowns made it harder for people to get advice in person, which slowed down the move of old clients to digital platforms. As asset values fell and income became less stable, investors lost faith. This made both mass-affluent and HNW clients more cautious. As a result, there were fewer new business opportunities, sales took longer, and demand stayed below what it was before the pandemic. Wealth-tech companies also had problems inside their own companies, such as having to work from home, changing compliance rules, and higher cybersecurity risks. These stresses made operations more complicated and expensive, which caused product launches to be delayed and the market to lose momentum. Overall, the sector's recovery took longer than expected because clients weren't as active and operations were disrupted. Thus, the COVID-19 pandemic had a negative impact on the market.

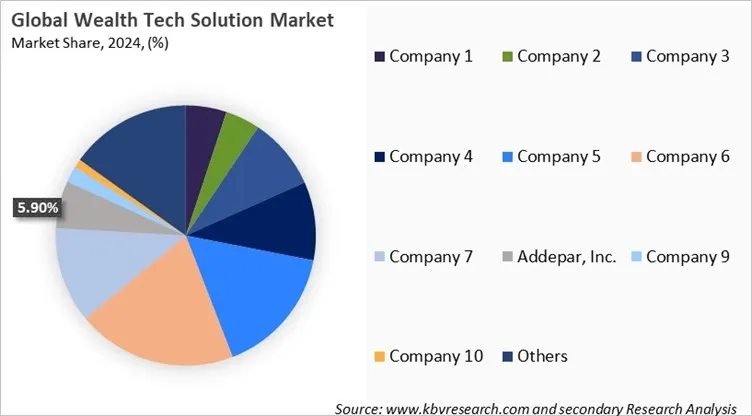

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Wealth Tech Solution Market size to reach USD 16.48 Billion by 2032

Based on enterprise size, the Wealth Tech Solution Market is characterized into large enterprises and small & medium-sized enterprises. The small & medium-sized enterprises segment attained 35% revenue share in the Wealth Tech Solution Market in 2024. These smaller wealth‐advisory firms, boutique asset managers, regional banks and fintech challengers typically face more constrained budgets and fewer internal IT resources compared to large enterprises. As a result, their adoption of wealth-tech solutions is often more selective or incremental — for example, deploying cloud-based components first, using modular platforms, or leveraging white-label solutions. Nonetheless, the SME segment is growing rapidly, driven by digital-first client expectations, cost-pressures and the need to differentiate through technology.

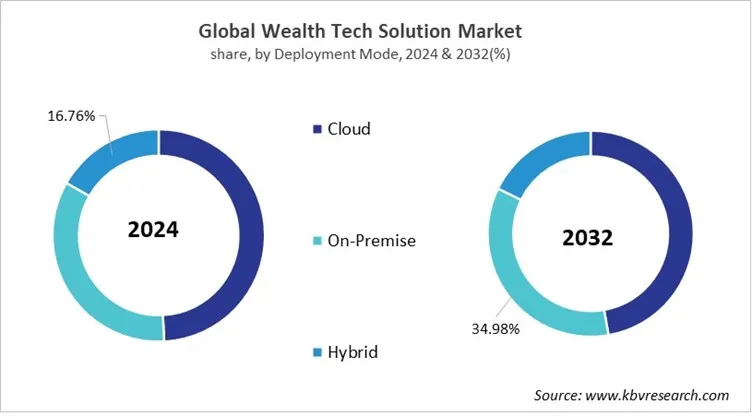

On the basis of deployment mode, the Wealth Tech Solution Market is classified into cloud, on-premise, and hybrid. The on-premise segment recorded 34% revenue share in the Wealth Tech Solution Market in 2024. This mode remains popular among large, established institutions that prioritise data-sovereignty, control over infrastructure, customisation and internal governance. Many firms with legacy systems already in place continue to operate with on-premise deployments to maintain operational consistency and minimise migration risk. The on-premise segment’s share underscores that despite the cloud momentum, a substantial portion of the market still values direct control and perceives lower risk in traditional infrastructure.

The wealth tech solutions market is predicted to grow at a significant rate in North America and Europe. This is due to high digital adoption, strong regulatory frameworks, and advanced financial ecosystems. In North America, particularly in the US, digital brokerage, early adoption of robo-advisory, and AI-based wealth platforms have positioned the region as a key innovation hub. Wealth managers largely invest in data-aggregation platforms, hyper-personalised advisory models, and cloud-native architectures to meet the expectations of high-net-worth clients. Furthermore, the European wealth tech solutions market is experiencing substantial growth. This expansion is supported by digital advisory uptake, ESG-focused investment demand, and open-banking regulations across Germany, Switzerland, and the UK. The region’s focus on investor protection, compliance, and sustainable finance accelerate the expansion of integrated platforms that combine analytics, multi-asset-class capabilities, and portfolio tools.

In the Asia Pacific and LAMEA regions, the wealth tech solutions market is anticipated to capture a prominent market share. This is due to increasing middle-class wealth, rapid fintech expansion reshaping financial services, and digital-first investor behaviour. Asia Pacific represents surging adoption of hybrid advisory models, digital-asset-enabled solutions, and mobile-first wealth platforms. The region’s strong super-app ecosystems, youthful investor base create opportunities for low-cost, scalable WealthTech services. Moreover, the LAMEA wealth tech solutions market is growing, driven by financial inclusion initiatives, government-led digital transformation, and financial inclusion initiatives in countries like Saudi Arabia, South Africa, and the UAE. The market expansion is further supported by demand for cloud-based platforms, affordable advisory and solutions that help institutions in modernizing wealth-management systems, along with navigating developing regulatory and cybersecurity frameworks.

Competition in the Wealth Tech Solutions market is intense, driven by rapid digital innovation, rising investor expectations, and the convergence of traditional finance with advanced technologies like AI, analytics, and automation. Firms compete on user experience, data security, personalization, and integration with digital advisory platforms. New entrants leverage agile models and low-cost digital services, while incumbents enhance offerings through innovation and partnerships. As wealth management becomes more technology-centric, differentiation increasingly depends on innovation, scalability, and regulatory compliance.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 6.63 Billion |

| Market size forecast in 2032 | USD 16.48 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 13.9% from 2025 to 2032 |

| Number of Pages | 667 |

| Number of Tables | 584 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Enterprise Size, Deployment Mode, Business Model, End User, Solution Type, Region |

| Country scope |

|

| Companies Included | DriveWealth, LLC, Wealthfront Corporation, InvestCloud, Inc., Avaloq Group Ltd. (NEC Corporation), FNZ Group, Envestnet Inc. (Bain Capital, LP.), Temenos AG, Addepar, Inc., Cube Consumer Services Pvt. Ltd. (Cube Wealth), and Equirus Wealth Private Limited |

By Enterprise Size

By Deployment Mode

By Business Model

By End User

By Solution Type

By Geography

This Market size is expected to reach USD 16.48 billion by 2032.

The wealth tech solution market is projected to grow at a CAGR of 13.9% between 2025 and 2032.

Digital transformation and rising technology adoption, combined with a shift in investor demographics and behaviour, are reshaping modern investment dynamics.

DriveWealth, LLC, Wealthfront Corporation, InvestCloud, Inc., Avaloq Group Ltd. (NEC Corporation), FNZ Group, Envestnet Inc. (Bain Capital, LP.), Temenos AG, Addepar, Inc., Cube Consumer Services Pvt. Ltd. (Cube Wealth), and Equirus Wealth Private Limited

The Cloud segment is generating the Global Wealth Tech Solution Market by Deployment Mode in 2024; thereby, achieving a market value of $7.78 billion by 2032.

The North America market dominated the Global Wealth Tech Solution Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $5,883.2 million by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges