“Global User Provisioning Market to reach a market value of USD 30.95 Billion by 2032 growing at a CAGR of 15%”

The Global User Provisioning Market size is estimated at $11.66 billion in 2025 and is expected to reach $30.95 billion by 2032, rising at a market growth of 15.0% CAGR during the forecast period (2025-2032). This market is expected to grow because more people are using the cloud, cybersecurity threats are rising, and identity and access management rules are getting stricter. Companies are automating user lifecycle management more and more to make hybrid IT environments and remote workforces safer, more compliant, and more efficient, which helps the market continue to grow.

User provisioning is a foundational function within IAM focused on automating the modification, creation, and removal of digital identities and access rights to ensure secure and timely access to organizational resources. User provisioning developed along with cloud computing, distributed computing, and mobile technologies into centralized, automated IAM solutions. Key providers like Microsoft and IBM have also supported this evolution by introducing identity lifecycle management tools that integrate with HR systems, scaling identity operations, and reducing human error. Industry standardization further surged this progress by allowing cross-platform provisioning, interoperable, while government frameworks and guidance reinforcing the importance of policy-driven automated lifecycle management for compliance and security.

The user provisioning is now developed as a mature, standards-based capability crucial for modern IAM strategies in hybrid and multi-cloud environments. Fully automated provisioning synchronizes identity data across HR systems, cloud applications, directories, HR systems, and on-premises systems, streamlining offboarding and onboarding while catering to audit requirements. Providers are positioning themselves by embedding provisioning into cloud-first IAM platforms, emphasizing deep automation, governance, and interoperability through open standards. Strategies largely integrate risk management, identity governance, and compliance controls, like access certifications, RBAC, and timely deprovisioning, to reduce breach risk and cater to regulatory demands. The competitive landscape is defined by the effectiveness of provisioning solutions in delivering security enforcement, scalability, automation, and seamless integration within complex business ecosystems.

The COVID-19 pandemic had a small, short-term negative effect on the User Provisioning Market, mostly during the first lockdown. Many businesses put off updating their IT systems and deploying new ones because they wanted to keep their operations running smoothly and keep costs down. Budget problems and problems with the supply chain made it harder to make decisions and took longer for sales to happen. Small and medium-sized businesses were especially careful when it came to using new user provisioning solutions. Even so, core demand stayed steady in important areas like government, healthcare, and BFSI. Ongoing maintenance and renewal contracts helped vendors keep making money. As remote and hybrid work models grew, the need for automated user access management grew as well, making up for the initial slowdowns. Thus, the COVID-19 pandemic had a mild negative impact on the market.

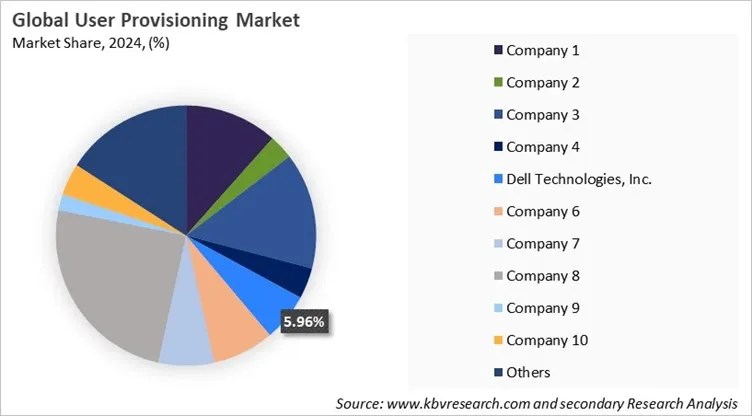

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

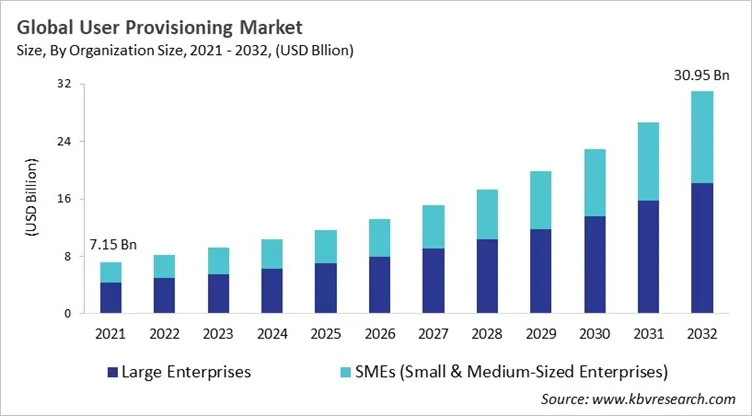

Based on organization size, the user provisioning market is characterized into large enterprises and SMEs (small & medium-sized enterprises). The SMEs (small & medium-sized enterprises) segment attained 37% revenue share in the user provisioning market in 2024. Small and medium-sized enterprises adopt user provisioning solutions to simplify identity management while supporting secure growth and digital transformation. OEMs including Microsoft, Oracle, and cloud service providers publicly emphasize lightweight, cloud-based provisioning tools tailored for organizations with limited IT resources. Publicly available guidance highlights ease of deployment, automation of routine access tasks, and integration with widely used productivity and business applications.

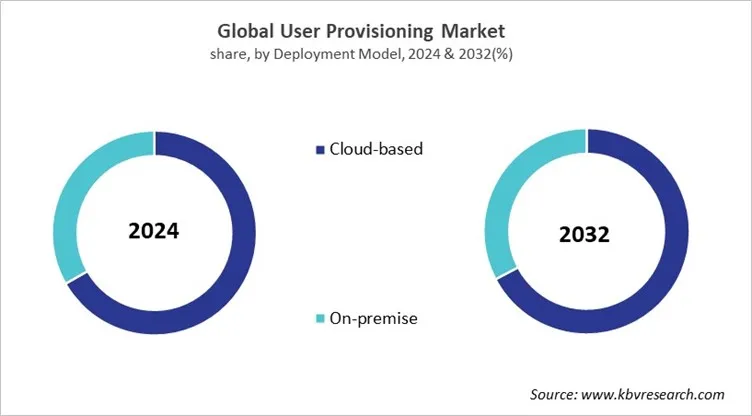

On the basis of deployment model, the user provisioning market is classified into cloud-based and on-premise. The on-premise segment recorded 33% revenue share in the user provisioning market in 2024. On-premise user provisioning remains relevant for organizations requiring full control over identity infrastructure, data residency, and system customization. OEMs including IBM, Oracle, SAP, and Microsoft provide publicly documented on-premise identity governance solutions designed to integrate with legacy systems and internal directories.

Free Valuable Insights: User Provisioning Market size to reach USD 30.95 Billion by 2032

Region-wise, the user provisioning market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 39% revenue share in the user provisioning market in 2024. In North America and Europe, the user provisioning market is anticipated to grow at a significant rate. This is because of advanced IT infrastructure, early technology adoption, strict compliance requirement, and high cybersecurity awareness. The US is experiencing large adoption with significant investments from public sector organizations, and enterprise looking to automate identity lifecycle processes and improve security posture in cloud-centric environments. Further, Canada showcases growth supported by digital transformation and regulatory mandates across industries. This region positions themselves reinforced by the presence of provisioning solution vendors, continued innovations, and organizational focus on zero-trust and policy-based access models. The user provisioning market is witnessing substantial growth in Europe and Asia during the forecast period. The is because of strict data protection regulations such as GDPR, enterprises in the UK, France, and Germany to invest in robust IAM practices to assure secure access controls and compliant provisioning. Also, the adoption is accelerating in regulated industries like public administration and finance.

The Asia Pacific region is expected to grow at a steady rate in user provisioning market. The market is driven by increasing cybersecurity concerns, expanding cloud usage, and rapid digital transformation initiatives in the regional nations. These elements are surging provisioning adoption amongst organizations modernizing identity management process. In addition to this, LAMEA region is estimated to experience rapid expansion during the forecast period supported by rising digitalization efforts and increased awareness of identity security. Further, the region also witnesses significant support by emerging cloud initiatives, and government digitalization projects, thereby offering growth opportunities in the market.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 11.66 Billion |

| Market size forecast in 2032 | USD 30.95 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 15.0% from 2025 to 2032 |

| Number of Pages | 646 |

| Number of Tables | 535 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Organization Size, Deployment Model, Component, Vertical, Region |

| Country scope |

|

| Companies Included | Oracle Corporation, Hitachi, Ltd., IBM Corporation, Atos SE, Dell Technologies, Inc., SAP SE, Broadcom, Inc., Microsoft Corporation, OneLogin, Inc. and Ping Identity Holding Corp. |

By Organization Size

By Deployment Model

By Component

By Vertical

By Geography

This Market size is expected to reach USD 30.95 Billion by 2032.

The user provisioning market is projected to grow at a CAGR of 15% between 2025 and 2032.

Regulatory compliance and data protection requirements, combined with workforce mobility, outsourcing, and ecosystem expansion, are driving market growth.

Oracle Corporation, Hitachi, Ltd., IBM Corporation, Atos SE, Dell Technologies, Inc., SAP SE, Broadcom, Inc., Microsoft Corporation, OneLogin, Inc. and Ping Identity Holding Corp.

The Large Enterprises segment is leading the Global User Provisioning Market by Organization Size in 2024, thereby, achieving a market value of $18.24 billion by 2032.

The North America region dominated the Global User Provisioning Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $11.50 billion by 2032, growing at a CAGR of 14.4 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges