USA Drinking Yogurt Market Size, Share & Trends Analysis Report By Type (Dairy Based, and Non Dairy Based), By Packaging (Bottles, and Tetra Pack), By Flavor (Flavored, and Plain), By Distribution Channel, and Forecast, 2023 - 2030

Published Date : 22-Apr-2024 | Pages: 88 | Formats: PDF |

COVID-19 Impact on the US Drinking Yogurt Market

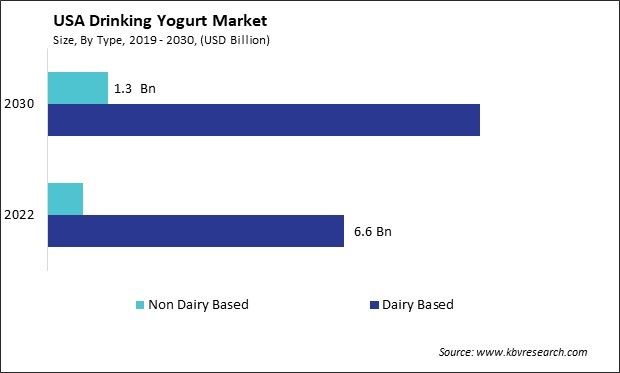

The USA Drinking Yogurt Market size is expected to reach $10.9 Billion by 2030, rising at a market growth of 5.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 926.8 million litres, experiencing a growth of 5.3% (2019-2022).

The drinking yogurt market in the United States has witnessed substantial growth in recent years, driven by evolving consumer preferences towards healthier beverage options and the rising popularity of probiotic-rich products. This segment within the broader dairy industry has become a dynamic and competitive landscape, reflecting the nation's changing dietary patterns and wellness trends.

One key factor contributing to the growth of the drinking yogurt market is the growing awareness of the health benefits of probiotics in drinking yogurts. Probiotics promote digestive health and strengthen the immune system, aligning with the broader wellness movement in the United States. As a result, consumers are turning to drinking yogurt not only as a delicious snack but also as a functional and wholesome addition to their daily routines.

In terms of distribution, the convenience of on-the-go packaging has contributed to the popularity of drinking yogurts, making them a preferred choice for busy Americans seeking portable and nutritious refreshments. As the industry continues to evolve, it is expected that product innovation, strategic partnerships, and a focus on health and wellness will remain pivotal in shaping the future trajectory of the drinking yogurt market in the United States.

Market Trends

Growing influence of supermarkets and hypermarkets in the U.S.

In the United States, the consumption of drinking yogurt has become increasingly popular, with supermarkets and hypermarkets emerging as the predominant purchasing methods for this dairy product. These establishments offer diverse drinking yogurt brands, flavors, and packaging options, providing consumers with a convenient and comprehensive shopping experience.

Supermarkets like Walmart play a pivotal role in shaping the drinking yogurt market landscape. Their extensive reach and large floor spaces allow for displaying and promoting various drinking yogurt brands, creating a competitive industry environment. Shoppers benefit from the one-stop-shop convenience offered by supermarkets, where they easily compare prices, explore new flavors, and access a broad selection of products.

According to NACS, in 2020, Walmart saw a 20% expansion in its pickup and delivery capacity, and it aims to further increase it by 35%. Notably, in 2021, Walmart witnessed a remarkable surge of 170% in the number of orders originating from its stores. Drawing parallels, the drinking yogurt market in the United States is currently witnessing a surge in supermarkets. This upswing signifies a notable expansion and increasing influence within the drinking yogurt market.

Hypermarkets, larger retail spaces that combine features of supermarkets and department stores, also contribute significantly to the popularity of drinking yogurt in the U.S. Hypermarket chains like Target offer bulk purchasing options, appealing to consumers seeking cost-effective and family-sized quantities of drinking yogurt. The vast product offerings within hypermarkets cater to diverse consumer preferences, from traditional to innovative and niche drinking yogurt varieties.

Accessibility, promotional activities, and consumer trust further accentuate the prominence of supermarkets and hypermarkets in the U.S. drinking yogurt market. These retail giants often collaborate with manufacturers to introduce exclusive products or promotions, attracting consumers and fostering brand loyalty. Thus, supermarkets and hypermarkets have become prominent in the U.S. drinking yogurt market, offering diverse choices and one-stop convenience.

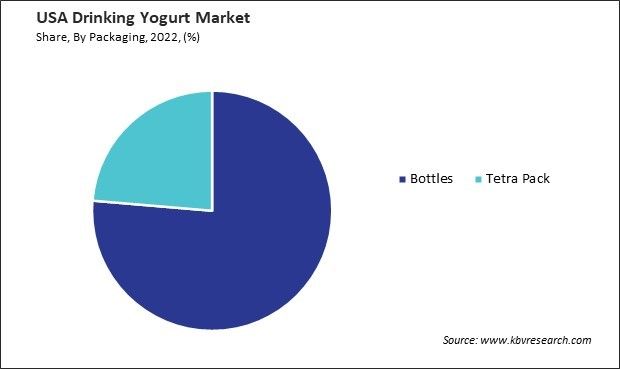

Rising preference for tetra packs

In recent years, the United States has witnessed a significant surge in the consumption and popularity of drinking yogurt, with a notable increase in the prevalence of tetra packs as the preferred packaging choice within the drinking yogurt market. One of the primary drivers behind the rise of tetra packs in the drinking yogurt sector is the growing demand for convenient, on-the-go options. With an increasing number of Americans leading busy lifestyles, there is a heightened need for portable and easily consumable products. Tetra packs provide a practical solution, offering a lightweight and easy-to-carry packaging format that caters to the fast-paced nature of daily life.

The convenience, health benefits, and eco-friendliness of tetra packs have collectively contributed to their rising prevalence in the U.S. drinking yogurt market. As manufacturers respond to evolving consumer demands, adopting tetra packs is expected to persist, shaping the landscape of the U.S. beverage industry.

Moreover, the U.S. consumer base has become increasingly health-conscious, seeking nutritious and functional beverage options. Tetra packs are often chosen for their ability to preserve the freshness and nutritional integrity of drinking yogurt without the need for preservatives. The packaging protects the contents from light and air, ensuring a longer shelf life while maintaining quality and taste.

Environmental considerations have also played a role in the growing popularity of tetra packs in the U.S. Consumers are increasingly mindful of the ecological impact of their choices, and tetra packs are recognized for their eco-friendly attributes. These packages are lightweight, reducing transportation-related carbon emissions, and they are recyclable, aligning with the sustainability preferences of environmentally conscious consumers. Hence, the surge in tetra pack usage within the U.S. drinking yogurt market reflects a consumer-driven shift towards convenience, health consciousness, and environmental sustainability.

Competition Analysis

The drinking yogurt market has grown significantly in recent years, driven by consumer preferences for convenient and healthy beverage options. One prominent player in the drinking yogurt market is Danone. As a global food company, Danone has a strong presence in the dairy industry, and its yogurt products, including those in drinkable form, have gained widespread popularity. The company's commitment to promoting health and well-being aligns with the growing consumer demand for nutritious and functional beverages.

Another player, Yakult, from Japan, has become a household name worldwide, particularly known for its probiotic-rich fermented milk drinks. The company's focus on digestive health has resonated with consumers seeking products that contribute to overall well-being.

Greek yogurt giant Chobani has also made significant strides in the drinking yogurt market. Known for its thick and creamy yogurt products, Chobani has successfully extended its portfolio to include convenient, portable, drinkable yogurt options. The company's emphasis on using natural ingredients and offering a variety of flavors has contributed to its success in capturing a share of the growing industry.

A global leader, Nestlé in the food and beverage industry, has a strong presence in the drinking yogurt market. With an extensive product portfolio that includes well-known brands such as Nesquik and Actimel, Nestlé has successfully catered to diverse consumer preferences. The company's innovation in introducing new flavors and formulations reflects its commitment to staying ahead in a competitive industry.

In the United States, The Dannon Company, a subsidiary of Danone, has been a major player in the drinking yogurt market. The company's flagship brand, Dannon, offers a range of yogurt-based beverages, capitalizing on the popularity of yogurt as a versatile and nutritious snack. Dannon's efforts to adapt its product offerings to changing consumer trends have contributed to its sustained success in the industry.

Closer to home, smaller and niche players have also made noteworthy contributions to the drinking yogurt market. Local and artisanal brands often focus on unique flavors, organic ingredients, and health-conscious formulations to carve out a niche. These companies cater to consumers seeking distinct and personalized options in the crowded industry. Overall, the drinking yogurt market is characterized by a mix of global giants, regional leaders, and emerging players. The industry's growth is fueled by a combination of factors, including increasing awareness of health and wellness, demand for on-the-go snack options, and the continual innovation by companies to meet evolving consumer preferences.

List of Key Companies Profiled

- Meiji Holdings Co., Ltd.

- Arla Foods, Inc.

- Danone S.A.

- Schreiber Foods, Inc.

- Lactalis Group

- Nestle S.A

- Chobani LLC

- Royal FrieslandCampina N.V.

- General Mills, Inc.

- DANA Dairy Group Ltd.

US Drinking Yogurt Market Report Segmentation

By Type

- Dairy Based

- Non Dairy Based

By Packaging

- Bottles

- Tetra Pack

By Flavor

- Flavored

- Chocolate

- Vanilla

- Berries

- Mango

- Others

- Plain

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Drinking Yogurt Market, by Type

1.4.2 US Drinking Yogurt Market, by Packaging

1.4.3 US Drinking Yogurt Market, by Flavor

1.4.4 US Drinking Yogurt Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. US Drinking Yogurt Market

3.1 US Drinking Yogurt Market by Type

3.2 US Drinking Yogurt Market by Packaging

3.3 US Drinking Yogurt Market by Flavor

3.3.1 US Drinking Yogurt Market by Flavored Type

3.4 US Drinking Yogurt Market by Distribution Channel

Chapter 4. Company Profiles – Global Leaders

4.1 Meiji Holdings Co., Ltd.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental Analysis

4.1.4 Research & Development Expense

4.1.5 Recent strategies and developments:

4.1.5.1 Product Launches and Product Expansions:

4.1.5.2 Geographical Expansions:

4.1.6 SWOT Analysis

4.2 Arla Foods, Inc.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Regional Analysis

4.2.4 Research & Development Expense

4.2.5 Recent strategies and developments:

4.2.5.1 Partnerships, Collaborations, and Agreements:

4.2.6 SWOT Analysis

4.3 Danone S.A.

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Category and Regional Analysis

4.3.4 Recent strategies and developments:

4.3.4.1 Product Launches and Product Expansions:

4.3.5 SWOT Analysis

4.4 Schreiber Foods, Inc.

4.4.1 Company Overview

4.4.2 Recent strategies and developments:

4.4.2.1 Partnerships, Collaborations, and Agreements:

4.4.3 SWOT Analysis

4.5 Lactalis Group

4.5.1 Company Overview

4.5.2 Recent strategies and developments:

4.5.2.1 Product Launches and Product Expansions:

4.5.3 SWOT Analysis

4.6 Nestle S.A

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expenses

4.6.5 SWOT Analysis

4.7 Chobani LLC

4.7.1 Company Overview

4.7.2 Recent strategies and developments:

4.7.2.1 Product Launches and Product Expansions:

4.7.3 SWOT Analysis

4.8 Royal FrieslandCampina N.V.

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 General Mills, Inc.

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Segmental and Regional Analysis

4.9.4 Research & Development Expense

4.9.5 Recent strategies and developments:

4.9.5.1 Product Launches and Product Expansions:

4.9.6 SWOT Analysis

4.10. DANA Dairy Group Ltd.

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 US Drinking Yogurt Market, 2023 - 2030, USD Million

TABLE 3 US Drinking Yogurt Market, 2019 - 2022, Million Litres

TABLE 4 US Drinking Yogurt Market, 2023 - 2030, Million Litres

TABLE 5 US Drinking Yogurt Market by Type, 2019 - 2022, USD Million

TABLE 6 US Drinking Yogurt Market by Type, 2023 - 2030, USD Million

TABLE 7 US Drinking Yogurt Market by Type, 2019 - 2022, Million Litres

TABLE 8 US Drinking Yogurt Market by Type, 2023 - 2030, Million Litres

TABLE 9 US Drinking Yogurt Market by Packaging, 2019 - 2022, USD Million

TABLE 10 US Drinking Yogurt Market by Packaging, 2023 - 2030, USD Million

TABLE 11 US Drinking Yogurt Market by Packaging, 2019 - 2022, Million Litres

TABLE 12 US Drinking Yogurt Market by Packaging, 2023 - 2030, Million Litres

TABLE 13 US Drinking Yogurt Market by Flavor, 2019 - 2022, USD Million

TABLE 14 US Drinking Yogurt Market by Flavor, 2023 - 2030, USD Million

TABLE 15 US Drinking Yogurt Market by Flavor, 2019 - 2022, Million Litres

TABLE 16 US Drinking Yogurt Market by Flavor, 2023 - 2030, Million Litres

TABLE 17 US Drinking Yogurt Market by Flavored Type, 2019 - 2022, USD Million

TABLE 18 US Drinking Yogurt Market by Flavored Type, 2023 - 2030, USD Million

TABLE 19 US Drinking Yogurt Market by Flavored Type, 2019 - 2022, Million Litres

TABLE 20 US Drinking Yogurt Market by Flavored Type, 2023 - 2030, Million Litres

TABLE 21 US Drinking Yogurt Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 22 US Drinking Yogurt Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 23 US Drinking Yogurt Market by Distribution Channel, 2019 - 2022, Million Litres

TABLE 24 US Drinking Yogurt Market by Distribution Channel, 2023 - 2030, Million Litres

TABLE 25 Key Information – Meiji Holdings Co., Ltd.

TABLE 26 Key information – Arla Foods, Inc.

TABLE 27 Key information – Danone S.A.

TABLE 28 Key Information – Schreiber Foods, Inc.

TABLE 29 Key Information – Lactalis Group

TABLE 30 Key Information – Nestle S.A

TABLE 31 key information – Chobani LLC

TABLE 32 Key Information – Royal FrieslandCampina N.V.

TABLE 33 Key Information – General Mills, Inc.

TABLE 34 Key Information – DANA Dairy Group Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Drinking Yogurt Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Drinking Yogurt Market

FIG 4 Porter’s Five Forces Analysis – Drinking Yogurt Market

FIG 5 US Drinking Yogurt Market share by type, 2022

FIG 6 US Drinking Yogurt Market share by type, 2030

FIG 7 US Drinking Yogurt Market by Application, 2019 - 2030, USD MILLION

FIG 8 US Drinking Yogurt Market share by Packaging, 2022

FIG 9 US Drinking Yogurt Market share by Packaging, 2030

FIG 10 US Drinking Yogurt Market by Packaging, 2019 - 2030, USD Million

FIG 11 US Drinking Yogurt Market share by Flavor, 2022

FIG 12 US Drinking Yogurt Market share by Flavor, 2030

FIG 13 US Drinking Yogurt Market by Flavor, 2019 - 2030, USD Million

FIG 14 US Drinking Yogurt Market share by Flavored Type, 2022

FIG 15 US Drinking Yogurt Market share by Flavored Type, 2030

FIG 16 US Drinking Yogurt Market by Flavored Type, 2019 - 2030, USD Million

FIG 17 US Drinking Yogurt Market share by Distribution Channel, 2022

FIG 18 US Drinking Yogurt Market share by Distribution Channel, 2030

FIG 19 US Drinking Yogurt Market by Distribution Channel, 2019 - 2030, USD Million

FIG 20 Recent strategies and developments: Meiji Holdings Co., Ltd.

FIG 21 SWOT Analysis: Meiji Holdings Co., Ltd.

FIG 22 SWOT Analysis: Arla Foods, Inc.

FIG 23 SWOT Analysis: Danone, S.A.

FIG 24 SWOT Analysis: Schreiber Foods, Inc.

FIG 25 SWOT Analysis: Lactalis Group

FIG 26 SWOT Analysis: Nestle S.A

FIG 27 SWOT Analysis: Chobani LLC.

FIG 28 SWOT Analysis: Royal FrieslandCampina N.V.

FIG 29 Swot Analysis: General Mills, Inc.

FIG 30 SWOT Analysis: DANA Dairy Group Ltd.