“Global Telecom Order Management Market to reach a market value of USD 9.79 Billion by 2032 growing at a CAGR of 11.2%”

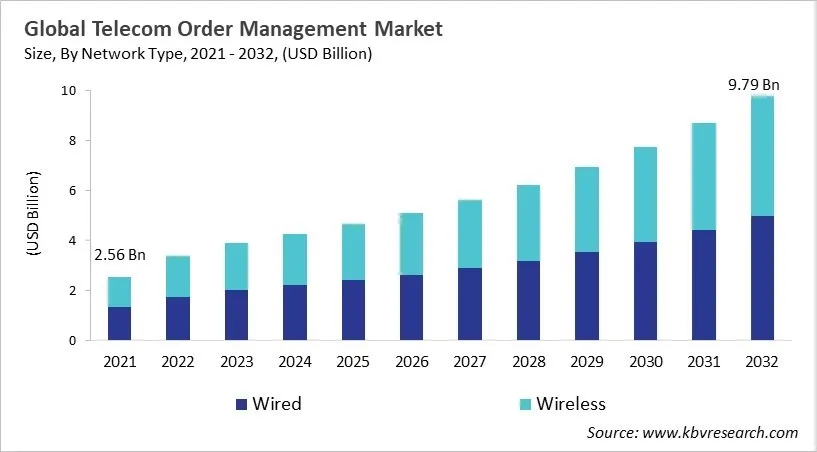

The Global Telecom Order Management Market size is expected to reach $9.79 billion by 2032, rising at a market growth of 11.2% CAGR during the forecast period.

The telecom order management market has transformed from standard order-tracking systems to advanced cloud-native orchestration management platforms that analyze and manage the whole lifecycle of telecom services. The adoption of the advanced technologies such as mobile, broadband, fibre, IPTV, enterprise connectivity, and IoT by the operators made conventional manual or siloed processes solvent. In modern OSS/BSS architectures, OMS is now the main controller that coordinates order capture, validation, inventory, provisioning, and activation across networks that are getting more complex and offer more than one service. This change is a result of the need for speed, automation, real-time visibility, and consistent customer experiences in the global telecom industry.

Some of the biggest trends in today's telecom order management market are catalog-driven architectures, automation and real-time orchestration, and unified order-to-cash platforms. Vendors and operators all over the world are moving to modular, cloud-native systems with open APIs. This makes it easier to scale, launch new products quickly, and fulfill orders without touching them. Automation tools break down complicated orders, cut down on manual work, lower order fallout, and speed up service delivery. Unified platforms, on the other hand, bring together sales, order management, billing, and lifecycle management into a single, smooth process that makes things run more smoothly and makes customers happier. As 5G, IoT, enterprise services, and dynamic bundles grow, OMS becomes more and more important to businesses. Competition is based on how flexible, deep, and automated it is, as well as how well it can handle new use cases.

During the early pandemic, the telecom order management market was severely disrupted because lockdowns stopped field operations, installations were delayed, and there were huge backlogs in service activation. Fiber rollouts and broadband provisioning were hit the hardest by limited technician visits, slowed supply chains, and smaller warehouse space. Operators who still used old on-premise OSS/BSS systems had trouble with remote workflows, which led to delays, mistakes, and longer activation cycles. There weren't enough routers, fiber modems, and other customer premises equipment (CPE), which made fulfillment take even longer and caused more orders to fall through. Also, less spending by businesses and a halt in technology investments lowered the need for new connectivity and managed services. Thus, the COVID-19 pandemic had a negative impact on the market.

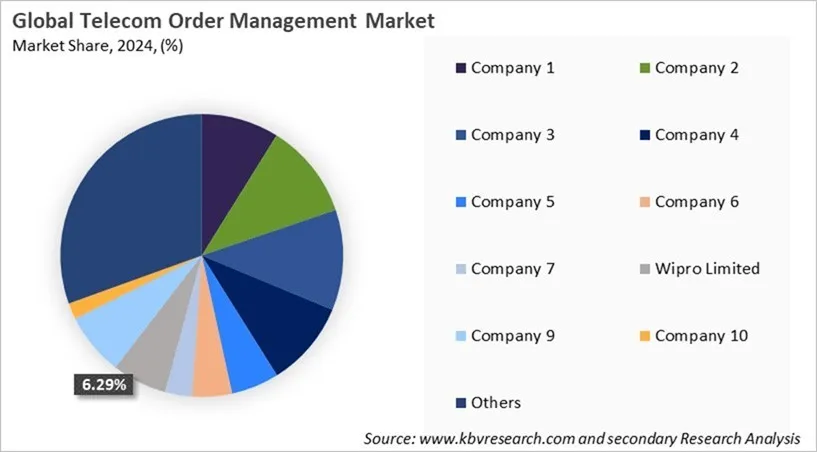

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on Network Type, the market is segmented into Wired, and Wireless. The wireless segment attained 48% revenue share in the telecom order management market in 2024. The market also features a wireless segment, which encompasses order management systems designed to support mobile and cellular communication networks. This segment captures the growing operational needs surrounding mobile subscriptions, data services, device provisioning, and the rapid evolution of wireless technologies.

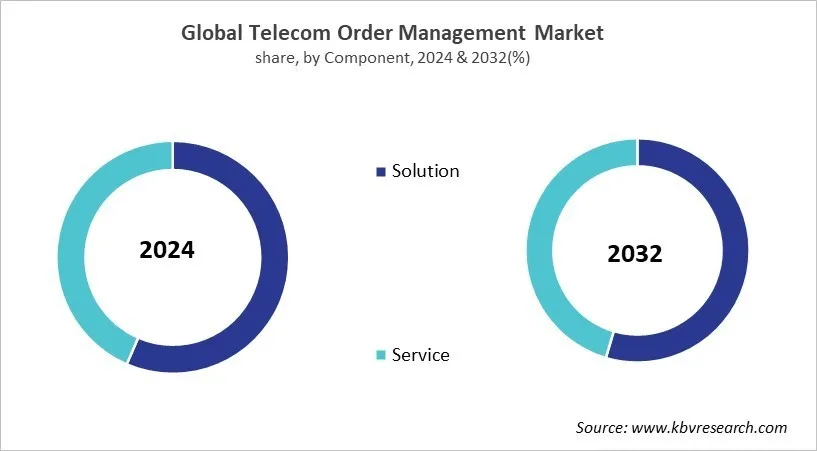

Based on Component, the market is segmented into Solution, and Service. The service segment recorded 44% revenue share in the Telecom Order Management Market in 2024. The service segment encompasses a broad range of professional and managed services that support telecom operators in deploying, optimizing, and maintaining their order management systems. These services often include consulting, system integration, training, support, and ongoing maintenance to ensure that complex order management platforms function effectively within dynamic telecom ecosystems.

Free Valuable Insights: Telecom Order Management Market size to reach USD 9.79 Billion by 2032

North America and Europe are the most likely to use cloud-native, catalog-driven Telecom Order Management Systems as operators modernize their old OSS/BSS systems and expand their 5G, fiber, and business services. Operators need to use automation, unified order-to-cash workflows, and real-time orchestration to lower order fallout and speed up service activation because customers have high expectations and there is a lot of competition. These areas are working to bring together fragmented systems, improve integration between CRM, billing, and network platforms, and speed up the rollout of digital and converged service offerings. Major OSS/BSS vendors and system integrators are heavily involved in these efforts.

Mobile broadband, fiber, and IoT services are growing quickly in the APAC and LAMEA regions. This is creating a lot of demand for OMS platforms that are flexible, scalable, and API-driven. Many operators are moving from manual or siloed processes to cloud-based order orchestration to deal with a lot of transactions and a wide range of service bundles. More competition and different levels of market maturity make it more likely that businesses will use automation, workflow orchestration, and unified customer lifecycle tools. As 5G, enterprise connectivity, and digital services grow, businesses need to invest in modern OMS solutions to help with faster provisioning, more efficient fulfillment, and more service innovation.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 4.65 Billion |

| Market size forecast in 2032 | USD 9.79 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 11.2% from 2025 to 2032 |

| Number of Pages | 614 |

| Number of Tables | 582 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Network Type, Component, Deployment Mode, Organization Size, Region |

| Country scope |

|

| Companies Included | Cognizant Technology Solutions Corporation, Ericsson AB, IBM Corporation, Oracle Corporation, Fujitsu Limited, Pegasystems, Inc., Cerillion Technologies Limited, Wipro Limited, Infosys Limited, and Salesforce, Inc. |

By Network Type

By Component

By Deployment Mode

By Organization Size

By Geography

The market size is projected to reach USD 9.79 Billion by 2032.

The telecom order management market is projected to grow at a CAGR of 11.2% between 2025 and 2032.

Rising service complexity, coupled with growing operational efficiency needs, is driving market growth.

Cognizant Technology Solutions Corporation, Ericsson AB, IBM Corporation, Oracle Corporation, Fujitsu Limited, Pegasystems, Inc., Cerillion Technologies Limited, Wipro Limited, Infosys Limited, and Salesforce, Inc.

The Cloud-based segment led the maximum revenue in the Global Telecom Order Management Market by Deployment Mode in 2024, thereby, achieving a market value of $5.7 billion by 2032.

The North America region dominated the Global Telecom Order Management Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $3.2 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges