“Global Software Defined Data Center Market to reach a market value of USD 534.75 Billion by 2032 growing at a CAGR of 29.3%”

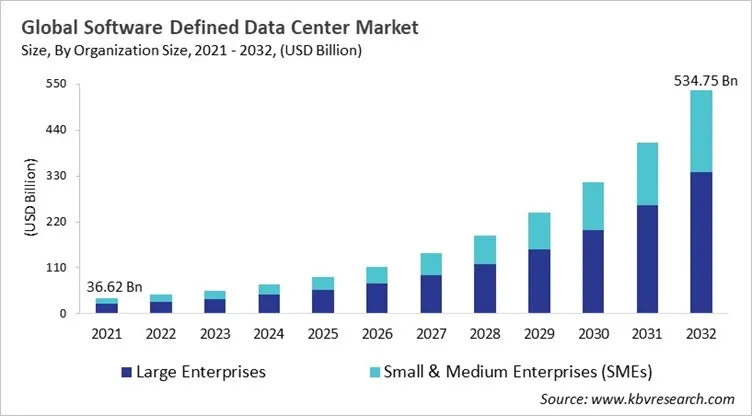

The Global Software Defined Data Center Market size is expected to reach USD 534.75 billion by 2032, rising at a market growth of 29.3% CAGR during the forecast period.

The software defined data center transforms IT infrastructure from hardware-centric systems to software-enabled environments in which storage, compute, and networking resources are pooled, virtualized and centrally managed. This development rooted in early server virtualization, has accelerated as enterprises seek automation, scalable cloud-ready architecture, agility, and faster provisioning. Further, SDDC empowers enterprises to respond rapidly to evolving business demands by allowing real-time scalability and on-demand resources allocation. Software defined data center has developed into a mainstream enterprise model supporting multi-cloud and hybrid environments, allowing efficient resource utilization, dynamic workload placement, and policy-based orchestration.

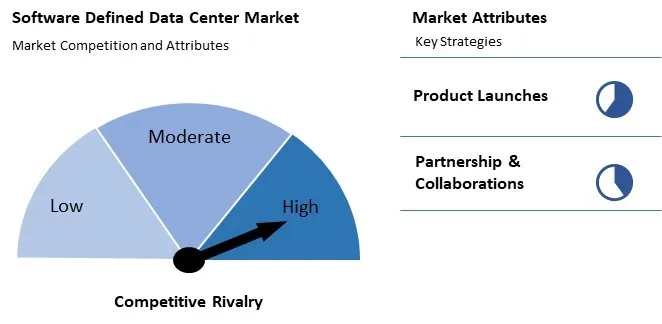

The software defined data center market is fuelled by trends including deep automation, elastic scaling, unified hybrid-cloud management, and the requirement of flexible, cost-effective infrastructure. Market players are competing on offering software-defined storage & networking, professional services to ease migration, integrated virtualization platforms, and strong orchestration capabilities. The competitive landscape of software defined data center market represents a shift from traditional data center models towards software-centric architectures. The market seems to be profitable for those offering hybrid-cloud support, seamless integration, and robust automation. Further, investment in consulting, training, and managed services help enterprises in overcoming implementation challenges and accelerating ROI. As a result, the software defined data center market represents a technological shift, along with a strategic move toward resilient, agile, and cost-effective IT infrastructure, globally.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, Two news of any two random companies apart from leaders and key innovators. In March, 2025, IBM Corporation unveiled a new software-defined storage solution to streamline infrastructure management. The solution enhances storage efficiency, scalability, and automation, helping businesses optimize data management. With advanced features, it simplifies operations, reduces complexity, and improves overall performance, making storage infrastructure more adaptable to evolving enterprise needs. Additionally, In 2025, February, Cisco Systems, Inc. unveiled the N9300 Series Smart Switches, integrating AMD Pensando DPUs to enhance data center efficiency and scalability for AI workloads. The first service, Hypershield, embeds security directly into the network fabric, converging networking and security layers into a unified solution.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Software Defined Data Center Market. Companies such as Oracle Corporation, Cisco Systems, Inc., and IBM Corporation are some of the key innovators in Software Defined Data Center Market. In December, 2024, Microsoft Corporation unveiled its first hyperscale data center in New Zealand, enhancing cloud services and digital transformation in the region. The facility aims to support local businesses with scalable computing power, security, and sustainability. This marks a significant milestone in Microsoft's investment in New Zealand’s technology infrastructure and innovation.

The Covid-19 pandemic sped up digital transformation and greatly increased the Software Defined Data Center market as businesses moved to work from home. As more people used the internet, it became clear that traditional data centers couldn't keep up. This made people want infrastructure that could grow, change, and be managed from one place. Companies quickly started using virtualization to make the most of their resources and rely less on physical hardware. Automation and remote management became necessary so that operations could continue with as few on-site staff as possible. Because of this, SDDCs helped with resilience, cost-effectiveness, flexibility, and long-term cloud strategy alignment, making them a key part of modern IT ecosystems. Thus, the COVID-19 pandemic had a positive impact on the market.

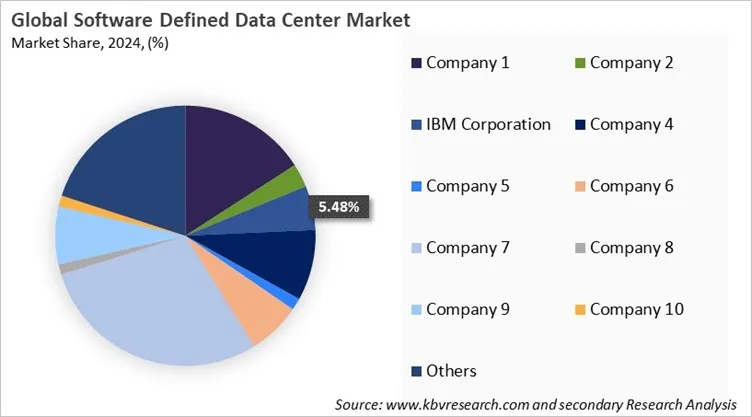

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Software Defined Data Center Market size to reach USD 534.75 Billion by 2032

Based on organization size, the software defined data center market is characterized into large enterprises and small & medium enterprises (SMEs). The small & medium enterprises (SMEs) segment attained 35% revenue share in the software defined data center market in 2024. Worldwide, small and medium-sized enterprises are adopting software-defined data center solutions to gain accessible, cost-efficient, and scalable IT capabilities that align with their growing digital needs. SMEs across both developed and emerging markets use software-defined architectures to reduce reliance on physical hardware, simplify infrastructure management, and support cloud-first business models.

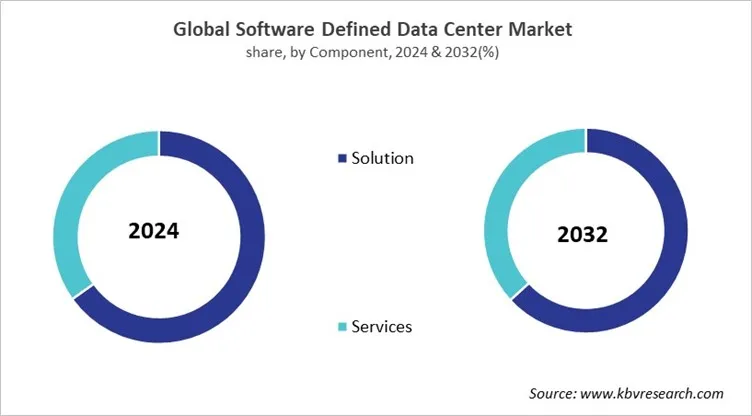

On the basis of component, the software defined data center market is classified into solution and services. The services segment recorded 35% revenue share in the software defined data center market in 2024. The services segment plays a vital global role in ensuring the successful deployment, optimization, and long-term management of software-defined data center environments. Organizations depend on integration services, consulting, migration support, and managed services to transition from traditional infrastructures to software-driven architectures. Service providers assist enterprises in designing automated workflows, configuring policy-based controls, maintaining security compliance, and improving infrastructure performance across distributed environments.

Region-wise, the software defined data center market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 40% revenue share in the software defined data center market in 2024. In North America and Europe region, the software defined data center market is estimated to experience significant growth. The growth in North America region is supported by a well-established cloud ecosystem, early virtualization adoption, and strong investments by hyperscale data-center operators. Organizations across Canada, and the US are largely modernizing their infrastructure to support multi-cloud, and hybrid environments, AI/ML workloads, and automation, thus making North America the highest-revenue and most technologically advanced region. Furthermore, Europe software defined data center market is expanding backed by strict data-privacy regulations, strong demand for software-defined infrastructure and hybrid-cloud, and digital transformation initiatives across various sectors including manufacturing, finance and government.

The software defined data center market is predicted to capture prominent growth in Asia Pacific and LAMEA region. This growth is propelled by large-scale cloud adoption, expanding data-center investments, rapid digitalization, and increasing demand from industries such as telecom, financial services, and e-commerce. Regional nations including Japan, South Korea, China and India are surging deployment of SDDC as a part of IT modernization and broader cloud strategies. Furthermore, LAMEA software defined data center market is representing growth with enterprises modernizing infrastructure and adopting cloud services. The market growth is further supported by expanding enterprise IT requirements, and government digital initiatives.

The Software Defined Data Center market shows high competition with vendors differentiating through automation, scalability, security, and AI-driven orchestration. Demand is driven by cloud adoption, hybrid IT models, edge computing, and digital transformation initiatives. Key buying attributes include interoperability, workload portability, performance efficiency, policy-based management, and reduced operational cost. The market is shifting toward software-first architectures, enabling faster provisioning and centralized control. Customer preference increasingly favors flexible, modular, subscription-based solutions with strong resilience and compliance features.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 88.44 Billion |

| Market size forecast in 2032 | USD 534.75 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 29.3% from 2025 to 2032 |

| Number of Pages | 704 |

| Number of Tables | 563 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Organization Size, Component, Deployment, Type, End Use, Region |

| Country scope |

|

| Companies Included | Microsoft Corporation, Oracle Corporation, IBM Corporation, Cisco Systems, Inc., SAP SE, Dell Technologies, Inc., VMware, Inc. (Broadcom Inc.), NEC Corporation, Hewlett Packard Enterprise Company and Fujitsu Limited |

By Organization Size

By Component

By Deployment

By Type

By End Use

By Geography

This Market size is expected to reach USD 534.75 Billion by 2032.

The software defined data center market is projected to grow at a CAGR of 29.3% between 2025 and 2032.

Rising demand for scalable, agile, programmable IT infrastructure alongside expanding hybrid and multi-cloud adoption.

Microsoft Corporation, Oracle Corporation, IBM Corporation, Cisco Systems, Inc., SAP SE, Dell Technologies, Inc., VMware, Inc. (Broadcom Inc.), NEC Corporation, Hewlett Packard Enterprise Company and Fujitsu Limited

The Software-Defined Networking (SDN) segment is leading the Global Software Defined Data Center Market by Type in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $210,075.5 million by 2032, growing at a CAGR of 28.5 % during the forecast period.

The North America region dominated the Global Software Defined Data Center Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $205,666.9 million by 2032. The Europe region is experiencing a CAGR of 28.8% during (2025 - 2032).

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges