Global Shipbuilding Market Size, Share & Industry Trends Analysis Report By Type, By End Use, By Regional Outlook, Strategy, Challenges and Forecast, 2021 - 2027

Published Date : 28-Feb-2022 | Pages: 178 | Formats: PDF |

COVID-19 Impact on the Shipbuilding Market

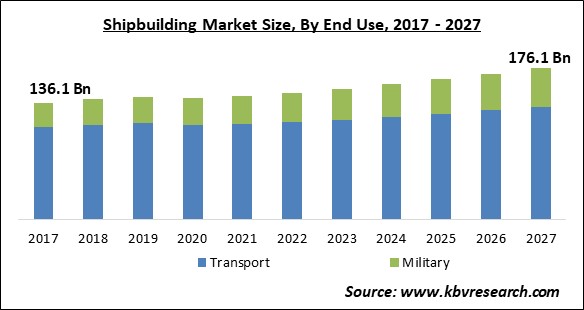

The Global Shipbuilding Market size is expected to reach $ 176.1 billion by 2027, rising at a market growth of 3.4% CAGR during the forecast period.

Shipbuilding is the process of constructing floating vessels such as ships. Usually, there is a separate area designed for this activity called a shipyard. Shipbuilders are known by the name of shipwrights. All the vessels presently floating in the oceans are designed and constructed by the shipbuilding sector. Major factors responsible for the growth of the shipbuilding market are seaborne trade, rising demand for cargo transportation, increasing agreements related to trade, advanced technologies adopted by the marine vessel engines, and automation facilities in marine vessels.

Various warships like submarines and amphibious assault ships are designed by the shipbuilding industry in order to protect the coastal boundaries of the countries. Submarines are designed in such a manner that enables them to travel and carry weapons under the water. Submarines are capable of attacking enemy ships. A submarine can stay underwater for around six months.

The main advantage of maritime transport is that it can ship all types of goods. It can carry heavy goods which aircrafts cannot carry. Various machines, automobiles, industrial parts are some goods transported with the help of maritime transport. Also, the other special warships such as command ships, mine countermeasure ships, oceanographic ships, surveillance ships, sea fighters, and amphibious assault ships are designed by the shipbuilding sector for serving the naval defense forces of the world.

COVID-19 Impact Analysis

The widespread COVID-19 pandemic resulted in the downfall of the economies of various countries. Strict regulations over import and export and the imposition of lockdown to curb the effects of COVID-19 has hampered the supply chains of majorly all the sectors. The shipbuilding market has also witnessed huge loss due to this pandemic.

Moreover, the pandemic has also negatively affected the establishment of new shipyards, conversion, and repairs projects. This pandemic also has forced many companies in this sector to stop their operations due to less demand in the market. For example, due to this pandemic, Irving shipbuilding has issued a notice which resulted in the shutdown of Halifax shipyard for a few weeks.

Market Growth Factors:

Technological Advancements

The rising development of the latest technologies in the shipbuilding sector is likely to result in the growth of the shipbuilding market. The major issue of the shipping industry is the communication gap. The role of shipyards is to enhance the efficiency of the transportation sector by reducing the time taken for the delivery of goods over the seas. But they face many issues due to different time zones and not having control over necessary information due to lack of proper communication facilities.

Increasing investment in Naval defense

The safety and security of the country is the major concern of the ruling government of all the countries due to which the government prefers to invest more in the defense sector in terms of money and manpower. Moreover, the coastal regions are the most sensitive areas of any country as it is difficult to judge the unexpected movement in the water and thus have more chances of attacks from the enemies and thus there is a need to have proper defense facilities in the coastal regions.

Marketing Restraining Factor:

Harmful for environment

The governments, as well as the public, are concerned about continuous environmental changes taking place all over the globe. The major contributors to these increasing climate changes and global warming are the various activities performed by the industrial sector. The shipbuilding industry is one of the pollution-causing industries. Similar to all other modes of transportation, ships also release carbon dioxide due to the use of fossil fuels.

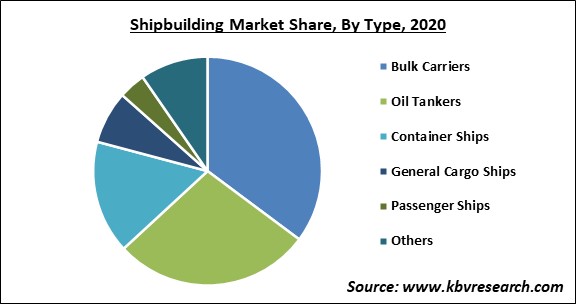

Type Outlook

On the basis of type, the shipbuilding market is segmented into oil tankers, bulk carriers, general cargo ships, container ships and passenger ships. In 2020, the Bulk carrier segment dominated the shipbuilding market with the largest market share. Bulk carriers are the merchant ships mainly developed to transport bulk amounts of unpacked cargo, like coal, ore, cement, steel coils, grains. These ships can be abrasive as well as dense. These kinds of ships are designed to increase capacity, durability, and efficiency.

End Use Outlook

Based on end-use, the shipbuilding market is classified into transport and military. In 2020, the transport segment has dominated the shipbuilding market by acquiring the maximum revenue share. Ships are widely used for transportation of various commodities from large machines to even oil, and passengers also. This mode of transportation is widely being used since the last couple of years. Transportation through water is cheaper as compared to that of air, exempting the changing exchange rates and the currency adjustment factor which means the fee imposed on the carrier companies.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 141.7 Billion |

| Market size forecast in 2027 | USD 176.1 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 3.4% from 2021 to 2027 |

| Number of Pages | 178 |

| Number of Tables | 283 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, End Use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Region-wise, the shipbuilding market is analyzed in North America, Europe, Asia-Pacific, LAMEA. In 2020, Asia-Pacific dominated the shipbuilding market by generating maximum revenue. The rising development in the regional seaborne transportation and naval shipbuilding sector in the region is expected to support the shipbuilding industry. Countries such as China, Japan, and Korea are the major contributors to the shipbuilding market in the region.

Free Valuable Insights: Global Shipbuilding Market size to reach USD 176.1 Billion by 2027

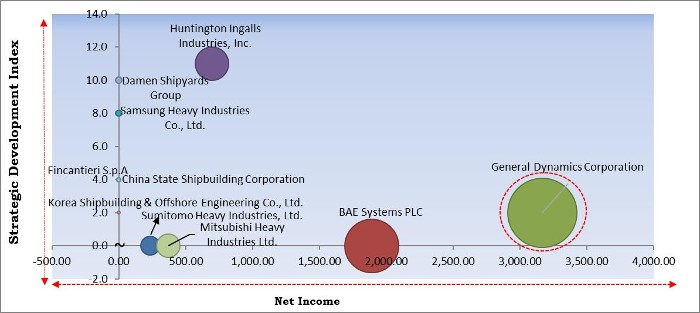

KBV Cardinal Matrix - Shipbuilding Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; General Dynamics Corporation is the major forerunner in the Shipbuilding Market. Companies such as Huntington Ingalls Industries, Inc., Samsung Heavy Industries Co., Ltd., Damen Shipyards Group are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Huntington Ingalls Industries, Inc., Samsung Heavy Industries Co., Ltd. (Samsung Group), Sumitomo Heavy Industries, Ltd., BAE Systems PLC, Damen Shipyards Group, China State Shipbuilding Corporation, Fincantieri S.p.A (CDP Industria S.p.A.), Korea Shipbuilding & Offshore Engineering Co., Ltd., General Dynamics Corporation, and Mitsubishi Heavy Industries Ltd.

Recent Strategies Deployed in Shipbuilding Market

» Partnerships, Collaborations and Agreements:

- Nov-2021: Samsung Heavy Industries collaborated with Microsoft Korea, a computer software, consumer electronics, personal computers, and related services providing company. Under this collaboration, Microsoft would provide cloud computing service Azure, artificial intelligence, group chat software Teams, and metaverse technologies to Samsung. The company aimed to build up a collaboration system among every shipbuilding sector in its shipyard.

- Aug-2021: China State Shipbuilding Corporation (CSSC) came into an agreement with Shanghai municipal government. This agreement aimed to strengthen the development of high-end industries and advanced resources in Shanghai and enhance the development of the marine equipment industry along with the improvement of the industrial chain and supply chain.

- Jul-2021: Samsung Heavy Industries entered into a partnership with Dae Sun, a compatriot midsize shipbuilder. Under this partnership, Samsung Heavily would share SVESSEL, a smart ship system, with Dae Sun. Through this partnership, the companies aimed to boost technology exchange in smart and eco-friendly ships and help shipbuilders gain a competitive advantage in the midsized shipbuilding market.

- Jun-2021: Samsung Heavy Industries partnered with Korea Atomic Energy Research Institute (KAERI), a national nuclear research institute in the Republic of Korea. Through this partnership, the entities aimed to design molten salt reactors to power ships and market offshore power plants, and plan to build nuclear-powered merchant ships.

- Mar-2021: Korea Shipbuilding & Offshore Engineering (KSOE) came into partnership with Korean Register (KR), a not-for-profit classification society offering verification and certification services for ships and marine structures. Under this partnership, the companies aimed to design the world's first hydrogen vessel standard. In addition, companies signed an MOU on establishing safety design regulations with the hydrogen ships, reported Business Korea.

- Oct-2020: Fincantieri entered into a Memorandum of understanding (MoU) with Cochin Shipyard Limited (CSL), India’s state-owned shipbuilder. This MoU aimed to improve Fincantieri’s presence in the country by providing momentum to a long-term partnership with CSL which has facilities on the East as well as West coast of India.

- Jun-2020: General Dynamics Electric Boat (GDEB) entered into a contract with AECOM, the world's trusted infrastructure consulting firm in Los Angeles, California. Under the contract, the companies would construct a facility to support the construction of the U.S. Navy's future class of ballistic-missile submarines (SSBN) and to accomplish the construction of the South Yard Assembly Building (SYAB), the centerpiece of the largest facility expansion at the company’s Groton shipyard in last 50 years.

- Feb-2020: Technical Solutions business, a business of Huntington Ingalls Industries signed an agreement with Titan Acquisition Holdings, a company comprised of Vigor Industrial and MHI Holdings. Under this agreement, Technical Solutions would contribute its San Diego Shipyard to Titan. This agreement would expand Titan’s ship repair and complex fabrication business with critical mass, augment, and strategically located facilities in Norfolk; San Diego; Seattle; Portland, Oregon; Vancouver, Washington; and Ketchikan, Alaska.

» Product Launches and Product Expansions:

- May-2021: Damen introduced its new product, Crane Barge 7532. By this launch, the yard would make the end preparations for its coming journey to Huisman’s Chinese yard in Fujian Province. The company took time to know the exact water depth required to perform the triumphant launch of the barge.

- May-2021: Damen Yichang Shipyard unveiled RoPax 6716 into the water. Port Authority of Timor-Leste (APORTIL) would operate the vessel between Timor-Leste’s capital Dili, the Oecusse enclave, and the Ataúro island, carrying up to 308 passengers, vehicles, and cargo. In addition, this ferry would enhance access to trade, employment, and education.

- Mar-2020: Huntington Ingalls Industries introduced Fort Lauderdale, an amphibious transport dock ship. The San Antonio class is the advanced addition in the Navy’s 21st-century amphibious assault force. By this launch, the company aimed to embark and land Marines, wherein their equipment and supplies ashore through air cushion or conventional landing craft and amphibious assault vehicles, amplified by helicopters or vertical takeoff and landing aircraft such as the MV-22 Osprey.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Bulk Carriers

- Oil Tankers

- Container Ships

- General Cargo Ships

- Passenger Ships and

- Others

By End Use

- Transport and

- Military

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Huntington Ingalls Industries, Inc.

- Samsung Heavy Industries Co., Ltd. (Samsung Group)

- Sumitomo Heavy Industries, Ltd.

- BAE Systems PLC

- Damen Shipyards Group

- China State Shipbuilding Corporation

- Fincantieri S.p.A (CDP Industria S.p.A.)

- Korea Shipbuilding & Offshore Engineering Co., Ltd.

- General Dynamics Corporation

- Mitsubishi Heavy Industries Ltd.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Shipbuilding Market, by Type

1.4.2 Global Shipbuilding Market, by End Use

1.4.3 Global Shipbuilding Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2017-2021)

3.3.2 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018, Aug – 2021, Nov) Leading Players

Chapter 4. Global Shipbuilding Market by Type

4.1 Global Bulk Carriers Market by Region

4.2 Global Oil Tankers Market by Region

4.3 Global Container Ships Market by Region

4.4 Global General Cargo Ships Market by Region

4.5 Global Passenger Ships Market by Region

4.6 Global Other Type Market by Region

Chapter 5. Global Shipbuilding Market by End Use

5.1 Global Transport Market by Region

5.2 Global Military Market by Region

Chapter 6. Global Shipbuilding Market by Region

6.1 North America Shipbuilding Market

6.1.1 North America Shipbuilding Market by Type

6.1.1.1 North America Bulk Carriers Market by Country

6.1.1.2 North America Oil Tankers Market by Country

6.1.1.3 North America Container Ships Market by Country

6.1.1.4 North America General Cargo Ships Market by Country

6.1.1.5 North America Passenger Ships Market by Country

6.1.1.6 North America Other Type Market by Country

6.1.2 North America Shipbuilding Market by End Use

6.1.2.1 North America Transport Market by Country

6.1.2.2 North America Military Market by Country

6.1.3 North America Shipbuilding Market by Country

6.1.3.1 US Shipbuilding Market

6.1.3.1.1 US Shipbuilding Market by Type

6.1.3.1.2 US Shipbuilding Market by End Use

6.1.3.2 Canada Shipbuilding Market

6.1.3.2.1 Canada Shipbuilding Market by Type

6.1.3.2.2 Canada Shipbuilding Market by End Use

6.1.3.3 Mexico Shipbuilding Market

6.1.3.3.1 Mexico Shipbuilding Market by Type

6.1.3.3.2 Mexico Shipbuilding Market by End Use

6.1.3.4 Rest of North America Shipbuilding Market

6.1.3.4.1 Rest of North America Shipbuilding Market by Type

6.1.3.4.2 Rest of North America Shipbuilding Market by End Use

6.2 Europe Shipbuilding Market

6.2.1 Europe Shipbuilding Market by Type

6.2.1.1 Europe Bulk Carriers Market by Country

6.2.1.2 Europe Oil Tankers Market by Country

6.2.1.3 Europe Container Ships Market by Country

6.2.1.4 Europe General Cargo Ships Market by Country

6.2.1.5 Europe Passenger Ships Market by Country

6.2.1.6 Europe Other Type Market by Country

6.2.2 Europe Shipbuilding Market by End Use

6.2.2.1 Europe Transport Market by Country

6.2.2.2 Europe Military Market by Country

6.2.3 Europe Shipbuilding Market by Country

6.2.3.1 Germany Shipbuilding Market

6.2.3.1.1 Germany Shipbuilding Market by Type

6.2.3.1.2 Germany Shipbuilding Market by End Use

6.2.3.2 UK Shipbuilding Market

6.2.3.2.1 UK Shipbuilding Market by Type

6.2.3.2.2 UK Shipbuilding Market by End Use

6.2.3.3 France Shipbuilding Market

6.2.3.3.1 France Shipbuilding Market by Type

6.2.3.3.2 France Shipbuilding Market by End Use

6.2.3.4 Russia Shipbuilding Market

6.2.3.4.1 Russia Shipbuilding Market by Type

6.2.3.4.2 Russia Shipbuilding Market by End Use

6.2.3.5 Spain Shipbuilding Market

6.2.3.5.1 Spain Shipbuilding Market by Type

6.2.3.5.2 Spain Shipbuilding Market by End Use

6.2.3.6 Italy Shipbuilding Market

6.2.3.6.1 Italy Shipbuilding Market by Type

6.2.3.6.2 Italy Shipbuilding Market by End Use

6.2.3.7 Rest of Europe Shipbuilding Market

6.2.3.7.1 Rest of Europe Shipbuilding Market by Type

6.2.3.7.2 Rest of Europe Shipbuilding Market by End Use

6.3 Asia Pacific Shipbuilding Market

6.3.1 Asia Pacific Shipbuilding Market by Type

6.3.1.1 Asia Pacific Bulk Carriers Market by Country

6.3.1.2 Asia Pacific Oil Tankers Market by Country

6.3.1.3 Asia Pacific Container Ships Market by Country

6.3.1.4 Asia Pacific General Cargo Ships Market by Country

6.3.1.5 Asia Pacific Passenger Ships Market by Country

6.3.1.6 Asia Pacific Other Type Market by Country

6.3.2 Asia Pacific Shipbuilding Market by End Use

6.3.2.1 Asia Pacific Transport Market by Country

6.3.2.2 Asia Pacific Military Market by Country

6.3.3 Asia Pacific Shipbuilding Market by Country

6.3.3.1 China Shipbuilding Market

6.3.3.1.1 China Shipbuilding Market by Type

6.3.3.1.2 China Shipbuilding Market by End Use

6.3.3.2 Japan Shipbuilding Market

6.3.3.2.1 Japan Shipbuilding Market by Type

6.3.3.2.2 Japan Shipbuilding Market by End Use

6.3.3.3 India Shipbuilding Market

6.3.3.3.1 India Shipbuilding Market by Type

6.3.3.3.2 India Shipbuilding Market by End Use

6.3.3.4 South Korea Shipbuilding Market

6.3.3.4.1 South Korea Shipbuilding Market by Type

6.3.3.4.2 South Korea Shipbuilding Market by End Use

6.3.3.5 Singapore Shipbuilding Market

6.3.3.5.1 Singapore Shipbuilding Market by Type

6.3.3.5.2 Singapore Shipbuilding Market by End Use

6.3.3.6 Malaysia Shipbuilding Market

6.3.3.6.1 Malaysia Shipbuilding Market by Type

6.3.3.6.2 Malaysia Shipbuilding Market by End Use

6.3.3.7 Rest of Asia Pacific Shipbuilding Market

6.3.3.7.1 Rest of Asia Pacific Shipbuilding Market by Type

6.3.3.7.2 Rest of Asia Pacific Shipbuilding Market by End Use

6.4 LAMEA Shipbuilding Market

6.4.1 LAMEA Shipbuilding Market by Type

6.4.1.1 LAMEA Bulk Carriers Market by Country

6.4.1.2 LAMEA Oil Tankers Market by Country

6.4.1.3 LAMEA Container Ships Market by Country

6.4.1.4 LAMEA General Cargo Ships Market by Country

6.4.1.5 LAMEA Passenger Ships Market by Country

6.4.1.6 LAMEA Other Type Market by Country

6.4.2 LAMEA Shipbuilding Market by End Use

6.4.2.1 LAMEA Transport Market by Country

6.4.2.2 LAMEA Military Market by Country

6.4.3 LAMEA Shipbuilding Market by Country

6.4.3.1 Brazil Shipbuilding Market

6.4.3.1.1 Brazil Shipbuilding Market by Type

6.4.3.1.2 Brazil Shipbuilding Market by End Use

6.4.3.2 Argentina Shipbuilding Market

6.4.3.2.1 Argentina Shipbuilding Market by Type

6.4.3.2.2 Argentina Shipbuilding Market by End Use

6.4.3.3 UAE Shipbuilding Market

6.4.3.3.1 UAE Shipbuilding Market by Type

6.4.3.3.2 UAE Shipbuilding Market by End Use

6.4.3.4 Saudi Arabia Shipbuilding Market

6.4.3.4.1 Saudi Arabia Shipbuilding Market by Type

6.4.3.4.2 Saudi Arabia Shipbuilding Market by End Use

6.4.3.5 South Africa Shipbuilding Market

6.4.3.5.1 South Africa Shipbuilding Market by Type

6.4.3.5.2 South Africa Shipbuilding Market by End Use

6.4.3.6 Nigeria Shipbuilding Market

6.4.3.6.1 Nigeria Shipbuilding Market by Type

6.4.3.6.2 Nigeria Shipbuilding Market by End Use

6.4.3.7 Rest of LAMEA Shipbuilding Market

6.4.3.7.1 Rest of LAMEA Shipbuilding Market by Type

6.4.3.7.2 Rest of LAMEA Shipbuilding Market by End Use

Chapter 7. Company Profiles

7.1 Huntington Ingalls Industries, Inc.

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expenses

7.1.5 Recent strategies and developments:

7.1.5.1 Partnerships, Collaborations, and Agreements:

7.1.5.2 Product Launches and Product Expansions:

7.2 Samsung Heavy Industries Co., Ltd. (Samsung Group)

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Segmental and Regional Analysis

7.2.4 Research & Development Expenses

7.2.5 Recent strategies and developments:

7.2.5.1 Partnerships, Collaborations, and Agreements:

7.3 Sumitomo Heavy Industries, Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental and Regional Analysis

7.4 BAE Systems PLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expenses

7.4.5 SWOT Analysis

7.5 Damen Shipyards Group

7.5.1 Company Overview

7.5.2 Recent strategies and developments:

7.5.2.1 Product Launches and Product Expansions:

7.5.2.2 Acquisition and Mergers:

7.6 China State Shipbuilding Corporation

7.6.1 Company Overview

7.6.2 Recent strategies and developments:

7.6.2.1 Partnerships, Collaborations, and Agreements:

7.7 Fincantieri S.p.A (CDP Industria S.p.A.)

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Segmental and Regional Analysis

7.7.4 Research & Development Expenses

7.7.5 Recent strategies and developments:

7.7.5.1 Partnerships, Collaborations, and Agreements:

7.8 Korea Shipbuilding & Offshore Engineering Co., Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Segmental and Regional Analysis

7.8.4 Recent strategies and developments:

7.8.4.1 Partnerships, Collaborations, and Agreements:

7.9 General Dynamics Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Segmental and Regional Analysis

7.9.4 Research & Development Expense

7.9.5 Recent strategies and developments:

7.9.5.1 Partnerships, Collaborations, and Agreements:

7.9.6 SWOT Analysis

7.10. Mitsubishi Heavy Industries Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Regional & Segmental Analysis

TABLE 2 Global Shipbuilding Market, 2021 - 2027, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Shipbuilding Market

TABLE 4 Product Launches And Product Expansions– Shipbuilding Market

TABLE 5 Acquisition and Mergers– Shipbuilding Market

TABLE 6 Global Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 7 Global Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 8 Global Bulk Carriers Market by Region, 2017 - 2020, USD Million

TABLE 9 Global Bulk Carriers Market by Region, 2021 - 2027, USD Million

TABLE 10 Global Oil Tankers Market by Region, 2017 - 2020, USD Million

TABLE 11 Global Oil Tankers Market by Region, 2021 - 2027, USD Million

TABLE 12 Global Container Ships Market by Region, 2017 - 2020, USD Million

TABLE 13 Global Container Ships Market by Region, 2021 - 2027, USD Million

TABLE 14 Global General Cargo Ships Market by Region, 2017 - 2020, USD Million

TABLE 15 Global General Cargo Ships Market by Region, 2021 - 2027, USD Million

TABLE 16 Global Passenger Ships Market by Region, 2017 - 2020, USD Million

TABLE 17 Global Passenger Ships Market by Region, 2021 - 2027, USD Million

TABLE 18 Global Other Type Market by Region, 2017 - 2020, USD Million

TABLE 19 Global Other Type Market by Region, 2021 - 2027, USD Million

TABLE 20 Global Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 21 Global Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 22 Global Transport Market by Region, 2017 - 2020, USD Million

TABLE 23 Global Transport Market by Region, 2021 - 2027, USD Million

TABLE 24 Global Military Market by Region, 2017 - 2020, USD Million

TABLE 25 Global Military Market by Region, 2021 - 2027, USD Million

TABLE 26 Global Shipbuilding Market by Region, 2017 - 2020, USD Million

TABLE 27 Global Shipbuilding Market by Region, 2021 - 2027, USD Million

TABLE 28 North America Shipbuilding Market, 2017 - 2020, USD Million

TABLE 29 North America Shipbuilding Market, 2021 - 2027, USD Million

TABLE 30 North America Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 31 North America Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 32 North America Bulk Carriers Market by Country, 2017 - 2020, USD Million

TABLE 33 North America Bulk Carriers Market by Country, 2021 - 2027, USD Million

TABLE 34 North America Oil Tankers Market by Country, 2017 - 2020, USD Million

TABLE 35 North America Oil Tankers Market by Country, 2021 - 2027, USD Million

TABLE 36 North America Container Ships Market by Country, 2017 - 2020, USD Million

TABLE 37 North America Container Ships Market by Country, 2021 - 2027, USD Million

TABLE 38 North America General Cargo Ships Market by Country, 2017 - 2020, USD Million

TABLE 39 North America General Cargo Ships Market by Country, 2021 - 2027, USD Million

TABLE 40 North America Passenger Ships Market by Country, 2017 - 2020, USD Million

TABLE 41 North America Passenger Ships Market by Country, 2021 - 2027, USD Million

TABLE 42 North America Other Type Market by Country, 2017 - 2020, USD Million

TABLE 43 North America Other Type Market by Country, 2021 - 2027, USD Million

TABLE 44 North America Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 45 North America Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 46 North America Transport Market by Country, 2017 - 2020, USD Million

TABLE 47 North America Transport Market by Country, 2021 - 2027, USD Million

TABLE 48 North America Military Market by Country, 2017 - 2020, USD Million

TABLE 49 North America Military Market by Country, 2021 - 2027, USD Million

TABLE 50 North America Shipbuilding Market by Country, 2017 - 2020, USD Million

TABLE 51 North America Shipbuilding Market by Country, 2021 - 2027, USD Million

TABLE 52 US Shipbuilding Market, 2017 - 2020, USD Million

TABLE 53 US Shipbuilding Market, 2021 - 2027, USD Million

TABLE 54 US Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 55 US Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 56 US Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 57 US Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 58 Canada Shipbuilding Market, 2017 - 2020, USD Million

TABLE 59 Canada Shipbuilding Market, 2021 - 2027, USD Million

TABLE 60 Canada Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 61 Canada Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 62 Canada Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 63 Canada Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 64 Mexico Shipbuilding Market, 2017 - 2020, USD Million

TABLE 65 Mexico Shipbuilding Market, 2021 - 2027, USD Million

TABLE 66 Mexico Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 67 Mexico Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 68 Mexico Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 69 Mexico Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 70 Rest of North America Shipbuilding Market, 2017 - 2020, USD Million

TABLE 71 Rest of North America Shipbuilding Market, 2021 - 2027, USD Million

TABLE 72 Rest of North America Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 73 Rest of North America Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 74 Rest of North America Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 75 Rest of North America Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 76 Europe Shipbuilding Market, 2017 - 2020, USD Million

TABLE 77 Europe Shipbuilding Market, 2021 - 2027, USD Million

TABLE 78 Europe Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 79 Europe Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 80 Europe Bulk Carriers Market by Country, 2017 - 2020, USD Million

TABLE 81 Europe Bulk Carriers Market by Country, 2021 - 2027, USD Million

TABLE 82 Europe Oil Tankers Market by Country, 2017 - 2020, USD Million

TABLE 83 Europe Oil Tankers Market by Country, 2021 - 2027, USD Million

TABLE 84 Europe Container Ships Market by Country, 2017 - 2020, USD Million

TABLE 85 Europe Container Ships Market by Country, 2021 - 2027, USD Million

TABLE 86 Europe General Cargo Ships Market by Country, 2017 - 2020, USD Million

TABLE 87 Europe General Cargo Ships Market by Country, 2021 - 2027, USD Million

TABLE 88 Europe Passenger Ships Market by Country, 2017 - 2020, USD Million

TABLE 89 Europe Passenger Ships Market by Country, 2021 - 2027, USD Million

TABLE 90 Europe Other Type Market by Country, 2017 - 2020, USD Million

TABLE 91 Europe Other Type Market by Country, 2021 - 2027, USD Million

TABLE 92 Europe Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 93 Europe Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 94 Europe Transport Market by Country, 2017 - 2020, USD Million

TABLE 95 Europe Transport Market by Country, 2021 - 2027, USD Million

TABLE 96 Europe Military Market by Country, 2017 - 2020, USD Million

TABLE 97 Europe Military Market by Country, 2021 - 2027, USD Million

TABLE 98 Europe Shipbuilding Market by Country, 2017 - 2020, USD Million

TABLE 99 Europe Shipbuilding Market by Country, 2021 - 2027, USD Million

TABLE 100 Germany Shipbuilding Market, 2017 - 2020, USD Million

TABLE 101 Germany Shipbuilding Market, 2021 - 2027, USD Million

TABLE 102 Germany Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 103 Germany Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 104 Germany Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 105 Germany Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 106 UK Shipbuilding Market, 2017 - 2020, USD Million

TABLE 107 UK Shipbuilding Market, 2021 - 2027, USD Million

TABLE 108 UK Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 109 UK Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 110 UK Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 111 UK Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 112 France Shipbuilding Market, 2017 - 2020, USD Million

TABLE 113 France Shipbuilding Market, 2021 - 2027, USD Million

TABLE 114 France Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 115 France Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 116 France Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 117 France Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 118 Russia Shipbuilding Market, 2017 - 2020, USD Million

TABLE 119 Russia Shipbuilding Market, 2021 - 2027, USD Million

TABLE 120 Russia Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 121 Russia Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 122 Russia Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 123 Russia Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 124 Spain Shipbuilding Market, 2017 - 2020, USD Million

TABLE 125 Spain Shipbuilding Market, 2021 - 2027, USD Million

TABLE 126 Spain Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 127 Spain Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 128 Spain Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 129 Spain Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 130 Italy Shipbuilding Market, 2017 - 2020, USD Million

TABLE 131 Italy Shipbuilding Market, 2021 - 2027, USD Million

TABLE 132 Italy Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 133 Italy Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 134 Italy Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 135 Italy Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 136 Rest of Europe Shipbuilding Market, 2017 - 2020, USD Million

TABLE 137 Rest of Europe Shipbuilding Market, 2021 - 2027, USD Million

TABLE 138 Rest of Europe Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 139 Rest of Europe Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 140 Rest of Europe Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 141 Rest of Europe Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 142 Asia Pacific Shipbuilding Market, 2017 - 2020, USD Million

TABLE 143 Asia Pacific Shipbuilding Market, 2021 - 2027, USD Million

TABLE 144 Asia Pacific Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 145 Asia Pacific Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 146 Asia Pacific Bulk Carriers Market by Country, 2017 - 2020, USD Million

TABLE 147 Asia Pacific Bulk Carriers Market by Country, 2021 - 2027, USD Million

TABLE 148 Asia Pacific Oil Tankers Market by Country, 2017 - 2020, USD Million

TABLE 149 Asia Pacific Oil Tankers Market by Country, 2021 - 2027, USD Million

TABLE 150 Asia Pacific Container Ships Market by Country, 2017 - 2020, USD Million

TABLE 151 Asia Pacific Container Ships Market by Country, 2021 - 2027, USD Million

TABLE 152 Asia Pacific General Cargo Ships Market by Country, 2017 - 2020, USD Million

TABLE 153 Asia Pacific General Cargo Ships Market by Country, 2021 - 2027, USD Million

TABLE 154 Asia Pacific Passenger Ships Market by Country, 2017 - 2020, USD Million

TABLE 155 Asia Pacific Passenger Ships Market by Country, 2021 - 2027, USD Million

TABLE 156 Asia Pacific Other Type Market by Country, 2017 - 2020, USD Million

TABLE 157 Asia Pacific Other Type Market by Country, 2021 - 2027, USD Million

TABLE 158 Asia Pacific Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 159 Asia Pacific Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 160 Asia Pacific Transport Market by Country, 2017 - 2020, USD Million

TABLE 161 Asia Pacific Transport Market by Country, 2021 - 2027, USD Million

TABLE 162 Asia Pacific Military Market by Country, 2017 - 2020, USD Million

TABLE 163 Asia Pacific Military Market by Country, 2021 - 2027, USD Million

TABLE 164 Asia Pacific Shipbuilding Market by Country, 2017 - 2020, USD Million

TABLE 165 Asia Pacific Shipbuilding Market by Country, 2021 - 2027, USD Million

TABLE 166 China Shipbuilding Market, 2017 - 2020, USD Million

TABLE 167 China Shipbuilding Market, 2021 - 2027, USD Million

TABLE 168 China Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 169 China Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 170 China Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 171 China Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 172 Japan Shipbuilding Market, 2017 - 2020, USD Million

TABLE 173 Japan Shipbuilding Market, 2021 - 2027, USD Million

TABLE 174 Japan Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 175 Japan Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 176 Japan Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 177 Japan Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 178 India Shipbuilding Market, 2017 - 2020, USD Million

TABLE 179 India Shipbuilding Market, 2021 - 2027, USD Million

TABLE 180 India Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 181 India Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 182 India Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 183 India Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 184 South Korea Shipbuilding Market, 2017 - 2020, USD Million

TABLE 185 South Korea Shipbuilding Market, 2021 - 2027, USD Million

TABLE 186 South Korea Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 187 South Korea Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 188 South Korea Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 189 South Korea Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 190 Singapore Shipbuilding Market, 2017 - 2020, USD Million

TABLE 191 Singapore Shipbuilding Market, 2021 - 2027, USD Million

TABLE 192 Singapore Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 193 Singapore Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 194 Singapore Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 195 Singapore Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 196 Malaysia Shipbuilding Market, 2017 - 2020, USD Million

TABLE 197 Malaysia Shipbuilding Market, 2021 - 2027, USD Million

TABLE 198 Malaysia Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 199 Malaysia Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 200 Malaysia Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 201 Malaysia Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 202 Rest of Asia Pacific Shipbuilding Market, 2017 - 2020, USD Million

TABLE 203 Rest of Asia Pacific Shipbuilding Market, 2021 - 2027, USD Million

TABLE 204 Rest of Asia Pacific Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 205 Rest of Asia Pacific Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 206 Rest of Asia Pacific Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 207 Rest of Asia Pacific Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 208 LAMEA Shipbuilding Market, 2017 - 2020, USD Million

TABLE 209 LAMEA Shipbuilding Market, 2021 - 2027, USD Million

TABLE 210 LAMEA Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 211 LAMEA Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 212 LAMEA Bulk Carriers Market by Country, 2017 - 2020, USD Million

TABLE 213 LAMEA Bulk Carriers Market by Country, 2021 - 2027, USD Million

TABLE 214 LAMEA Oil Tankers Market by Country, 2017 - 2020, USD Million

TABLE 215 LAMEA Oil Tankers Market by Country, 2021 - 2027, USD Million

TABLE 216 LAMEA Container Ships Market by Country, 2017 - 2020, USD Million

TABLE 217 LAMEA Container Ships Market by Country, 2021 - 2027, USD Million

TABLE 218 LAMEA General Cargo Ships Market by Country, 2017 - 2020, USD Million

TABLE 219 LAMEA General Cargo Ships Market by Country, 2021 - 2027, USD Million

TABLE 220 LAMEA Passenger Ships Market by Country, 2017 - 2020, USD Million

TABLE 221 LAMEA Passenger Ships Market by Country, 2021 - 2027, USD Million

TABLE 222 LAMEA Other Type Market by Country, 2017 - 2020, USD Million

TABLE 223 LAMEA Other Type Market by Country, 2021 - 2027, USD Million

TABLE 224 LAMEA Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 225 LAMEA Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 226 LAMEA Transport Market by Country, 2017 - 2020, USD Million

TABLE 227 LAMEA Transport Market by Country, 2021 - 2027, USD Million

TABLE 228 LAMEA Military Market by Country, 2017 - 2020, USD Million

TABLE 229 LAMEA Military Market by Country, 2021 - 2027, USD Million

TABLE 230 LAMEA Shipbuilding Market by Country, 2017 - 2020, USD Million

TABLE 231 LAMEA Shipbuilding Market by Country, 2021 - 2027, USD Million

TABLE 232 Brazil Shipbuilding Market, 2017 - 2020, USD Million

TABLE 233 Brazil Shipbuilding Market, 2021 - 2027, USD Million

TABLE 234 Brazil Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 235 Brazil Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 236 Brazil Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 237 Brazil Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 238 Argentina Shipbuilding Market, 2017 - 2020, USD Million

TABLE 239 Argentina Shipbuilding Market, 2021 - 2027, USD Million

TABLE 240 Argentina Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 241 Argentina Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 242 Argentina Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 243 Argentina Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 244 UAE Shipbuilding Market, 2017 - 2020, USD Million

TABLE 245 UAE Shipbuilding Market, 2021 - 2027, USD Million

TABLE 246 UAE Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 247 UAE Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 248 UAE Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 249 UAE Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 250 Saudi Arabia Shipbuilding Market, 2017 - 2020, USD Million

TABLE 251 Saudi Arabia Shipbuilding Market, 2021 - 2027, USD Million

TABLE 252 Saudi Arabia Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 253 Saudi Arabia Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 254 Saudi Arabia Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 255 Saudi Arabia Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 256 South Africa Shipbuilding Market, 2017 - 2020, USD Million

TABLE 257 South Africa Shipbuilding Market, 2021 - 2027, USD Million

TABLE 258 South Africa Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 259 South Africa Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 260 South Africa Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 261 South Africa Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 262 Nigeria Shipbuilding Market, 2017 - 2020, USD Million

TABLE 263 Nigeria Shipbuilding Market, 2021 - 2027, USD Million

TABLE 264 Nigeria Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 265 Nigeria Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 266 Nigeria Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 267 Nigeria Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 268 Rest of LAMEA Shipbuilding Market, 2017 - 2020, USD Million

TABLE 269 Rest of LAMEA Shipbuilding Market, 2021 - 2027, USD Million

TABLE 270 Rest of LAMEA Shipbuilding Market by Type, 2017 - 2020, USD Million

TABLE 271 Rest of LAMEA Shipbuilding Market by Type, 2021 - 2027, USD Million

TABLE 272 Rest of LAMEA Shipbuilding Market by End Use, 2017 - 2020, USD Million

TABLE 273 Rest of LAMEA Shipbuilding Market by End Use, 2021 - 2027, USD Million

TABLE 274 Key Information – Huntington Ingalls Industries, Inc.

TABLE 275 Key Information – Samsung Heavy Industries Co., Ltd.

TABLE 276 Key Information – Sumitomo Heavy Industries, Ltd.

TABLE 277 Key Information – BAE Systems PLC

TABLE 278 Key Information – Damen Shipyards Group

TABLE 279 Key Information – China State Shipbuilding Corporation

TABLE 280 Key Information – Fincantieri S.p.A.

TABLE 281 Key Information – Korea Shipbuilding & Offshore Engineering Co., Ltd.

TABLE 282 key information – General Dynamics Corporation

TABLE 283 Key Information – Mitsubishi Heavy Industries Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2017-2021)

FIG 4 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2018, Aug – 2021, Nov) Leading Players

FIG 5 Recent strategies and developments: Huntington Ingalls Industries, Inc.

FIG 6 SWOT Analysis: BAE SYSTEMS PLC

FIG 7 Recent strategies and developments: Damen Shipyards Group

FIG 8 SWOT Analysis: General Dynamics Corporation