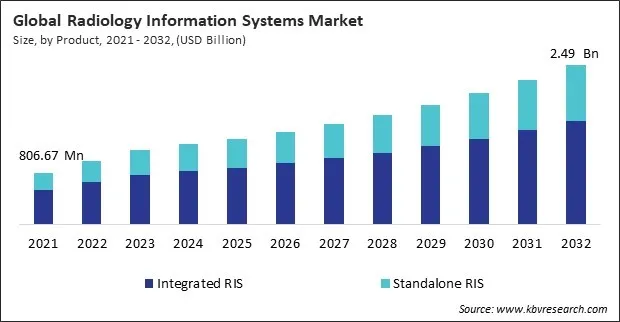

“Global Radiology Information System Market to reach a market value of USD 2.49 Billion by 2032 growing at a CAGR of 9.3%”

The Global Radiology Information System Market size is expected to reach $2.49 billion by 2032, rising at a market growth of 9.3% CAGR during the forecast period.

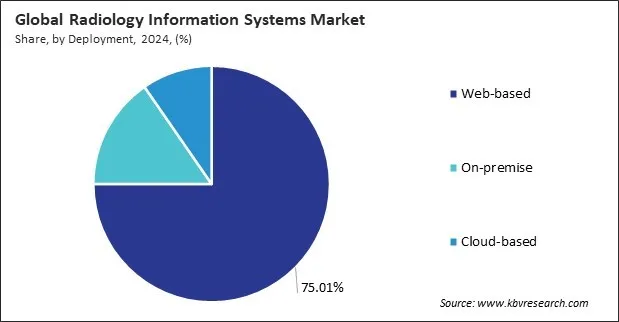

The rising interest in digital transformation and the need for scalable, cost-effective solutions have driven the adoption of cloud-based RIS. These systems offer advantages such as remote accessibility, automatic software updates, and reduced capital expenditure. Furthermore, the growing emphasis on interoperability and data sharing across healthcare networks has made cloud-based deployment an attractive option for many providers, particularly in regions with advanced IT infrastructure.

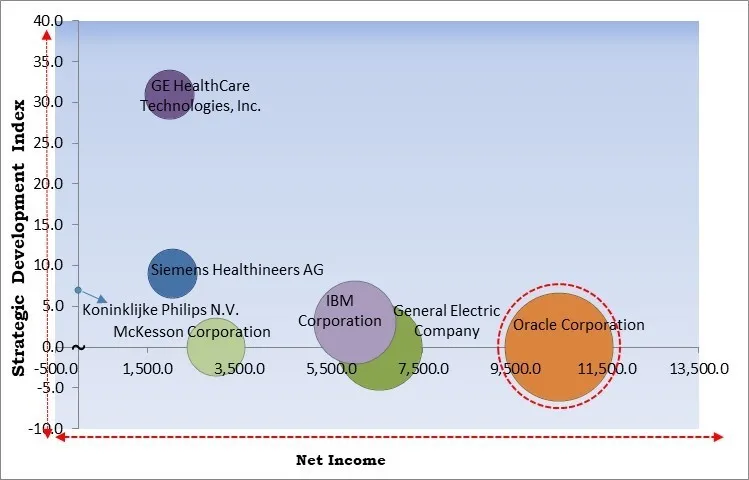

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2025, Siemens Healthineers AG teamed up with Tower Health, a regional integrated healthcare system to enhance diagnostic imaging and digital tools across radiology, oncology, and cardiology. The collaboration includes upgrading equipment, implementing digital automation, and standardizing clinical operations, aiming to improve patient care, efficiency, and long-term viability for Tower Health's healthcare network. Additionally, In March, 2025, GE HealthCare Technologies, Inc. announced the partnership with NVIDIA, a computer manufacturer corporation to develop AI-driven autonomous imaging solutions, starting with X-ray and ultrasound. Leveraging NVIDIA’s Isaac and Cosmos platforms, the goal is to ease radiology staff shortages and improve workflow efficiency through smart, automated systems that enhance diagnostic imaging and patient care.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunner in the Radiology Information System Market. Companies such as General Electric Company, IBM Corporation, McKesson Corporation are some of the key innovators in Radiology Information System Market. In February, 2025, Koninklijke Philips N.V. teamed up with Mass General Brigham, a nonprofit organization that is committed to patient care, research, teaching, and service to the community to develop advanced data infrastructure and AI to enhance patient care. This collaboration integrates live healthcare data from various sources, enabling real-time analysis and actionable insights. It focuses on improving patient safety, operational efficiency, and early detection of critical health issues.

The rising adoption of advanced healthcare IT systems is significantly driving the growth of the market. As healthcare institutions continue to modernize their infrastructure, RIS solutions have become indispensable in streamlining radiological operations. These systems offer robust tools for patient scheduling, workflow management, image tracking, and result distribution. Hence, the widespread integration of advanced healthcare IT systems significantly fuels the market's growth by streamlining radiology workflows and enhancing care delivery.

Additionally, the global expansion of imaging centers is one of the most influential factors fuelling the growth of the market. As the world’s population ages, healthcare systems are seeing a marked increase in age-related health conditions, which require diagnostic imaging for effective treatment. To meet this growing demand, public and private healthcare entities invest in new diagnostic and imaging centers equipped with state-of-the-art technology, of which RIS is a foundational component.

The high cost associated with implementing and maintaining Radiology Information Systems presents a significant barrier to market growth. Setting up a RIS infrastructure requires substantial capital investment in hardware, software licensing, networking, and integration with other hospital information systems like PACS and EHR. Thus, RIS implementation's substantial initial and ongoing costs can hinder adoption, especially among small and mid-sized healthcare providers.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Free Valuable Insights: Global Radiology Information System Market size to reach USD 2.49 Billion by 2032

Based on product, the market is characterized into integrated RIS and standalone RIS. This growth can be attributed to its cost-effectiveness and ease of implementation, especially among smaller healthcare facilities and imaging centres. These systems provide essential radiology-specific functionalities such as patient scheduling, reporting, and results tracking without the complexity of full-scale integration. The demand for standalone RIS remains robust in regions with limited healthcare IT infrastructure or where budget constraints make integrated systems less feasible.

Based on deployment, the market is classified into web-based, on-premise, and cloud-based. This is primarily due to its flexibility, scalability, and ease of access, which allows users to retrieve and manage radiology data remotely through internet-enabled devices. Web-based RIS solutions reduce the need for extensive hardware infrastructure, lower maintenance costs, and enable real-time collaboration among healthcare professionals across multiple locations. These advantages have driven widespread adoption of web-based systems, especially in large hospital networks and diagnostic centres aiming to streamline operations and enhance service delivery.

By end use, the market is divided into hospitals & clinics, outpatient department (OPD) clinics, and others. The outpatient department (OPD) clinics segment garnered 13% revenue share in the market in 2024. This growth is attributed to the increasing demand for specialized imaging services in outpatient settings, where quick turnaround and efficient patient scheduling are crucial.

The Radiology Information System (RIS) market is highly competitive, driven by rapid technological advancements, growing demand for efficient healthcare management, and increasing adoption of digital imaging solutions. Key attributes defining competition include system integration capabilities, user-friendly interfaces, data security, interoperability with other healthcare systems, and compliance with regulatory standards. Market players compete on innovation, offering cloud-based solutions, AI-driven analytics, and scalable architectures. Customer support, pricing flexibility, and seamless integration with Picture Archiving and Communication Systems (PACS) are also crucial for market success.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. This growth is supported by the increasing digitization of healthcare services, a strong focus on improving clinical efficiency, and rising investments in health IT infrastructure. Many European countries are adopting RIS to streamline diagnostic workflows, enhance data sharing between healthcare providers, and improve patient outcomes.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 1.24 Billion |

| Market size forecast in 2032 | USD 2.49 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 9.3% from 2024 to 2031 |

| Number of Pages | 263 |

| Number of Tables | 345 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Deployment, End Use, Region |

| Country scope |

|

| Companies Included | GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Siemens Healthineers AG (Siemens AG), Carestream Health, Inc. (Onex Corporation), NEXTGEN HEALTHCARE, INC., Oracle Corporation, IBM Corporation, Epic Systems Corporation, General Electric Company and McKesson Corporation |

By Product

By Deployment

By End Use

By Geography

This Market size is expected to reach $2.49 billion by 2032.

Adoption of Advanced Healthcare IT for Radiology Workflow Optimization are driving the Market in coming years, however, High Costs of Implementation and Maintenance restraints the growth of the Market.

GE HealthCare Technologies, Inc., Koninklijke Philips N.V., Siemens Healthineers AG (Siemens AG), Carestream Health, Inc. (Onex Corporation), NEXTGEN HEALTHCARE, INC., Oracle Corporation, IBM Corporation, Epic Systems Corporation, General Electric Company and McKesson Corporation

The expected CAGR of this Market is 9.3% from 2023 to 2032.

The Integrated RIS segment is leading the Market by Product in 2024; thereby, achieving a market value of $1.6 billion by 2032.

The North America region dominated the Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1.18 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges