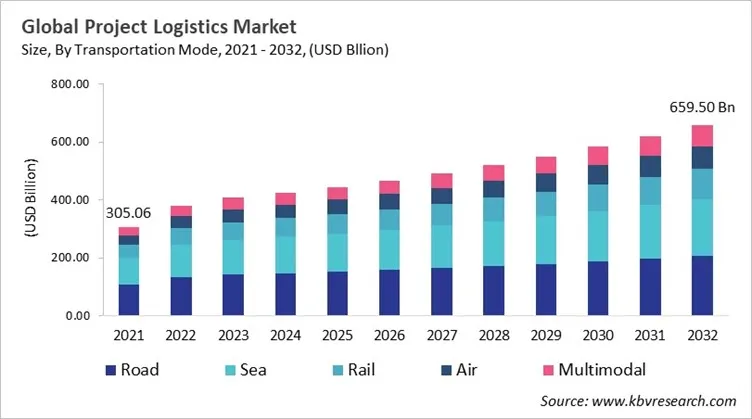

“Global Project Logistics Market to reach a market value of USD 659.50 Billion by 2032 growing at a CAGR of 5.8%”

The Global Project Logistics Market size is expected to reach USD 659.50 billion by 2032, rising at a market growth of 5.8% CAGR during the forecast period

The project logistics market has recently developed into a highly integrated ecosystem necessary for executing large scale infrastructure and industrial projects. The market is witnessing growth supported by standardized documentation, performance benchmarking, and trade facilitation reforms such as the World Bank’s Logistics Performance Index. Additionally, the rise in renewable energy, hydrogen, LNG, and grid projects has resulted in increased demand for handling heavy and large components, thereby forcing logistics to become a board-level concern. This has encouraged OEMs to adopt logistics-based industrialization strategies like port-proximate manufacturing, and roll-off models, while AI-driven safety screening have shifted from being differentiators to base requirements.

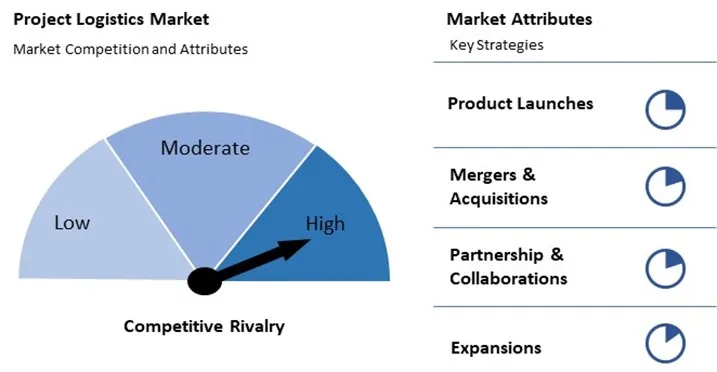

The project logistics market is witnessing expansion due to elements such as increased demand for early logistics coordination to safeguard scarce cranes, vessels, in collaboration with OEM production schedules. Also, digitalization and safety have resulted in competitive advantages, with multimodal platforms allowing predictive visibility and AI tools improving hazardous logistics governance. The key market players are pursuing strategies such as end-to-end deployment of services across mega projects and OEM-based logistics industrialization to reduce handling costs and risks. The project logistics market seems to be competitive with operators having controllable assets, resilience-by-design approaches, and digital visibility are largely setting the pace, while customer and ESG requirements demand predictability.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In 2025, August, C.H. Robinson Worldwide, Inc. unveiled its AI-powered premium service, the "Always-on Logistics Planner." This service integrates AI agents into customer operations to automate routine tasks, provide strategic insights, and enable smooth coordination across all transport modes and regions, enhancing the efficiency of project logistics management. Additionally, In 2025, June, GEODIS unveiled Return Solutions to streamline reverse logistics processes. This initiative aims to enhance efficiency in handling product returns, reducing costs, and improving customer satisfaction, thereby supporting sustainable supply chain practices.

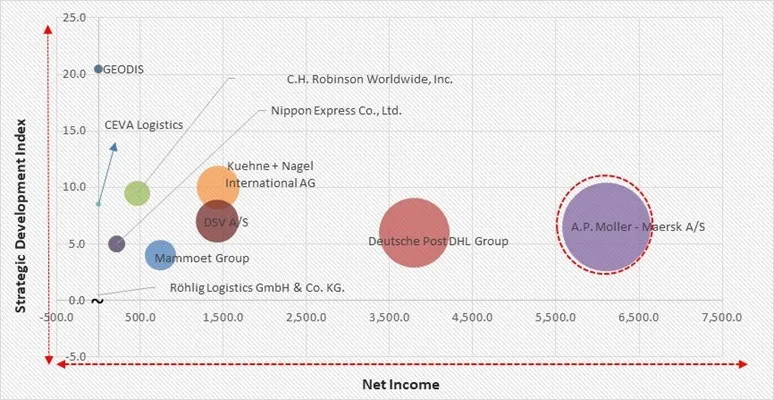

Based on the Analysis presented in the KBV Cardinal matrix; A.P. Moller - Maersk A/S is the forerunner in the Project Logistics Market. Companies such as Kuehne + Nagel International AG, DSV A/S, and Mammoet Group are some of the key innovators in Project Logistics Market. In December, 2021, DSV A/S unveiled "Green Logistics," a suite of services designed to assist customers in reducing CO₂ emissions across global supply chains. Offerings include CO₂ reporting, green supply chain optimization, sustainable fuel options, and carbon offsetting, aiming to drive the green transition in project logistics without disrupting business operations.

The COVID-19 pandemic caused a lot of problems in the global project logistics market, with delays caused by lockdowns, port closures, and supply chain bottlenecks. There were shortages of critical cargo, freight rates went up, and operations were slowed down by a lack of workers. In response, businesses changed by moving shipments to different places, building more warehouses, and using digital tools. The crisis sped up the diversification of supply chains and made it clear that businesses need to be more resilient, plan for the unexpected, and use technology better. Even though there were a lot of problems, the industry came out of it more focused on being flexible and ready for future disruptions. This period ultimately set the stage for more integrated and risk-aware practices in the post-pandemic market.

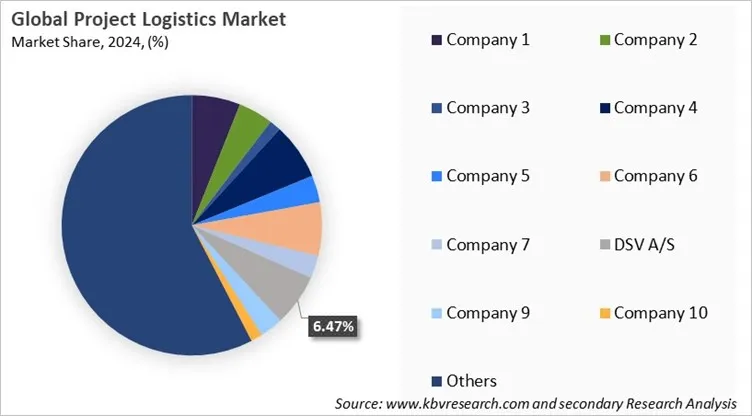

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, Product Launches and Product Expansions, and Partnerships & Collaborations.

Free Valuable Insights: Global Project Logistics Market size to reach USD 659.50 Billion by 2032

Based on transportation mode, the global project logistics market is segmented into road, sea, rail, air, and multimodal. The sea segment procured 29.6% revenue share in the market in 2024. It is the preferred choice for transporting heavy machinery, oversized equipment, and large volumes of materials across continents. Maritime logistics is particularly suited for long-distance shipments where cost efficiency outweighs speed. Ports act as critical hubs that connect global markets, supporting industries such as oil and gas, mining, and infrastructure development. Despite longer transit times, sea transport remains highly reliable for handling massive project-related cargo. This mode continues to dominate large-scale, cross-border logistics operations.

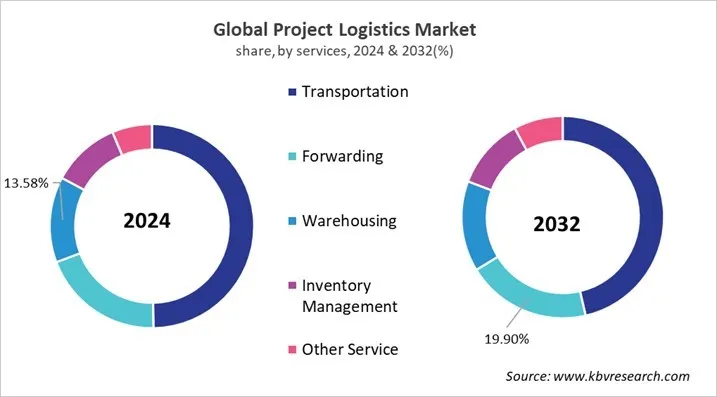

On the basis of service, the global project logistics market is segmented into transportation, forwarding, warehousing, inventory management, and other services. The forwarding segment recorded 19.5% revenue share in the market in 2024. Freight forwarding services ensure that project cargo moves smoothly from origin to destination, handling all regulatory requirements along the way. They act as intermediaries between shippers and carriers, offering expertise in compliance and route optimization. Forwarding services are especially important in global projects where multiple stakeholders and countries are involved. Their ability to streamline international shipping adds significant value to project timelines and cost efficiency.

Based on Region, the global project logistics market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded 38.9% revenue share in the market in 2024. The project logistics market is predicted to grow at a substantial rate in the North America and Europe region. This is due to the elements such as industrial decarbonization agendas, infrastructure modernization, and energy transition investments. North America is witnessing increasing demand from LNG terminals, grid reinforcement, and offshore wind projects, with US policy incentives such as the Inflation Reduction Act offering multi-year pipelines of over-dimensional and heavy-lift cargoes. Moreover, Europe region is estimated to expand at a significant rate. The region is considered a global hub for renewable energy and offshore wind logistics. The demand for integrated, engineered logistics solutions is driven by North Sea Projects and port upgrades. The well-developed logistics infrastructure, coupled with geopolitical rerouting risks, has grown the premium on corridor diversification.

The project logistics market is witnessing a significant market share in the Asia Pacific and LAMEA region. The growth is driven by expanding energy projects, rapid industrialization, and infrastructure development. Asia Pacific is experiencing high demand for complex multimodal solutions supported by India’s renewable push, China’s manufacturing-heavy supply chains, and Southeast Asia’s power and transport projects. Furthermore, the LAMEA region is expected to expand at a steady pace. This is supported by renewable energy, large-scale mining, port development, and oil & gas projects, especially in the Middle East and Africa regions. Rising port investment, adoption of digital visibility, and Ro/Ro capacity expansion are allowing operators in the region to compete with global providers.

The project logistics market is highly competitive, driven by the growing demand for complex, large-scale transportation and infrastructure projects across industries. Companies compete on service reliability, global reach, technological innovation, and cost efficiency. Market players continuously invest in advanced planning tools, specialized equipment, and integrated supply chain solutions to gain a competitive edge. Additionally, the rise in cross-border projects and renewable energy developments intensifies competition, prompting firms to offer customized, flexible logistics services tailored to specific project requirements.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 445.01 Billion |

| Market size forecast in 2032 | USD 659.50 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 5.8% from 2025 to 2032 |

| Number of Pages | 497 |

| Number of Tables | 435 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Transportation Mode, Service, End-use Industry, Region |

| Country scope |

|

| Companies Included | A.P. Moller - Maersk A/S, CEVA Logistics (CMA CGM Group), Mammoet Group (SHV Holdings N.V.), Deutsche Post DHL Group (The Deutsche Post AG), GEODIS (SNCF SA), Kuehne + Nagel International AG (Kuehne Holding AG), Nippon Express Co., Ltd., DSV A/S, C.H. Robinson Worldwide, Inc. and Röhlig Logistics GmbH & Co. KG. |

By Transportation Mode

By Service

By End-use Industry

By Geography

The market size is projected to reach USD 659.50 Billion by 2032.

The project logistics market is projected to grow at a CAGR of 5.8% between 2025 and 2032.

Massive investment in infrastructure and energy transition, coupled with globalization, supply chain integration, and evolving trade policy dynamics, is reshaping global economic growth and industrial development.

A.P. Moller - Maersk A/S, CEVA Logistics (CMA CGM Group), Mammoet Group (SHV Holdings N.V.), Deutsche Post DHL Group (The Deutsche Post AG), GEODIS (SNCF SA), Kuehne + Nagel International AG (Kuehne Holding AG), Nippon Express Co., Ltd., DSV A/S, C.H. Robinson Worldwide, Inc. and Röhlig Logistics GmbH & Co. KG.

The Transportation segment is leading the Global Project Logistics Market by Service in 2024, thereby achieving a market value of $305.83 billion by 2032.

The Asia Pacific region dominated the Global Project Logistics Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $264,266.9 million by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges