According to a new report, published by KBV research, The Global Equity Management Software Market size is expected to reach $1.5 billion by 2031, rising at a market growth of 13.8% CAGR during the forecast period.

Equity management software providers are integrating with emerging technologies such as blockchain, distributed ledger technology (DLT), and smart contracts to enhance security, transparency, and efficiency in equity transactions. Blockchain-based solutions offer immutable records of equity ownership, secure peer-to-peer transactions, and automated compliance checks. Innovations in personalized and tailored solutions enable equity management software providers to address individual customers' unique needs and preferences.

The Small & Medium-sized Enterprises segment is anticipated to have a CAGR of 14.4% during (2024 - 2031). Streamline the implementation and onboarding process to minimize the time and resources required for SMEs to start using the software. Provide user-friendly interfaces, guided setup wizards, and self-service resources to help SMEs get up and running quickly. Simplified implementation reduces barriers to adoption and accelerates time to value for SME customers.

The Basic (Under $50/Month) segment is leading the Global Equity Management Software Market by Type in 2023 thereby, achieving a market value of $720 Million by 2031. The affordability of basic (Under $50/Month) equity management software makes it accessible to small businesses and startups with limited budgets. These businesses may not have the resources to invest in higher-priced software solutions but can still benefit from basic features to manage their equity effectively. Basic-tier software often offers scalability options, allowing companies to upgrade to higher tiers as they grow and require more advanced features.

The Start-ups segment is poised to have a CAGR of 14.5% during (2024 - 2031). Start-ups often have limited resources and personnel dedicated to administrative tasks such as equity compensation management. Equity management software streamlines these processes, automating tasks such as grant approvals, vesting schedules, and reporting, thereby improving efficiency and freeing up resources for strategic initiatives.

Full Report: https://www.kbvresearch.com/equity-management-software-market/

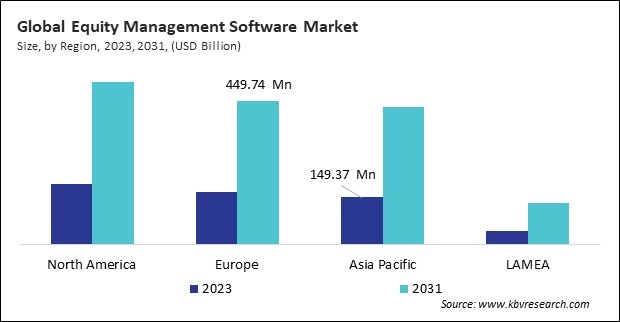

The North America region dominated the Global Equity Management Software Market by Region in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $508.4 Million by 2031. The Europe region is experiencing a CAGR of 13.6% during (2024 - 2031). Additionally, The Asia Pacific region would exhibit a CAGR of 14.4% during (2024 - 2031).

By Enterprise Size

By Type

By Application

Unique Offerings

Unique Offerings