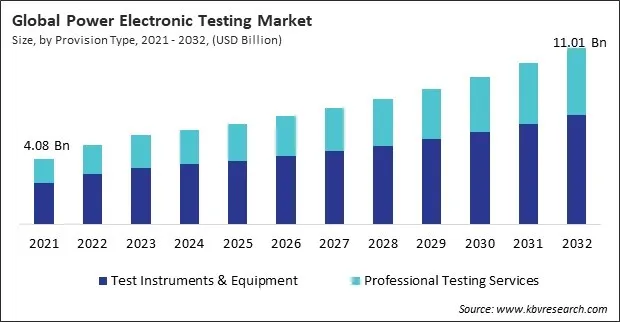

“Global Power Electronic Testing Market to reach a market value of USD 11.01 Billion by 2032 growing at a CAGR of 8.3%”

The Global Power Electronic Testing Market size is expected to reach $11.01 billion by 2032, rising at a market growth of 8.3% CAGR during the forecast period.

Due to the quick transition to electric vehicles (EVs), hybrid electric vehicles (HEVs), and next-generation mobility platforms, the automotive & mobility solutions segment leads the power electronic testing market. The performance and safety of vehicles depend on power electronic components like inverters, DC-DC converters, onboard chargers, and battery management systems. By testing these parts, you can make sure they perform well under a variety of loads, driving circumstances, and temperatures. High-precision, high-reliability testing is now essential for both OEMs and tier-1 suppliers due to growing global regulations for vehicle electrification and sustainable transportation. Thus, the automotive & mobility solutions segment witnessed 26% revenue share in the power electronic testing market in 2024.

The market for power electronic testing is significantly shaped by the global increase in the use of electric and hybrid vehicles. An intricate web of power electronic parts, including inverters, converters, battery management systems, onboard chargers, and electric drive systems, is essential to EV operation. Because these parts work with high voltages and currents, the vehicle's success depends heavily on their dependability, performance, and safety. In conclusion, the market for power electronic testing is expected to grow due in large part to the exponential growth of EV and HEV technologies, which has increased the demand for reliable, effective, and high-voltage-compatible testing solutions.

Furthermore, compared to conventional silicon-based devices, wide bandgap (WBG) semiconductors like silicon carbide (SiC) and gallium nitride (GaN) are transforming the power electronics industry by enabling faster switching, higher efficiency, and better thermal performance. Compact form factors, high power densities, and thermal robustness—features that are becoming increasingly prevalent in EVs, renewable energy systems, industrial drives, and aerospace applications—are essential for applications requiring these semiconductors. Thus, the development of power electronic testing techniques is being accelerated by the emergence of wide bandgap semiconductors, which is fueling both technological advancement and consumer demand.

However, the high capital expenditure (CAPEX) needed to set up a reliable testing infrastructure is one of the biggest obstacles preventing the widespread use of power electronic testing solutions. High-precision instruments, safety enclosures, specialized probes, shielding, thermal chambers, and automated control systems are all necessary for testing advanced power electronic systems, which operate under high voltage and current conditions. In summary, the time-consuming nature of thorough power electronic testing and the need for iterative validation significantly limit market responsiveness, agility, and innovation.

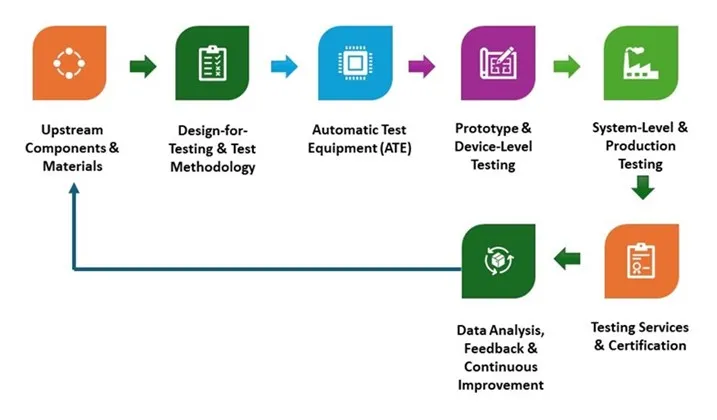

The value chain of the Power Electronic Testing Market begins with Upstream Components & Materials, where foundational elements for devices are sourced. This is followed by Design-for-Testing & Test Methodology, which ensures testability is embedded during design. Automatic Test Equipment (ATE) is then deployed for high-speed and precise functional evaluations. Next, Prototype & Device-Level Testing validates early-stage units for compliance and performance. System-Level & Production Testing follows to ensure reliability at scale. Then, Testing Services & Certification are performed to meet regulatory and quality benchmarks. Finally, Data Analysis, Feedback & Continuous Improvement closes the loop, optimizing future designs and feeding back into Upstream Components & Materials.

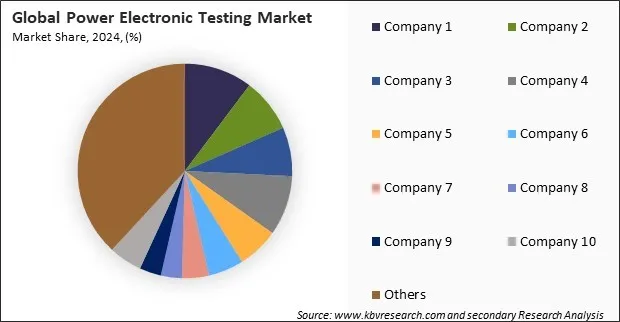

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The global market for power electronic testing suffered significant setbacks during the height of the COVID-19 pandemic. Manufacturing facilities were temporarily shut down as a result of lockdown procedures and social distancing guidelines, particularly in nations like China, Germany, the United States, and Japan that rely significantly on industrial automation and the production of high-end electronics. The manufacturing and delivery of necessary testing apparatus and parts were postponed due to these limitations. Additional project delays resulted from the pandemic's restrictions on the movement of qualified engineers and technicians who were essential for onsite testing, equipment setup, and calibration. Consequently, the market was negatively impacted by the COVID-19 pandemic.

Based on provision type, the power electronic testing market is characterized into test instruments & equipment and professional testing services. The professional testing services segment procured 37% revenue share in the power electronic testing market in 2024. Outsourced testing solutions from third-party companies or specialized labs are covered under the professional testing services segment. Environmental stress analysis, failure diagnostics, regulatory compliance testing, and performance evaluation are some of these services. When businesses lack internal resources, require independent verification, or are getting ready for certifications, they frequently turn to professional testing providers. These services guarantee that devices fulfill strict industry standards, cut down on risk, and shorten the time needed to develop new products. The demand for expert-led, external testing support is rising because of the complexity of electronic systems and mounting regulatory demands.

| Category | Details |

|---|---|

| Use Case Title | Confidential |

| Date | 2025 |

| Entities Involved | Confidential |

| Objective | Offer third-party, accredited testing services to validate the safety, durability, compliance, and performance of power electronics across end-use industries. |

| Context and Background | Manufacturers and OEMs increasingly rely on external testing labs to avoid high capital costs and to ensure impartiality in meeting regulatory standards. These services cover environmental stress, lifecycle fatigue, surge withstand, and failure mode testing. |

| Description | Product developers submit power modules, chargers, inverters, or power supplies for UL, CE, or IEC certification. Labs simulate real-world operating environments, conduct accelerated life testing (ALT), and deliver detailed failure diagnostics to guide redesign and product approval. |

| Key Capabilities Deployed |

|

| Regions Covered |

|

| Benefits |

|

| Source | Confidential |

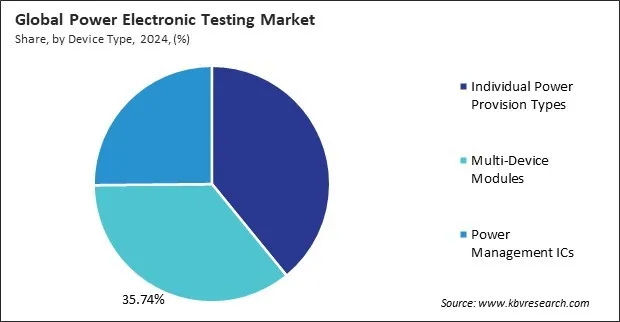

On the basis of device type, the power electronic testing market is classified into individual power provision types, multi-device modules, and power management ICs. The individual power provision types segment acquired 39% revenue share in the power electronic testing market in 2024. Discrete parts that perform power control tasks, such as diodes, transistors, rectifiers, and thyristors, are included in the individual power provision types of segments. To assess switching behavior, thermal performance, voltage thresholds, and current handling capacity, these devices need to undergo specialized testing. Testing guarantees their dependability in a range of applications, from consumer electronics to electric cars and industrial drives. Maintaining quality through rigorous testing is essential for guaranteeing overall system stability and efficiency because of their fundamental role in circuit design.

By end use, the power electronic testing market is divided into automotive & mobility solutions, industrial automation & machinery, information & communication technology (ICT), consumer electronics & devices, renewable power & utility networks, aerospace & defense applications, and others. The industrial automation & machinery segment garnered 22% revenue share in the power electronic testing market in 2024. Since factories and production lines rely heavily on motors, drives, control systems, and converters, the industrial automation & machinery segment is essential to the testing market. Testing for durability and performance is crucial because these components are subjected to harsh environments and continuous operation.

Free Valuable Insights: Global Power Electronic Testing Market size to reach USD 11.01 Billion by 2032

Region-wise, the power electronic testing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded 39% revenue share in the power electronic testing market in 2024. The Asia Pacific region leads the power electronic testing market, driven by rapid industrialization, robust electronics manufacturing, and the accelerating shift toward electric mobility and renewable energy. Countries like China, Japan, South Korea, and India are major hubs to produce power semiconductors, automotive electronics, and consumer devices—all of which require extensive testing.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 5.92 Billion |

| Market size forecast in 2032 | USD 11.01 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 8.3% from 2025 to 2032 |

| Number of Pages | 381 |

| Number of Tables | 386 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Provision Type, Device Type, End Use, Region |

| Country scope |

|

| Companies Included | SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Advantest Corporation, Teradyne, Inc., Infineon Technologies AG, Fluke Corporation (Fortive Corporation) and TUV SUD |

By Provision Type

By Device Type

By End Use

By Geography

This Market size is expected to reach $11.01 billion by 2032.

Rapid Growth in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) are driving the Market in coming years, however, High Capital Investment and Operational Costs restraints the growth of the Market.

SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Advantest Corporation, Teradyne, Inc., Infineon Technologies AG, Fluke Corporation (Fortive Corporation) and TUV SUD

The expected CAGR of this Market is 8.3% from 2023 to 2032.

The Test Instruments & Equipment segment is leading the Market by Provision Type in 2024; thereby, achieving a market value of $6.8 billion by 2032.

The Asia Pacific region dominated the Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $4.1 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges