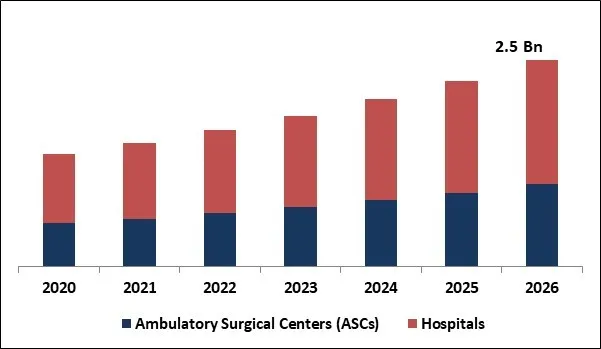

The Global Operating Room Integration Market size is expected to reach $2.5 billion by 2026, rising at a market growth of 10.6% CAGR during the forecast period. Operating Room Integration (ORI) is intended to streamline the operating room by consolidating data and providing audio & video connectivity and control for all central command station equipment, enabling the surgeon to conduct multiple tasks efficiently without the need to walk across the operating room.

Global Operating Room Integration Market Size

The OR is a demanding environment requiring focus, efficiency, communication, and expertise. Without OR integration, surgical teams need to navigate around the operating room to perform a variety of tasks. These tasks include checking the patient information on a computer, writing this information on a whiteboard, moving to the wall to control OR lighting, entering the surgical field to display or change the video they are viewing, and more. The movement and time taken to complete certain procedures slows down the process and can deter focus from when it is most important: to the patient.

OR integration systems include and organize all patient details for surgical staff throughout the procedure, minimizing congestion and streamlining information through various platforms. Through OR integration, surgical staff have streamlined access to the controls and information they require - to monitor patient records, control room or surgical lights, display images throughout surgery, and more. OR Integration provides OR staff with increased productivity, safety, and efficiency to keep the focus on providing patient care.

Operating Room Integration Market Share

Today, the benefits of OR integration often extend beyond the operating room as OR Integration connects and supports teams, processes, and information across the operative workflow. For example, OR Incorporation allows in-OR teams to exchange real-time surgical video with remote experts or students' classrooms for teaching applications. During a procedure, a clinician can conveniently view high-definition pictures of the treatment on a tablet during a post-operative visit with the patient and relatives. OR integration ensures that all images and videos are seamlessly connected to the patient record for accurate documentation of each procedure.

The market is dominated by a wide number of companies operating in this sector. Key players are focused on introducing new strategies, such as regional expansion, mergers, and acquisitions, expanding their product portfolio by technology developments, alliances and distribution deals to increase their sales share and to mark their position in the operating room integration industry.

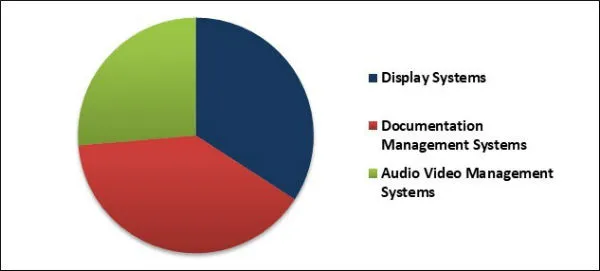

Based on Component, the market is segmented into Software and Services. Based on Application, the market is segmented into General Surgery, Orthopedic Surgery, Neurosurgery and Other Application. Based on End Use, the market is segmented into Ambulatory Surgical Centers (ASCs) and Hospitals. Based on Devices, the market is segmented into Display Systems, Documentation Management Systems, and Audio Video Management Systems. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

Free Valuable Insights: Global Operating Room Integration Market to reach a market size of $2.5 billion by 2026

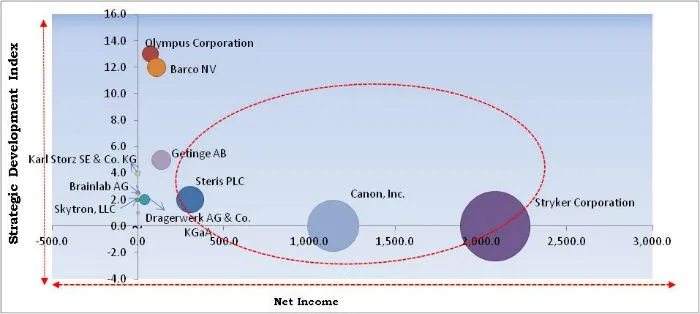

Operating Room Integration Market Cardinal Matrix

The major strategies followed by the market participants are Partnerships and Product Launches. Based on the Analysis presented in the Cardinal matrix, Canon, Inc., Stryker Corporation, and Steris PLC are the forerunners in the Operating Room Integration Market. Companies such as Olympus Corporation, Barco NV, Getinge AB, Dragerwerk AG & Co. KGaA, Skytron, LLC, Brainlab AG, Karl Storz SE & Co. KG are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, Dragerwerk AG & Co. KGaA, Steris PLC, Olympus Corporation, Canon, Inc., Barco NV, Getinge AB, Brainlab AG, Skytron, LLC, and Karl Storz SE & Co. KG.

» Partnerships, Collaborations, and Agreements:

» Acquisition and Mergers:

» Product Launches and Product Expansions:

Market Segmentation:

By Component

By Application

By Geography

Companies Profiled

The global operating room integration market size is expected to reach $2.5 billion by 2026.

The major factors that are anticipated to drive the operating room integration industry include growing adoption of minimally invasive surgeries, Integrated operating rooms will use intelligent delivery options, and Video integration in the operating room.

The segment of general surgery held the largest market share in 2019.

Stryker Corporation, Dragerwerk AG & Co. KGaA, Steris PLC, Olympus Corporation, Canon, Inc., Barco NV, Getinge AB, Brainlab AG, Skytron, LLC, and Karl Storz SE & Co. KG.

The expected CAGR of operating room integration market is 10.6% from 2020 to 2026.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.