North America Hip Replacement Implants Market By Application (Metal-on-Metal, Metal-on-Polyethylene, Ceramic-on-Polyethylene, Ceramic-on-Metal and Ceramic-on-Ceramic) By Product (Total Hip, Partial Femoral Head, Hip Resurfacing and Revision Hip) By End Use (Orthopedic Clinics, Hospitals & Surgery Centers and Other End Use)

Published Date : 31-Oct-2019 | Pages: 89 | Formats: PDF |

COVID-19 Impact on the North America Hip Replacement Implants Market

The North America Hip Replacement Implants Market would witness market growth of 4.4% CAGR during the forecast period (2019-2025). The North America Cochlear Implants market is studied across the U.S., Canada, and Mexico. A 2018 fact published by the World Health Organization claims that the number of individuals aged 60 years or older could rise from 900 million to 2 billion between 2015 and 2050.

The aging of the population happens faster than it has ever been. For example, while France had to adjust to the changes in the population over 60 years of age from 10 to 20 percent, areas would have to realign for the same timespan slightly over 20 years. The hip joint can be damaged by various conditions and lead to lasting hip pain. The overall rate of aseptic loosening has been less than that experienced in younger patients when they were over eighty years of age, but recurrent fractures, periprosthetic fractures, and diseases were more common in this age group. Femoral stem cementation showed better long-term results than cement-less attachment which indicated that it could provide better initial fixation, and thus longer service life.

The competitive and key market players in the global hip replacement implants market include Zimmer Biomet Holdings, Inc.; Johnson & Johnson; Stryker Corporation; MicroPort Scientific Corporation; DJO Global, Inc.; Smith & Nephew plc; and MicroPort Scientific Corporation.

Aforementioned players are constantly involved in strategic initiatives such as new product launch, technological advancements, and mergers & acquisitions to gain higher market share.

For instance, in September 2017, Stryker (US) taken over NOVADAQ for expanding its instruments portfolio which delivers enhanced visualizations in reconstructive procedures.

In November 2016, Medacta International launched a new MasterLoc Hip System to improve its hips implants product portfolio. In October 2018, Zimmer Biomet collaborated with Apple to launch a mobile app of joint replacement.

MicroPort launched Procotyl® Prime Acetabular Cup System in August 2017 for the patients in the US. It is used in surgery of total hip replacement. The company also signed an agreement with Wiltrom Medical for developing fixation products.

The market is expected to grow at a rapid pace with the prevalence of affordable healthcare facilities in advanced economies and technological advancements in minimally-invasive surgeries. The development of non-metallic materials, like polymer and ceramic, will aid resolve conventional instrument-related problems like increased blood metal ions in the patient's bloodstream and a long time implant deterioration. The newer procedures have reduced hospital stay to less than 4 days after completing hip replacement surgery.

Moreover, over the prediction period, an increasing percentage of older people with degenerative diseases is expected to have a positive effect on market growth. The success rate of minimally-invasive surges, which is expected to provide lucrative growth leads to this industry, has been boosted by an increasing number of robot-assisted surgeries.

Favorable policy for reimbursements continues to stimulate the overall growth. The Patient Protection and Affordable Care Act (PPACA), which provides access to a higher degree of patients, has led to an increasing level of insurance coverage of orthopedic tools. Both the public (for instance CMS) and private payers have provided adequate prosthetics and orthotics coverage in recent years.

For example in November 2018, the "India Centric" reimbursement program was launched by Johnson & Johnson to provide full reimbursement for patients under revision surgery within 15 years of the primary hip replacement operation. Conformis, Inc., a medical technology firm, started working with JFK Medical Center in Florida on the first 3D total hip replacements operations in August 2018.

Based on products, the hip replacement implants market has been categorized into the partial femoral head, total hip implants, hip resurfacing, and revision hip. As a result of the increasing demand for minimally invasive operations and continuous technological advancements, total hip implants had the largest business value in 2018. Another significant cause for the market is the growing incidence of osteoarthritis. In the UK, 90% of the overall hip replacement in 2016, was reported for osteoarthritis by the national joint registry for England.

The report highlights the adoption of Hip Replacement Implants in North America. Based on Application, the market is segmented into Metal-on-Metal, Metal-on-Polyethylene, Ceramic-on-Polyethylene, Ceramic-on-Metal and Ceramic-on-Ceramic. Based on Product, the market is segmented into Total Hip, Partial Femoral Head, Hip Resurfacing and Revision Hip. Based on End Use, the market is segmented into Orthopedic Clinics, Hospitals & Surgery Centers and Other End Use. The report also covers geographical segmentation of Hip Replacement Implants market. The countries included in the report are USA, Canada, Mexico and Rest of North America.

Key market participants profiled in this report includes Zimmer Biomet Holdings, Inc., Stryker Corporation, MicroPort Scientific Corporation, Smith & Nephew PLC, ConMed Corporation, B. Braun Melsungen AG, Exactech, Inc., Corin Group PLC, Colfax Corporation (DJO Global, Inc.) and Johnson & Johnson.

Scope of the Hip Replacement Implants Market Analysis

Market Segmentation:

By Application

- Metal-on-Metal

- Metal-on-Polyethylene

- Ceramic-on-Polyethylene

- Ceramic-on-Metal and

- Ceramic-on-Ceramic

By Product

- Total Hip

- Partial Femoral Head

- Hip Resurfacing and

- Revision Hip

By End Use

- Orthopedic Clinics

- Hospitals & Surgery Centers and

- Other End Use

By Country

- US

- Canada

- Mexico

- Rest of North America

Companies Profiled

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- MicroPort Scientific Corporation

- Smith & Nephew PLC

- ConMed Corporation

- B. Braun Melsungen AG

- Exactech, Inc.

- Corin Group PLC

- Colfax Corporation (DJO Global, Inc.) and

- Johnson & Johnson

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 North America Hip Replacement Implants Market, by Application

1.4.2 North America Hip Replacement Implants Market, by Product

1.4.3 North America Hip Replacement Implants Market, by End Use

1.4.4 North America Hip Replacement Implants Market, by Country

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

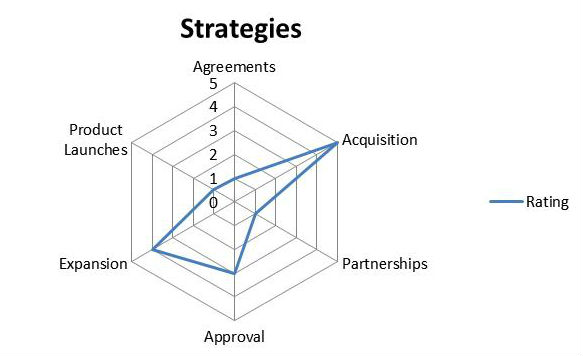

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Expansions

3.2.3 Mergers & Acquisitions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2015-2019)

3.3.2 Key Strategic Move: (Acquisition: 2019-Sep-2015-Dec)Leading Players

Chapter 4. North America Hip Replacement Implants Market by Application

4.1 North America Metal-on-Metal Market by Country

4.2 North America Metal-on-Polyethylene Market by Country

4.3 North America Ceramic-on-Polyethylene Market by Country

4.4 North America Ceramic-on-Metal Market by Country

4.5 North America Ceramic-on-Ceramic Market by Country

Chapter 5. North America Hip Replacement Implants Market by Product

5.1 North America Total Hip Market by Country

5.2 North America Partial Femoral Head Market by Country

5.3 North America Hip Resurfacing Market by Country

5.4 North America Revision Hip Market by Country

Chapter 6. North America Hip Replacement Implants Market by End Use

6.1 North America Orthopedic Clinics Market by Country

6.2 North America Hospitals & Surgery Centers Market by Country

6.3 North America Others End Use Market by Country

Chapter 7. North America Hip Replacement Implants Market by Country

7.1 USA Hip Replacement Implants Market

7.1.1 USA Hip Replacement Implants Market by Application

7.1.2 USA Hip Replacement Implants Market by Product

7.1.3 USA Hip Replacement Implants Market by End Use

7.2 Canada Hip Replacement Implants Market

7.2.1 Canada Hip Replacement Implants Market by Application

7.2.2 Canada Hip Replacement Implants Market by Product

7.2.3 Canada Hip Replacement Implants Market by End Use

7.3 Mexico Hip Replacement Implants Market

7.3.1 Mexico Hip Replacement Implants Market by Application

7.3.2 Mexico Hip Replacement Implants Market by Product

7.3.3 Mexico Hip Replacement Implants Market by End Use

7.4 Rest of North America Hip Replacement Implants Market

7.4.1 Rest of North America Hip Replacement Implants Market by Application

7.4.2 Rest of North America Hip Replacement Implants Market by Product

7.4.3 Rest of North America Hip Replacement Implants Market by End Use

Chapter 8. Company Profiles

8.1 Zimmer Biomet Holdings, Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Collaborations, partnerships and agreements:

8.1.5.2 Acquisition and mergers:

8.2 Stryker Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Collaborations, partnerships and agreements:

8.2.5.2 Acquisition and mergers:

8.3 MicroPort Scientific Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Collaborations, partnerships and agreements:

8.3.5.2 Expansions:

8.4 Smith & Nephew PLC

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Acquisition and mergers:

8.4.5.2 Product launches:

8.5 ConMed Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Regional Analysis

8.5.4 Research & Development Expense

8.5.5 Recent strategies and developments:

8.5.5.1 Acquisition and mergers:

8.6 B. Braun Melsungen AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Expansions:

8.7 Exactech, Inc.

8.7.1 Company Overview

8.7.2 Recent strategies and developments:

8.7.2.1 Expansions:

8.7.2.2 Approvals:

8.8 Corin Group PLC

8.8.1 Company Overview

8.8.2 Recent strategies and developments:

8.8.2.1 Collaborations, partnerships and agreements:

8.8.2.2 Product launches:

8.8.2.3 Expansions:

8.9 Colfax Corporation (DJO Global, Inc.)

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expense

8.9.5 Recent strategies and developments:

8.9.5.1 Product launches:

8.1 Johnson & Johnson

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Segmental &Regional Analysis

8.10.4 Research & Development Expenses

8.10.5 Recent strategies and developments:

8.10.5.1 Acquisition and mergers:

8.10.5.2 Expansions:

8.10.5.3 Awareness:

TABLE 2 North America Hip Replacement Implants Market, 2019 - 2025, USD Million

TABLE 3 Partnerships, Collaborations and Agreements- Hip Replacement Implants Market

TABLE 4 Product Launches And Expansions- Hip Replacement Implants Market

TABLE 5 Mergers & Acquisitions - Hip Replacement Implants Market

TABLE 6 North America Hip Replacement Implants Market by Application, 2015 - 2018, USD Million

TABLE 7 North America Hip Replacement Implants Market by Application, 2019 - 2025, USD Million

TABLE 8 North America Metal-on-Metal Market by Country, 2015 - 2018, USD Million

TABLE 9 North America Metal-on-Metal Market by Country, 2019 - 2025, USD Million

TABLE 10 North America Metal-on-Polyethylene Market by Country, 2015 - 2018, USD Million

TABLE 11 North America Metal-on-Polyethylene Market by Country, 2019 - 2025, USD Million

TABLE 12 North America Ceramic-on-Polyethylene Market by Country, 2015 - 2018, USD Million

TABLE 13 North America Ceramic-on-Polyethylene Market by Country, 2019 - 2025, USD Million

TABLE 14 North America Ceramic-on-Metal Market by Country, 2015 - 2018, USD Million

TABLE 15 North America Ceramic-on-Metal Market by Country, 2019 - 2025, USD Million

TABLE 16 North America Ceramic-on-Ceramic Market by Country, 2015 - 2018, USD Million

TABLE 17 North America Ceramic-on-Ceramic Market by Country, 2019 - 2025, USD Million

TABLE 18 North America Hip Replacement Implants Market by Product, 2015 - 2018, USD Million

TABLE 19 North America Hip Replacement Implants Market by Product, 2019 - 2025, USD Million

TABLE 20 North America Total Hip Market by Country, 2015 - 2018, USD Million

TABLE 21 North America Total Hip Market by Country, 2019 - 2025, USD Million

TABLE 22 North America Partial Femoral Head Market by Country, 2015 - 2018, USD Million

TABLE 23 North America Partial Femoral Head Market by Country, 2019 - 2025, USD Million

TABLE 24 North America Hip Resurfacing Market by Country, 2015 - 2018, USD Million

TABLE 25 North America Hip Resurfacing Market by Country, 2019 - 2025, USD Million

TABLE 26 North America Revision Hip Market by Country, 2015 - 2018, USD Million

TABLE 27 North America Revision Hip Market by Country, 2019 - 2025, USD Million

TABLE 28 North America Hip Replacement Implants Market by End Use, 2015 - 2018, USD Million

TABLE 29 North America Hip Replacement Implants Market by End Use, 2019 - 2025, USD Million

TABLE 30 North America Orthopedic Clinics Market by Country, 2015 - 2018, USD Million

TABLE 31 North America Orthopedic Clinics Market by Country, 2019 - 2025, USD Million

TABLE 32 North America Hospitals & Surgery Centers Market by Country, 2015 - 2018, USD Million

TABLE 33 North America Hospitals & Surgery Centers Market by Country, 2019 - 2025, USD Million

TABLE 34 North America Others End Use Market by Country, 2015 - 2018, USD Million

TABLE 35 North America Others End Use Market by Country, 2019 - 2025, USD Million

TABLE 36 North America Hip Replacement Implants Market by Country, 2015 - 2018, USD Million

TABLE 37 North America Hip Replacement Implants Market by Country, 2019 - 2025, USD Million

TABLE 38 USA Hip Replacement Implants Market, 2015 - 2018, USD Million

TABLE 39 USA Hip Replacement Implants Market, 2019 - 2025, USD Million

TABLE 40 USA Hip Replacement Implants Market by Application, 2015 - 2018, USD Million

TABLE 41 USA Hip Replacement Implants Market by Application, 2019 - 2025, USD Million

TABLE 42 USA Hip Replacement Implants Market by Product, 2015 - 2018, USD Million

TABLE 43 USA Hip Replacement Implants Market by Product, 2019 - 2025, USD Million

TABLE 44 USA Hip Replacement Implants Market by End Use, 2015 - 2018, USD Million

TABLE 45 USA Hip Replacement Implants Market by End Use, 2019 - 2025, USD Million

TABLE 46 Canada Hip Replacement Implants Market, 2015 - 2018, USD Million

TABLE 47 Canada Hip Replacement Implants Market, 2019 - 2025, USD Million

TABLE 48 Canada Hip Replacement Implants Market by Application, 2015 - 2018, USD Million

TABLE 49 Canada Hip Replacement Implants Market by Application, 2019 - 2025, USD Million

TABLE 50 Canada Hip Replacement Implants Market by Product, 2015 - 2018, USD Million

TABLE 51 Canada Hip Replacement Implants Market by Product, 2019 - 2025, USD Million

TABLE 52 Canada Hip Replacement Implants Market by End Use, 2015 - 2018, USD Million

TABLE 53 Canada Hip Replacement Implants Market by End Use, 2019 - 2025, USD Million

TABLE 54 Mexico Hip Replacement Implants Market, 2015 - 2018, USD Million

TABLE 55 Mexico Hip Replacement Implants Market, 2019 - 2025, USD Million

TABLE 56 Mexico Hip Replacement Implants Market by Application, 2015 - 2018, USD Million

TABLE 57 Mexico Hip Replacement Implants Market by Application, 2019 - 2025, USD Million

TABLE 58 Mexico Hip Replacement Implants Market by Product, 2015 - 2018, USD Million

TABLE 59 Mexico Hip Replacement Implants Market by Product, 2019 - 2025, USD Million

TABLE 60 Mexico Hip Replacement Implants Market by End Use, 2015 - 2018, USD Million

TABLE 61 Mexico Hip Replacement Implants Market by End Use, 2019 - 2025, USD Million

TABLE 62 Rest of North America Hip Replacement Implants Market, 2015 - 2018, USD Million

TABLE 63 Rest of North America Hip Replacement Implants Market, 2019 - 2025, USD Million

TABLE 64 Rest of North America Hip Replacement Implants Market by Application, 2015 - 2018, USD Million

TABLE 65 Rest of North America Hip Replacement Implants Market by Application, 2019 - 2025, USD Million

TABLE 66 Rest of North America Hip Replacement Implants Market by Product, 2015 - 2018, USD Million

TABLE 67 Rest of North America Hip Replacement Implants Market by Product, 2019 - 2025, USD Million

TABLE 68 Rest of North America Hip Replacement Implants Market by End Use, 2015 - 2018, USD Million

TABLE 69 Rest of North America Hip Replacement Implants Market by End Use, 2019 - 2025, USD Million

TABLE 70 key Information - Zimmer Biomet Holdings, Inc.

TABLE 71 key Information - Stryker Corporation

TABLE 72 key Information - MicroPort Scientific Corporation

TABLE 73 key Information - Smith & Nephew PLC

TABLE 74 key Information - ConMed Corporation

TABLE 75 key Information - B. Braun Melsungen AG

TABLE 76 key Information - Exactech, Inc.

TABLE 77 key Information - Corin Group PLC

TABLE 78 key Information - Colfax Corporation

TABLE 79 Key information - Johnson & Johnson

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2015-2019)

FIG 4 Key Strategic Move: (Acquisition: 2019-Sep-2015-Dec) Leading Players

FIG 5 Recent strategies and developments: Stryker Corporation

FIG 7 Recent strategies and developments: Smith & Nephew PLC

FIG 9 Recent strategies and developments: Corin Group PLC