The North America Electronic Cash Register Market would witness market growth of 11.9% CAGR during the forecast period (2025-2032).

The US market dominated the North America Electronic Cash Register Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $2,541.7 million by 2032. The Canada market is experiencing a CAGR of 13.8% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 12.7% during (2025 - 2032). The US and Canada led the North America Electronic Cash Register Market by Country with a market share of 67.2% and 14.8% in 2024.The US market is expected to witness a CAGR of 11% during throughout the forecast period.

The North American electronic cash register market has developed a lot since James Ritty made the first one in 1879. Today, we have cloud-connected retail management systems that are the result of U.S. industrial innovation and quick adoption of new technologies. In the early 1900s, NCR and other companies made mechanical registers that were reliable and could do basic accounting. In the 1970s, electronic components came along, bringing integrated circuits, LED displays, and memory. ECRs combined with computerized POS systems in the 1980s and 1990s. These systems now have barcode scanning, card authorization, and centralized databases. Cloud computing, mobile connectivity, EMV, NFC, and security features that are required by law all came out in the 2000s. These led to today's integrated, omni-channel platforms that handle sales, staffing, inventory, marketing, and compliance for both small and medium-sized businesses (SMBs) and large businesses across the U.S. and Canada.

The move from old-fashioned registers to cloud-based POS systems that let you access data in real time, lower infrastructure costs, and manage multiple locations is one of the most important trends in the market right now. The COVID-19 pandemic sped up the use of contactless and mobile payments, which led to the integration of NFC and QR code transactions for omnichannel experiences. Compliance is another big reason why, since systems must meet PCI-DSS standards, CRA guidelines, and changing state and provincial data privacy laws. NCR, Verifone, Clover, and Square are some of the biggest players in the market. They compete by offering end-to-end, scalable solutions that combine hardware, software, secure payment processing, and regulatory customization. This turns ECRs into full-service retail ecosystems that are tailored to North America's ever-changing consumer and regulatory environment.

Based on Component, the market is segmented into Hardware, and Software. With a compound annual growth rate (CAGR) of 11.2% over the projection period, the Hardware Market, dominate the US Electronic Cash Register Market by Component in 2024 and would be a prominent market until 2032. From 2025 to 2032 The Software market is expected to witness a CAGR of 10.7% during (2025 - 2032).

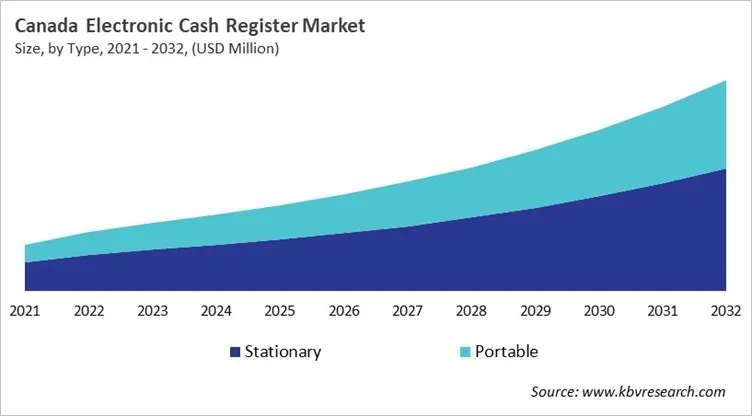

Based on Type, the market is segmented into Stationary, and Portable. With a compound annual growth rate (CAGR) of 13.3% over the projection period, the Stationary Market, dominate the Canada Electronic Cash Register Market by Type in 2024 and would be a prominent market until 2032. From 2025 to 2032 The Portable market is expected to witness a CAGR of 14.5% during (2025 - 2032).

Free Valuable Insights: The Electronic Cash Register Market is Predict to reach USD 16.87 Billion by 2032, at a CAGR of 12.1%

Based on Product Type, the market is segmented into POS system, Standard electronic cash registers, Checkouts, Personal electronic cash registers, and Mobile POS systems. The POS system market segment dominated the Mexico Electronic Cash Register Market by Product Type is expected to grow at a CAGR of 11.7 % during the forecast period thereby continuing its dominance until 2032. Also, The Checkouts market is anticipated to grow as a CAGR of 13.2 % during the forecast period during (2025 - 2032).

The electronic cash register (ECR) market in Canada is still important for small and medium-sized businesses (SMEs), independent retailers, and seasonal businesses, even though it follows trends in the U.S. but is shaped by local needs. Bilingual functionality, tax compliance that is specific to each province, and modular features that support digital payments like tap-and-pay and QR scanning all drive demand. More businesses are using advanced POS systems, but many still prefer simple, reliable, and subscription-free models, especially in rural areas where internet access is limited. Some trends are portable and hybrid setups, sales of refurbished units, and short-term rentals during busy times. Competition ranges from global brands to local resellers, and bilingual support and tax-configurable firmware are becoming important ways to stand out. The market is still stable overall, with a balance between traditional use and slow digital integration.

By Type

By Component

By Product Type

By End-use

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.