The North America Crop Insurance Market would witness market growth of 5.3% CAGR during the forecast period (2025-2032).

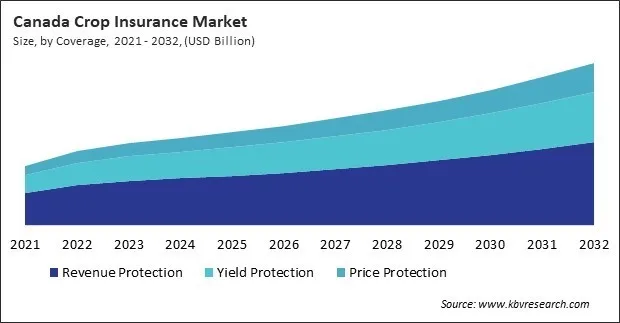

The US market dominated the North America Crop Insurance Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $20,148.3 million by 2032. The Canada market is experiencing a CAGR of 8.2% during (2025 - 2032). Additionally, The Mexico market would exhibit a CAGR of 7% during (2025 - 2032).

The crop insurance market has emerged as a critical component of modern agriculture, offering farmers a financial safety net against the unpredictable risks inherent in farming. As agriculture remains a cornerstone of global economies, ensuring food security and supporting rural livelihoods, crop insurance has evolved into a vital tool for mitigating losses caused by natural disasters, market fluctuations, and other unforeseen events. By providing a mechanism to stabilize farmers' incomes and promote sustainable agricultural practices, crop insurance plays an indispensable role in fostering resilience in the face of environmental and economic uncertainties.

Crop insurance serves a wide range of applications, addressing the diverse risks farmers face across different regions and farming systems. At its core, crop insurance is designed to protect farmers from financial losses due to crop failure or reduced yields caused by events such as droughts, floods, hailstorms, pests, diseases, or extreme weather conditions. It provides coverage for a variety of crops, including staple grains like wheat, rice, and maize, as well as cash crops such as cotton, soybeans, and coffee.

The market in North America is highly structured and mature, driven by well-established government support systems, a high level of agricultural productivity, and increasing climate-related risks. The region—comprising major economies like the United States, Canada, and Mexico—has a significant stake in global food production, which necessitates effective risk mitigation tools. In countries like the U.S. and Canada, strong public-private partnerships and substantial government subsidies have made crop insurance a fundamental part of agricultural sustainability.

Meanwhile, Mexico is rapidly evolving its insurance infrastructure to support its large base of smallholder farmers. As climate change intensifies the frequency and severity of extreme weather events, demand for tailored, data-driven crop insurance solutions continues to rise across the region. In the United States, the market is well-established and supported by a robust public-private partnership, primarily governed by the Federal Crop Insurance Corporation (FCIC) and administered through the Risk Management Agency (RMA) under the USDA.

The agriculture sector’s substantial economic contribution—approximately $1.264 trillion in 2021, with $164.7 billion directly from farm output—underscores the importance of risk mitigation tools like crop insurance. U.S. farmers face diverse challenges ranging from climate change to volatile commodity prices, which has amplified the need for comprehensive crop insurance coverage. The Canadian market is witnessing trends such as an increasing focus on coverage for climate-related perils, including drought, floods, and early frost.

There is also growing interest in integrating parametric insurance models and weather-based indexes to better serve regions with unpredictable climatic patterns. Competition is primarily among provincial agencies and a few private players operating under government frameworks. Provinces like Saskatchewan and Alberta have recently adopted digital claim filing and monitoring systems to streamline services. Thus, North America leads in crop insurance with strong government backing and tech adoption and is set to expand further amid rising climate risks.

Free Valuable Insights: The Crop Insurance Market is Predict to reach USD 59.32 Billion by 2032, at a CAGR of 5.8 %

Based on Type, the market is segmented into Multi-peril Crop Insurance (MPCI), Crop-hail Insurance, and Revenue Insurance. Based on Coverage, the market is segmented into Revenue Protection, Yield Protection, and Price Protection. Based on Distribution Channel, the market is segmented into Government Agencies, Insurance Companies, and Other Distribution Channel. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

By Type

By Coverage

By Distribution Channel

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.