Global Mobile Banking Market Size, Share & Trends Analysis Report By Platform (Android, iOS, and Others), By Transaction (Consumer-to-business, and Consumer-to-consumer), By Regional Outlook and Forecast, 2024 - 2031

Published Date : 12-Apr-2024 | Pages: 157 | Formats: PDF |

COVID-19 Impact on the Mobile Banking Market

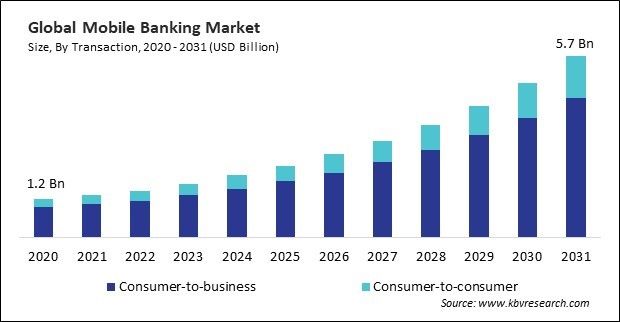

The Global Mobile Banking Market size is expected to reach $5.7 billion by 2031, rising at a market growth of 16.5% CAGR during the forecast period.

The banking sector in Europe is undergoing a digital transformation driven by technological advancements, changing consumer preferences, and regulatory initiatives such as the Revised Payment Services Directive (PSD2). Consequently, the Europe region would acquire nearly, 30% market share by 2031. Banks and financial institutions are investing in digital banking solutions, including banking apps, to meet the growing demand for convenient, accessible, and innovative banking services.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, in February, 2024, HSBC announced the acquisition of Silicon Valley Bank's UK subsidiary. The acquisition strengthens HSBC's commercial banking franchise and enhances its ability to serve innovative and fast-growing firms, particularly in the technology and life science sectors, in the UK and globally. Moreover, in July, 2023, BNP Paribas announced the acquisition of Kantox, a leading fintech specializing in the automation of currency risk management. The acquisition is part of BNP Paribas' Growth Technology Sustainability 2025 plan, aiming to enhance technological innovations, customer experience, and capabilities for clients.

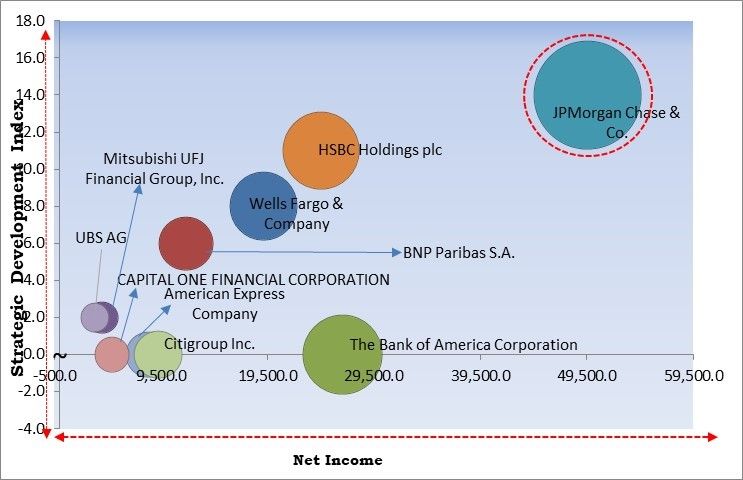

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; JPMorgan Chase & Co. is the forerunner in the Market. In May, 2023, JP Morgan Chase acquired California-based First Republic Bank. The acquisition complements JPMorgan Chase's wealth strategy. Companies such as HSBC Holdings plc, Wells Fargo & Company and BNP Paribas S.A. are some of the key innovators in Market.

Market Growth Factors

With people leading increasingly busy lives, there is a growing preference for services that can be accessed anytime, anywhere. Moreover, this banking eliminates the need for customers to visit physical bank branches or ATMs for routine transactions. Therefore, increasing demand for convenient products and services drives the market’s growth.

Traditional brick-and-mortar bank branches require substantial investments in real estate, construction, maintenance, and staffing. Furthermore, this banking streamlines various banking processes, such as account management, transaction processing, and customer support. Thus, cost efficiency for banks and consumers is propelling the market’s growth.

Market Restraining Factors

This banking involves transmitting sensitive financial information over networks, which can make it vulnerable to data breaches and hacking attempts. Likewise, mobile devices are susceptible to malware infections and other malicious software that can compromise the security of banking applications. Hence, security concerns related to this banking are impeding the market’s growth.

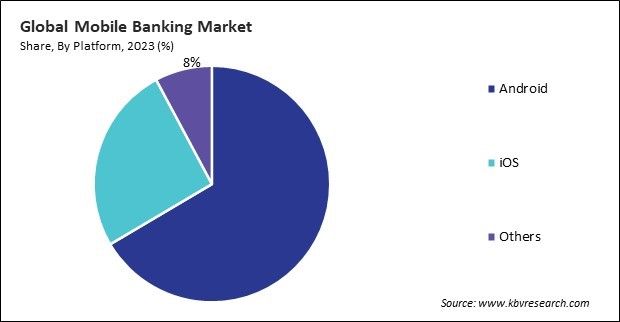

By Platform Analysis

Based on platform, the market is divided into Android, iOS, and others. The iOS segment attained a 25% revenue share in the market in 2023. iOS devices like iPhones and iPads are generally associated with a more affluent user base. Users of iOS devices often have higher disposable incomes and greater purchasing power, making them attractive customers for financial institutions offering premium banking services and products.

By Transaction Analysis

On the basis of transaction, the market is segmented into consumer-to-business and consumer-to-consumer. In 2023, the consumer-to-consumer segment attained a 20% revenue share in the market. The availability of peer-to-peer (P2P) payment apps integrated into banking platforms has significantly contributed to the growth of the C2C segment. These apps enable users to transfer funds directly to friends, family members, or acquaintances using their mobile devices, eliminating the need for cash or checks.

Free Valuable Insights: Global Mobile Banking Market size to reach USD 5.7 Billion by 2031

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 34% revenue share in the market in 2023. North America has one of the highest smartphone penetration rates globally, with a significant portion of the population owning smartphones. The widespread adoption of smartphones provides a robust foundation for banking usage, as consumers increasingly rely on their mobile devices for various activities, including banking.

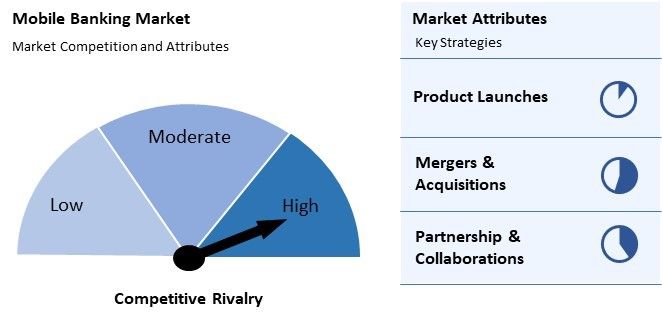

Market Competition and Attributes

The market is fiercely competitive, with traditional banks, fintech firms, and tech giants battling for supremacy. Innovations like mobile check deposits and AI-driven services are key battlegrounds. Strong emphasis on security, user experience, regulatory compliance, and global expansion define strategies in this dynamic and rapidly evolving industry.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 1.7 Billion |

| Market size forecast in 2031 | USD 5.7 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 16.5% from 2024 to 2031 |

| Number of Pages | 157 |

| Number of Tables | 253 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Platform, Transaction, Region |

| Country scope |

|

| Companies Included | Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group), JPMorgan Chase & Co., Wells Fargo & Company, BNP Paribas S.A., American Express Company, HSBC Holdings plc, UBS AG (UBS Group AG), CAPITAL ONE FINANCIAL CORPORATION, The Bank of America Corporation and Citigroup Inc. |

Recent Strategies Deployed in the Market

- Feb-2024: BNP Paribas came into partnership with Orange, France's largest telecommunications company. Under the partnership, BNP Paribas would offer its services to Orange Bank's customers in France and Spain.

- Feb-2023: Wells Fargo & Company launched LifeSync, a personalized digital tool for its Wells Fargo Mobile app for Wealth & Investment Management (WIM) clients. LifeSync aims to align clients' financial goals with their money, providing a convenient and intuitive digital experience.

- Nov-2022: HSBC Holdings plc (HSBC) signed an agreement to fully acquire L&T Investment Management Limited (LTIM), a mutual fund company. The acquisition aids HSBC in its strategy of becoming a leading wealth manager in Asia.

- Aug-2022: J.P. Morgan took over Global Shares, a leading provider of cloud-based share plan management software. This acquisition strengthens J.P. Morgan's position as a top provider of employee ownership solutions globally.

- Jun-2021: JPMorgan Chase signed an agreement to acquire Nutmeg Saving and Investment Limited, a prominent digital wealth manager in the UK. The acquisition complements JPMorgan's digital bank launch in the UK under the Chase brand, focusing on customer experience and innovative wealth management solutions.

List of Key Companies Profiled

- Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

- JPMorgan Chase & Co.

- Wells Fargo & Company

- BNP Paribas S.A.

- American Express Company

- HSBC Holdings plc

- UBS AG (UBS Group AG)

- CAPITAL ONE FINANCIAL CORPORATION

- The Bank of America Corporation

- Citigroup Inc.

Mobile Banking Market Report Segmentation

By Platform

- Android

- iOS

- Others

By Transaction

- Consumer-to-business

- Consumer-to-consumer

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Mobile Banking Market, by Platform

1.4.2 Global Mobile Banking Market, by Transaction

1.4.3 Global Mobile Banking Market, by Geography

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

3.2.3 Market Opportunities

3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Top Winning Strategies

4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.3.2 Key Strategic Move: (Mergers & Acquisition: 2021, Jun – 2024, Feb) Leading Players

4.4 Porter Five Forces Analysis

Chapter 5. Global Mobile Banking Market by Platform

5.1 Global Android Market by Region

5.2 Global iOS Market by Region

5.3 Global Others Market by Region

Chapter 6. Global Mobile Banking Market by Transaction

6.1 Global Consumer-to-business Market by Region

6.2 Global Consumer-to-consumer Market by Region

Chapter 7. Global Mobile Banking Market by Region

7.1 North America Mobile Banking Market

7.1.1 North America Mobile Banking Market by Platform

7.1.1.1 North America Android Market by Country

7.1.1.2 North America iOS Market by Country

7.1.1.3 North America Others Market by Country

7.1.2 North America Mobile Banking Market by Transaction

7.1.2.1 North America Consumer-to-business Market by Country

7.1.2.2 North America Consumer-to-consumer Market by Country

7.1.3 North America Mobile Banking Market by Country

7.1.3.1 US Mobile Banking Market

7.1.3.1.1 US Mobile Banking Market by Platform

7.1.3.1.2 US Mobile Banking Market by Transaction

7.1.3.2 Canada Mobile Banking Market

7.1.3.2.1 Canada Mobile Banking Market by Platform

7.1.3.2.2 Canada Mobile Banking Market by Transaction

7.1.3.3 Mexico Mobile Banking Market

7.1.3.3.1 Mexico Mobile Banking Market by Platform

7.1.3.3.2 Mexico Mobile Banking Market by Transaction

7.1.3.4 Rest of North America Mobile Banking Market

7.1.3.4.1 Rest of North America Mobile Banking Market by Platform

7.1.3.4.2 Rest of North America Mobile Banking Market by Transaction

7.2 Europe Mobile Banking Market

7.2.1 Europe Mobile Banking Market by Platform

7.2.1.1 Europe Android Market by Country

7.2.1.2 Europe iOS Market by Country

7.2.1.3 Europe Others Market by Country

7.2.2 Europe Mobile Banking Market by Transaction

7.2.2.1 Europe Consumer-to-business Market by Country

7.2.2.2 Europe Consumer-to-consumer Market by Country

7.2.3 Europe Mobile Banking Market by Country

7.2.3.1 Germany Mobile Banking Market

7.2.3.1.1 Germany Mobile Banking Market by Platform

7.2.3.1.2 Germany Mobile Banking Market by Transaction

7.2.3.2 UK Mobile Banking Market

7.2.3.2.1 UK Mobile Banking Market by Platform

7.2.3.2.2 UK Mobile Banking Market by Transaction

7.2.3.3 France Mobile Banking Market

7.2.3.3.1 France Mobile Banking Market by Platform

7.2.3.3.2 France Mobile Banking Market by Transaction

7.2.3.4 Russia Mobile Banking Market

7.2.3.4.1 Russia Mobile Banking Market by Platform

7.2.3.4.2 Russia Mobile Banking Market by Transaction

7.2.3.5 Spain Mobile Banking Market

7.2.3.5.1 Spain Mobile Banking Market by Platform

7.2.3.5.2 Spain Mobile Banking Market by Transaction

7.2.3.6 Italy Mobile Banking Market

7.2.3.6.1 Italy Mobile Banking Market by Platform

7.2.3.6.2 Italy Mobile Banking Market by Transaction

7.2.3.7 Rest of Europe Mobile Banking Market

7.2.3.7.1 Rest of Europe Mobile Banking Market by Platform

7.2.3.7.2 Rest of Europe Mobile Banking Market by Transaction

7.3 Asia Pacific Mobile Banking Market

7.3.1 Asia Pacific Mobile Banking Market by Platform

7.3.1.1 Asia Pacific Android Market by Country

7.3.1.2 Asia Pacific iOS Market by Country

7.3.1.3 Asia Pacific Others Market by Country

7.3.2 Asia Pacific Mobile Banking Market by Transaction

7.3.2.1 Asia Pacific Consumer-to-business Market by Country

7.3.2.2 Asia Pacific Consumer-to-consumer Market by Country

7.3.3 Asia Pacific Mobile Banking Market by Country

7.3.3.1 China Mobile Banking Market

7.3.3.1.1 China Mobile Banking Market by Platform

7.3.3.1.2 China Mobile Banking Market by Transaction

7.3.3.2 Japan Mobile Banking Market

7.3.3.2.1 Japan Mobile Banking Market by Platform

7.3.3.2.2 Japan Mobile Banking Market by Transaction

7.3.3.3 India Mobile Banking Market

7.3.3.3.1 India Mobile Banking Market by Platform

7.3.3.3.2 India Mobile Banking Market by Transaction

7.3.3.4 South Korea Mobile Banking Market

7.3.3.4.1 South Korea Mobile Banking Market by Platform

7.3.3.4.2 South Korea Mobile Banking Market by Transaction

7.3.3.5 Singapore Mobile Banking Market

7.3.3.5.1 Singapore Mobile Banking Market by Platform

7.3.3.5.2 Singapore Mobile Banking Market by Transaction

7.3.3.6 Malaysia Mobile Banking Market

7.3.3.6.1 Malaysia Mobile Banking Market by Platform

7.3.3.6.2 Malaysia Mobile Banking Market by Transaction

7.3.3.7 Rest of Asia Pacific Mobile Banking Market

7.3.3.7.1 Rest of Asia Pacific Mobile Banking Market by Platform

7.3.3.7.2 Rest of Asia Pacific Mobile Banking Market by Transaction

7.4 LAMEA Mobile Banking Market

7.4.1 LAMEA Mobile Banking Market by Platform

7.4.1.1 LAMEA Android Market by Country

7.4.1.2 LAMEA iOS Market by Country

7.4.1.3 LAMEA Others Market by Country

7.4.2 LAMEA Mobile Banking Market by Transaction

7.4.2.1 LAMEA Consumer-to-business Market by Country

7.4.2.2 LAMEA Consumer-to-consumer Market by Country

7.4.3 LAMEA Mobile Banking Market by Country

7.4.3.1 Brazil Mobile Banking Market

7.4.3.1.1 Brazil Mobile Banking Market by Platform

7.4.3.1.2 Brazil Mobile Banking Market by Transaction

7.4.3.2 Argentina Mobile Banking Market

7.4.3.2.1 Argentina Mobile Banking Market by Platform

7.4.3.2.2 Argentina Mobile Banking Market by Transaction

7.4.3.3 UAE Mobile Banking Market

7.4.3.3.1 UAE Mobile Banking Market by Platform

7.4.3.3.2 UAE Mobile Banking Market by Transaction

7.4.3.4 Saudi Arabia Mobile Banking Market

7.4.3.4.1 Saudi Arabia Mobile Banking Market by Platform

7.4.3.4.2 Saudi Arabia Mobile Banking Market by Transaction

7.4.3.5 South Africa Mobile Banking Market

7.4.3.5.1 South Africa Mobile Banking Market by Platform

7.4.3.5.2 South Africa Mobile Banking Market by Transaction

7.4.3.6 Nigeria Mobile Banking Market

7.4.3.6.1 Nigeria Mobile Banking Market by Platform

7.4.3.6.2 Nigeria Mobile Banking Market by Transaction

7.4.3.7 Rest of LAMEA Mobile Banking Market

7.4.3.7.1 Rest of LAMEA Mobile Banking Market by Platform

7.4.3.7.2 Rest of LAMEA Mobile Banking Market by Transaction

Chapter 8. Company Profiles

8.1 Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Recent strategies and developments:

8.1.3.1 Partnerships, Collaborations, and Agreements:

8.2 BNP Paribas S.A.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Partnerships, Collaborations, and Agreements:

8.2.4.2 Acquisition and Mergers:

8.3 UBS AG (UBS Group AG)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.4 Capital One Financial Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.5 Citigroup Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.6 JPMorgan Chase & Co.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Partnerships, Collaborations, and Agreements:

8.6.4.2 Acquisition and Mergers:

8.6.5 SWOT Analysis

8.7 HSBC Holdings plc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Recent strategies and developments:

8.7.3.1 Product Launches and Product Expansions:

8.7.3.2 Acquisition and Mergers:

8.8 The Bank of America Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.9 Wells Fargo & Company

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Recent strategies and developments:

8.9.3.1 Partnerships, Collaborations, and Agreements:

8.9.3.2 Product Launches and Product Expansions:

8.9.4 SWOT Analysis

8.10. American Express Company

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Regional Analysis

Chapter 9. Winning Imperatives for Mobile Banking Market

TABLE 2 Global Mobile Banking Market, 2024 - 2031, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Mobile Banking Market

TABLE 4 Product Launches And Product Expansions– Mobile Banking Market

TABLE 5 Acquisition and Mergers– Mobile Banking Market

TABLE 6 Global Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 7 Global Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 8 Global Android Market by Region, 2020 - 2023, USD Million

TABLE 9 Global Android Market by Region, 2024 - 2031, USD Million

TABLE 10 Global iOS Market by Region, 2020 - 2023, USD Million

TABLE 11 Global iOS Market by Region, 2024 - 2031, USD Million

TABLE 12 Global Others Market by Region, 2020 - 2023, USD Million

TABLE 13 Global Others Market by Region, 2024 - 2031, USD Million

TABLE 14 Global Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 15 Global Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 16 Global Consumer-to-business Market by Region, 2020 - 2023, USD Million

TABLE 17 Global Consumer-to-business Market by Region, 2024 - 2031, USD Million

TABLE 18 Global Consumer-to-consumer Market by Region, 2020 - 2023, USD Million

TABLE 19 Global Consumer-to-consumer Market by Region, 2024 - 2031, USD Million

TABLE 20 Global Mobile Banking Market by Region, 2020 - 2023, USD Million

TABLE 21 Global Mobile Banking Market by Region, 2024 - 2031, USD Million

TABLE 22 North America Mobile Banking Market, 2020 - 2023, USD Million

TABLE 23 North America Mobile Banking Market, 2024 - 2031, USD Million

TABLE 24 North America Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 25 North America Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 26 North America Android Market by Country, 2020 - 2023, USD Million

TABLE 27 North America Android Market by Country, 2024 - 2031, USD Million

TABLE 28 North America iOS Market by Country, 2020 - 2023, USD Million

TABLE 29 North America iOS Market by Country, 2024 - 2031, USD Million

TABLE 30 North America Others Market by Country, 2020 - 2023, USD Million

TABLE 31 North America Others Market by Country, 2024 - 2031, USD Million

TABLE 32 North America Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 33 North America Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 34 North America Consumer-to-business Market by Country, 2020 - 2023, USD Million

TABLE 35 North America Consumer-to-business Market by Country, 2024 - 2031, USD Million

TABLE 36 North America Consumer-to-consumer Market by Country, 2020 - 2023, USD Million

TABLE 37 North America Consumer-to-consumer Market by Country, 2024 - 2031, USD Million

TABLE 38 North America Mobile Banking Market by Country, 2020 - 2023, USD Million

TABLE 39 North America Mobile Banking Market by Country, 2024 - 2031, USD Million

TABLE 40 US Mobile Banking Market, 2020 - 2023, USD Million

TABLE 41 US Mobile Banking Market, 2024 - 2031, USD Million

TABLE 42 US Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 43 US Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 44 US Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 45 US Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 46 Canada Mobile Banking Market, 2020 - 2023, USD Million

TABLE 47 Canada Mobile Banking Market, 2024 - 2031, USD Million

TABLE 48 Canada Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 49 Canada Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 50 Canada Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 51 Canada Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 52 Mexico Mobile Banking Market, 2020 - 2023, USD Million

TABLE 53 Mexico Mobile Banking Market, 2024 - 2031, USD Million

TABLE 54 Mexico Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 55 Mexico Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 56 Mexico Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 57 Mexico Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 58 Rest of North America Mobile Banking Market, 2020 - 2023, USD Million

TABLE 59 Rest of North America Mobile Banking Market, 2024 - 2031, USD Million

TABLE 60 Rest of North America Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 61 Rest of North America Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 62 Rest of North America Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 63 Rest of North America Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 64 Europe Mobile Banking Market, 2020 - 2023, USD Million

TABLE 65 Europe Mobile Banking Market, 2024 - 2031, USD Million

TABLE 66 Europe Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 67 Europe Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 68 Europe Android Market by Country, 2020 - 2023, USD Million

TABLE 69 Europe Android Market by Country, 2024 - 2031, USD Million

TABLE 70 Europe iOS Market by Country, 2020 - 2023, USD Million

TABLE 71 Europe iOS Market by Country, 2024 - 2031, USD Million

TABLE 72 Europe Others Market by Country, 2020 - 2023, USD Million

TABLE 73 Europe Others Market by Country, 2024 - 2031, USD Million

TABLE 74 Europe Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 75 Europe Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 76 Europe Consumer-to-business Market by Country, 2020 - 2023, USD Million

TABLE 77 Europe Consumer-to-business Market by Country, 2024 - 2031, USD Million

TABLE 78 Europe Consumer-to-consumer Market by Country, 2020 - 2023, USD Million

TABLE 79 Europe Consumer-to-consumer Market by Country, 2024 - 2031, USD Million

TABLE 80 Europe Mobile Banking Market by Country, 2020 - 2023, USD Million

TABLE 81 Europe Mobile Banking Market by Country, 2024 - 2031, USD Million

TABLE 82 Germany Mobile Banking Market, 2020 - 2023, USD Million

TABLE 83 Germany Mobile Banking Market, 2024 - 2031, USD Million

TABLE 84 Germany Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 85 Germany Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 86 Germany Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 87 Germany Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 88 UK Mobile Banking Market, 2020 - 2023, USD Million

TABLE 89 UK Mobile Banking Market, 2024 - 2031, USD Million

TABLE 90 UK Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 91 UK Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 92 UK Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 93 UK Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 94 France Mobile Banking Market, 2020 - 2023, USD Million

TABLE 95 France Mobile Banking Market, 2024 - 2031, USD Million

TABLE 96 France Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 97 France Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 98 France Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 99 France Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 100 Russia Mobile Banking Market, 2020 - 2023, USD Million

TABLE 101 Russia Mobile Banking Market, 2024 - 2031, USD Million

TABLE 102 Russia Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 103 Russia Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 104 Russia Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 105 Russia Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 106 Spain Mobile Banking Market, 2020 - 2023, USD Million

TABLE 107 Spain Mobile Banking Market, 2024 - 2031, USD Million

TABLE 108 Spain Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 109 Spain Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 110 Spain Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 111 Spain Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 112 Italy Mobile Banking Market, 2020 - 2023, USD Million

TABLE 113 Italy Mobile Banking Market, 2024 - 2031, USD Million

TABLE 114 Italy Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 115 Italy Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 116 Italy Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 117 Italy Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 118 Rest of Europe Mobile Banking Market, 2020 - 2023, USD Million

TABLE 119 Rest of Europe Mobile Banking Market, 2024 - 2031, USD Million

TABLE 120 Rest of Europe Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 121 Rest of Europe Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 122 Rest of Europe Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 123 Rest of Europe Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 124 Asia Pacific Mobile Banking Market, 2020 - 2023, USD Million

TABLE 125 Asia Pacific Mobile Banking Market, 2024 - 2031, USD Million

TABLE 126 Asia Pacific Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 127 Asia Pacific Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 128 Asia Pacific Android Market by Country, 2020 - 2023, USD Million

TABLE 129 Asia Pacific Android Market by Country, 2024 - 2031, USD Million

TABLE 130 Asia Pacific iOS Market by Country, 2020 - 2023, USD Million

TABLE 131 Asia Pacific iOS Market by Country, 2024 - 2031, USD Million

TABLE 132 Asia Pacific Others Market by Country, 2020 - 2023, USD Million

TABLE 133 Asia Pacific Others Market by Country, 2024 - 2031, USD Million

TABLE 134 Asia Pacific Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 135 Asia Pacific Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 136 Asia Pacific Consumer-to-business Market by Country, 2020 - 2023, USD Million

TABLE 137 Asia Pacific Consumer-to-business Market by Country, 2024 - 2031, USD Million

TABLE 138 Asia Pacific Consumer-to-consumer Market by Country, 2020 - 2023, USD Million

TABLE 139 Asia Pacific Consumer-to-consumer Market by Country, 2024 - 2031, USD Million

TABLE 140 Asia Pacific Mobile Banking Market by Country, 2020 - 2023, USD Million

TABLE 141 Asia Pacific Mobile Banking Market by Country, 2024 - 2031, USD Million

TABLE 142 China Mobile Banking Market, 2020 - 2023, USD Million

TABLE 143 China Mobile Banking Market, 2024 - 2031, USD Million

TABLE 144 China Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 145 China Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 146 China Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 147 China Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 148 Japan Mobile Banking Market, 2020 - 2023, USD Million

TABLE 149 Japan Mobile Banking Market, 2024 - 2031, USD Million

TABLE 150 Japan Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 151 Japan Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 152 Japan Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 153 Japan Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 154 India Mobile Banking Market, 2020 - 2023, USD Million

TABLE 155 India Mobile Banking Market, 2024 - 2031, USD Million

TABLE 156 India Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 157 India Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 158 India Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 159 India Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 160 South Korea Mobile Banking Market, 2020 - 2023, USD Million

TABLE 161 South Korea Mobile Banking Market, 2024 - 2031, USD Million

TABLE 162 South Korea Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 163 South Korea Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 164 South Korea Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 165 South Korea Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 166 Singapore Mobile Banking Market, 2020 - 2023, USD Million

TABLE 167 Singapore Mobile Banking Market, 2024 - 2031, USD Million

TABLE 168 Singapore Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 169 Singapore Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 170 Singapore Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 171 Singapore Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 172 Malaysia Mobile Banking Market, 2020 - 2023, USD Million

TABLE 173 Malaysia Mobile Banking Market, 2024 - 2031, USD Million

TABLE 174 Malaysia Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 175 Malaysia Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 176 Malaysia Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 177 Malaysia Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 178 Rest of Asia Pacific Mobile Banking Market, 2020 - 2023, USD Million

TABLE 179 Rest of Asia Pacific Mobile Banking Market, 2024 - 2031, USD Million

TABLE 180 Rest of Asia Pacific Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 181 Rest of Asia Pacific Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 182 Rest of Asia Pacific Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 183 Rest of Asia Pacific Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 184 LAMEA Mobile Banking Market, 2020 - 2023, USD Million

TABLE 185 LAMEA Mobile Banking Market, 2024 - 2031, USD Million

TABLE 186 LAMEA Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 187 LAMEA Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 188 LAMEA Android Market by Country, 2020 - 2023, USD Million

TABLE 189 LAMEA Android Market by Country, 2024 - 2031, USD Million

TABLE 190 LAMEA iOS Market by Country, 2020 - 2023, USD Million

TABLE 191 LAMEA iOS Market by Country, 2024 - 2031, USD Million

TABLE 192 LAMEA Others Market by Country, 2020 - 2023, USD Million

TABLE 193 LAMEA Others Market by Country, 2024 - 2031, USD Million

TABLE 194 LAMEA Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 195 LAMEA Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 196 LAMEA Consumer-to-business Market by Country, 2020 - 2023, USD Million

TABLE 197 LAMEA Consumer-to-business Market by Country, 2024 - 2031, USD Million

TABLE 198 LAMEA Consumer-to-consumer Market by Country, 2020 - 2023, USD Million

TABLE 199 LAMEA Consumer-to-consumer Market by Country, 2024 - 2031, USD Million

TABLE 200 LAMEA Mobile Banking Market by Country, 2020 - 2023, USD Million

TABLE 201 LAMEA Mobile Banking Market by Country, 2024 - 2031, USD Million

TABLE 202 Brazil Mobile Banking Market, 2020 - 2023, USD Million

TABLE 203 Brazil Mobile Banking Market, 2024 - 2031, USD Million

TABLE 204 Brazil Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 205 Brazil Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 206 Brazil Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 207 Brazil Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 208 Argentina Mobile Banking Market, 2020 - 2023, USD Million

TABLE 209 Argentina Mobile Banking Market, 2024 - 2031, USD Million

TABLE 210 Argentina Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 211 Argentina Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 212 Argentina Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 213 Argentina Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 214 UAE Mobile Banking Market, 2020 - 2023, USD Million

TABLE 215 UAE Mobile Banking Market, 2024 - 2031, USD Million

TABLE 216 UAE Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 217 UAE Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 218 UAE Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 219 UAE Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 220 Saudi Arabia Mobile Banking Market, 2020 - 2023, USD Million

TABLE 221 Saudi Arabia Mobile Banking Market, 2024 - 2031, USD Million

TABLE 222 Saudi Arabia Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 223 Saudi Arabia Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 224 Saudi Arabia Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 225 Saudi Arabia Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 226 South Africa Mobile Banking Market, 2020 - 2023, USD Million

TABLE 227 South Africa Mobile Banking Market, 2024 - 2031, USD Million

TABLE 228 South Africa Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 229 South Africa Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 230 South Africa Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 231 South Africa Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 232 Nigeria Mobile Banking Market, 2020 - 2023, USD Million

TABLE 233 Nigeria Mobile Banking Market, 2024 - 2031, USD Million

TABLE 234 Nigeria Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 235 Nigeria Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 236 Nigeria Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 237 Nigeria Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 238 Rest of LAMEA Mobile Banking Market, 2020 - 2023, USD Million

TABLE 239 Rest of LAMEA Mobile Banking Market, 2024 - 2031, USD Million

TABLE 240 Rest of LAMEA Mobile Banking Market by Platform, 2020 - 2023, USD Million

TABLE 241 Rest of LAMEA Mobile Banking Market by Platform, 2024 - 2031, USD Million

TABLE 242 Rest of LAMEA Mobile Banking Market by Transaction, 2020 - 2023, USD Million

TABLE 243 Rest of LAMEA Mobile Banking Market by Transaction, 2024 - 2031, USD Million

TABLE 244 Key Information – Mitsubishi UFJ Financial Group, Inc.

TABLE 245 Key Information – BNP Paribas S.A.

TABLE 246 Key Information – UBS AG

TABLE 247 Key Information – Capital One Financial Corporation

TABLE 248 Key Information – Citigroup Inc.

TABLE 249 key information – JPMorgan Chase & Co.

TABLE 250 Key Information – HSBC Holdings plc

TABLE 251 Key Information – The Bank of America Corporation

TABLE 252 Key Information – Wells Fargo & Company

TABLE 253 Key Information – American Express Company

List of Figures

FIG 1 Methodology for the research

FIG 2 Global Mobile Banking Market, 2020 - 2031, USD Million

FIG 3 Key Factors Impacting Mobile Banking Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Mergers & Acquisition: 2021, Jun – 2024, Feb) Leading Players

FIG 7 Porter’s Five Forces Analysis – Mobile Banking Market

FIG 8 Global Mobile Banking Market share by Platform, 2023

FIG 9 Global Mobile Banking Market share by Platform, 2031

FIG 10 Global Mobile Banking Market by Platform, 2020 - 2031, USD Million

FIG 11 Global Mobile Banking Market share by Transaction, 2023

FIG 12 Global Mobile Banking Market share by Transaction, 2031

FIG 13 Global Mobile Banking Market by Transaction, 2020 - 2031, USD Million

FIG 14 Global Mobile Banking Market share by Region, 2023

FIG 15 Global Mobile Banking Market share by Region, 2031

FIG 16 Global Mobile Banking Market by Region, 2020 - 2031, USD Million

FIG 17 Recent strategies and developments: JPMorgan Chase & Co.

FIG 18 SWOT Analysis: JPMorgan Chase & Co.

FIG 19 Recent strategies and developments: HSBC Holdings plc

FIG 20 Recent strategies and developments: Wells Fargo & Company

FIG 21 SWOT Analysis: Wells Fargo & Company