“Global Medical Imaging Informatics Market to reach a market value of USD 5.42 Billion by 2032 growing at a CAGR of 6%”

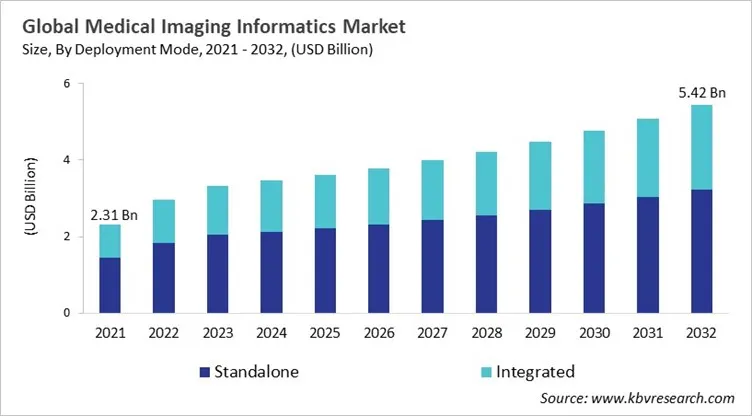

The Global Medical Imaging Informatics Market size is expected to reach USD 5.42 billion by 2032, rising at a market growth of 6.0% CAGR during the forecast period.

Medical imaging informatics is a healthcare IT discipline that manages the storage, analysis, acquisition, and exchange of medical images to support clinical decision making. Developing from the digitization of imaging and the adoption of RIS and PACS, the field evolved with enhanced workflow efficiency, and integrating imaging data with electronic health records. Standards organizations and professional bodies helped in formalizing data exchange frameworks, while leading OEMs expanded solutions that combine image management with workflow analytics and automation. Imaging informatics has extended beyond radiology into multiple specialties and has become a mission-critical component of modern healthcare infrastructure.

Recently, the medical imaging informatics market has advanced rapidly through the integration of advanced analytics, artificial intelligence, and cloud computing. AI-enabled tools now assist clinicians with anomaly detection, image interpretation, and precision medicine by combining imaging with clinical health data. Cloud-based platforms enable secure access, scalable storage, and enterprise-wide collaboration, while interoperability standards assure seamless data sharing across systems. The competitive landscape of the medical imaging informatics market is driven by innovation in cloud deployment, AI, and workflow optimization, with major global providers and developing specialists continually improving capabilities to enhance diagnostic accuracy, patient outcomes, and operational efficiency.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2025, Fujifilm Holdings Corporation teamed up with Hackensack Meridian Health, a helthcare services provider company to implement Synapse Cardiology PACS across 18 hospitals. This unified, AI-enabled cardiovascular imaging platform enhances clinical workflow, collaboration, and patient care. The solution integrates with Fujifilm’s enterprise imaging tools, supporting secure, cloud-ready access and advanced decision-making across the healthcare network. Additionally, In March, 2025, Fujifilm Holdings Corporation teamed up with Tiger Health Technology, an AI-Driven Medical Data Solutions to enhance digital pathology data management through Synapse Pathology. The collaboration improves storage efficiency, accessibility, and integration with vendor-neutral archives. It aims to accelerate diagnoses, reduce costs, and support broader digital pathology adoption across healthcare systems with scalable, cloud-based imaging solutions.

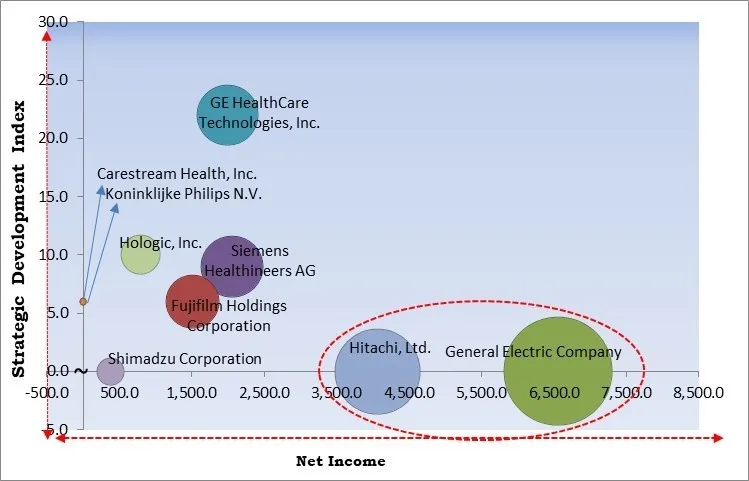

Based on the Analysis presented in the KBV Cardinal matrix; General Electric Company and Hitachi, Ltd. are the forerunners in the Medical Imaging Informatics Market. Companies such as Siemens Healthineers AG, GE HealthCare Technologies, Inc., and Fujifilm Holdings Corporation are some of the key innovators in Medical Imaging Informatics Market. In April, 2025, Siemens Healthineers AG teamed up with Tower Health, a medical services provider to modernize imaging equipment, enhance technology, and elevate patient care. The collaboration covers radiology, oncology, and cardiology, providing advanced CT, MRI, and radiation therapy systems, along with Siemens' digital automation tools and clinical algorithms for improved diagnostics and operations.

The COVID-19 pandemic hurt the medical imaging informatics market because healthcare systems put emergency response ahead of routine diagnostics. Imaging procedures were put off or called off, which lowered the number of imaging procedures and the need for informatics solutions. Hospitals were under a lot of financial stress, which caused them to put off buying new technology and upgrading their systems. Shortages of workers and redeployment made it hard to carry out and integrate activities. Interruptions in the supply chain made it even longer before hardware was available and installations could begin. All these things led to delays in procurement, slower deployments, and a temporary drop in market growth during the pandemic. Thus, the COVID-19 pandemic had a negative impact on the market.

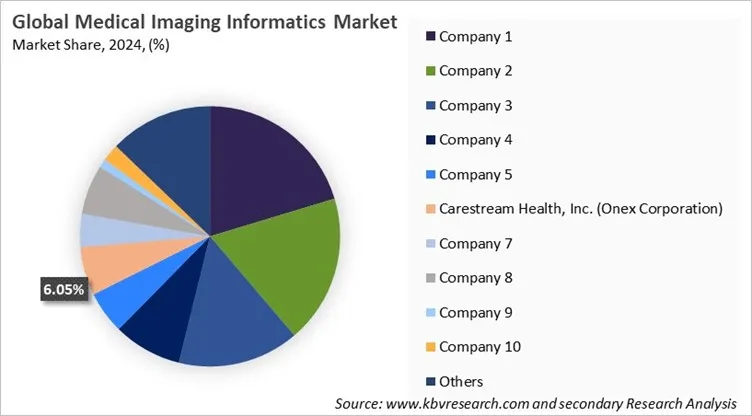

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Medical Imaging Informatics Market size to reach USD 5.42 Billion by 2032

Based on Deployment Mode, the Medical Imaging Informatics Market is segmented into Standalone, and Integrated. The Integrated segment acquired 39% revenue share in the market in 2024. The integrated deployment mode in the medical imaging informatics market encompasses solutions that are embedded within or seamlessly connected to enterprise-level healthcare IT ecosystems, including electronic health records, hospital information systems, and clinical decision-support platforms.

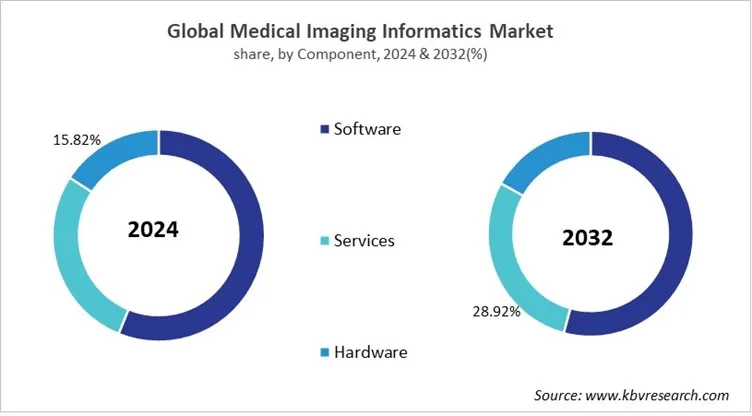

Based on Component, the Medical Imaging Informatics Market is segmented into Software, Services, and Hardware. The Services segment attained 28% revenue share in the market in 2024. The services component of the medical imaging informatics market encompasses a wide range of professional and managed services that support the deployment, optimization, and ongoing operation of imaging informatics solutions. These services typically include implementation support, system integration, training, maintenance, upgrades, and technical support.

Region-wise, the Medical Imaging Informatics Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The medical imaging informatics market is predicted to capture prominent growth in North America and Europe. This is because of the highly advanced healthcare infrastructure, strong government and institutional support for AI integration and digital health, and robust adoption of imaging IT systems such as RIS, cloud platforms, and PACS. The US leads the region with widespread implementation of cloud-based imaging solutions and AI-enabled diagnostic tools that enhance workflow efficiency and patient outcomes, supported by favourable regulatory frameworks. North America’s well-established healthcare ecosystem and large investment in innovation are elements supporting the market growth. Furthermore, the European medical imaging informatics market is estimated to grow at a steady rate. This is due to widespread digitalization of healthcare systems, rising integration of AI technologies in imaging workflows, and strong regulatory support for secure data handling. Nations such as France, Germany, and the UK are major contributors with many hospitals adopting advanced informatics solutions to improve diagnostic efficiency and patient care.

In the Asia Pacific and LAMEA regions, the medical imaging informatics market is estimated to experience substantial growth in the upcoming years. The market is driven by rapid expansion of healthcare infrastructure, rising demand for imaging services in nations such as Japan, India, China and South Korea, increasing healthcare expenditure. Investments in cloud-based platforms and AI adoption are strong in the region. Moreover, the LAMEA medical imaging informatics market is predicted to grow, supported by growing awareness of digital healthcare benefits, enhancing healthcare access, and ongoing modernization efforts in informatics and diagnostics.

The medical imaging informatics market is very competitive and driven by fast changes in technology. Companies are trying to stand out by using advanced AI, cloud-based platforms, and better interoperability. The focus of the competition is on providing complete, scalable solutions that make managing images, analyzing data, and improving workflow easier. Some important things about the market are that it is growing quickly because of the growing demand for diagnostic imaging, it is becoming more integrated with electronic health records, and tele-radiology services are becoming more popular. However, there are also problems, such as high implementation costs and a lack of skilled workers. Competitive dynamics are based on constant innovation and decision support based on data.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 3.61 Billion |

| Market size forecast in 2032 | USD 5.42 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 6.0% from 2025 to 2032 |

| Number of Pages | 600 |

| Number of Tables | 474 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Deployment Mode, Component, End User, Application, Region |

| Country scope |

|

| Companies Included | HealthCare Technologies, Inc., Koninklijke Philips N.V., Fujifilm Holdings Corporation, Hitachi, Ltd., Carestream Health, Inc. (Onex Corporation), Shimadzu Corporation, Agfa-Gevaert Group, General Electric Company and Hologic, Inc. |

By Deployment Mode

By Component

By End User

By Application

By Geography

This Market size is expected to reach USD 5.42 billion by 2032.

The medical imaging informatics market is projected to grow at a CAGR of 6% between 2025 and 2032.

Expansion of healthcare IT infrastructure and interoperability initiatives, driving demand for improved clinical workflows and operational efficiency.

HealthCare Technologies, Inc., Koninklijke Philips N.V., Fujifilm Holdings Corporation, Hitachi, Ltd., Carestream Health, Inc. (Onex Corporation), Shimadzu Corporation, Agfa-Gevaert Group, General Electric Company and Hologic, Inc.

The Standalone segment is leading the Global Medical Imaging Informatics Market by Deployment Mode in 2024; thereby, achieving a market value of $3.23 billion by 2032.

The North America region dominated the Global Medical Imaging Informatics Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1.8 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges