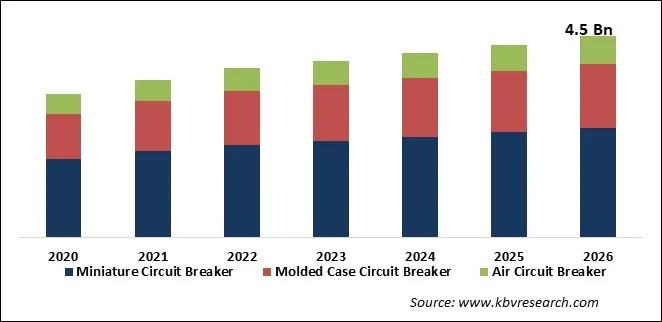

The Global Low Voltage Circuit Breaker Market size is expected to reach $4.5 billion by 2026, rising at a market growth of 5.8% CAGR during the forecast period. The expansion in the market of low voltage circuit breakers is significantly attributed to the fact that the demand in electricity is tenaciously increasing in the developing nations. Besides, the expansion in infrastructural ventures for safe electrical dispersion is anticipated to guide the low voltage circuit breakers market in the coming years.

A circuit breaker is an electrical switch that works spontaneously and its essential function is to separate portions of the electrical distribution system. The low voltage circuit breakers ensure the no damage happens due to electrical short circuit or overload. Low voltage circuit breakers are not straightforwardly intended to open the circuit like breaker or fuse, its opening relies on the degree and time of overload current. A low voltage circuit breaker is appropriate for 600 volts or under 600 volts rated circuits. The low voltage circuit breakers can be reset either physically or consequently to continue its normal function.

The developing economies in Asian and African regions are very much prone to constant power lags and a network collapses, hence the area presents huge potential for the deployment of effective electric products. Moreover, growing measures to cut down fire hazards, faults in electrical supply, and significant operational neglect will eventually influence the dynamics of the industry.

The globally spread coronavirus has a massive effect on the different industries and nations across the world. Due to the lockdown in every single economy examined in the report and others, there is a decline in the growth rate of the businesses, for example, construction and building, transportation, oil and gas, energy, and others. Furthermore, there is a decline in electricity demand from the COVID-19 influenced areas since the last three months, which is required to hamper the development of the low voltage circuit breaker market in the next couple of years. In Europe, economies, for example, Germany, France, Spain, Italy, and others are following severe measures to break the spread of coronavirus in their respective areas.

Free Valuable Insights: Global Low Voltage Circuit Breaker Market to reach a market size of $4.5 billion by 2026

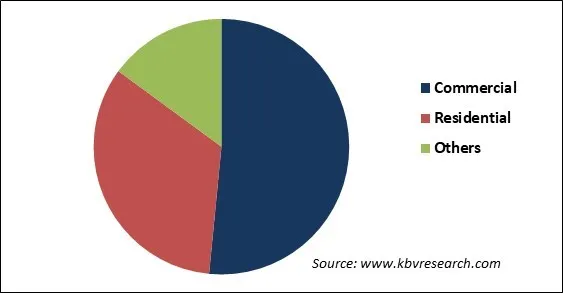

Based on Type, the market is segmented into Miniature Circuit Breaker, Molded Case Circuit Breaker and Air Circuit Breaker. Based on Application, the market is segmented into Shut-off Circuit, Energy Allocation and Others. Based on End User, the market is segmented into Commercial, Residential and Others. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Mitsubishi Electric Corporation, Siemens AG, Panasonic Corporation, Schneider Electric SE, Eaton Corporation PLC, The Danfoss Group, Hager Group, Carling Technologies, Inc., and CHINT Group.

Market Segmentation:

By Type

By Application

By End-User

By Geography

Companies Profiled

The low voltage circuit breaker market is projected to reach USD 4.5 billion by 2026.

The major factors that are anticipated to drive the low voltage circuit breaker industry include safe & secure distribution to strengthen market.

ABB Group, Mitsubishi Electric Corporation, Siemens AG, Panasonic Corporation, Schneider Electric SE, Eaton Corporation PLC, The Danfoss Group, Hager Group, Carling Technologies, Inc., and CHINT Group.

The miniature circuit breaker segment held the biggest share of the overall industry in 2019, due to increment in demand for miniature circuit breakers from cable protection, protection of small motors, x-ray machines, UPS systems, and other residential and business applications.

The Asia Pacific is anticipated to generate higher revenue in the low voltage circuit breakers market during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.