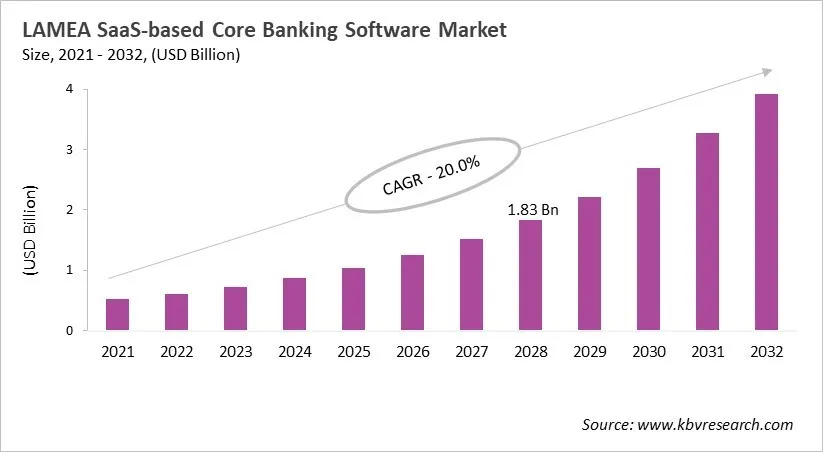

The Latin America, Middle East and Africa SaaS-based Core Banking Software Market would witness market growth of 21.0% CAGR during the forecast period (2025-2032).

The Brazil market dominated the LAMEA SaaS-based Core Banking Software Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of USD 955.3 Million by 2032. The Argentina market is showcasing a CAGR of 23.2% during (2025 - 2032). Additionally, The UAE market would register a CAGR of 19.5% during (2025 - 2032). The Brazil and Saudi Arabia led the LAMEA SaaS-based Core Banking Software Market by Country with a market share of 26.8% and 13.3% in 2024.

The LAMEA SaaS-based core banking software market has quickly moved away from old-fashioned on-premise systems and toward more flexible, cloud-native platforms. This change is due to more people using the internet, more people being able to connect to the internet on their phones, and government efforts to promote digital banking and financial inclusion. Banks in Brazil, South Africa, India, and other emerging markets are using these solutions to modernize their operations, make customers happier, and get new products to market faster. SaaS platforms give banks the infrastructure they need to be more efficient and compete in a financial world that is becoming more digital-first.

In the LAMEA market, modular, API-driven architectures, strict adherence to data sovereignty and regulatory compliance, and the use of AI and machine learning to improve fraud detection, tailor services, and streamline operations are all important trends. Top companies are teaming up with local fintechs, putting money into research and development, offering flexible hybrid and multi-cloud solutions, and putting a lot of emphasis on customer support. There is a lot of competition, and both established companies and new fintech startups are coming up with new ways to offer flexible, compliant, and customer-focused solutions. Success depends on providing platforms that are modular, flexible, and technologically advanced, and that follow local laws and changing market needs.

Based on Banking Type, the market is segmented into Large Banks, Midsize Banks, Small Banks, Community Banks, and Credit Unions. Among various UAE SaaS-based Core Banking Software Market by Banking Type; The Small Banks market achieved a market size of USD $79 Million in 2024 and is expected to grow at a CAGR of 19.9 % during the forecast period. The Credit Unions market is predicted to experience a CAGR of 21.7% throughout the forecast period from (2025 - 2032).

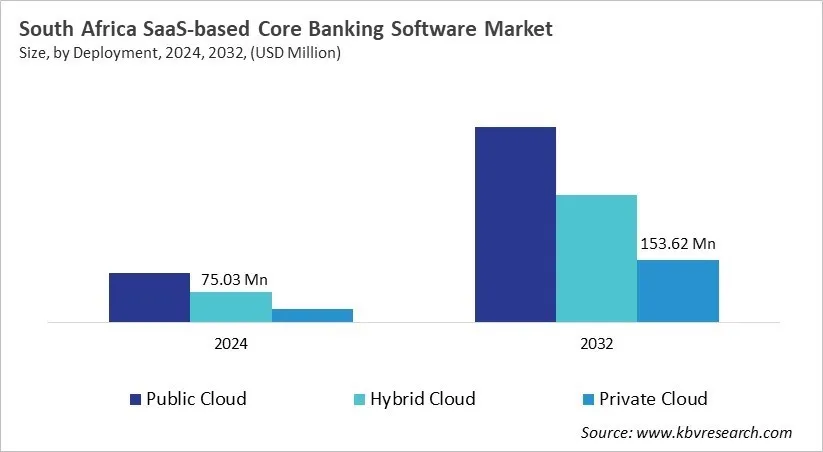

Based on Deployment, the market is segmented into Public Cloud, Hybrid Cloud, and Private Cloud. The Public Cloud market segment dominated the South Africa SaaS-based Core Banking Software Market by Deployment is expected to grow at a CAGR of 21.8 % during the forecast period thereby continuing its dominance until 2032. Also, The Private Cloud market is anticipated to grow as a CAGR of 23.8 % during the forecast period during (2025 - 2032).

Free Valuable Insights: The Worldwide SaaS-based Core Banking Software Market is Projected to reach USD 43.72 Billion by 2032, at a CAGR of 18.9%

Brazil’s SaaS-based core banking software market is growing rapidly, driven by digital banking expansion, regulatory changes, and initiatives to improve financial inclusion. SaaS platforms help banks enhance operational efficiency, reduce costs, and offer faster, personalized services, particularly in digital payments and micro-lending. The rise of mobile banking among younger populations accelerates modernization of core systems. Compliance with Brazil’s General Data Protection Law (LGPD) encourages adoption of secure, cloud-based platforms. Competition is strong, with international providers like Temenos and Finastra and local fintechs leveraging market knowledge to offer tailored, compliant solutions.

By Deployment

By End-User

By Banking Type

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.