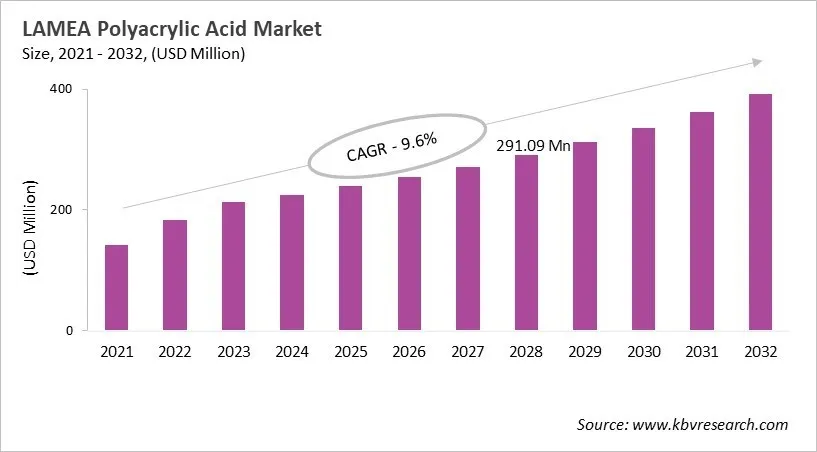

The Latin America, Middle East and Africa Polyacrylic Acid Market would witness market growth of 7.3% CAGR during the forecast period (2025-2032). In the year 2028, the LAMEA market's volume is expected to surge to 2,003.83 hundred tonnes, showcasing a growth of 5.6% (2025-2032).

The Brazil market dominated the LAMEA Polyacrylic Acid Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $99.3 million by 2032. The Argentina market is showcasing a CAGR of 8.1% during (2025 - 2032). Additionally, The UAE market would register a CAGR of 6% during (2025 - 2032). The Brazil and UAE led the LAMEA Polyacrylic Acid Market by Country with a market share of 27.8% and 10.1% in 2024.

The LAMEA polyacrylic acid market has grown from a small number of uses in scale inhibition to a wide range of uses in water treatment, desalination, construction, and hygiene. This is because of industrialization, urbanization, and problems with water scarcity. High-performance polymers are in higher demand because of government-led water conservation programs in places like Saudi Arabia and South Africa and the growth of desalination plants. BASF, Dow, Arkema, and Evonik are some of the big companies that have made advanced PAA grades that work well in harsh environments. Local production in South Africa and Brazil has also made supply chains stronger. Some trends are that more people are using bio-based and biodegradable PAA, it is being used in big infrastructure projects like NEOM, and it is being used more in superabsorbent polymers for concrete admixtures. Strategic partnerships with governments, innovation for the sake of sustainability, and product development for specific uses are all part of competitive strategies. However, barriers are still high because of the high cost of capital and regulatory requirements.

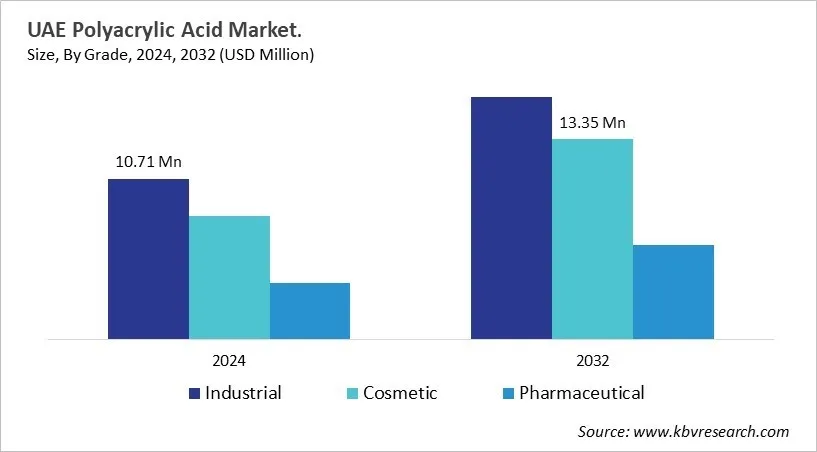

By grade, industrial PAA is the most popular type. This is because it is used to treat water for the manufacturing, power, and oil industries. Next is cosmetic-grade PAA, which is used in personal care products, and then pharmaceutical-grade PAA, which is used in drug delivery systems. Water and wastewater treatment has the biggest share of the market, thanks to investments in infrastructure that are driven by scarcity. Detergents and cleaners, on the other hand, are growing because of eco-friendly, phosphate-free formulations. The paints, coatings, and inks segment benefits from the demand for weather-resistant and eco-friendly coatings in construction and cars. Superabsorbent polymers are also becoming more popular in hygiene products. PAA is very useful because it can be used in a wide range of products, including adhesives, textiles, pharmaceuticals, and building materials. In general, the market is moderately concentrated. Global leaders win big contracts, while regional players gain ground by offering localized, cost-effective, and sustainable solutions.

Based on Grade, the market is segmented into Industrial, Cosmetic, and Pharmaceutical. The Industrial market segment dominated the UAE Polyacrylic Acid Market by Grade is expected to grow at a CAGR of 5.4 % during the forecast period thereby continuing its dominance until 2032. Also, The Pharmaceutical market is anticipated to grow as a CAGR of 6.8 % during the forecast period during (2025 - 2032). In terms of volume, 1,322.85 hundred tonnes are expected to be utilized by the year 2032. In Maxico, 56.56 hundred tonnes of volume polyacrylic acid is expected to be utilized in cosmetic by grade by the year 2032.

Free Valuable Insights: The Worldwide Polyacrylic Acid Market is Projected to reach USD 4.15 Billion by 2032, at a CAGR of 6.2%

Brazil is an important Latin American market for polyacrylic acid. Water treatment, agricultural hydrogels, detergents, and coatings all drive demand. Utilities are using PAA to stop and spread scale because cities and industries are growing. In areas that are prone to drought, farmers are using cross-linked hydrogels to make irrigation more efficient. The switch from phosphate-based detergents to phosphate-free ones, along with new rules about how to handle sludge and wastewater, makes adoption even more likely. There is a growing need for water-based coatings with PAA that have low VOC levels in construction. The market is divided, and distributors import and supply different grades, competing on things like logistics, compliance, and technical support. There is also a growing interest in biodegradable and bio-based grades.

By Grade (Volume, Hundred Tonnes, USD Billion, 2021-2032)

By Application (Volume, Hundred Tonnes, USD Billion, 2021-2032)

By Country (Volume, Hundred Tonnes, USD Billion, 2021-2032)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.