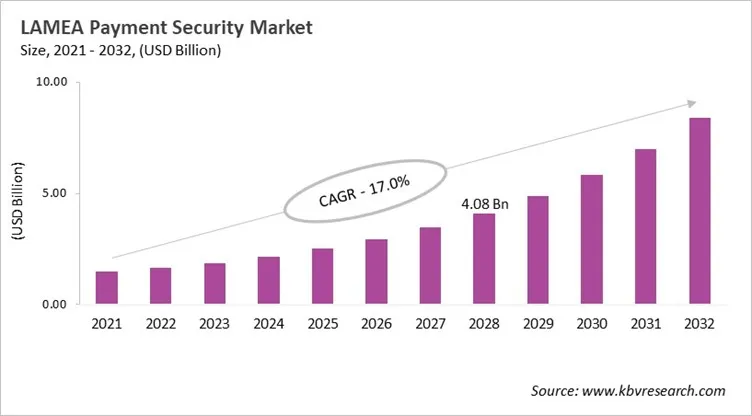

The Latin America, Middle East and Africa Payment Security Market would witness market growth of 18.9% CAGR during the forecast period (2025-2032).

The Brazil market dominated the LAMEA Payment Security Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1,567.5 million by 2032. The Argentina market is registering a CAGR of 20.5% during (2025 - 2032). Additionally, The UAE market is expected to witness a CAGR of 17.6% during (2025 - 2032). The Brazil and Saudi Arabia led the LAMEA Payment Security Market by Country with a market share of 21.2% and 16.1% in 2024.The South Africa market is expected to witness a CAGR of 20.1% during throughout the forecast period.

The LAMEA Payment Security Market has changed as more people use digital payments and work to include more people in the financial system. It has often skipped over older systems in favor of mobile and real-time platforms. Latin America improved security by having the central bank keep an eye on things and using instant payment systems like PIX. The Middle East, on the other hand, made payment security a part of its national digital transformation and regulatory frameworks. As mobile money grew in Africa, protecting consumers, checking their identities, and stopping fraud became very important. By the early 2020s, the market had grown into a complex ecosystem with regulatory oversight, network-level security, and real-time risk management.

Current trends focus on security built into instant payments, more tokenization for digital wallets and cross-border transactions, and AI-driven fraud detection. Market leaders focus on security models that can grow and include everyone, and that are in line with regulators and ecosystem partners. There is a fair amount of competition, with global networks providing the basic infrastructure and regional banks, fintechs, and mobile operators competing on analytics, service quality, and user experience.

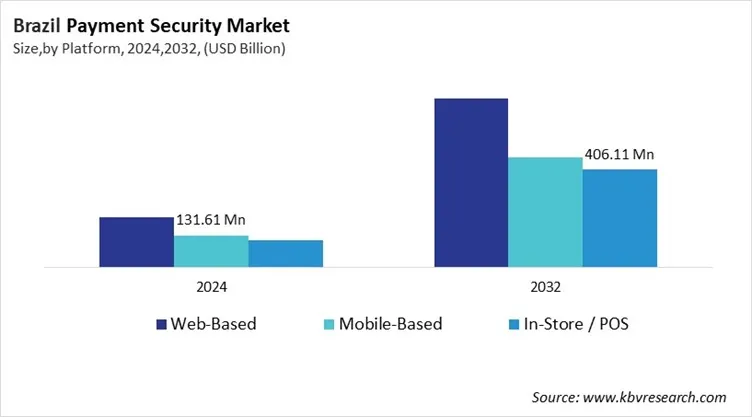

Based on Platform, the market is segmented into Web-Based, Mobile-Based, and In-Store / POS. The Web-Based market segment dominated the Brazil Payment Security Market by Platform is expected to grow at a CAGR of 16.5 % during the forecast period thereby continuing its dominance until 2032. Also, The In-Store / POS market is anticipated to grow as a CAGR of 17.7 % during the forecast period during (2025 - 2032).

Based on Solution Type, the market is segmented into Fraud Detection & Prevention, Encryption, Tokenization, and Other Solution Type. Among various UAE Payment Security Market by Solution Type; The Fraud Detection & Prevention market achieved a market size of USD $91.9 Million in 2024 and is expected to grow at a CAGR of 16.7 % during the forecast period. The Tokenization market is predicted to experience a CAGR of 18.2% throughout the forecast period from (2025 - 2032).

Free Valuable Insights: The Worldwide Payment Security Market is Projected to reach USD 96.90 Billion by 2032, at a CAGR of 16.9%

Brazil has one of the most advanced payment systems in Latin America. This is because more people are using digital payments, e-commerce is growing, and the financial sector is changing quickly. The move from cash to cards, instant payments, and digital wallets has made keeping payments safe a top priority. Banks and payment processors are spending more on encryption, tokenization, and multi-factor authentication because of the growing number of transactions and cyber threats. Strong regulatory oversight makes compliance-driven security adoption even stronger. The market depends on EMV standards, biometric authentication, real-time fraud monitoring, and AI-based analytics when it comes to technology. Market trends show that people want safe instant payments and easy ways to verify their identity. Global providers, domestic banks, and fintechs are all competing to see who can grow the fastest, stop fraud, and follow the rules.

By Organization Size

By Platform

By Solution Type

By End-User Industry

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.