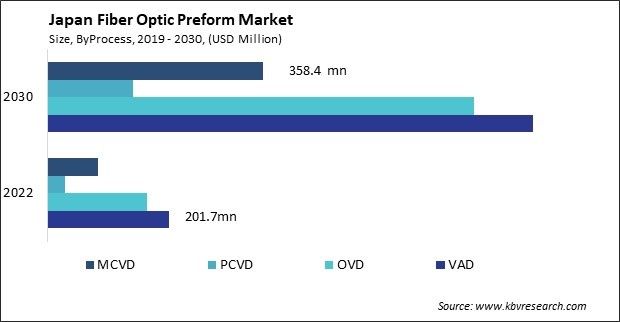

Japan Fiber Optic Preform Market Size, Share & Industry Trends Analysis Report By Process (VAD, OVD, PCVD, and MCVD), By End-USer, By Type (Multi-Mode, Single-Mode, and Plastic Optical Fiber), Growth Forecast, 2023 - 2030

Published Date : 15-Feb-2024 | Pages: 93 | Formats: PDF |

COVID-19 Impact on the Japan Fiber Optic Preform Market

The Japan Fiber Optic Preform Market size is expected to reach $2 billion by 2030, rising at a market growth of 19.8% CAGR during the forecast period.

Japan's fiber optic preform market is currently experiencing a notable transformation, primarily driven by a strategic focus on telecommunication infrastructure upgrades. Recognizing the crucial role of advanced communication technologies in meeting the increasing demand for high-speed internet and facilitating the integration of cutting-edge technologies, Japan is investing in enhancing its telecommunication capabilities.

Japan's commitment to technological innovation and its vision of becoming a global leader in 5G adoption further underscores the importance of telecommunication infrastructure upgrades. The fiber optic preform market responds to this vision by developing preforms supporting higher data transfer rates and low-latency requirements for 5G networks. Integrating fiber optic preforms into the telecommunication infrastructure aligns with Japan's goal of providing cutting-edge connectivity solutions to its population.

The International Trade Administration (ITA) states that DOCOMO launched a limited 5G commercial service in major Japanese cities on March 25, 2020. The organization anticipates allocating more than $7 billion by 2025 to extend its network coverage to 97% of the nation's densely populated regions. It intends to deploy 8,001 base stations across the 3.7GHz and 4.5GHz frequency bands, in addition to 5,001 base stations in the 28GHz band.

According to the ITA, NTT DOCOMO's comprehensive network expansion plan is geared towards positioning the company at the forefront of the 5G landscape in Japan. The deployment of base stations across different spectrum bands reflects a holistic approach to ensuring widespread coverage and catering to diverse communication needs, including high-speed data transfer and low-latency applications.

The fiber optic preform market is instrumental in creating the communication infrastructure for these applications to function optimally. From smart traffic management to intelligent energy systems, the demand for fiber optic preform is spurred by diverse technologies that make cities more efficient, sustainable, and connected. Moreover, Japan's fiber optic preform market is integral to the nation's endeavors to foster smart cities. As Japan urbanizes and seeks advanced connectivity solutions, Smart cities are becoming a growing trend to improve sustainability, efficiency, and general quality of life. The fiber optic preform market plays a pivotal role in laying the groundwork for the robust and high-speed communication infrastructure essential for the success of smart city initiatives.

Market Trends

Upgrade in telecommunication infrastructure

Japan's fiber optic preform market is undergoing a significant transformation, driven by a strategic focus on telecommunication infrastructure upgrades. Japan, known for its advanced technology landscape, emphasizes enhancing its telecommunication capabilities to meet the escalating demand for high-speed internet and facilitate the integration of cutting-edge technologies.

One of the primary drivers of this transformation is the relentless demand for high-speed internet services. As a technologically advanced nation, Japan is experiencing an unprecedented surge in data consumption. This surge is attributed to the proliferation of connected devices, increased reliance on video streaming, and the growing complexity of digital applications. To address this surge in demand, there is a critical need to upgrade and expand the existing telecommunication infrastructure, making fiber optic preform integral to this process. In conclusion, Japan's fiber optic preform market is benefiting from the increasing awareness of the advantages of fiber optic technology.

Adoption of next-generation applications

Japan's fiber optic preform market is undergoing a noteworthy transformation driven by the rapid adoption of next-generation applications. This shift is reshaping the telecommunications landscape in Japan, propelling the demand for fiber optic preform to new heights as the country embraces cutting-edge technologies and seeks to maintain its position as a global technology leader.

The advent of 5G technology is not only about faster internet for mobile devices but also unlocks many applications across various industries. The gaming industry is another sector fueling Japan's fiber optic preform market demand. As gaming experiences become more immersive and data-intensive, high-speed and low-latency internet connectivity becomes imperative. Fiber optics, supported by fiber optic preform, provide the bandwidth and reliability needed for seamless online gaming, virtual reality gaming, and cloud gaming services. This aligns with Japan's prominent position in the global gaming industry, where technological advancements and superior connectivity are essential for delivering cutting-edge gaming experiences.

Moreover, the increasing reliance on cloud computing services contributes to the surge in demand for fiber optic preform. Businesses and individuals in Japan are adopting cloud-based applications for storage, computing, and other services. The robustness and high-speed capabilities of fiber optics, driven by fiber optic preforms, are essential for ensuring efficient and real-time access to cloud resources. This trend is accentuated by the ongoing digital transformation across various industries, emphasizing the importance of a reliable and high-performance communication infrastructure.

Applications like telemedicine, remote patient monitoring, and high-resolution medical imaging rely on fiber optics for seamless data transmission. The fiber optic preform market contributes to creating optical fibers that form the backbone of communication networks supporting these healthcare applications, aligning with Japan's commitment to technological innovation in the healthcare sector. Thus, the demand for fiber optic preform market is amplified by the rising adoption of advanced technologies across various sectors.

Competition Analysis

Japan's fiber optic preform market has witnessed significant growth and competition driven by the rising demand for technological advancements, high-speed internet connectivity, and the increasing awareness of the benefits of fiber optic preform infrastructure. Several players have emerged in this competitive landscape, each striving to capture a substantial industry share and establish a strong foothold.

Furukawa Electric Co., Ltd. is a noteworthy player with a significant market presence in fiber optic preform. As a leading manufacturer of optical fibers and cables, Furukawa Electric has been instrumental in supplying the necessary hardware for building robust and efficient fiber optic networks.

In addition to these key players, several other local and international companies are competing in the Japanese fiber optic preform market. Some international players, such as Huawei Technologies Co., Ltd., and Corning Incorporated, have also made strategic investments to capitalize on the growing opportunities in Japan. These companies bring global expertise and technological innovation, intensifying the competition and driving further advancements in the industry.

Japan's fiber optic preform market is characterized by intense competition among key players striving to offer reliable, high-performance solutions. NTT Communications, KDDI Corporation, Furukawa Electric Co., Ltd., and other domestic and international players are shaping the market through strategic investments, technological advancements, and comprehensive service offerings. More innovation and development in the Japanese fiber optic preform market are anticipated due to the competition and the growing demand for high-speed connectivity.

List of Key Companies Profiled

- Corning Incorporated

- Optical Cable Corporation

- Sterlite Technologies Limited

- Prysmian Group

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

- Hengtong Group Co., Ltd

- Fujikura Ltd.

- Shin-Etsu Chemical Co., Ltd

Japan Fiber Optic Preform Market Report Segmentation

By Process

- VAD

- OVD

- PCVD

- MCVD

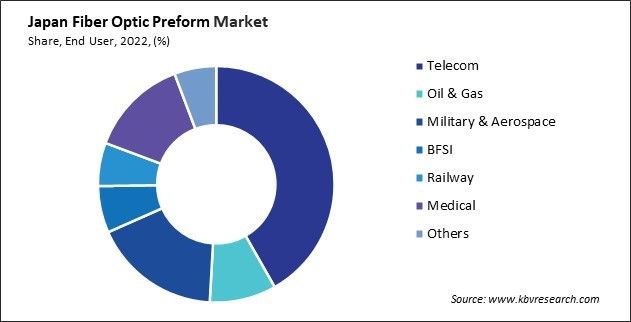

By End-user

- Telecom

- Oil & Gas

- Military & Aerospace

- BFSI

- Railway

- Medical

- Others

By Type

- Multi-Mode

- Single-Mode

- Plastic Optical Fiber

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Fiber Optic Preform Market, by Process

1.4.2 Japan Fiber Optic Preform Market, by End-user

1.4.3 Japan Fiber Optic Preform Market, by Type

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Geographical Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2021, Jun – 2023, Jan) Leading Players

3.3.3 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2019, Feb – 2023, Oct) Leading Players

3.4 Porter’s Five Force Analysis

Chapter 4. Japan Fiber Optic Preform Market

4.1 Japan Fiber Optic Preform Market, by Process

4.2 Japan Fiber Optic Preform Market, by End-user

4.3 Japan Fiber Optic Preform Market, by Type

Chapter 5. Company Profiles – Global Leaders

5.1 Corning Incorporated

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 Recent strategies and developments:

5.1.5.1 Geographical Expansions:

5.1.6 SWOT Analysis

5.2 Optical Cable Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Research & Development Expenses

5.2.4 SWOT Analysis

5.3 Sterlite Technologies Limited

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Recent strategies and developments:

5.3.4.1 Partnerships, Collaborations, and Agreements:

5.3.4.2 Product Launches and Product Expansions:

5.3.5 SWOT Analysis

5.4 Prysmian Group

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Research & Development Expenses

5.4.5 Recent strategies and developments:

5.4.5.1 Acquisition and Mergers:

5.4.5.2 Product Launches and Product Expansions:

5.4.6 SWOT Analysis

5.5 Furukawa Electric Co., Ltd.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 Recent strategies and developments:

5.5.5.1 Partnerships, Collaborations, and Agreements:

5.5.6 SWOT Analysis

5.6 Sumitomo Electric Industries, Ltd.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expenses

5.6.5 Recent strategies and developments:

5.6.5.1 Partnerships, Collaborations, and Agreements:

5.6.5.2 Product Launches and Product Expansions:

5.6.5.3 Acquisition and Mergers:

5.6.6 SWOT Analysis

5.7 Yangtze Optical Fibre and Cable Joint Stock Limited Company

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expenses

5.7.5 SWOT Analysis

5.8 Hengtong Group Co., Ltd.

5.8.1 Company Overview

5.8.2 SWOT Analysis

5.9 Fujikura Ltd.

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expenses

5.9.5 SWOT Analysis

5.10. Shin-Etsu Chemical Co., Ltd.

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 Japan Fiber Optic Preform Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Fiber Optic Preform Market

TABLE 4 Product Launches And Product Expansions– Fiber Optic Preform Market

TABLE 5 Acquisition and Mergers– Fiber Optic Preform Market

TABLE 6 Geographical Expansions– Fiber Optic Preform Market

TABLE 7 Japan Fiber Optic Preform Market, by Process, 2019 - 2022, USD Million

TABLE 8 Japan Fiber Optic Preform Market, by Process, 2023 - 2030, USD Million

TABLE 9 Japan Fiber Optic Preform Market, by End-user, 2019 - 2022, USD Million

TABLE 10 Japan Fiber Optic Preform Market, by End-user, 2023 - 2030, USD Million

TABLE 11 Japan Fiber Optic Preform Market, by Type, 2019 - 2022, USD Million

TABLE 12 Japan Fiber Optic Preform Market, by Type, 2023 - 2030, USD Million

TABLE 13 Key Information – Corning Incorporated

TABLE 14 Key Information – OPTICAL CABLE CORPORATION

TABLE 15 Key Information – Sterlite Technologies Limited

TABLE 16 Key Information – Prysmian Group

TABLE 17 Key Information –Furukawa Electric Co., Ltd.

TABLE 18 Key Information – Sumitomo Electric Industries, Ltd.

TABLE 19 Key Information – Yangtze Optical Fibre and Cable Joint Stock Limited Company

TABLE 20 Key Information – HENGTONG GROUP CO., LTD.

TABLE 21 Key Information – Fujikura Ltd.

TABLE 22 Key Information – Shin-Etsu Chemical Co., Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Fiber Optic Preform Market, 2019 - 2030, USD million

FIG 3 Key Factors Impacting the Fiber Optic Preform Market

FIG 4 KBV Cardinal Matrix

FIG 5 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 6 Key Strategic Move: (Product Launches and Product Expansions : 2021, Jun – 2023, Jan) Leading Players

FIG 7 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2019, Feb – 2023, Oct) Leading Players

FIG 8 Porter’s Five Force Analysis: Fiber Optic Preform Market

FIG 9 Japan Fiber Optic Preform Market, share by Process, 2022

FIG 10 Japan Fiber Optic Preform Market, share by Process, 2030

FIG 11 Japan Fiber Optic Preform Market, by Process, 2019 - 2030, USD million

FIG 12 Japan Fiber Optic Preform Market share, by End-user, 2022

FIG 13 Japan Fiber Optic Preform Market share, by End-user, 2030

FIG 14 Japan Fiber Optic Preform Market, by End-user, 2019 - 2030, usd million

FIG 15 Japan Fiber Optic Preform Market share, by Type, 2022

FIG 16 Japan Fiber Optic Preform Market share, by Type, 2030

FIG 17 Japan Fiber Optic Preform Market, by Type, 2019 - 2030, USD million

FIG 18 SWOT Analysis: Corning Incorporated

FIG 19 SWOT Analysis: OPTICAL CABLE CORPORATION

FIG 20 Recent strategies and developments: Sterlite Technologies Limited

FIG 21 SWOT Analysis: Sterlite Technologies Limited

FIG 22 Recent strategies and developments: Prysmian Group

FIG 23 SWOT Analysis: Prysmian Group

FIG 24 SWOT Analysis: Furukawa Electric Co., Ltd.

FIG 25 Recent strategies and developments: Sumitomo Electric Industries, Ltd

FIG 26 SWOT Analysis: Sumitomo Electric Industries, Ltd

FIG 27 SWOT Analysis: YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY

FIG 28 SWOT Analysis: HENGTONG GROUP CO., LTD.

FIG 29 SWOT Analysis: Fujikura Ltd.

FIG 30 SWOT Analysis: Shin-Etsu Chemical Co., Ltd.