Japan Drinking Yogurt Market Size, Share & Trends Analysis Report By Type (Dairy Based, and Non Dairy Based), By Packaging (Bottles, and Tetra Pack), By Flavor (Flavored, and Plain), By Distribution Channel, and Forecast, 2023 - 2032

Published Date : 22-Apr-2024 | Pages: 88 | Formats: PDF |

COVID-19 Impact on the Japan Drinking Yogurt Market

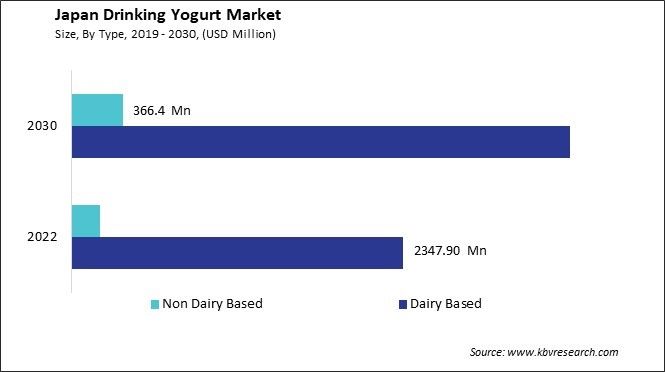

The Japan Drinking Yogurt Market size is expected to reach $3.8 Billion by 2030, rising at a market growth of 5.5% CAGR during the forecast period. In the year 2022, the market attained a volume of 349.1 million litres, experiencing a growth of 6.0% (2019-2022).

The drinking yogurt market in Japan has experienced significant growth and popularity in recent years, reflecting a cultural shift toward healthier dietary choices. This trend is driven by the increasing awareness of the health benefits of probiotics and fermented products, which are key components of drinking yogurt.

The health-conscious consumer demographic in Japan has propelled the demand for functional beverages, and drinking yogurt has emerged as a convenient option for those seeking a nutritious and easily consumable source of probiotics. With an aging population in Japan, there is a growing interest in products that promote gut health and overall well-being, making drinking yogurt a popular choice among a wide range of age groups. In addition to the health benefits, the convenient and on-the-go nature of drinking yogurt products aligns with the fast-paced lifestyle of many Japanese consumers.

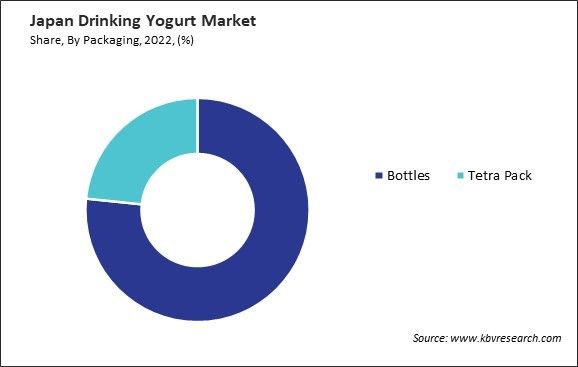

Single-serve bottles and pouches dominate the industry, providing a portable and hassle-free option for those with busy schedules. Major players in the Japanese drinking yogurt market have responded to consumer preferences by continually innovating in terms of flavors, packaging, and formulations. Collaborations with local dairy farmers and focusing on sustainable and natural ingredients have further enhanced these products for the Japanese audience.

Market Trends

E-commerce surge reshaping Japan's drinking yogurt market

Japan has witnessed a significant rise in e-commerce within the drinking yogurt market in recent years, reflecting a broader trend in the country's evolving consumer landscape. This surge can be attributed to several factors that highlight Japanese consumers' changing preferences and behaviors. E-commerce platforms also provide diverse options for consumers to explore and compare different drinking yogurt products. This has empowered Japanese consumers to make more informed choices based on flavors, nutritional content, and brand reputation, contributing to a more competitive and dynamic market.

One key driver behind the growth of e-commerce in the drinking yogurt sector is its convenience. Japanese consumers, known for their fast-paced and busy lifestyles, increasingly appreciate the ease of ordering products online and having them delivered directly to their doorsteps. This is particularly evident in the case of drinking yogurt, where the demand for on-the-go and portable options aligns seamlessly with the hassle-free nature of e-commerce. In addition to convenience and variety, promotional strategies employed by e-commerce platforms, such as exclusive online discounts and loyalty programs, have further incentivized Japanese consumers to choose online channels for their drinking yogurt purchases.

According to the United States Department of Agriculture, E-commerce in Japan is an approximately $4 trillion industry, and Japan is the fourth-largest e-commerce industry in the world. The E-commerce marketplace experienced marginal increases totaling $180 billion. Despite this overall growth, there is notable room for further development, particularly in the food and beverage sector, accounted for approximately $20 billion in 2020. This signifies a promising opportunity for expansion and investment in the drinking yogurt market within Japan's dynamic e-commerce industry. Hence, the escalating popularity of e-commerce in Japan's drinking yogurt market is a response to evolving consumer preferences for convenience and informed choices.

Increasing popularity of dairy-based yogurt in Japan

Japan has witnessed a significant surge in the popularity of dairy-based drinking yogurt, marking a notable shift in consumer preferences and dietary habits. The country's drinking yogurt market has experienced remarkable growth, driven by a confluence of factors that reflect Japanese consumers' unique tastes and health-conscious mindset.

In recent years, there has been a growing awareness among the Japanese population regarding the health benefits associated with consuming dairy products. Drinking yogurt, rich in probiotics and essential nutrients, has become a favored choice among those seeking a convenient and nutritious beverage. The traditional Japanese diet, often characterized by its emphasis on fresh and wholesome ingredients, has seamlessly incorporated drinking yogurt as a modern, health-enhancing element.

Japanese consumers have developed a penchant for functional foods, and drinking yogurt aligns well with this trend. Including probiotics in these beverages particularly appeals to health-conscious individuals, as it promotes gut health and overall well-being. This emphasis on functional ingredients has spurred innovation among dairy-based beverage producers, continually introducing new flavors and formulations to cater to diverse tastes. Thus, Japan's embrace of dairy-based drinking yogurt reflects a cultural shift towards health-conscious choices, focusing on convenience and functional benefits.

Competition Analysis

The drinking yogurt market has witnessed remarkable growth in Japan in recent years, with several companies actively contributing to its expansion. One of the key players in the Japanese drinking yogurt market is Meiji Co., Ltd. With a rich history from 1917, Meiji has evolved into a household name, offering a diverse range of dairy products. The company's drinking yogurt line includes various flavors, catering to the eclectic taste preferences of consumers.

Yakult Honsha Co., Ltd. is another major player deeply entrenched in the Japanese drinking yogurt sector. Established in 1955, The product is renowned for its probiotic beverage, Yakult, which has become synonymous with good digestive health. In addition to its flagship product, Yakult has expanded its portfolio to include various drinking yogurt options, capitalizing on the growing demand for functional and nutritious beverages.

Morinaga Milk Industry Co., Ltd. is a prominent name in Japan's dairy industry and has made significant inroads into the drinking yogurt market. Founded in 1917, the company has a strong legacy of producing high-quality dairy products. Morinaga offers diverse drinking yogurt products, focusing on taste innovation and nutritional benefits to appeal to the discerning Japanese consumer.

Glico Dairy Co., Ltd., a subsidiary of Ezaki Glico Co., Ltd., has also played a pivotal role in shaping the drinking yogurt landscape in Japan. With a commitment to providing wholesome and delicious dairy products, Glico Dairy has introduced innovative formulations and packaging to capture consumer attention. The company's drinking yogurt products blend traditional dairy expertise and contemporary taste preferences.

Furthermore, Asahi Group Holdings, Ltd., a major player in the beverage industry, has made strategic forays into the drinking yogurt market. Leveraging its extensive distribution network and marketing prowess, Asahi has introduced various drinking yogurt products to meet the evolving preferences of Japanese consumers. The company's focus on convenience and portability has contributed to the success of its drinking yogurt offerings. Hence, the drinking yogurt market's growth is fueled by tradition, quality, and adaptability to changing consumer preferences, making these companies integral contributors to the evolving narrative of drinking yogurt in Japan.

List of Key Companies Profiled

- Meiji Holdings Co., Ltd.

- Arla Foods, Inc.

- Danone S.A.

- Schreiber Foods, Inc.

- Lactalis Group

- Nestle S.A

- Chobani LLC

- Royal FrieslandCampina N.V.

- General Mills, Inc.

- DANA Dairy Group Ltd.

Japan Drinking Yogurt Market Report Segmentation

By Type

- Dairy Based

- Non Dairy Based

By Packaging

- Bottles

- Tetra Pack

By Flavor

- Flavored

- Chocolate

- Vanilla

- Berries

- Mango

- Others

- Plain

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Japan Drinking Yogurt Market, by Type

1.4.2 Japan Drinking Yogurt Market, by Packaging

1.4.3 Japan Drinking Yogurt Market, by Flavor

1.4.4 Japan Drinking Yogurt Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. Japan Drinking Yogurt Market

3.1 Japan Drinking Yogurt Market by Type

3.2 Japan Drinking Yogurt Market by Packaging

3.3 Japan Drinking Yogurt Market by Flavor

3.3.1 Japan Drinking Yogurt Market by Flavored Type

3.4 Japan Drinking Yogurt Market by Distribution Channel

Chapter 4. Company Profiles

4.1 Meiji Holdings Co., Ltd.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental Analysis

4.1.4 Research & Development Expense

4.1.5 Recent strategies and developments:

4.1.5.1 Product Launches and Product Expansions:

4.1.5.2 Geographical Expansions:

4.1.6 SWOT Analysis

4.2 Arla Foods, Inc.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Regional Analysis

4.2.4 Research & Development Expense

4.2.5 Recent strategies and developments:

4.2.5.1 Partnerships, Collaborations, and Agreements:

4.2.6 SWOT Analysis

4.3 Danone S.A.

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Category and Regional Analysis

4.3.4 Recent strategies and developments:

4.3.4.1 Product Launches and Product Expansions:

4.3.5 SWOT Analysis

4.4 Schreiber Foods, Inc.

4.4.1 Company Overview

4.4.2 Recent strategies and developments:

4.4.2.1 Partnerships, Collaborations, and Agreements:

4.4.3 SWOT Analysis

4.5 Lactalis Group

4.5.1 Company Overview

4.5.2 Recent strategies and developments:

4.5.2.1 Product Launches and Product Expansions:

4.5.3 SWOT Analysis

4.6 Nestle S.A

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expenses

4.6.5 SWOT Analysis

4.7 Chobani LLC

4.7.1 Company Overview

4.7.2 Recent strategies and developments:

4.7.2.1 Product Launches and Product Expansions:

4.7.3 SWOT Analysis

4.8 Royal FrieslandCampina N.V.

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Segmental and Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 General Mills, Inc.

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Segmental and Regional Analysis

4.9.4 Research & Development Expense

4.9.5 Recent strategies and developments:

4.9.5.1 Product Launches and Product Expansions:

4.9.6 SWOT Analysis

4.10. DANA Dairy Group Ltd.

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 Japan Drinking Yogurt Market, 2023 - 2030, USD Million

TABLE 3 Japan Drinking Yogurt Market, 2019 - 2022, Million Litres

TABLE 4 Japan Drinking Yogurt Market, 2023 - 2030, Million Litres

TABLE 5 Japan Drinking Yogurt Market by Type, 2019 - 2022, USD Million

TABLE 6 Japan Drinking Yogurt Market by Type, 2023 - 2030, USD Million

TABLE 7 Japan Drinking Yogurt Market by Type, 2019 - 2022, Million Litres

TABLE 8 Japan Drinking Yogurt Market by Type, 2023 - 2030, Million Litres

TABLE 9 Japan Drinking Yogurt Market by Packaging, 2019 - 2022, USD Million

TABLE 10 Japan Drinking Yogurt Market by Packaging, 2023 - 2030, USD Million

TABLE 11 Japan Drinking Yogurt Market by Packaging, 2019 - 2022, Million Litres

TABLE 12 Japan Drinking Yogurt Market by Packaging, 2023 - 2030, Million Litres

TABLE 13 Japan Drinking Yogurt Market by Flavor, 2019 - 2022, USD Million

TABLE 14 Japan Drinking Yogurt Market by Flavor, 2023 - 2030, USD Million

TABLE 15 Japan Drinking Yogurt Market by Flavor, 2019 - 2022, Million Litres

TABLE 16 Japan Drinking Yogurt Market by Flavor, 2023 - 2030, Million Litres

TABLE 17 Japan Drinking Yogurt Market by Flavored Type, 2019 - 2022, USD Million

TABLE 18 Japan Drinking Yogurt Market by Flavored Type, 2023 - 2030, USD Million

TABLE 19 Japan Drinking Yogurt Market by Flavored Type, 2019 - 2022, Million Litres

TABLE 20 Japan Drinking Yogurt Market by Flavored Type, 2023 - 2030, Million Litres

TABLE 21 Japan Drinking Yogurt Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 22 Japan Drinking Yogurt Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 23 Japan Drinking Yogurt Market by Distribution Channel, 2019 - 2022, Million Litres

TABLE 24 Japan Drinking Yogurt Market by Distribution Channel, 2023 - 2030, Million Litres

TABLE 25 Key Information – Meiji Holdings Co., Ltd.

TABLE 26 Key information – Arla Foods, Inc.

TABLE 27 Key information – Danone S.A.

TABLE 28 Key Information – Schreiber Foods, Inc.

TABLE 29 Key Information – Lactalis Group

TABLE 30 Key Information – Nestle S.A

TABLE 31 key information – Chobani LLC

TABLE 32 Key Information – Royal FrieslandCampina N.V.

TABLE 33 Key Information – General Mills, Inc.

TABLE 34 Key Information – DANA Dairy Group Ltd.

List of Figures

FIG 1 Methodology for the research

FIG 2 Japan Drinking Yogurt Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Drinking Yogurt Market

FIG 4 Porter’s Five Forces Analysis – Drinking Yogurt Market

FIG 5 Japan Drinking Yogurt Market share by Type, 2022

FIG 6 Japan Drinking Yogurt Market share by Type, 2030

FIG 7 Japan Drinking Yogurt Market by Type, 2019 - 2030, USD Million

FIG 8 Japan Drinking Yogurt Market share by Packaging, 2022

FIG 9 Japan Drinking Yogurt Market share by Packaging, 2030

FIG 10 Japan Drinking Yogurt Market by Packaging, 2019 - 2030, USD Million

FIG 11 Japan Drinking Yogurt Market share by Flavor, 2022

FIG 12 Japan Drinking Yogurt Market share by Flavor, 2030

FIG 13 Japan Drinking Yogurt Market by Flavor, 2019 - 2030, USD Million

FIG 14 Japan Drinking Yogurt Market share by Flavored Type, 2022

FIG 15 Japan Drinking Yogurt Market share by Flavored Type, 2030

FIG 16 Japan Drinking Yogurt Market by Flavored Type, 2019 - 2030, USD Million

FIG 17 Japan Drinking Yogurt Market share by Distribution Channel, 2022

FIG 18 Japan Drinking Yogurt Market share by Distribution Channel, 2030

FIG 19 Japan Drinking Yogurt Market by Distribution Channel, 2019 - 2030, USD Million

FIG 20 Recent strategies and developments: Meiji Holdings Co., Ltd.

FIG 21 SWOT Analysis: Meiji Holdings Co., Ltd.

FIG 22 SWOT Analysis: Arla Foods, Inc.

FIG 23 SWOT Analysis: Danone, S.A.

FIG 24 SWOT Analysis: Schreiber Foods, Inc.

FIG 25 SWOT Analysis: Lactalis Group

FIG 26 SWOT Analysis: Nestle S.A

FIG 27 SWOT Analysis: Chobani LLC.

FIG 28 SWOT Analysis: Royal FrieslandCampina N.V.

FIG 29 Swot Analysis: General Mills, Inc.

FIG 30 SWOT Analysis: DANA Dairy Group Ltd.