Global Hardware in the Loop Market Size, Share & Industry Trends Analysis Report By Type (Open Loop and Closed Loop), By Vertical (Automobile, Aerospace, Research & Education, Defense, Power Electronics), By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-Aug-2022 | Pages: 179 | Formats: PDF |

COVID-19 Impact on the Hardware in the Loop Market

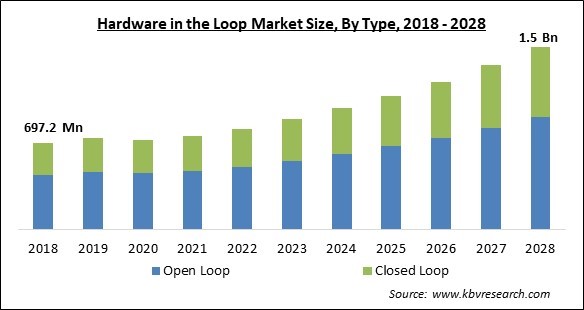

The Global Hardware in the Loop Market size is expected to reach $1.5 billion by 2028, rising at a market growth of 10.4% CAGR during the forecast period.

The hardware-in-the-loop (HIL) simulation is a method used in testing and developing complex real-time embedded systems. These are also abbreviated as HWIL or HITL. By integrating the intricacy of the process-actuator system, or a plant, into a test platform, HIL simulation creates an efficient testing environment. The inclusion of a mathematical description of all connected dynamic systems in testing and development takes into account the complexity of the controlled plant. The term "plant simulation" refers to these mathematical depictions. This industrial simulation interacts with the embedded that is being tested.

Traditionally, testing of control systems has been done on actual machinery (i.e., plant) out in the field, on the entire system, or on a powered test bed in a lab. This method can be exceedingly costly, ineffective, and even dangerous while providing testing fidelity. HIL testing is a fantastic alternative to conventional testing techniques. When using a simulator with inputs and outputs (I/Os) capable of interacting with control systems and other equipment, a computer model exactly replicating the physical plant replaces it during HIL simulation. By precisely simulating the plant and its dynamics, as well as sensors and actuators, the HIL simulator can provide thorough closed-loop testing without the requirement for testing on actual systems.

In fields like aviation or automotive where operations are particularly complicated, HIL has been employed for years. HIL can supplement the testing of physical plants to offer a number of benefits. One such benefit is reduced testing costs. A significant investment in HIL can be justified by the high costs associated with testing complex machinery like airplane subsystems. By adding HIL as a supplementary tool, field research can be minimized.

COVID-19 Impact Analysis

With implementations in so many products and services, the HIL market cannot experience the individual impact of COVID-19 pandemic. Flight cancellations travel bans, quarantines, restaurant closures, restrictions on all indoor and outdoor events, and a significant slowdown in the supply chain, all resulted from the counteractions taken by various governments around the globe. Some other impacts of the pandemic included rising public panic, stock market volatility, a decline in business confidence, and future uncertainty. While commerce in some goods and services drastically decreased, it significantly expanded in others.

Market Growth Factors

A Rise in Automation is Propelling the Need for HIL Technological Advancements

Automobile manufacturers are incorporating technologies like autonomous driving, accident avoidance systems, and enhanced driver aid systems. ECUs, algorithms, and software used in autonomous technologies are tested using hardware-in-the-loop techniques. Hardware in the loop test bench is used to check the sensor data for cameras, radar, LiDAR, image signal processors, GPS, and other sensors. HIL simulators enable developers to verify new software and hardware automotive alternatives while adhering to quality standards and time-to-market constraints because in-vehicle driving tests to assess the performance and diagnostic features of Engine Management Systems are frequently time-consuming, expensive, and unreproducible.

Application of HIL in Multitude of Areas like Robotics, Aviation and Offshore Systems

The demand for hardware in the loop testing solutions that can fulfill these new benchmarks has increased as a result of the expanding functionality in contemporary cars. Hardware-in-the-loop solutions are primarily employed in the aviation industry for the validation and verification of aeronautical control systems. The hardware in the loop technique is used for the majority of testing demands because physical testing in this industry may be extremely dangerous for both real plants and people. Control systems and mechanical structures are typically constructed concurrently in offshore and marine engineering. Only following integration is possible to test the control systems.

Marketing Restraining Factor:

Lowering Demand of HIL Systems Due To High Complexity and Price

As building the mathematical model can be challenging depending on the variables and function blocks added to the system, hardware in the loop is a tough technique to apply. Microgrids, aviation models, and the development of automotive environments are examples of complex systems that call for hardware which can handle intensive data processing. In order to run the simulation model, companies must first invest in a costly initial configuration of real-time simulators and rack computers. A HIL simulator must be extremely complicated to run at high speeds or to use dedicated IO to produce high frequencies.

Type Outlook

Based on the type, the hardware in the loop market is bifurcated into open loop, and closed loop. The closed loop segment acquired a significant revenue share in the hardware in the loop market in 2021. A closed-loop feedback loop on universal testing machines transmits data constantly from the closed-loop controller to the motor as well as from the motor to the closed-loop controller. The load rate and stress rate, for example, can remain constant throughout the testing due to this continuous input. Closed-loop systems are more accurate because they can respond quickly to potential changes.

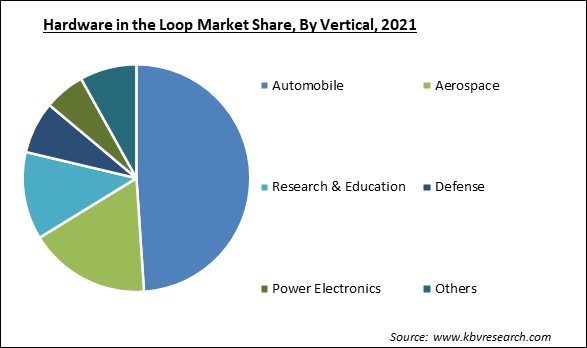

Vertical Outlook

On the basis of vertical, the hardware in the loop market is segmented into automobile, aerospace, defense, power electronics, research & education, and others. The automobile vertical segment garnered the largest revenue share in the hardware in the loop market in 2021. The growth is notable because more and more autos are using the hardware-in-the-loop technology to create improved ECUs, shorten the time to market, and meet different industry standards. The testing of Battery Management Systems, LiDAR, computer vision, and other crucial components must evolve due to new technological advancements in electric vehicles and autonomous driving.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 751.1 Million |

| Market size forecast in 2028 | USD 1.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.4% from 2022 to 2028 |

| Number of Pages | 179 |

| Number of Tables | 275 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on the region, the hardware in the loop market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia-Pacific region dominated the hardware in the loop market with the maximum revenue share in 2021. India, China, and Japan are major market influencers. Hardware sales in the loop market have increased as a result of the industries' explosive growth in the automotive, aerospace, and power electronics fields. The increased initiatives to expand manufacturing units and factories in this region would further propel the segment growth.

Free Valuable Insights: Global Hardware in the Loop Market size to reach USD 1.5 Billion by 2028

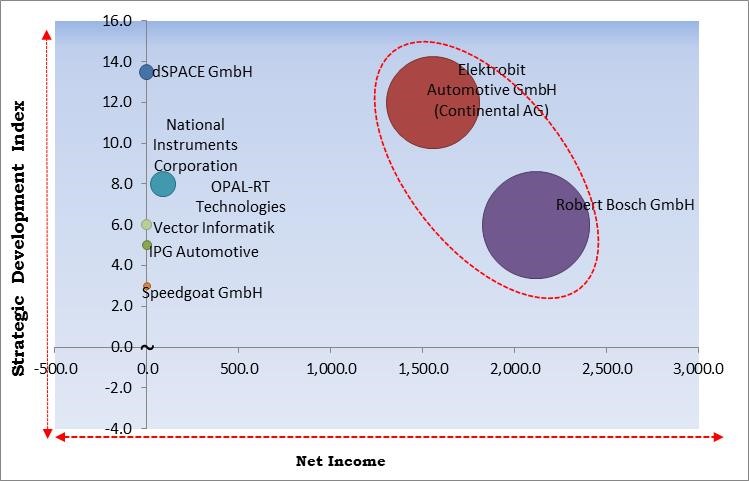

KBV Cardinal Matrix - Hardware in the Loop Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Elektrobit Automotive GmbH (Continental AG) and Robert Bosch GmbH are the forerunners in the Hardware in the Loop. Companies such as dSPACE GmbH, National Instruments Corporation, OPAL-RT Technologies are some of the key innovators in Hardware in the Loop.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, National Instruments Corporation, dSPACE GmbH, Elektrobit Automotive GmbH (Continental AG), OPAL-RT Technologies, Speedgoat GmbH, Acutronic Group, Plexim GmbH, IPG Automotive GmbH and Vector Informatik GmbH

Strategies deployed in Hardware in the Loop Market

» Partnerships, Collaborations and Agreements:

- Jul-2022: IPG Automotive formed a collaboration with Foretellix, a leading ADAS and AV verification, and validation platform provider. Under this collaboration, the companies focused on strengthening their cooperation to bring a comprehensive solution that would reduce development costs and time to market and increase the safety of automated driving systems. This collaboration combined Foretellix’s Foretify verification and validation platform with IPG Automotive’s virtual vehicle simulation environment CarMaker yielding a solution that can be rapidly deployed by ADAS/AD development teams.

- Jul-2022: Elektrobit collaborated with The Qt Company, a software company based in Espoo, Finland. Through this collaboration, the companies brought together the Qt Device Creation framework and the NXP i.MX 8 Series Applications Processor with Elektrobit’s EB tresos software for AUTOSAR development and user interface engineering services, thus making it easier for carmakers to cost-effectively develop next-generation digital cockpits.

- Apr-2022: ETAS formed a partnership with PLC2 Design, a Germany-based professional design services company. Under this partnership, the new holistic solution from ETAS and PLC2 Design allowed sophisticated customer software to be validated realistically in the AD/DA environment.

- Mar-2022: dSPACE collaborated with Avionics Interface Technologies, a leading designer and manufacturer of Test Instrumentation. Through this collaboration, the companies jointly offered rapid control prototyping (RCP) and hardware-in-the-loop (HIL) solutions for aerospace applications by combining these products and their capabilities in dSPACE’s SCALEXIO Interface Solutions. This collaboration also supported a broad range of avionics system development and test activities, including embedded system prototyping, avionics system integration, and avionics system verification.

- Feb-2022: OPAL-RT Technologies came into agreement with Coordinador Electrico Nacional (CEN) of Chile, an independent technical corporation. Under this agreement, CEN got permission to start using OPAL-RT's real-time simulation expertise and experience in the modeling of a digital twin of their electrical network.

- Sep-2021: NI formed a collaboration with Foretellix, a leading automated driving systems product development, verification, and validation solution provider. Through this collaboration, the companies aimed at enhancing the safety and reliability of advanced driver-assistance systems (ADAS) and autonomous vehicles (AVs). In addition, the companies would deliver new integrated solutions to help engineers get high-quality autonomous driving systems to market faster and at lower development costs, while seamlessly integrating test data and tools across the software verification and validation workflow.

- Sep-2021: Vector Informatik came into collaboration with Rohde & Schwarz, an international electronics group. Under this collaboration, the companies integrated the DYNA4 virtual test drive simulation platform from Vector with the Rohde & Schwarz radar moving object stimulation system and so, focused on closed-loop scenario testing of automotive radar sensors for advanced driver assistance systems (ADAS) and autonomous driving (AD). This enabled powerful verification of safety-critical ADAS functions including emergency braking in an integrated hardware-in-the-loop (HiL) environment.

- Jul-2021: dSPACE formed a collaboration with Cepton, a Silicon Valley-based supplier of state-of-the-art, intelligent lidar-based solutions. From this collaboration the companies aimed at enabling easier adoption of lidar technology in advanced driver assistance systems (ADAS), autonomous vehicles (AV), and other autonomous applications. Additionally, this collaboration enabled dSPACE to integrate Cepton’s lidar sensors into its simulation toolchain, thereby helping customers accelerate their development using Cepton lidars.

- Jun-2021: dSPACE came into collaboration with Anritsu Corporation, a Japanese multinational corporation in the telecommunications electronics equipment market. Under this collaboration, both companies planned to jointly demonstrate an unparalleled integration of a 5G network emulator in a hardware-in-the-loop (HIL) system to develop next-generation automotive applications for connected vehicles.

- Apr-2021: Elektrobit collaborated with SUSE, the multinational, open-source software company. Under this collaboration, the companies provided car makers and Tier 1 suppliers in China with automotive-grade Linux. The EB corbos Linux is an operating system for high-performance CPUs providing a basis for the latest AUTOSAR standard and would enable car makers to accelerate the development of cutting-edge software for next-gen E/E architecture.

- Jan-2021: NI signed an agreement with Konrad Technologies, a provider of value-added and application-specific automated test solutions. Under this agreement, the companies focused on developing test systems and solutions for autonomous driving software and hardware validation. Their combined efforts would help in the deliverance of new technologies to help automotive Tier 1 suppliers and OEMs leverage real-world road data and simulation.

- Nov-2020: NI came into collaboration with SET, a technology company specializing in Hardware-in-the-loop (HiL), functional and power semiconductor test systems, and Tech180, a fast-growing tech company advancing the future of aerospace engineering. Through this collaboration, the companies aimed at disrupting the design, development, and maintenance of test systems. The collaboration would deliver an innovative approach to test systems, including new products, hardware, and software frameworks, open systems reference architecture, and a paradigm-shifting System-on-Demand methodology.

- Oct-2020: Elektrobit formed a collaboration with Unity, the world’s leading platform for creating and operating interactive, real-time 3D (RT3D) content. Through this collaboration, the companies aimed to streamline the process of designing and developing automotive human-machine interfaces (HMIs), extending together the power of real-time rendering to create next-generation, future-proof user experiences. This collaboration harnessed the power of Unity’s real-time 3D rendering platform, and EB GUIDE, Elektrobit’s unique and comprehensive HMI development toolchain that powers more than 50 million vehicles on the road today.

- Sep-2020: dSPACE partnered with Cruden, a Dutch motion-based racing simulator designing and manufacturing company. Through this partnership, the companies aimed at supplying the world’s first driving simulator integrated with a wet bench testing rig at the technical center of a Chinese OEM in Shanghai. Together, the companies developed a unique, combined driver-in-the-loop (DIL) and hardware-in-the-loop (HIL) testing tool for the development of automotive braking and steering systems.

» Product Launches and Product Expansions:

- Apr-2022: IPG Automotive unveiled SensInject, a new product to inject data from the camera, radar, and lidar sources for advanced automobile test systems. Through this launch, the company expanded its hardware range in the market.

- Feb-2022: dSPACE introduced AURELION, a new sensor simulation solution. AURELION provides high-resolution visualization for testing and validating functions for autonomous driving. The solution, which can be operated either in the cloud or locally, generates photorealistic images in real-time for camera simulation and, using ray tracing, an exact environment for radar and lidar simulation. With AURELION, developers would be able to validate algorithms for autonomous driving by means of simulation during virtual test drives, long before a prototype hits the road.

- Dec-2021: Speedgoat introduced IO324, a configurable I/O module, and versatile Simulink-programmable FPGA. This product has combined accurate analog and digital input and output channels with a large selection of standard interfaces.

- Nov-2021: Elektrobit unveiled EB zoneo SwitchCore, the industry’s first Automotive Ethernet switch enabling secure, high-performance communications for in-vehicle networks. This product would make it easier for car makers and their suppliers to develop the advanced, high-bandwidth communications systems required by next-generation vehicles.

- Jun-2021: Elektrobit launched EB Cockpit System Solutions, a new offering providing car makers with solutions for intelligent automotive digital cockpits. The System Solutions support the development of next-generation in-vehicle user experiences, from specification, design, and conception to production engineering and integration of hardware, software, and third-party applications.

» Acquisitions and Mergers:

- Mar-2022: Vector Informatik acquired Gimpel Software, a leading pioneer of static analysis software. From this acquisition, Vector expanded its testing portfolio of embedded systems by adding PC-lint Plus, a solution for comprehensive static code checking analysis of C and C++ coding languages.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Open Loop

- Closed Loop

By Vertical

- Automobile

- Aerospace

- Research & Education

- Defense

- Power Electronics

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Robert Bosch GmbH

- National Instruments Corporation

- dSPACE GmbH

- Elektrobit Automotive GmbH (Continental AG)

- OPAL-RT Technologies

- Speedgoat GmbH

- Acutronic Group

- Plexim GmbH

- IPG Automotive GmbH

- Vector Informatik GmbH

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Hardware in the Loop Market, by Type

1.4.2 Global Hardware in the Loop Market, by Vertical

1.4.3 Global Hardware in the Loop Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Geographical Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2018, Jan – 2022, Jul) Leading Players

Chapter 4. Global Hardware in the Loop Market by Type

4.1 Global Open Loop Market by Region

4.2 Global Closed Loop Market by Region

Chapter 5. Global Hardware in the Loop Market by Vertical

5.1 Global Automobile Market by Region

5.2 Global Aerospace Market by Region

5.3 Global Research & Education Market by Region

5.4 Global Defense Market by Region

5.5 Global Power Electronics Market by Region

5.6 Global Others Market by Region

Chapter 6. Global Hardware in the Loop Market by Region

6.1 North America Hardware in the Loop Market

6.1.1 North America Hardware in the Loop Market by Type

6.1.1.1 North America Open Loop Market by Country

6.1.1.2 North America Closed Loop Market by Country

6.1.2 North America Hardware in the Loop Market by Vertical

6.1.2.1 North America Automobile Market by Country

6.1.2.2 North America Aerospace Market by Country

6.1.2.3 North America Research & Education Market by Country

6.1.2.4 North America Defense Market by Country

6.1.2.5 North America Power Electronics Market by Country

6.1.2.6 North America Others Market by Country

6.1.3 North America Hardware in the Loop Market by Country

6.1.3.1 US Hardware in the Loop Market

6.1.3.1.1 US Hardware in the Loop Market by Type

6.1.3.1.2 US Hardware in the Loop Market by Vertical

6.1.3.2 Canada Hardware in the Loop Market

6.1.3.2.1 Canada Hardware in the Loop Market by Type

6.1.3.2.2 Canada Hardware in the Loop Market by Vertical

6.1.3.3 Mexico Hardware in the Loop Market

6.1.3.3.1 Mexico Hardware in the Loop Market by Type

6.1.3.3.2 Mexico Hardware in the Loop Market by Vertical

6.1.3.4 Rest of North America Hardware in the Loop Market

6.1.3.4.1 Rest of North America Hardware in the Loop Market by Type

6.1.3.4.2 Rest of North America Hardware in the Loop Market by Vertical

6.2 Europe Hardware in the Loop Market

6.2.1 Europe Hardware in the Loop Market by Type

6.2.1.1 Europe Open Loop Market by Country

6.2.1.2 Europe Closed Loop Market by Country

6.2.2 Europe Hardware in the Loop Market by Vertical

6.2.2.1 Europe Automobile Market by Country

6.2.2.2 Europe Aerospace Market by Country

6.2.2.3 Europe Research & Education Market by Country

6.2.2.4 Europe Defense Market by Country

6.2.2.5 Europe Power Electronics Market by Country

6.2.2.6 Europe Others Market by Country

6.2.3 Europe Hardware in the Loop Market by Country

6.2.3.1 Germany Hardware in the Loop Market

6.2.3.1.1 Germany Hardware in the Loop Market by Type

6.2.3.1.2 Germany Hardware in the Loop Market by Vertical

6.2.3.2 UK Hardware in the Loop Market

6.2.3.2.1 UK Hardware in the Loop Market by Type

6.2.3.2.2 UK Hardware in the Loop Market by Vertical

6.2.3.3 France Hardware in the Loop Market

6.2.3.3.1 France Hardware in the Loop Market by Type

6.2.3.3.2 France Hardware in the Loop Market by Vertical

6.2.3.4 Russia Hardware in the Loop Market

6.2.3.4.1 Russia Hardware in the Loop Market by Type

6.2.3.4.2 Russia Hardware in the Loop Market by Vertical

6.2.3.5 Spain Hardware in the Loop Market

6.2.3.5.1 Spain Hardware in the Loop Market by Type

6.2.3.5.2 Spain Hardware in the Loop Market by Vertical

6.2.3.6 Italy Hardware in the Loop Market

6.2.3.6.1 Italy Hardware in the Loop Market by Type

6.2.3.6.2 Italy Hardware in the Loop Market by Vertical

6.2.3.7 Rest of Europe Hardware in the Loop Market

6.2.3.7.1 Rest of Europe Hardware in the Loop Market by Type

6.2.3.7.2 Rest of Europe Hardware in the Loop Market by Vertical

6.3 Asia Pacific Hardware in the Loop Market

6.3.1 Asia Pacific Hardware in the Loop Market by Type

6.3.1.1 Asia Pacific Open Loop Market by Country

6.3.1.2 Asia Pacific Closed Loop Market by Country

6.3.2 Asia Pacific Hardware in the Loop Market by Vertical

6.3.2.1 Asia Pacific Automobile Market by Country

6.3.2.2 Asia Pacific Aerospace Market by Country

6.3.2.3 Asia Pacific Research & Education Market by Country

6.3.2.4 Asia Pacific Defense Market by Country

6.3.2.5 Asia Pacific Power Electronics Market by Country

6.3.2.6 Asia Pacific Others Market by Country

6.3.3 Asia Pacific Hardware in the Loop Market by Country

6.3.3.1 China Hardware in the Loop Market

6.3.3.1.1 China Hardware in the Loop Market by Type

6.3.3.1.2 China Hardware in the Loop Market by Vertical

6.3.3.2 Japan Hardware in the Loop Market

6.3.3.2.1 Japan Hardware in the Loop Market by Type

6.3.3.2.2 Japan Hardware in the Loop Market by Vertical

6.3.3.3 India Hardware in the Loop Market

6.3.3.3.1 India Hardware in the Loop Market by Type

6.3.3.3.2 India Hardware in the Loop Market by Vertical

6.3.3.4 South Korea Hardware in the Loop Market

6.3.3.4.1 South Korea Hardware in the Loop Market by Type

6.3.3.4.2 South Korea Hardware in the Loop Market by Vertical

6.3.3.5 Singapore Hardware in the Loop Market

6.3.3.5.1 Singapore Hardware in the Loop Market by Type

6.3.3.5.2 Singapore Hardware in the Loop Market by Vertical

6.3.3.6 Malaysia Hardware in the Loop Market

6.3.3.6.1 Malaysia Hardware in the Loop Market by Type

6.3.3.6.2 Malaysia Hardware in the Loop Market by Vertical

6.3.3.7 Rest of Asia Pacific Hardware in the Loop Market

6.3.3.7.1 Rest of Asia Pacific Hardware in the Loop Market by Type

6.3.3.7.2 Rest of Asia Pacific Hardware in the Loop Market by Vertical

6.4 LAMEA Hardware in the Loop Market

6.4.1 LAMEA Hardware in the Loop Market by Type

6.4.1.1 LAMEA Open Loop Market by Country

6.4.1.2 LAMEA Closed Loop Market by Country

6.4.2 LAMEA Hardware in the Loop Market by Vertical

6.4.2.1 LAMEA Automobile Market by Country

6.4.2.2 LAMEA Aerospace Market by Country

6.4.2.3 LAMEA Research & Education Market by Country

6.4.2.4 LAMEA Defense Market by Country

6.4.2.5 LAMEA Power Electronics Market by Country

6.4.2.6 LAMEA Others Market by Country

6.4.3 LAMEA Hardware in the Loop Market by Country

6.4.3.1 Brazil Hardware in the Loop Market

6.4.3.1.1 Brazil Hardware in the Loop Market by Type

6.4.3.1.2 Brazil Hardware in the Loop Market by Vertical

6.4.3.2 Argentina Hardware in the Loop Market

6.4.3.2.1 Argentina Hardware in the Loop Market by Type

6.4.3.2.2 Argentina Hardware in the Loop Market by Vertical

6.4.3.3 UAE Hardware in the Loop Market

6.4.3.3.1 UAE Hardware in the Loop Market by Type

6.4.3.3.2 UAE Hardware in the Loop Market by Vertical

6.4.3.4 Saudi Arabia Hardware in the Loop Market

6.4.3.4.1 Saudi Arabia Hardware in the Loop Market by Type

6.4.3.4.2 Saudi Arabia Hardware in the Loop Market by Vertical

6.4.3.5 South Africa Hardware in the Loop Market

6.4.3.5.1 South Africa Hardware in the Loop Market by Type

6.4.3.5.2 South Africa Hardware in the Loop Market by Vertical

6.4.3.6 Nigeria Hardware in the Loop Market

6.4.3.6.1 Nigeria Hardware in the Loop Market by Type

6.4.3.6.2 Nigeria Hardware in the Loop Market by Vertical

6.4.3.7 Rest of LAMEA Hardware in the Loop Market

6.4.3.7.1 Rest of LAMEA Hardware in the Loop Market by Type

6.4.3.7.2 Rest of LAMEA Hardware in the Loop Market by Vertical

Chapter 7. Company Profiles

7.1 Robert Bosch GmbH

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Segmental and Regional Analysis

7.1.4 Research & Development Expense

7.1.5 Recent strategies and developments:

7.1.5.1 Partnerships, Collaborations, and Agreements:

7.1.5.2 Acquisition and Mergers:

7.1.6 SWOT Analysis

7.2 National Instruments Corporation

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Regional Analysis

7.2.4 Research & Development Expense

7.2.5 Recent strategies and developments:

7.2.5.1 Partnerships, Collaborations, and Agreements:

7.3 dSPACE GmbH

7.3.1 Company Overview

7.3.2 Recent strategies and developments:

7.3.2.1 Partnerships, Collaborations, and Agreements:

7.3.2.2 Product Launches and Product Expansions:

7.3.2.3 Geographical Expansions:

7.4 Elektrobit Automotive GmbH (Continental AG)

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental and Regional Analysis

7.4.4 Research & Development Expense

7.4.5 Recent strategies and developments:

7.4.5.1 Partnerships, Collaborations, and Agreements:

7.4.5.2 Product Launches and Product Expansions:

7.5 IPG Automotive GmbH

7.5.1 Company Overview

7.5.2 Recent strategies and developments:

7.5.2.1 Partnerships, Collaborations, and Agreements:

7.5.2.2 Product Launches and Product Expansions:

7.6 Vector Informatik GmbH

7.6.1 Company Overview

7.6.2 Recent strategies and developments:

7.6.2.1 Partnerships, Collaborations, and Agreements:

7.6.2.2 Acquisition and Mergers:

7.7 OPAL-RT Technologies

7.7.1 Company Overview

7.7.2 Recent strategies and developments:

7.7.2.1 Partnerships, Collaborations, and Agreements:

7.8 Speedgoat GmbH

7.8.1 Company Overview

7.8.2 Recent strategies and developments:

7.8.2.1 Product Launches and Product Expansions:

7.9 Acutronic Group

7.9.1 Company Overview

7.10. Plexim GmbH

7.10.1 Company Overview

TABLE 2 Global Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Hardware in the Loop

TABLE 4 Product Launches And Product Expansions– Hardware in the Loop

TABLE 5 Acquisition and Mergers– Hardware in the Loop

TABLE 6 geographical Expansions – Hardware in the Loop

TABLE 7 Global Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 8 Global Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 9 Global Open Loop Market by Region, 2018 - 2021, USD Million

TABLE 10 Global Open Loop Market by Region, 2022 - 2028, USD Million

TABLE 11 Global Closed Loop Market by Region, 2018 - 2021, USD Million

TABLE 12 Global Closed Loop Market by Region, 2022 - 2028, USD Million

TABLE 13 Global Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 14 Global Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 15 Global Automobile Market by Region, 2018 - 2021, USD Million

TABLE 16 Global Automobile Market by Region, 2022 - 2028, USD Million

TABLE 17 Global Aerospace Market by Region, 2018 - 2021, USD Million

TABLE 18 Global Aerospace Market by Region, 2022 - 2028, USD Million

TABLE 19 Global Research & Education Market by Region, 2018 - 2021, USD Million

TABLE 20 Global Research & Education Market by Region, 2022 - 2028, USD Million

TABLE 21 Global Defense Market by Region, 2018 - 2021, USD Million

TABLE 22 Global Defense Market by Region, 2022 - 2028, USD Million

TABLE 23 Global Power Electronics Market by Region, 2018 - 2021, USD Million

TABLE 24 Global Power Electronics Market by Region, 2022 - 2028, USD Million

TABLE 25 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 26 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 27 Global Hardware in the Loop Market by Region, 2018 - 2021, USD Million

TABLE 28 Global Hardware in the Loop Market by Region, 2022 - 2028, USD Million

TABLE 29 North America Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 30 North America Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 31 North America Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 32 North America Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 33 North America Open Loop Market by Country, 2018 - 2021, USD Million

TABLE 34 North America Open Loop Market by Country, 2022 - 2028, USD Million

TABLE 35 North America Closed Loop Market by Country, 2018 - 2021, USD Million

TABLE 36 North America Closed Loop Market by Country, 2022 - 2028, USD Million

TABLE 37 North America Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 38 North America Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 39 North America Automobile Market by Country, 2018 - 2021, USD Million

TABLE 40 North America Automobile Market by Country, 2022 - 2028, USD Million

TABLE 41 North America Aerospace Market by Country, 2018 - 2021, USD Million

TABLE 42 North America Aerospace Market by Country, 2022 - 2028, USD Million

TABLE 43 North America Research & Education Market by Country, 2018 - 2021, USD Million

TABLE 44 North America Research & Education Market by Country, 2022 - 2028, USD Million

TABLE 45 North America Defense Market by Country, 2018 - 2021, USD Million

TABLE 46 North America Defense Market by Country, 2022 - 2028, USD Million

TABLE 47 North America Power Electronics Market by Country, 2018 - 2021, USD Million

TABLE 48 North America Power Electronics Market by Country, 2022 - 2028, USD Million

TABLE 49 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 50 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 51 North America Hardware in the Loop Market by Country, 2018 - 2021, USD Million

TABLE 52 North America Hardware in the Loop Market by Country, 2022 - 2028, USD Million

TABLE 53 US Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 54 US Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 55 US Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 56 US Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 57 US Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 58 US Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 59 Canada Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 60 Canada Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 61 Canada Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 62 Canada Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 63 Canada Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 64 Canada Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 65 Mexico Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 66 Mexico Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 67 Mexico Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 68 Mexico Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 69 Mexico Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 70 Mexico Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 71 Rest of North America Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 72 Rest of North America Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 73 Rest of North America Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 74 Rest of North America Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 75 Rest of North America Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 76 Rest of North America Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 77 Europe Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 78 Europe Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 79 Europe Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 80 Europe Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 81 Europe Open Loop Market by Country, 2018 - 2021, USD Million

TABLE 82 Europe Open Loop Market by Country, 2022 - 2028, USD Million

TABLE 83 Europe Closed Loop Market by Country, 2018 - 2021, USD Million

TABLE 84 Europe Closed Loop Market by Country, 2022 - 2028, USD Million

TABLE 85 Europe Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 86 Europe Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 87 Europe Automobile Market by Country, 2018 - 2021, USD Million

TABLE 88 Europe Automobile Market by Country, 2022 - 2028, USD Million

TABLE 89 Europe Aerospace Market by Country, 2018 - 2021, USD Million

TABLE 90 Europe Aerospace Market by Country, 2022 - 2028, USD Million

TABLE 91 Europe Research & Education Market by Country, 2018 - 2021, USD Million

TABLE 92 Europe Research & Education Market by Country, 2022 - 2028, USD Million

TABLE 93 Europe Defense Market by Country, 2018 - 2021, USD Million

TABLE 94 Europe Defense Market by Country, 2022 - 2028, USD Million

TABLE 95 Europe Power Electronics Market by Country, 2018 - 2021, USD Million

TABLE 96 Europe Power Electronics Market by Country, 2022 - 2028, USD Million

TABLE 97 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 98 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 99 Europe Hardware in the Loop Market by Country, 2018 - 2021, USD Million

TABLE 100 Europe Hardware in the Loop Market by Country, 2022 - 2028, USD Million

TABLE 101 Germany Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 102 Germany Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 103 Germany Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 104 Germany Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 105 Germany Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 106 Germany Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 107 UK Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 108 UK Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 109 UK Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 110 UK Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 111 UK Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 112 UK Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 113 France Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 114 France Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 115 France Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 116 France Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 117 France Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 118 France Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 119 Russia Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 120 Russia Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 121 Russia Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 122 Russia Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 123 Russia Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 124 Russia Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 125 Spain Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 126 Spain Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 127 Spain Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 128 Spain Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 129 Spain Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 130 Spain Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 131 Italy Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 132 Italy Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 133 Italy Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 134 Italy Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 135 Italy Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 136 Italy Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 137 Rest of Europe Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 138 Rest of Europe Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 139 Rest of Europe Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 140 Rest of Europe Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 141 Rest of Europe Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 142 Rest of Europe Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 143 Asia Pacific Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 144 Asia Pacific Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 145 Asia Pacific Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 146 Asia Pacific Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 147 Asia Pacific Open Loop Market by Country, 2018 - 2021, USD Million

TABLE 148 Asia Pacific Open Loop Market by Country, 2022 - 2028, USD Million

TABLE 149 Asia Pacific Closed Loop Market by Country, 2018 - 2021, USD Million

TABLE 150 Asia Pacific Closed Loop Market by Country, 2022 - 2028, USD Million

TABLE 151 Asia Pacific Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 152 Asia Pacific Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 153 Asia Pacific Automobile Market by Country, 2018 - 2021, USD Million

TABLE 154 Asia Pacific Automobile Market by Country, 2022 - 2028, USD Million

TABLE 155 Asia Pacific Aerospace Market by Country, 2018 - 2021, USD Million

TABLE 156 Asia Pacific Aerospace Market by Country, 2022 - 2028, USD Million

TABLE 157 Asia Pacific Research & Education Market by Country, 2018 - 2021, USD Million

TABLE 158 Asia Pacific Research & Education Market by Country, 2022 - 2028, USD Million

TABLE 159 Asia Pacific Defense Market by Country, 2018 - 2021, USD Million

TABLE 160 Asia Pacific Defense Market by Country, 2022 - 2028, USD Million

TABLE 161 Asia Pacific Power Electronics Market by Country, 2018 - 2021, USD Million

TABLE 162 Asia Pacific Power Electronics Market by Country, 2022 - 2028, USD Million

TABLE 163 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 164 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 165 Asia Pacific Hardware in the Loop Market by Country, 2018 - 2021, USD Million

TABLE 166 Asia Pacific Hardware in the Loop Market by Country, 2022 - 2028, USD Million

TABLE 167 China Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 168 China Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 169 China Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 170 China Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 171 China Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 172 China Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 173 Japan Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 174 Japan Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 175 Japan Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 176 Japan Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 177 Japan Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 178 Japan Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 179 India Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 180 India Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 181 India Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 182 India Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 183 India Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 184 India Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 185 South Korea Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 186 South Korea Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 187 South Korea Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 188 South Korea Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 189 South Korea Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 190 South Korea Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 191 Singapore Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 192 Singapore Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 193 Singapore Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 194 Singapore Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 195 Singapore Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 196 Singapore Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 197 Malaysia Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 198 Malaysia Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 199 Malaysia Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 200 Malaysia Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 201 Malaysia Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 202 Malaysia Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 203 Rest of Asia Pacific Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 204 Rest of Asia Pacific Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 205 Rest of Asia Pacific Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 206 Rest of Asia Pacific Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 207 Rest of Asia Pacific Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 208 Rest of Asia Pacific Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 209 LAMEA Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 210 LAMEA Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 211 LAMEA Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 212 LAMEA Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 213 LAMEA Open Loop Market by Country, 2018 - 2021, USD Million

TABLE 214 LAMEA Open Loop Market by Country, 2022 - 2028, USD Million

TABLE 215 LAMEA Closed Loop Market by Country, 2018 - 2021, USD Million

TABLE 216 LAMEA Closed Loop Market by Country, 2022 - 2028, USD Million

TABLE 217 LAMEA Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 218 LAMEA Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 219 LAMEA Automobile Market by Country, 2018 - 2021, USD Million

TABLE 220 LAMEA Automobile Market by Country, 2022 - 2028, USD Million

TABLE 221 LAMEA Aerospace Market by Country, 2018 - 2021, USD Million

TABLE 222 LAMEA Aerospace Market by Country, 2022 - 2028, USD Million

TABLE 223 LAMEA Research & Education Market by Country, 2018 - 2021, USD Million

TABLE 224 LAMEA Research & Education Market by Country, 2022 - 2028, USD Million

TABLE 225 LAMEA Defense Market by Country, 2018 - 2021, USD Million

TABLE 226 LAMEA Defense Market by Country, 2022 - 2028, USD Million

TABLE 227 LAMEA Power Electronics Market by Country, 2018 - 2021, USD Million

TABLE 228 LAMEA Power Electronics Market by Country, 2022 - 2028, USD Million

TABLE 229 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 230 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 231 LAMEA Hardware in the Loop Market by Country, 2018 - 2021, USD Million

TABLE 232 LAMEA Hardware in the Loop Market by Country, 2022 - 2028, USD Million

TABLE 233 Brazil Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 234 Brazil Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 235 Brazil Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 236 Brazil Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 237 Brazil Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 238 Brazil Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 239 Argentina Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 240 Argentina Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 241 Argentina Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 242 Argentina Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 243 Argentina Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 244 Argentina Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 245 UAE Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 246 UAE Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 247 UAE Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 248 UAE Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 249 UAE Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 250 UAE Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 251 Saudi Arabia Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 252 Saudi Arabia Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 253 Saudi Arabia Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 254 Saudi Arabia Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 255 Saudi Arabia Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 256 Saudi Arabia Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 257 South Africa Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 258 South Africa Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 259 South Africa Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 260 South Africa Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 261 South Africa Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 262 South Africa Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 263 Nigeria Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 264 Nigeria Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 265 Nigeria Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 266 Nigeria Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 267 Nigeria Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 268 Nigeria Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 269 Rest of LAMEA Hardware in the Loop Market, 2018 - 2021, USD Million

TABLE 270 Rest of LAMEA Hardware in the Loop Market, 2022 - 2028, USD Million

TABLE 271 Rest of LAMEA Hardware in the Loop Market by Type, 2018 - 2021, USD Million

TABLE 272 Rest of LAMEA Hardware in the Loop Market by Type, 2022 - 2028, USD Million

TABLE 273 Rest of LAMEA Hardware in the Loop Market by Vertical, 2018 - 2021, USD Million

TABLE 274 Rest of LAMEA Hardware in the Loop Market by Vertical, 2022 - 2028, USD Million

TABLE 275 key information – Robert Bosch GmbH

TABLE 276 Key Information – National Instruments Corporation

TABLE 277 Key Information – dSPACE GmbH

TABLE 278 Key Information – Elektrobit Automotive GmbH

TABLE 279 Key Information – IPG Automotive GmbH

TABLE 280 Key information – Vector Informatik GmbH

TABLE 281 Key Information – OPAL-RT Technologies

TABLE 282 Key Information – Speedgoat GmbH

TABLE 283 Key Information – Acutronic Group

TABLE 284 Key Information – Plexim GmbH

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 4 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2018, JAn – 2022, Jul) Leading Players

FIG 5 Global Hardware in the Loop Market share by Type, 2021

FIG 6 Global Hardware in the Loop Market share by Type, 2028

FIG 7 Global Hardware in the Loop Market by Type, 2018 - 2028, USD Million

FIG 8 Global Hardware in the Loop Market share by Vertical, 2021

FIG 9 Global Hardware in the Loop Market share by Vertical, 2028

FIG 10 Global Hardware in the Loop Market by Vertical, 2018 - 2028, USD Million

FIG 11 Global Hardware in the Loop Market share by Region, 2021

FIG 12 Global Hardware in the Loop Market share by Region, 2028

FIG 13 Global Hardware in the Loop Market by Region, 2018 - 2028, USD Million

FIG 14 Recent strategies and developments: Robert Bosch GmbH

FIG 15 Swot analysis: Robert bosch gmbh

FIG 16 Recent strategies and developments: dSPACE GmbH

FIG 17 Recent strategies and developments: Elektrobit Automotive GmbH

FIG 18 Recent strategies and developments: IPG Automotive GmbH

FIG 19 Recent strategies and developments: Vector Informatik GmbH