“Global Extended Detection and Response (XDR) Market to reach a market value of USD 49.56 Billion by 2032 growing at a CAGR of 31%”

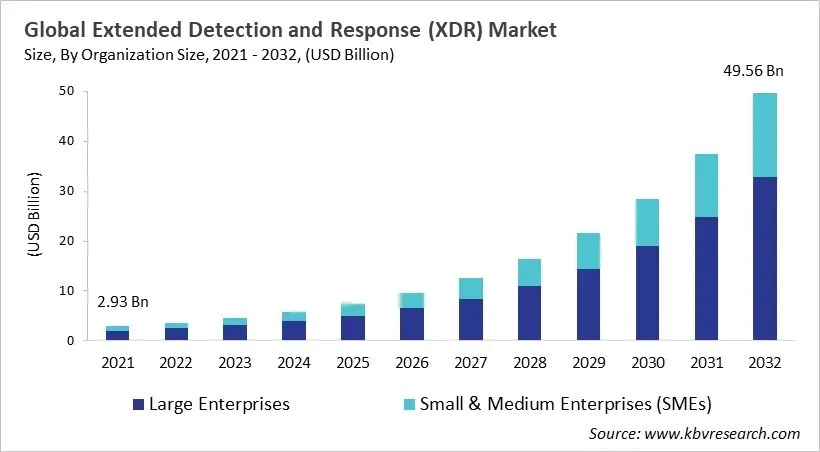

The Global Extended Detection and Response (XDR) Market size is expected to reach $49.56 billion by 2032, rising at a market growth of 31.0% CAGR during the forecast period.

The development of extended detection and response (XDR) showcases a major transformation in cybersecurity, evolving from the limitations of Security Information and Event Management (SIEM) and Endpoint Detection and Response (EDR) tools. As enterprises expanded into cloud, distributed, and hybrid infrastructures, the requirement for unified threat visibility became critical. XDR deploys data from multiple security layers-email, endpoint network, cloud, and identity into a single platform, allowing faster and more contextualized investigation, detection, and response. By integrating automation, AI, and orchestration, XDR improves operational efficiency, lessens human intervention, and strengthens real-time situational awareness. XDR’s development towards managed service and cloud-based models has raised its adoption among smaller enterprises, which initially was limited to large organizations.

The extended detection and response market is expanding, driven by trends including the integration of AI-based automation, the growth of managed XDR as a Service offerings, and the transformation towards interoperable and open architectures. Enterprises largely prefer subscription-based models that lessen operational burdens, while machine learning and AI are being integrated to analyze vast telemetry data, enhance threat accuracy, and prioritize alerts. Key players are combining capabilities into natively integrated platforms, emphasizing scalability, automation, and seamless user experiences. The competition in the extended detection and response market is intensifying with players forming partnerships, industry-specific customization, and acquisitions.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2025, Palo Alto Networks, Inc. announced the acquisition of Protect AI to integrate AI-focused security across the entire AI lifecycle. The addition enhances its Prisma AIRS platform with model scanning, posture management, runtime protection, and red teaming, enabling more comprehensive protection of AI applications and innovation infrastructure. Moreover, In September, 2025, CrowdStrike Holdings, Inc. announced the acquisition of Pangea, an AI security startup to integrate prompt-layer protection and monitoring of unmanaged (“shadow”) AI usage. This move extends CrowdStrike’s detection and response capabilities into the AI interaction layer, reinforcing its platform approach to unified threat detection.

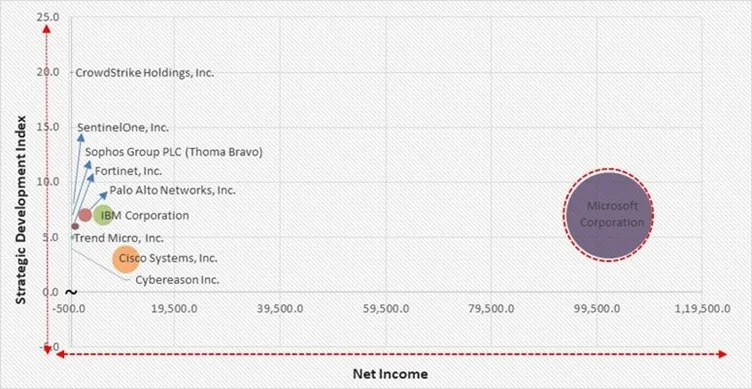

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Extended Detection and Response (XDR) Market. In July, 2021, Microsoft Corporation announced the acquisition of RiskIQ to enhance its threat intelligence and attack surface management capabilities. This strategic move helps Microsoft integrate external visibility into hybrid and cloud environments, bolstering its detection and response infrastructure and feeding richer context into its XDR / security operations ecosystem. Companies such as Cisco Systems, Inc., IBM Corporation, and Palo Alto Networks, Inc. are some of the key innovators in Extended Detection and Response (XDR) Market.

As companies moved to remote work quickly during the COVID-19 pandemic, they faced more cyber threats, which led to a rise in demand for Extended Detection and Response (XDR) solutions. The widespread use of cloud platforms and faster digital transformation in fields like healthcare, BFSI, and retail made networks more vulnerable, which increased the need for integrated threat detection systems. Companies spent money on XDR to improve endpoint security, keep an eye on cloud environments, and ensure business continuity. Governments and organizations, on the other hand, prioritized cybersecurity spending even though the economy was tough. Vendors added AI-driven analytics, automation, and advanced threat intelligence to XDR's capabilities in response. As a result of the pandemic, people became more aware of, used, and matured XDR solutions. These solutions are now a key part of modern cybersecurity strategies and will continue to grow in the market after the pandemic. Thus, the COVID-19 pandemic had a positive impact on the market.

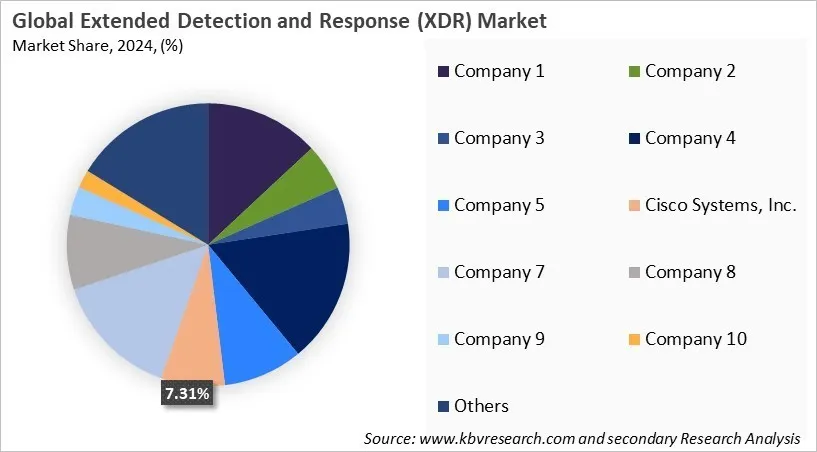

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Global Extended Detection and Response (XDR) Market size to reach USD 49.56 Billion by 2032

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The small & medium enterprises (SMEs) segment attained 32% revenue share in the Extended Detection and Response (XDR) market in 2024. These organizations often face resource constraints when it comes to cybersecurity personnel and budgets, which makes XDR solutions appealing due to their consolidated and automated nature. SMEs benefit from XDR by gaining enhanced visibility, faster incident response, and simplified security operations—all within a manageable cost structure.

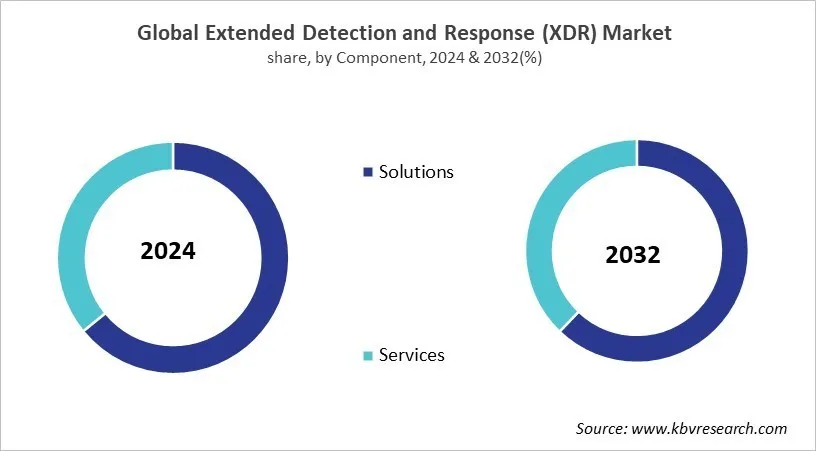

Based on Component, the market is segmented into Solutions and Services. The services segment recorded 36% revenue share in the extended detection and response (XDR) market in 2024. These services include consulting, integration, training, support, and managed detection and response (MDR). As cybersecurity threats grow more sophisticated, many organizations seek expert guidance to customize and optimize their XDR implementations. Services also help bridge internal skills gaps, especially for companies that lack in-house cybersecurity teams.

Region-wise, the Extended Detection and Response (XDR) market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 37% revenue share in the Extended Detection and Response (XDR) market in 2024. The extended detection and response market is predicted to procure a prominent share in North America and Europe. The expansion is supported by the stringent regulatory mandates, the presence of major tech giants, and the early adoption of advanced cybersecurity frameworks. In North America, especially in the US, enterprises across industries like healthcare, government, and finance are largely integrating XDR to address multi-vector threats and to comply with data protection regulations such as CISA and HIPAA directives. The region’s strong cybersecurity ecosystem and the rapid adoption of hybrid and cloud infrastructures continue to surge demand for response platforms and threat detection. Additionally, Europe extended detection and response market is also growing, driven by stringent privacy laws like the GDPR and rising emphasis on digital sovereignty and cyber resilience. European companies are adopting both managed and on-premise XDR models to strengthen their defense posture while assuring interoperability and compatibility with existing security systems.

In LAMEA and the Asia Pacific region, the extended detection and response market is anticipated to grow at a high rate. This expansion is supported by the accelerated digital transformation across various sectors. Nations such as Japan, India, China, and South Korea are experiencing significant growth because of the increasing cyberattack frequency, government-supported cybersecurity initiatives, and rising cloud adoption. Enterprises in the region are adopting managed XDR services to improve security automation and overcome talent shortages. Furthermore, the LAMEA’s extended detection and response market represents positive opportunities. This is because adoption is gaining traction in industries like banking and energy, where enterprises are modernizing their security operations in light of increasing regional threat activity. Also, rising awareness, regulatory frameworks, and investment in digital security are accelerating growth in both the Asia Pacific and LAMEA regions.

The Extended Detection and Response (XDR) market is very competitive, and technology is moving quickly. Vendors are trying to stand out by offering advanced analytics, cross-layer integration, and automation capabilities. Providers are putting more and more effort into making the user experience better while also making sure that response times to new cyber threats are as short as possible. As businesses put more emphasis on comprehensive security plans, the market focuses on platforms that can grow, change, and learn to solve tough cybersecurity problems quickly. In this ever-changing environment, staying ahead of the competition depends on innovation, seamless interoperability, and proactive threat management.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 7.48 Billion |

| Market size forecast in 2032 | USD 49.56 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 31.0% from 2025 to 2032 |

| Number of Pages | 722 |

| Number of Tables | 572 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Organization Size, Component, Deployment Type, Attack Surface Coverage, Industry Vertical, Region |

| Country scope |

|

| Companies Included | CrowdStrike Holdings, Inc., Trend Micro, Inc., Sophos Group PLC (Thoma Bravo), Palo Alto Networks, Inc., SentinelOne, Inc., Cisco Systems, Inc., Microsoft Corporation, Fortinet, Inc., IBM Corporation, and Cybereason Inc. |

By Organization Size

By Component

By Deployment Type

By Attack Surface Coverage

By Industry Vertical

By Geography

The market size is projected to reach USD 49.56 Billion billion by 2032.

The extended detection and response (XDR) market is projected to grow at a CAGR of 31% between 2025 and 2032.

Escalating complexity and volume of cyber threats are intensifying operational challenges, skills shortages, and alert overload.

CrowdStrike Holdings, Inc., Trend Micro, Inc., Sophos Group PLC (Thoma Bravo), Palo Alto Networks, Inc., SentinelOne, Inc., Cisco Systems, Inc., Microsoft Corporation, Fortinet, Inc., IBM Corporation, and Cybereason Inc.

Which segment has the largest share in the extended detection and response (XDR) market?

The North America region dominated the Global Extended Detection and Response (XDR) Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $17.6 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges