The Europe Medical Device Testing, Inspection And Certification Outsourcing Market would witness market growth of 7.6% CAGR during the forecast period (2025-2032).

The Germany market dominated the Europe Medical Device Testing, Inspection And Certification Outsourcing Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $388.2 million by 2032. The UK market is exhibiting a CAGR of 6.5% during (2025 - 2032). Additionally, The France market would experience a CAGR of 8.5% during (2025 - 2032).

The Europe Medical Device TIC (Testing, Inspection, and Certification) Outsourcing Market has evolved significantly in response to the increasing complexity of medical technologies and the stringent regulatory landscape governing healthcare products. Originally, medical device manufacturers in Europe conducted TIC activities internally, managing quality assurance and regulatory compliance within their production environments. However, over time, the growing sophistication of medical devices, the introduction of stringent European Union regulations, and the need for cost optimization prompted a shift toward outsourcing these critical activities to specialized third-party providers.

Free Valuable Insights: The Global Medical Device Testing, Inspection And Certification Outsourcing Market will Hit USD 5.48 Billion by 2032, at a CAGR of 8.3%

The medical device industry in Europe is going through a big change because technology is moving so quickly. New technologies like artificial intelligence (AI), machine learning, the Internet of Things (IoT), and advanced materials are making it possible to make more complex medical devices. These technologies let devices do complicated tasks, keep track of things in real time, and give each patient the care they need.

Adding AI and machine learning to medical devices makes it possible to use predictive analytics, which improves the accuracy of diagnoses and the success of treatments. For example, imaging devices that use AI can find problems with more accuracy, which can lead to earlier diagnosis and treatment. IoT-enabled devices also make it easier to keep an eye on patients all the time by sending data to healthcare providers so they can make decisions quickly.

The European medical device industry must follow a lot of rules to make sure that patients are safe and that the products work. The Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) have changed the compliance landscape in a big way, making it harder for manufacturers to meet the new standards.

These rules require thorough clinical evaluations, strong quality management systems, and better monitoring of products after they are sold. Manufacturers must provide strong proof that their devices are safe and work well, which means they must do a lot of testing and paperwork. Many businesses have turned to TIC outsourcing to get outside help because things have become more complicated and they need more resources.

The medical device industry in Europe is at a turning point. Technology is changing quickly, product design is becoming more innovative, and regulations are getting stricter. In this situation, Testing, Inspection, and Certification (TIC) services have become essential for meeting requirements, ensuring quality, and getting to market on time. As medical devices get more complicated and the European Union puts in place new rules like the Medical Device Regulation (MDR) and the In Vitro Diagnostic Regulation (IVDR), manufacturers are relying on specialized third-party TIC providers more than ever to help them deal with these problems in the best way possible.

The European medical device TIC outsourcing market is predominantly led by well-established multinational organizations. Companies such as TÜV SÜD, SGS, DEKRA, Intertek, and Bureau Veritas have cemented their positions through decades of experience, comprehensive service portfolios, and strong relationships with regulatory bodies. Their extensive global networks and accredited laboratories enable them to offer end-to-end services, including product testing, certification, and regulatory compliance support.

For instance, TÜV SÜD has been instrumental in assisting manufacturers with the transition to the European Union's Medical Device Regulation (MDR) by providing training, gap assessments, and conformity assessments. Similarly, SGS offers a wide range of services, from biocompatibility testing to clinical evaluation report reviews, ensuring that medical devices meet stringent EU standards.

While multinational TIC providers dominate the market, specialized regional players have carved out niches by offering tailored services and localized expertise. These companies often focus on specific areas such as software validation, cybersecurity assessments, or human factors engineering, catering to the unique needs of certain medical device segments.

For example, Toxikon, based in the United States, provides specialized testing services for biocompatibility and toxicology, which are crucial for medical devices intended for the European market. Their expertise in these areas allows them to support manufacturers in meeting the biological evaluation requirements outlined in the MDR.

Regional TIC providers often offer greater flexibility and faster turnaround times, making them attractive to small and medium-sized enterprises (SMEs) that require personalized support and quicker access to the market. Their deep understanding of local regulatory landscapes and close relationships with national competent authorities further enhance their value proposition.

Based on Service, the market is segmented into Testing, Inspection, and Certification.

The Testing part of the European TIC outsourcing market for medical devices is the biggest part. Testing services make sure that a product is safe, works well, meets electrical standards, is biocompatible, and is properly sterilized. European law says that both Class I and high-risk Class III medical devices must go through strict testing before they can be sold. This has led to labs getting more powerful and working with OEMs to meet shorter deadlines.

The Inspection part is very important to the compliance lifecycle of medical devices, especially when it comes to audits of manufacturing, inspections of facilities, and assessments of conformity before shipping. In the post-MDR world, these services are very important because Notified Bodies need to look more closely at both products and the processes used to make them.

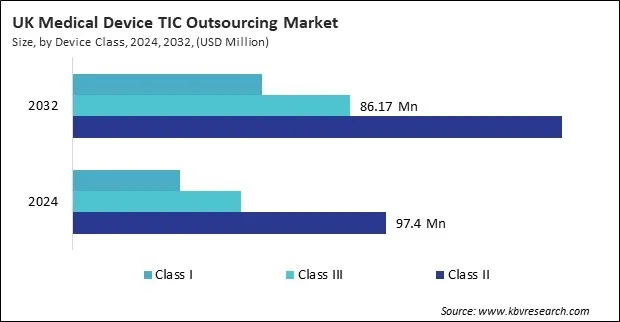

Based on Device Class, the market is segmented into Class II, Class III, and Class I.

Class II devices, which include both IIa and IIb categories, include a wide range of medical products, such as infusion pumps, surgical lasers, and imaging equipment for diagnosis. Because these devices are medium to high risk, they need a lot of conformity assessments, such as clinical evaluations and performance testing. The high demand for TIC services is due to the complexity and number of Class II devices.

Pacemakers, heart valves, and implantable defibrillators are all examples of Class III devices that are very dangerous but help or keep people alive. Because they are so important, these devices are subject to the strictest rules and regulations, which means they must go through long clinical trials, strict testing, and thorough certification processes.

Based on End Use, the market is segmented into Medical Device Companies, Pharmaceutical and Biotech Companies, and Other End Use.

Most of the business in the European TIC outsourcing market comes from medical device companies. Several changes in structure and regulation have led to this dominance. First, the EU MDR went into effect in 2021, which put an unprecedented amount of responsibility on manufacturers to do risk assessments, clinical evaluations, and post-market surveillance. These requirements are especially strict for Class II and III devices, and they often need help from outside Notified Bodies and accredited TIC firms. Because of this, manufacturers all over Europe, from big companies like Medtronic to smaller OEMs, are signing long-term outsourcing contracts with specialized testing and certification companies.

Pharmaceutical and biotech companies are becoming a bigger and more important part of the Europe Medical Device TIC Outsourcing Market. As the range of combination products, companion diagnostics, and drug-delivery systems that fall under both pharmaceutical and medical device regulations grows, they are increasingly relying on third-party testing, inspection, and certification services. These hybrid or border products now must follow the EU Medical Device Regulation (MDR), especially when the function of the device is important to how the drug works or how it is given.

By Service

By Device Class

By End Use

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.