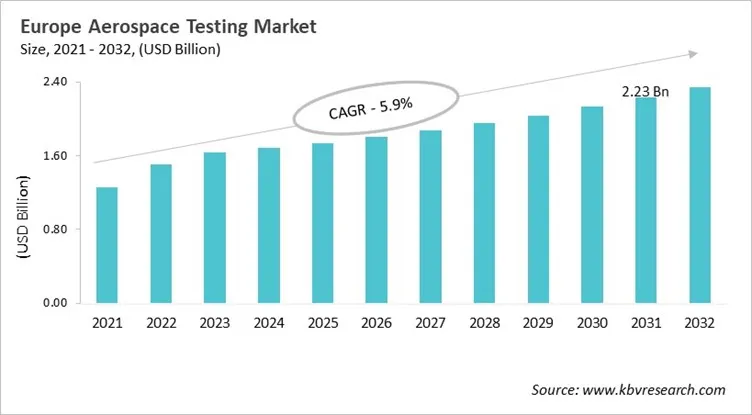

The Europe Aerospace Testing Market would witness market growth of 4.4% CAGR during the forecast period (2025-2032).

The Germany market dominated the Europe Aerospace Testing Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $395.4 million by 2032. The UK market is exhibiting a CAGR of 3.3% during (2025 - 2032). Additionally, The France market would exhibit a CAGR of 5.6% during (2025 - 2032). The Germany and UK led the Europe Aerospace Testing Market by Country with a market share of 19.1% and 16% in 2024.The Italy market is expected to witness a CAGR of 5.7% during throughout the forecast period.

The European aerospace testing market has grown along with the region's long history of aeronautical innovation. It has gone from simple material stress tests to very advanced, regulated systems. The Concorde and other post-war collaborations, as well as the growth of big companies like Airbus and Rolls-Royce, led to large-scale testing infrastructure and standardized EU certification standards. Today, the market includes civil, defense, and space areas, and it uses digital tools, simulation platforms, and non-destructive testing. Some trends are the use of AI and digital twins to make things more digital, testing hydrogen, hybrid, and electric propulsion systems for sustainability, and moving into space applications that need to be tested in extreme conditions.

There is a lot of competition in Europe's aerospace testing market. Major OEMs with strong in-house capabilities, specialized firms, independent labs, and government-backed facilities all play a role. Top companies put money into cutting-edge testing facilities and solutions that focus on sustainability. They also work with research institutions and agencies to make their operations more cost-effective and competitive on a global scale. Geographic hubs in France, Germany, and the UK make the ecosystem stronger by providing skilled workers and support for the supply chain. Smaller companies and startups are joining the market with specialized knowledge, especially in electric aviation and space propulsion. This makes the market even more competitive and encourages innovation.

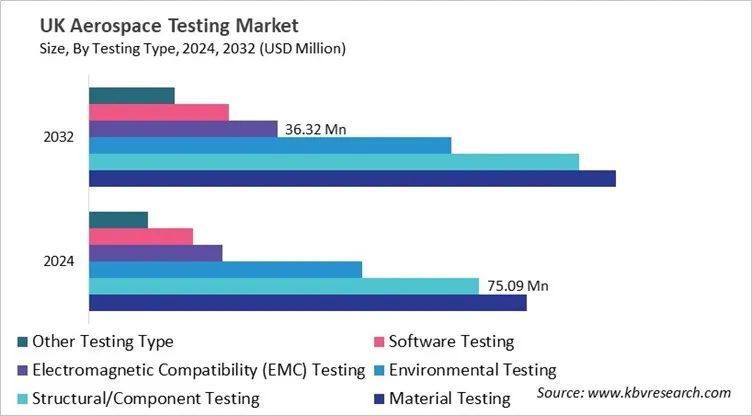

Based on Testing Type, the market is segmented into Material Testing, Structural/Component Testing, Environmental Testing, Electromagnetic Compatibility (EMC) Testing, Software Testing, and Other Testing Type. Among various UK Aerospace Testing Market by Testing Type; The Material Testing market achieved a market size of USD $84.3 Million in 2024 and is expected to grow at a CAGR of 2.4 % during the forecast period. The Electromagnetic Compatibility (EMC) Testing market is predicted to experience a CAGR of 4.5% throughout the forecast period from (2025 - 2032).

Based on End Use, the market is segmented into OEMs, MROs (Maintenance, Repair & Overhaul), Airlines & Defense Operators, Government & Space Agencies, and Other End Use. With a compound annual growth rate (CAGR) of 4.6% over the projection period, the OEMs Market, dominate the France Aerospace Testing Market by End Use in 2024 and would be a prominent market until 2032. The Government & Space Agencies market is expected to witness a CAGR of 6.3% during (2025 - 2032).

Free Valuable Insights: The Global Aerospace Testing Market will Hit USD 8.71 Billion by 2032, at a CAGR of 4.6%

Germany is a cornerstone of the European aerospace testing market, driven by its strong aerospace industry, precision engineering expertise, and strict EASA regulations. Heavy investments in R&D, sustainable aviation fuels, and electric propulsion, along with Industry 4.0 adoption, support advanced testing methods. Digitalization through AI, IoT, and digital twins enhances efficiency, while defense projects like the Future Combat Air System (FCAS) and the growing MRO sector increase demand. Competition is intense, with OEMs, independent providers, and niche firms all active, supported by collaborations with institutes like DLR, ensuring Germany remains a leading hub for sustainable and innovative aerospace testing.

By Application

By Testing Type

By End Use

By Aviation Type

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.