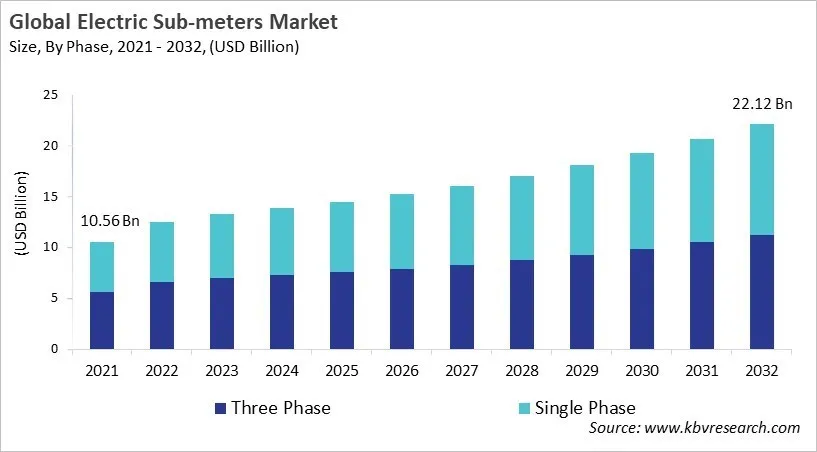

“Global Electric Sub-meters Market to reach a market value of USD 22.12 Billion by 2032 growing at a CAGR of 6.2%”

The Global Electric Sub-meters Market size is expected to reach USD 22.12 billion by 2032, rising at a market growth of 6.2% CAGR during the forecast period.

The electric sub-meters market has recently developed into advanced systems focused on sustainability, regulatory compliance, and energy management. The electric sub-meters market has witnessed significant growth owing to elements such as energy crises, increasing electricity prices, and government policies like the Energy Policy Act of 2005 and the US Public Utility Regulatory Policies Act of 1978, supporting larger adoption. Technological advancements have resulted in the transformation of sub-meters into digital platforms with the ability of real-time monitoring, support for sustainability certifications such as BREEAM and LEED, and integration with building management systems.

The electric sub-meter market is anticipated to grow steadily because of compliance-driven sustainability needs, rising demand for real-time visibility, IoT-enabled, and wireless solutions. Modern sub-meters offer detailed insights at the load level, enabling facility managers to manage operations, detect inefficiencies, and comply with energy efficiency mandates. IoT connectivity and wireless technologies have reduced installation costs and made sub-metering scalable. Also, the demand is surging continuously because of the favourable regulatory frameworks globally. The market is intensely competitive, shaped by digital transformation, bundled solutions, and product innovations. The market is witnessing a massive transformation from hardware-based bill tools to data-driven ecosystems that support decarbonization, efficiency, and compliance.

The COVID-19 pandemic had a huge effect on the global electric sub-meters market. Manufacturing shut down, there weren't enough raw materials, and workers weren't available, which caused delays in production and the cancellation of projects. End-use sectors like construction, real estate, and commercial buildings had to close, put projects on hold, and couldn't get the money they needed, which lowered the immediate need for sub-meters. Utility companies and property managers also had to move money from smart metering projects to important operations, and installation services were delayed because of health restrictions. Trade restrictions between countries made it even harder to export and import goods, especially between Asia-Pacific and Europe. The pandemic caused a sharp drop in the market, which slowed growth and pushed back recovery timelines by several quarters. Thus, the COVID-19 pandemic had a negative impact on the market.

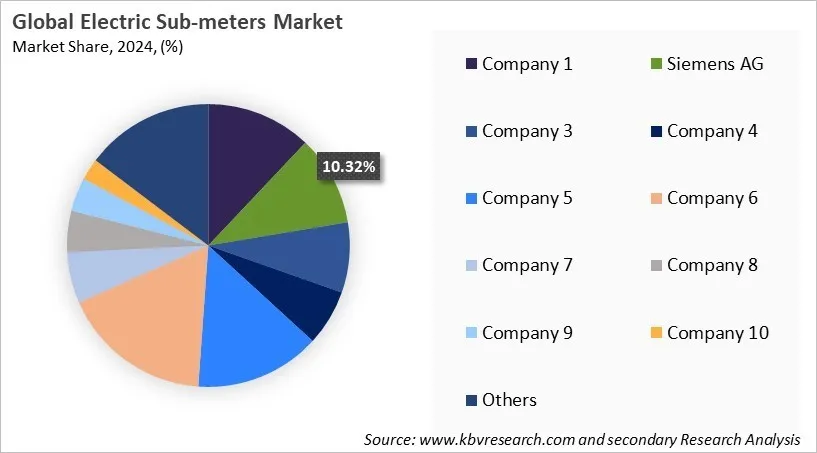

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

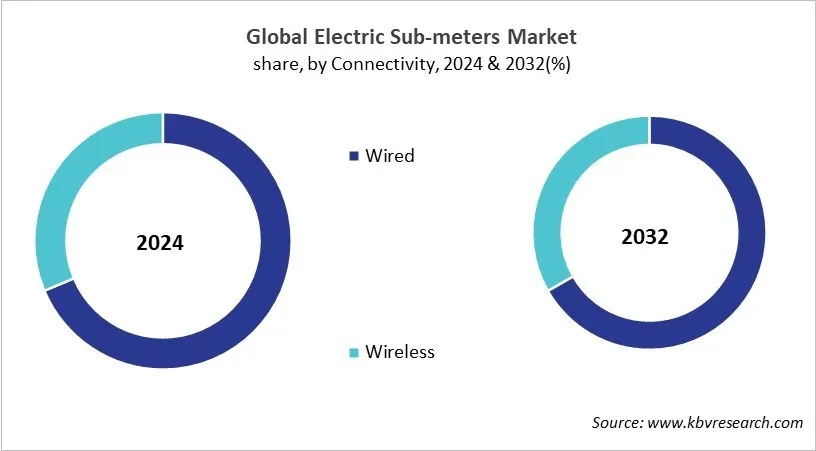

Based on Connectivity, the market is segmented into Wired, and Wireless. The wireless segment held 31% revenue share in the market in 2024. With growing adoption of smart grid technologies, IoT integration, and the demand for flexible energy monitoring solutions, wireless sub-meters are gradually gaining traction. These systems are particularly suited for retrofitting in existing structures, where laying physical wiring may be difficult or costly.

Based on End Use, the market is segmented into Industrial, Commercial, Residential, and Other End Use. The commercial segment attained 30% revenue share in the market in 2024. Businesses such as office complexes, shopping malls, educational institutions, and healthcare facilities rely on these devices to track energy usage across different tenants, departments, or service areas. By enabling transparent billing and effective energy allocation, sub-meters support cost-saving initiatives and sustainability goals.

Free Valuable Insights: Global Electric Sub-meters Market size to reach USD 22.12 Billion by 2032

Region-wise, the electric sub-meters market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the market in 2024. The electric sub-meter market is anticipated to grow at a high rate in North America and Europe. The expansion is supported by stringent regulatory frameworks, large adoption of smart building technologies, and sustainability goals. In Canada and the US, policies promoting transparency and energy efficiency in utility billing have made sub-metering a necessity in multi-tenant residential and commercial properties. Moreover, Europe’s growth is backed by elements such as carbon reduction targets, strict building energy codes, and certifications such as LEED and BREEAM, that require granual energy monitoring. Region’s expansion is also influenced by the rapid integration of IoT-enabled, digital solutions into building management systems, with facility managers looking for real-time insights.

In the Asia Pacific and LAMEA regions, the electric sub-meter market is predicted to witness substantial expansion during the forecast period. The expansion is driven by the modernization of infrastructure, government-led energy efficiency programs, and rapid urbanization. Regional nations such as Japan, India, and China are experiencing large adoption because of increasing energy costs, smart city initiatives, and policies mandating advanced metering in industrial and commercial sectors. Furthermore, the LAMEA region’s market expansion is driven by energy conservation initiatives, new construction projects, and the demand for cost-effective retrofit solutions. IoT-enabled and wireless sub-meters are gaining traction in the regions because of their ease of deployment and affordability.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 14.48 Billion |

| Market size forecast in 2032 | USD 22.12 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 6.2% from 2025 to 2032 |

| Number of Pages | 545 |

| Number of Tables | 451 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Phase, Type, Connectivity, End Use, Region |

| Country scope |

|

| Companies Included | Schneider Electric SE, Siemens AG, Honeywell International, Inc., ABB Ltd., Itron, Inc., Landis+Gyr Group AG, Eaton Corporation plc, General Electric Company, Mitsubishi Electric Corporation, and Xylem, Inc. (Sensus) |

By Phase

By Type

By Connectivity

By End Use

By Geography

This Market size is expected to reach USD 22.12 Billion by 2032.

The electric sub-meters market market is projected to grow at a CAGR of 6.2% between 2025 and 2032.

Growing demand for energy efficiency and conservation is being propelled by technological advancements in smart metering solutions.

Schneider Electric SE, Siemens AG, Honeywell International, Inc., ABB Ltd., Itron, Inc., Landis+Gyr Group AG, Eaton Corporation plc, General Electric Company, Mitsubishi Electric Corporation, and Xylem, Inc. (Sensus)

The Wired segment led the maximum revenue in the Global Electric Sub-meters Market by Connectivity in 2024, thereby, achieving a market value of USD 14.76 billion by 2032.

The North America region dominated the Global Electric Sub-meters Market by Region in 2024, thereby, achieving a market value of USD 7.23 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges