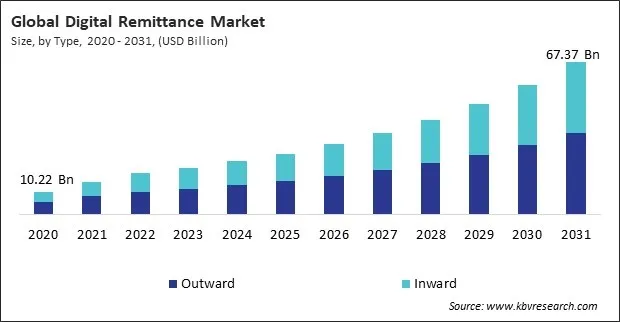

“Global Digital Remittance Market to reach a market value of USD 67.37 Billion by 2031 growing at a CAGR of 16.2%”

The Global Digital Remittance Market size is expected to reach $67.37 billion by 2031, rising at a market growth of 16.2% CAGR during the forecast period.

The United States and Canada are major sources of outward remittances, with millions of expatriates sending money to their home countries. The region's dominance is further fueled by fintech innovations, AI-driven remittance platforms, and blockchain-based cross-border payment solutions, which have enhanced transaction speed, security, and cost-efficiency. Additionally, the presence of leading digital remittance service providers such as PayPal, Wise, Western Union, and MoneyGram has significantly contributed to the market’s growth. Government initiatives promoting financial inclusion and digital transaction security have also been crucial in increasing adoption rates. The North America segment procured 34% revenue share in the market in 2023.

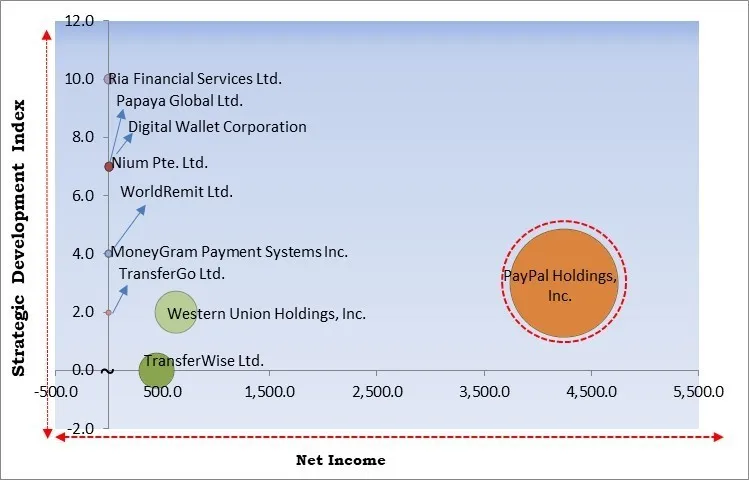

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2024, TransferGo Ltd. teamed up with UniPAY, a FinTech Company to enable IBAN payouts from the UK and EU to Georgia, enhancing cross-border transfers. This collaboration aims to support the Georgian diaspora by allowing direct bank transfers. UniPAY and TransferGo emphasize efficiency, security, and accessibility in international remittances. Additionally, In September, 2024, MoneyGram Payment Systems Inc. teamed up with dLocal, a Financial technology company to expand its global digital receive options, including wallets and bank accounts, across the APAC and EMEA regions, with future plans for LatAm. This collaboration will offer faster, more cost-effective transactions, reducing the average cross-border payment cost and improving financial access in emerging markets.

Based on the Analysis presented in the KBV Cardinal matrix; PayPal Holdings, Inc. is the forerunner in the Digital Remittance Market. Companies such as Western Union Holdings, Inc., TransferWise Ltd., and Ria Financial Services Ltd. are some of the key innovators in Digital Remittance Market. In January, 2025, Ria Financial Services Ltd. teamed up with GCash, a FinTech Company to offer international remittance services for Filipinos abroad. This collaboration enables users from the US, Australia, Europe, and Singapore to send funds directly to GCash wallets, with benefits like real-time transfers, low fees, and competitive exchange rates, boosting financial access for Filipinos worldwide.

Countries with large diaspora populations, such as India, China, the Philippines, and Mexico, are at the forefront of this remittance boom. India, for instance, has consistently ranked as the world's top remittance recipient, with millions of Indian workers employed in regions like the Middle East, North America, and Europe. Hence, as global migration continues to increase, the digital remittance market is expected to expand even further.

As 5G technology and mobile banking innovations continue to evolve, the adoption of digital remittance services is expected to grow even further. Governments and financial institutions support this shift by promoting digital literacy and expanding internet access in remote areas. With fintech companies continuously innovating and developing user-friendly mobile payment solutions, digital remittances will become even more efficient, inclusive, and widely adopted. Thus, smartphone and internet penetration will remain a cornerstone of the digital remittance market’s growth.

Governments and financial institutions worldwide have implemented stringent rules to prevent money laundering, fraud, and illicit financial activities. While these measures enhance security and trust in the financial ecosystem, they also create complexities for digital remittance service providers. One of the most pressing challenges is the stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Hence, these factors may hamper the expansion of the market.

Based on type, the market is bifurcated into inward and outward. The inward segment procured 44% revenue share in the market in 2023. The inward digital remittance segment is driven by the increasing reliance of developing nations on remittance inflows, as they contribute significantly to household income, economic stability, and national GDP. The expansion of mobile money networks, digital payment gateways, and real-time payment processing has made it easier for recipients to access funds instantly, even in rural or unbanked regions.

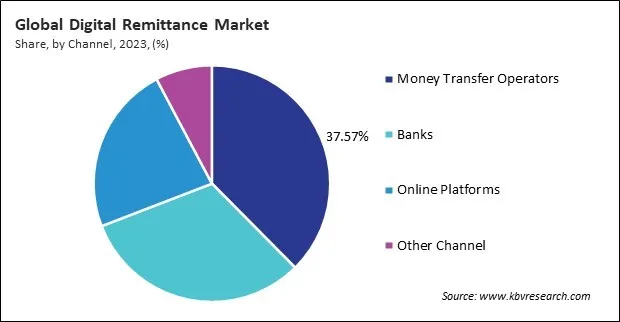

On the basis of channel, the market is classified into banks, money transfer operators, online platforms, and others. The money transfer operators segment acquired 38% revenue share in the market in 2023. Money transfer operators (MTOs) such as Western Union, MoneyGram, and Ria Money Transfer have long-established infrastructure and agent networks catering to digital and cash-based remittances.

By end use, the market is divided into migrant labor workforce, personal, small businesses, and others. The personal segment witnessed 46% revenue share in the market in 2023. Many migrant workers send money home to support their families, making personal remittances a dominant use case in this market. Additionally, the increasing penetration of mobile wallets and online payment solutions has simplified personal remittance transfers, enabling faster and more cost-effective cross-border transactions.

Free Valuable Insights: Global Digital Remittance Market size to reach USD 67.37 Billion by 2031

The digital remittance market is highly competitive, driven by increasing cross-border transactions, fintech innovations, and mobile banking adoption. Key attributes include low-cost transfers, real-time processing, regulatory compliance, and enhanced security. The market is shaped by blockchain technology, AI-driven fraud detection, and API-based integrations for seamless transactions. Competition intensifies as traditional financial institutions, fintech startups, and cryptocurrency-based platforms introduce faster, cost-effective, and transparent remittance solutions. Evolving regulations, digital wallets, and mobile payment ecosystems further influence market dynamics and global expansion strategies.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 29% revenue share in the market in 2023. Countries such as India, China, the Philippines, Bangladesh, and Indonesia are among the world’s largest recipients of remittances, with millions of migrant workers sending funds back home.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 20.68 Billion |

| Market size forecast in 2031 | USD 67.37 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 16.2% from 2024 to 2031 |

| Number of Pages | 219 |

| Number of Tables | 363 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Channel, End Use, Region |

| Country scope |

|

| Companies Included | Papaya Global Ltd., Digital Wallet Corporation, WorldRemit Ltd., Nium Pte. Ltd., MoneyGram Payment Systems Inc., PayPal Holdings, Inc., Ria Financial Services Ltd., TransferGo Ltd., TransferWise Ltd., and Western Union Holdings, Inc. |

By Type

By Channel

By End Use

By Geography

This Market size is expected to reach $67.37 billion by 2031.

Continual Increase in Global Migration are driving the Market in coming years, however, Stringent Regulatory and Compliance Challenges restraints the growth of the Market.

Papaya Global Ltd., Digital Wallet Corporation, WorldRemit Ltd., Nium Pte. Ltd., MoneyGram Payment Systems Inc., PayPal Holdings, Inc., Ria Financial Services Ltd., TransferGo Ltd., TransferWise Ltd., and Western Union Holdings, Inc.

The expected CAGR of this Market is 16.2% from 2023 to 2031.

The Outward segment is leading the Market by Type in 2023; thereby, achieving a market value of $36.10 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $22.01 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges