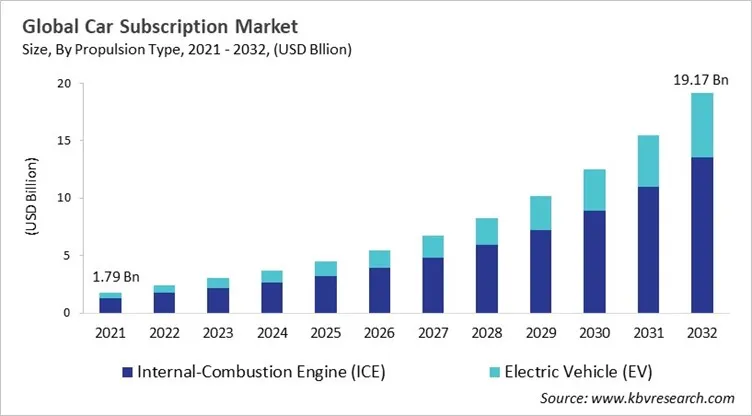

“Global Car Subscription Market to reach a market value of USD 19.17 Billion by 2032 growing at a CAGR of 23.1%”

The Global Car Subscription Market size is expected to reach USD 19.17 billion by 2032, rising at a market growth of 23.1% CAGR during the forecast period.

The car subscription market has evolved as a mainstream mobility option developed by changing consumer demands, industrial experiments, and technological advancements. Regulatory pressure on emissions and the requirement to promote electric vehicles, changing urban mobility preferences, are some of the factors supporting expansion of car subscription market. Also, the pandemic period has surged interest, as consumers sought cost-predictable and flexible alternatives to ownership, thereby supporting OEMs to serve with offerings of convenience, digital integration, and collaborations with mobility platforms as well as dealers.

The car subscription market is experiencing expansion driven by digital and software-based services into subscription ecosystems, increasing consumer demand for flexibility and transparency and a surge in adoption of electric and hybrid vehicles to meet the sustainability goals. Automakers are taking initiatives in order to expand geographically and across customer segments. The competition is intense in the market as OEMs are introducing programs that build brand loyalty and independent multi-brand platforms that focus on affordability and choice, along with the software-driven feature subscriptions from players such as BMW and Tesla. All these elements represent automakers and startups that are competing to transform the future of car ownership and access.

The COVID-19 pandemic had a big effect on the car subscription market. People lost their jobs, had their pay cut, and couldn't move around as much, which made them cut back on non-essential spending and lowered demand. Travel restrictions and working from home made these services even less necessary, which meant that fleets weren't being used as much as they could have been. Operational problems, such as stopped deliveries, limited maintenance, and problems with the supply chain, made service quality worse and made it harder to keep customers. Health worries about shared cars and less demand from businesses made things worse, leading to cancellations, financial stress, and a sharp drop in market growth. Thus, the COVID-19 pandemic had a negative impact on the market.

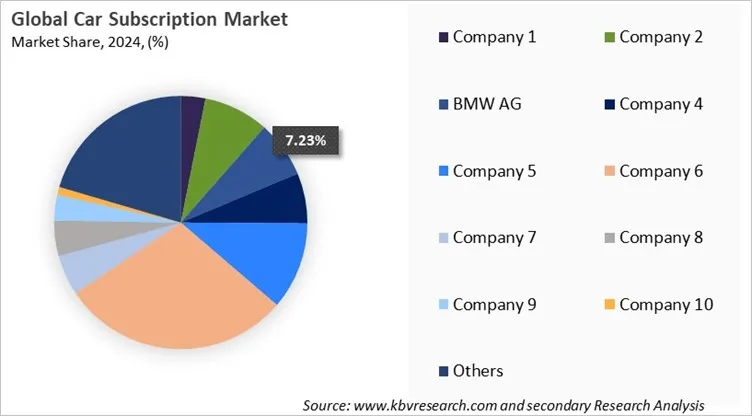

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on propulsion type, the car subscription market is characterized into internal-combustion engine (ICE), and electric vehicle (EV). The electric vehicle (EV) segment held 27% revenue share in the market in 2024. This is supported by growing interest in sustainable mobility solutions. This segment attracts consumers who are environmentally conscious and eager to explore alternatives to traditional fuel-based transportation. Subscription offerings for EVs often emphasize cost predictability and convenience, helping to reduce concerns about battery life, charging infrastructure, and upfront costs associated with ownership. Companies operating in this space are also focusing on expanding charging networks and incorporating incentives to encourage adoption.

By subscription type, the car subscription market is divided into single brand (single-brand swap), and multi brand. The multi brand segment acquired 43% revenue share in the market in 2024. The segment provides subscribers with access to a diverse portfolio of vehicles across multiple automotive brands. This model is designed to cater to consumers who value variety, flexibility, and the ability to adapt their choice of vehicle to different needs or occasions. Subscribers can switch between brands, exploring different features, performance levels, and designs, which enhances the overall user experience. Such an offering often appeals to individuals who prefer experimentation and do not wish to be tied down to one specific brand.

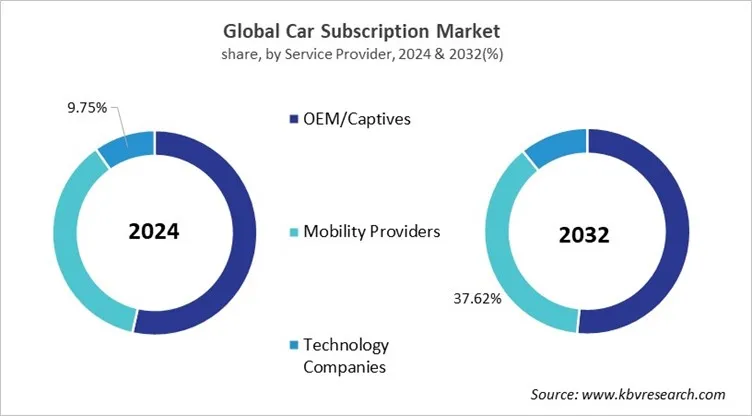

Based on service provider, the car subscription market is characterized into OEM/captives, mobility providers, and technology companies. The technology companies segment recorded 10% revenue share in the market in 2024. The segment includes firms that rely heavily on digital platforms and data-driven approaches to enable subscription services. These companies typically act as intermediaries or enablers, providing advanced solutions for fleet management, customer engagement, and subscription customization. Their focus is on building seamless digital experiences, leveraging analytics, and innovating around user-centric platforms.

Free Valuable Insights: Global Car Subscription Market size to reach USD 19.17 Billion by 2032

Region-wise, the car subscription market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment recorded 40% revenue share in the market in 2024. The car subscription market in North America and Europe region is gaining significant market share. This is owing to the rising traction as consumers are looking forward to mobility models over traditional ownership. North America region is considered a hub for OEM-led initiatives such as Porsche Drive, Care by Volvo and Audi on Demand. Furthermore, the demand is highly supported by the urban professionals looking for predictable costs and short-term convenience. Also, OEMs are offering subscription models to increase consumer engagement and surge EV adoption. Additionally, Europe region is experiencing growth in the car subscription market, driven by favourable regulatory frameworks supporting sustainable mobility and electric vehicle penetration. European automobile manufacturers like Mercedes-Benz, Volvo, and BMW are introducing subscription models as part of wider mobility strategies, leading to a positive influence on the market.

The car subscription market is anticipated to expand in Asia Pacific and LAMEA region during the forecast period. The growth in Asia Pacific is led by increasing urbanization, government-led initiatives supporting EV’s adoption, and smartphone-driven consumer behaviour. Automobile manufacturers are introducing tiered subscription plans to meet the demands of both cost-sensitive and premium segments. In addition, the LAMEA region is also expected to have growth opportunities in the car subscription market owing to the presence of premium consumers in the Middle East, surging the demand of luxury car subscriptions. Africa and Latin America are also offering expansion opportunities because of increased smartphone penetration and rising interest in flexible mobility solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 4.48 Billion |

| Market size forecast in 2032 | USD 19.17 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 23.1% from 2025 to 2032 |

| Number of Pages | 567 |

| Number of Tables | 501 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Propulsion Type, End User, Subscription Type, Service Provider, Subscription Period, Region |

| Country scope |

|

| Companies Included | Volvo Group, Mercedes-Benz Group AG, BMW AG, Hyundai Motor Company, Volkswagen AG, Sixt SE, The Hertz Corporation, FINN GmbH, Ayvens and Cazoo |

By Propulsion Type

By End User

By Subscription Type

By Service Provider

By Subscription Period

By Geography

The market size is projected to reach USD 19.17 Billion billion by 2032.

The car subscription market is projected to grow at a CAGR of 23.1% between 2025 and 2032.

Shifting consumer preferences toward flexibility and access over ownership supported by technological digitalization and the growth of connected, data-driven platforms.

Volvo Group, Mercedes-Benz Group AG, BMW AG, Hyundai Motor Company, Volkswagen AG, Sixt SE, The Hertz Corporation, FINN GmbH, Ayvens and Cazoo

The OEM/Captives segment is generating the maximum revenue in the Global Car Subscription Market by Service Provider in 2024; thereby, achieving a market value of $9.89 billion by 2032.

The Europe market dominated the Global Car Subscription Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $7.53 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges