“Global Autonomous Data Platform Market to reach a market value of USD 10.58 Billion by 2032 growing at a CAGR of 25.2%”

The Global Autonomous Data Platform Market size is expected to reach $10.58 billion by 2032, rising at a market growth of 25.2% CAGR during the forecast period.

The autonomous data platform market has developed from early database automation tools into cloud-native, AI-driven systems designed to manage the escalating speed, scale, and complexity of modern enterprise data. As enterprises shifted from on-premises databases to hybrid and cloud environments, the requirement for platforms that could self-tune, self-secure, self-repair, and self-provision became critical. Providers like Oracle introduced the concept of a “self-securing, self-repairing, and self-driving” database, deploying machine learning to optimise workloads, automate maintenance, and reduce administration costs. The transformation has been surged by rapid growth in real-time analytics demands, and regulatory pressures around data security and governance elements that make manual data operations largely untenable.

The autonomous data platform market is driven by key trends such as convergence with hybrid/multicloud architectures, increasing governance and security requirements, and embedded AI/ML for autonomous operation. Key providers are building platforms that include on-premises and cloud environments, support diverse workloads, and offer integrated governance and self-securing capabilities. The autonomous data platform market is witnessing intensively competition with hyperscalers and developing players introducing self-healing and automated data-ops features, supporting ecosystem collaborations and rapid innovation. The providers that combine deep database expertise with hybrid/multicloud flexibility, advanced automation, and strong compliance features are anticipated to grow at a steady pace.

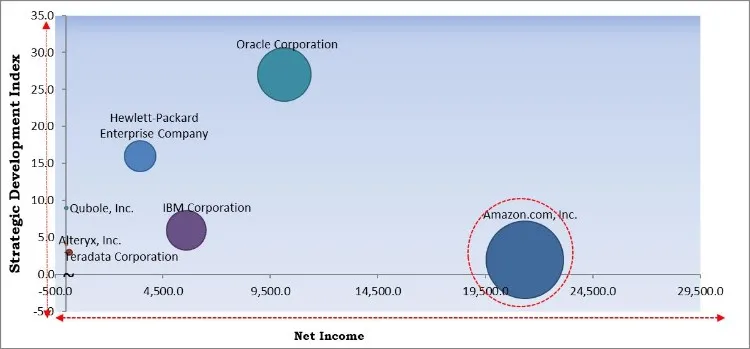

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2024, Amazon.com, Inc. partnered with Oracle Corporation to launch Oracle Database, enabling customers to run Oracle Autonomous Database on AWS infrastructure. This enhances multi-cloud access to autonomous data platforms, improving scalability, integration, and AI-driven database automation for enterprise workloads. Moreover, In June, 2025, Hewlett Packard Enterprise Company, in collaboration with NVIDIA, launched new AI and hybrid cloud programs to boost partner profitability. The initiative includes AI workshops, certifications, and enhanced HPE GreenLake offerings, supporting end-to-end AI lifecycle management and enabling autonomous data platform capabilities.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Autonomous Data Platform Market. In April, 2025, Google Cloud launched an industry-first partner program with Oracle, expanding Oracle Database Google Cloud capabilities. Key additions include Oracle Base Database Service, Exadata X11M support, and multicloud access—boosting automation, analytics, and flexibility in the Autonomous Data Platform Market. Companies such as Amazon.com Inc. and Oracle Corporation are some of the key innovators in Autonomous Data Platform Market.

The COVID-19 pandemic temporarily slowed the market for autonomous data platforms because companies shifted their budgets from long-term digital transformation to crisis response, business continuity, and remote work support. Supply-chain delays, limited access to data centers, and halted on-site implementation all messed up deployment cycles. This led to postponed projects and delayed revenues for vendors. At the same time, the lack of data engineering and cloud knowledge got worse, making it harder for businesses to support complicated platform rollouts. Because of the uncertainty in the economy, businesses were more likely to focus on short-term ROI than on advanced technologies that needed a lot of money up front. Because of this, the pandemic made people more careful about spending, which made it harder for people to adopt new technologies and slowed the growth of the market as a whole. Thus, the COVID-19 pandemic had a negative impact on the market.

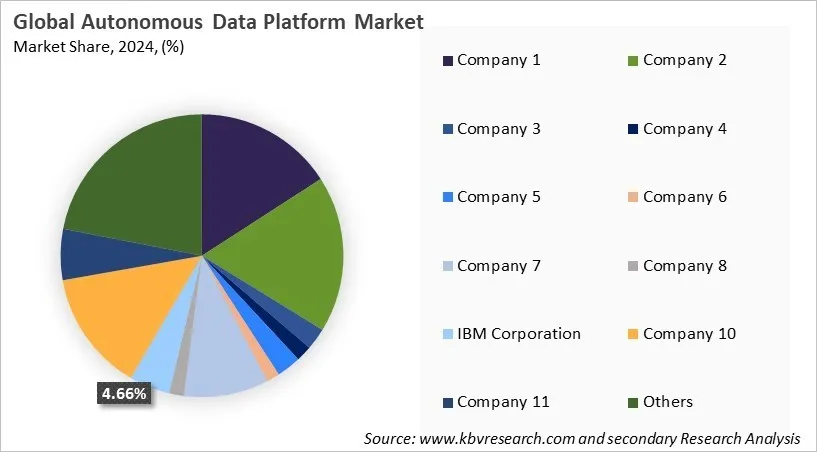

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Free Valuable Insights: Autonomous Data Platform Market size to reach USD 10.58 Billion by 2032

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The small & medium enterprises (SMEs) segment attained 37% revenue share in the autonomous data platform market in 2024. Small and medium enterprises are increasingly adopting autonomous data platforms as cloud-native tools become more accessible, scalable, and easier to implement without large IT teams. Public disclosures from AWS, Google Cloud, and Microsoft Azure show expanding SME uptake of automated data preparation, integration, and analytics capabilities to accelerate decision-making and improve operational efficiency.

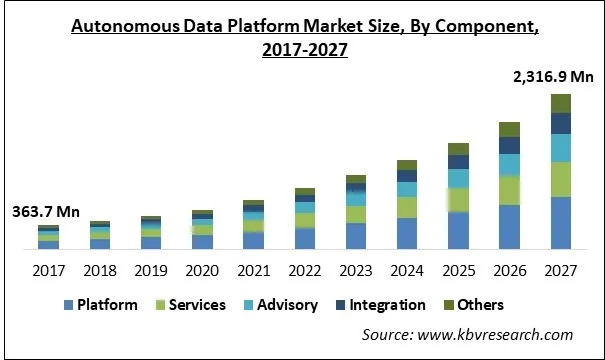

Based on Component, the market is segmented into Platform and Services. The services segment recorded 34% revenue share in the autonomous data platform market in 2024. The services component includes implementation, integration, migration, support, consulting, and managed services required to operationalize autonomous data platforms within enterprise environments. Even though these platforms automate core data operations, vendors such as Microsoft, AWS, and Oracle acknowledge that expert services are essential for configuring governance models, connecting complex legacy systems, establishing multi-cloud or hybrid architectures, and enabling secure and compliant data operations.

Region-wise, the autonomous data platform market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 38% revenue share in the autonomous data platform market in 2024. In North America and Europe, the autonomous data platform market is projected to capture a prominent share. The expansion is driven by strict regulatory environments, high cloud adoption, and rising demand for AI-driven data management. In North America, large businesses in industries like healthcare, technology, BFSI, and retail are widely adopting autonomous platforms to improve security, reduce operational overhead, and support real-time analytics at scale. The region benefits from early adoption of AI/ML, advanced cloud ecosystems, and strong investments by key players such as AWS, Google, Microsoft, and Oracle. Additionally, Europe autonomous data platform market is expanding, driven by stringent data governance and privacy regulations like GDPR, which encourage enterprises toward platforms that offer self-securing capabilities, strong multi-cloud governance, and automated compliance. Rising digital transformation initiatives, combined with the increase in hybrid cloud adoption, are further surging demand in the region.

The autonomous data platform market is anticipated to grow at a significant rate in the Asia Pacific and LAMEA regions. This is because of surging modernise legacy systems, cloud migration, and expand real-time analytics capabilities. In the Asia Pacific, expanding IT investments, rapidly growing digital economies, and the proliferation of data intensive sectors like e-commerce, smart cities, telecom and manufacturing are accelerating the autonomous data platform market’s growth. The requirement of diverse and rapidly growing datasets, coupled with rising hybrid/multi-cloud usage in nations such as Australia, Japan, China, and India, is supporting market expansion. Moreover, the LAMEA market is also showcasing growth opportunities with enterprises looking for cloud-based solutions to address limited IT resources, modernise data environments, and enhance security posture. Advancing cloud infrastructure, rising regulatory frameworks, and increasing interest in automation-driven cost efficiency are some elements predicted to support the market expansion.

Competition in the autonomous data platform market is getting tougher as providers work to create data ecosystems that are smarter, more flexible, and able to grow quickly. Competition is based on how deep automation goes, how well it can be integrated, how well real-time analytics works, and how reliable governance is. Vendors compete by coming up with new ways to use AI to organize data, automate security, and make workflows that work better on their own. Differentiation is becoming more and more dependent on seamless multi-cloud support, less complicated operations, and a better user experience. This makes for a dynamic environment where ongoing progress determines competitive strength.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 2.19 Billion |

| Market size forecast in 2032 | USD 10.58 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 25.2% from 2025 to 2032 |

| Number of Pages | 624 |

| Number of Tables | 544 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Enterprise Size, Component, Deployment, End Use, Region |

| Country scope |

|

| Companies Included | Amazon.com, Inc., Oracle Corporation, Teradata Corporation, Hewlett Packard Enterprise Company, Cloudera, Inc., DataRobot, Inc., Databricks, Inc., SAP SE, IBM Corporation, Microsoft Corporation, and Google LLC |

By Enterprise Size

By Component

By Deployment

By End Use

By Geography

This Market size is expected to reach USD 10.58 Billion by 2032.

The autonomous data platform market is projected to grow at a CAGR of 25.2% between 2025 and 2032.

Rapid growth in data volumes and complex enterprise workloads is driving increased demand for security automation, zero-trust compliance, and regulatory governance.

Amazon.com, Inc., Oracle Corporation, Teradata Corporation, Hewlett Packard Enterprise Company, Cloudera, Inc., DataRobot, Inc., Databricks, Inc., SAP SE, IBM Corporation, Microsoft Corporation, and Google LLC

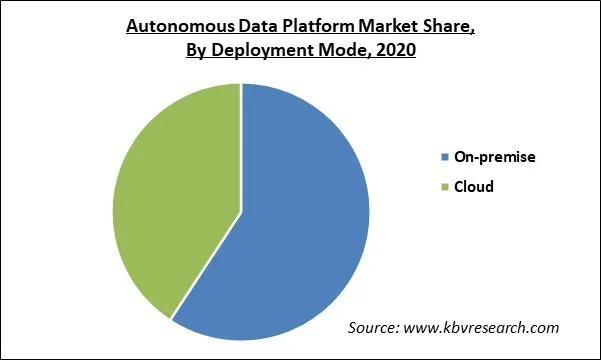

The On-premise segment led the maximum revenue in the Global Autonomous Data Platform Market by Deployment in 2024, thereby, achieving a market value of $5.4 billion by 2032.

The North America region dominated the Global Autonomous Data Platform Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $3.8 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges