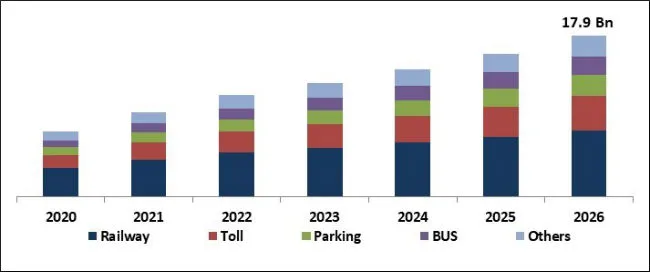

The Global Automated Fare Collection System Market size is expected to reach $17.9 billion by 2026, rising at a market growth of 16.3% CAGR during the forecast period. Increasing use of new solutions to increase transaction speed and minimize problems related to cash processing and ticket distribution is expected to be one of the leading drivers driving the industry. Policy emphasis on improving the efficiency of current mass transportation networks, such as subways, Buses, trams and metros, is also anticipated to promote the usage of technology.

Global Automated Fare Collection System Market Size

The automated fare collection system is an end-to-end contactless solution for collecting fare payments and replacing the conventional ticketing method with electronic ticketing. This includes automated gate machines, vending machines for tickets, recharging terminals and check machines for tickets. This system makes it easier to collect fares quickly, increases the overall transaction rate and saves a huge amount of time, reducing waiting time in queues and looking for cash to buy tickets. In addition, it is an easy way to collect revenue. This provides travelers with one pass to use for all transit modes.

Automated Fare Collection System Market Share

Numerous plans have been proposed in recent years to reform the fare system used in public transport. The adoption of automated tariff collection systems would replace passports and paper-based tickets with electronic fare payments. The implementation of national electronic card systems is expected to offer fare discounts to students and pensioners using public transport. There is also a substantial rise in demand for automated fare collection ticketing systems due to rising demand for contactless mobile payment solutions and smartphones, decreased rates of fraud, flexible fare plans, decreased traffic congestion and improved transport infrastructure.

Free Valuable Insights: Global Automated Fare Collection System Market to reach a market size of $17.9 billion by 2026

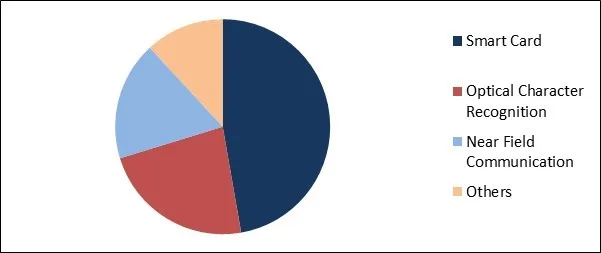

Based on Technology Platform, the market is segmented into Smart Card, Optical Character Recognition, Near Field Communication and Others. Based on Component, the market is segmented into Hardware and Software. Based on End User, the market is segmented into Railway, Toll, Parking, Bus and Others. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Omron Corporation, Atos Group, Dormakaba Holding AG, LG Corporation, NXP Semiconductors N.V., Samsung Electronics Co., Ltd. (Samsung Group), Thales Group S.A., Cubic Corporation, LECIP Holdings Corporation, and Scheidt & Bachmann GmbH.

Market Segmentation:

By Technology Platform

By Component

By End-User

By Geography

Companies Profiled

The global automated fare collection system market size is expected to reach $17.9 billion by 2026.

The major factors that are anticipated to drive the automated fare collection system industry include increasing demand for smartphones.

Omron Corporation, Atos Group, Dormakaba Holding AG, LG Corporation, NXP Semiconductors N.V., Samsung Electronics Co., Ltd. (Samsung Group), Thales Group S.A., Cubic Corporation, LECIP Holdings Corporation, and Scheidt & Bachmann GmbH.

The North America dominated the retail market in 2019 and will remain dominant over the projected years due to the rapid proliferation of new technologies in the region.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.