Asia Pacific Polytetrafluoroethylene Market Size, Share & Trends Analysis Report By End-use, By Form (Fine Powder, Granular/Molded Powder, Dispersion, and Micronized Powder), By Application, By Country and Growth Forecast, 2023 - 2030

Published Date : 27-Mar-2024 | Pages: 167 | Formats: PDF |

COVID-19 Impact on the Asia Pacific Polytetrafluoroethylene Market

The Asia Pacific Polytetrafluoroethylene Market would witness market growth of 6.2% CAGR during the forecast period (2023-2030). In the year 2021, the Asia Pacific market's volume surged to 786.67 hundred tonnes, showcasing a growth of 3.5% (2019-2022).

In the (PTFE) market, fine powder serves as a fundamental component with diverse applications owing to its unique properties. With its ultrafine particle size, fine powder PTFE is extensively utilized in the production of coatings and lubricants, offering exceptional non-stick and low friction characteristics. These properties make it indispensable in industries ranging from food processing to electronics, where surfaces require protection against adhesion and wear. Consequently, the Japan market consumed 116.30 hundred tonnes in volume in the market in 2022.

The China market dominated the Asia Pacific Polytetrafluoroethylene Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $521.2 million by 2030. The Japan market is registering a CAGR of 5.5% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 6.8% during (2023 - 2030).

The adoption of PTFE in the automotive sector is driven by its low friction coefficient and self-lubricating properties. These characteristics make PTFE ideal for manufacturing seals, gaskets, and bearings, improving fuel efficiency and reducing wear and tear. As the automotive industry focuses on enhancing performance and efficiency, PTFE plays a pivotal role in various components.

The medical and pharmaceutical industries have embraced PTFE for its biocompatibility and resistance to bodily fluids and chemicals. PTFE is utilized to manufacture medical devices, including catheters, vascular grafts, and components for pharmaceutical processing equipment. The utilization of PTFE in these sectors is motivated by the substance's capacity to meet rigorous regulatory standards and guarantee the effectiveness and security of medical products. For example, as per Invest India, the pharmaceutical industry in India is anticipated to increase to $65 billion by 2024 and $130 billion by 2030.

PTFE’s low coefficient of friction makes it ideal for aerospace applications, particularly in bearings and bushings in China. Components made from PTFE reduce friction, improve efficiency, and reduce wear in aerospace systems in China. PTFE’s resistance to corrosion is essential for aircraft components exposed to diverse environmental conditions in China. It is utilized in coating applications to protect critical aerospace components from corrosion, enhancing their durability and lifespan in China. PTFE is utilized in thermal insulation applications within aerospace structures in China. Its low thermal conductivity helps provide effective insulation, prevent heat transfer, and maintain temperature stability in critical aerospace components in China. Therefore, due to the above-mentioned factors, the market will grow significantly in this region.

Free Valuable Insights: The Global Polytetrafluoroethylene Market is Predict to reach $ 4.2 Billion by 2030, at a CAGR of 6.0%

Based on End-use, the market is segmented into Chemical & Industrial Processing, Electronics & Electrical, Automotive & Aerospace, Consumer Goods, Building & Construction, and Others. Based on Form, the market is segmented into Fine Powder, Granular/Molded Powder, Dispersion, and Micronized Powder. Based on Application, the market is segmented into Coatings, Sheets, Pipes, Films, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- The Chemours Company

- Daikin Industries Ltd.

- 3M Company

- Gujarat Fluorochemicals Limited (INOXGFL Group)

- Dongyue Group Limited

- Solvay SA

- Arkema S.A.

- DuPont de Nemours, Inc.

- Jiangsu Meilan Chemical Co., Ltd.

- HaloPolymer, OJSC

Asia Pacific Polytetrafluoroethylene Market Report Segmentation

By End-use (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- Chemical & Industrial Processing

- Electronics & Electrical

- Automotive & Aerospace

- Consumer Goods

- Building & Construction

- Others

By Form (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- Fine Powder

- Granular/Molded Powder

- Dispersion

- Micronized Powder

By Application (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- Coatings

- Sheets

- Pipes

- Films

- Others

By Country (Volume, Hundred Tonnes, USD Billion, 2019-2030)

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Asia Pacific Polytetrafluoroethylene Market, by End-use

1.4.2 Asia Pacific Polytetrafluoroethylene Market, by Form

1.4.3 Asia Pacific Polytetrafluoroethylene Market, by Application

1.4.4 Asia Pacific Polytetrafluoroethylene Market, by Country

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Opportunities

3.2.3 Market Restraints

3.2.4 Market Challenges

3.3 Porter’s Five Forces Analysis

Chapter 4. Asia Pacific Polytetrafluoroethylene Market by End-use

4.1 Asia Pacific Chemical & Industrial Processing Market by Country

4.2 Asia Pacific Electronics & Electrical Market by Country

4.3 Asia Pacific Automotive & Aerospace Market by Country

4.4 Asia Pacific Consumer Goods Market by Country

4.5 Asia Pacific Building & Construction Market by Country

4.6 Asia Pacific Others Market by Country

Chapter 5. Asia Pacific Polytetrafluoroethylene Market by Form

5.1 Asia Pacific Fine Powder Market by Country

5.2 Asia Pacific Granular/Molded Powder Market by Country

5.3 Asia Pacific Dispersion Market by Country

5.4 Asia Pacific Micronized Powder Market by Country

Chapter 6. Asia Pacific Polytetrafluoroethylene Market by Application

6.1 Asia Pacific Coatings Market by Country

6.2 Asia Pacific Sheets Market by Country

6.3 Asia Pacific Pipes Market by Country

6.4 Asia Pacific Films Market by Country

6.5 Asia Pacific Others Market by Country

Chapter 7. Asia Pacific Polytetrafluoroethylene Market by Country

7.1 China Polytetrafluoroethylene Market

7.1.1 China Polytetrafluoroethylene Market by End-use

7.1.2 China Polytetrafluoroethylene Market by Form

7.1.3 China Polytetrafluoroethylene Market by Application

7.2 Japan Polytetrafluoroethylene Market

7.2.1 Japan Polytetrafluoroethylene Market by End-use

7.2.2 Japan Polytetrafluoroethylene Market by Form

7.2.3 Japan Polytetrafluoroethylene Market by Application

7.3 India Polytetrafluoroethylene Market

7.3.1 India Polytetrafluoroethylene Market by End-use

7.3.2 India Polytetrafluoroethylene Market by Form

7.3.3 India Polytetrafluoroethylene Market by Application

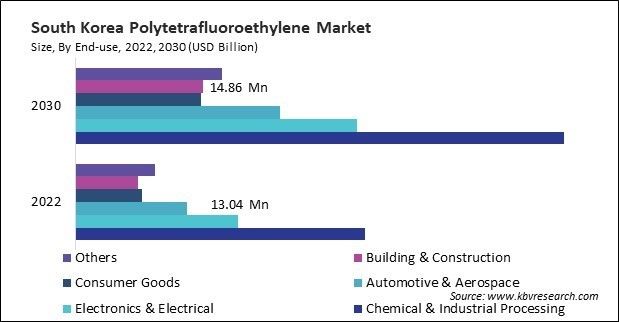

7.4 South Korea Polytetrafluoroethylene Market

7.4.1 South Korea Polytetrafluoroethylene Market by End-use

7.4.2 South Korea Polytetrafluoroethylene Market by Form

7.4.3 South Korea Polytetrafluoroethylene Market by Application

7.5 Singapore Polytetrafluoroethylene Market

7.5.1 Singapore Polytetrafluoroethylene Market by End-use

7.5.2 Singapore Polytetrafluoroethylene Market by Form

7.5.3 Singapore Polytetrafluoroethylene Market by Application

7.6 Malaysia Polytetrafluoroethylene Market

7.6.1 Malaysia Polytetrafluoroethylene Market by End-use

7.6.2 Malaysia Polytetrafluoroethylene Market by Form

7.6.3 Malaysia Polytetrafluoroethylene Market by Application

7.7 Rest of Asia Pacific Polytetrafluoroethylene Market

7.7.1 Rest of Asia Pacific Polytetrafluoroethylene Market by End-use

7.7.2 Rest of Asia Pacific Polytetrafluoroethylene Market by Form

7.7.3 Rest of Asia Pacific Polytetrafluoroethylene Market by Application

Chapter 8. Company Profiles

8.1 The Chemours Company

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 SWOT Analysis

8.2 Daikin Industries Ltd.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expenses

8.2.5 SWOT Analysis

8.3 3M Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 SWOT Analysis

8.4 Gujarat Fluorochemicals Limited (INOXGFL Group)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 SWOT Analysis

8.5 Dongyue Group Limited

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 SWOT Analysis

8.6 Arkema S.A.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 SWOT Analysis

8.7 Solvay SA

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expenses

8.7.5 SWOT Analysis

8.8 DuPont de Nemours, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 SWOT Analysis

8.9 Jiangsu Meilan Chemical Co., Ltd.

8.9.1 Company Overview

8.10. HaloPolymer, OJSC

8.10.1 Company Overview

TABLE 2 Asia Pacific Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 3 Asia Pacific Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 4 Asia Pacific Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 5 Asia Pacific Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 6 Asia Pacific Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 7 Asia Pacific Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 8 Asia Pacific Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 9 Asia Pacific Chemical & Industrial Processing Market by Country, 2019 - 2022, USD Million

TABLE 10 Asia Pacific Chemical & Industrial Processing Market by Country, 2023 - 2030, USD Million

TABLE 11 Asia Pacific Chemical & Industrial Processing Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 12 Asia Pacific Chemical & Industrial Processing Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 13 Asia Pacific Electronics & Electrical Market by Country, 2019 - 2022, USD Million

TABLE 14 Asia Pacific Electronics & Electrical Market by Country, 2023 - 2030, USD Million

TABLE 15 Asia Pacific Electronics & Electrical Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 16 Asia Pacific Electronics & Electrical Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 17 Asia Pacific Automotive & Aerospace Market by Country, 2019 - 2022, USD Million

TABLE 18 Asia Pacific Automotive & Aerospace Market by Country, 2023 - 2030, USD Million

TABLE 19 Asia Pacific Automotive & Aerospace Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 20 Asia Pacific Automotive & Aerospace Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 21 Asia Pacific Consumer Goods Market by Country, 2019 - 2022, USD Million

TABLE 22 Asia Pacific Consumer Goods Market by Country, 2023 - 2030, USD Million

TABLE 23 Asia Pacific Consumer Goods Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 24 Asia Pacific Consumer Goods Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 25 Asia Pacific Building & Construction Market by Country, 2019 - 2022, USD Million

TABLE 26 Asia Pacific Building & Construction Market by Country, 2023 - 2030, USD Million

TABLE 27 Asia Pacific Building & Construction Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 28 Asia Pacific Building & Construction Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 29 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

TABLE 30 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

TABLE 31 Asia Pacific Others Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 32 Asia Pacific Others Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 33 Asia Pacific Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 34 Asia Pacific Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 35 Asia Pacific Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 36 Asia Pacific Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 37 Asia Pacific Fine Powder Market by Country, 2019 - 2022, USD Million

TABLE 38 Asia Pacific Fine Powder Market by Country, 2023 - 2030, USD Million

TABLE 39 Asia Pacific Fine Powder Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 40 Asia Pacific Fine Powder Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 41 Asia Pacific Granular/Molded Powder Market by Country, 2019 - 2022, USD Million

TABLE 42 Asia Pacific Granular/Molded Powder Market by Country, 2023 - 2030, USD Million

TABLE 43 Asia Pacific Granular/Molded Powder Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 44 Asia Pacific Granular/Molded Powder Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 45 Asia Pacific Dispersion Market by Country, 2019 - 2022, USD Million

TABLE 46 Asia Pacific Dispersion Market by Country, 2023 - 2030, USD Million

TABLE 47 Asia Pacific Dispersion Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 48 Asia Pacific Dispersion Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 49 Asia Pacific Micronized Powder Market by Country, 2019 - 2022, USD Million

TABLE 50 Asia Pacific Micronized Powder Market by Country, 2023 - 2030, USD Million

TABLE 51 Asia Pacific Micronized Powder Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 52 Asia Pacific Micronized Powder Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 53 Asia Pacific Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 54 Asia Pacific Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 55 Asia Pacific Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 56 Asia Pacific Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 57 Asia Pacific Coatings Market by Country, 2019 - 2022, USD Million

TABLE 58 Asia Pacific Coatings Market by Country, 2023 - 2030, USD Million

TABLE 59 Asia Pacific Coatings Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 60 Asia Pacific Coatings Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 61 Asia Pacific Sheets Market by Country, 2019 - 2022, USD Million

TABLE 62 Asia Pacific Sheets Market by Country, 2023 - 2030, USD Million

TABLE 63 Asia Pacific Sheets Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 64 Asia Pacific Sheets Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 65 Asia Pacific Pipes Market by Country, 2019 - 2022, USD Million

TABLE 66 Asia Pacific Pipes Market by Country, 2023 - 2030, USD Million

TABLE 67 Asia Pacific Pipes Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 68 Asia Pacific Pipes Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 69 Asia Pacific Films Market by Country, 2019 - 2022, USD Million

TABLE 70 Asia Pacific Films Market by Country, 2023 - 2030, USD Million

TABLE 71 Asia Pacific Films Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 72 Asia Pacific Films Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 73 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

TABLE 74 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

TABLE 75 Asia Pacific Others Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 76 Asia Pacific Others Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 77 Asia Pacific Polytetrafluoroethylene Market by Country, 2019 - 2022, USD Million

TABLE 78 Asia Pacific Polytetrafluoroethylene Market by Country, 2023 - 2030, USD Million

TABLE 79 Asia Pacific Polytetrafluoroethylene Market by Country, 2019 - 2022, Hundred Tonnes

TABLE 80 Asia Pacific Polytetrafluoroethylene Market by Country, 2023 - 2030, Hundred Tonnes

TABLE 81 China Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 82 China Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 83 China Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 84 China Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 85 China Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 86 China Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 87 China Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 88 China Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 89 China Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 90 China Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 91 China Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 92 China Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 93 China Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 94 China Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 95 China Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 96 China Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 97 Japan Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 98 Japan Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 99 Japan Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 100 Japan Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 101 Japan Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 102 Japan Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 103 Japan Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 104 Japan Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 105 Japan Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 106 Japan Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 107 Japan Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 108 Japan Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 109 Japan Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 110 Japan Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 111 Japan Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 112 Japan Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 113 India Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 114 India Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 115 India Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 116 India Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 117 India Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 118 India Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 119 India Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 120 India Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 121 India Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 122 India Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 123 India Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 124 India Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 125 India Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 126 India Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 127 India Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 128 India Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 129 South Korea Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 130 South Korea Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 131 South Korea Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 132 South Korea Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 133 South Korea Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 134 South Korea Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 135 South Korea Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 136 South Korea Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 137 South Korea Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 138 South Korea Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 139 South Korea Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 140 South Korea Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 141 South Korea Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 142 South Korea Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 143 South Korea Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 144 South Korea Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 145 Singapore Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 146 Singapore Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 147 Singapore Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 148 Singapore Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 149 Singapore Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 150 Singapore Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 151 Singapore Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 152 Singapore Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 153 Singapore Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 154 Singapore Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 155 Singapore Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 156 Singapore Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 157 Singapore Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 158 Singapore Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 159 Singapore Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 160 Singapore Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 161 Malaysia Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 162 Malaysia Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 163 Malaysia Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 164 Malaysia Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 165 Malaysia Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 166 Malaysia Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 167 Malaysia Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 168 Malaysia Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 169 Malaysia Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 170 Malaysia Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 171 Malaysia Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 172 Malaysia Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 173 Malaysia Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 174 Malaysia Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 175 Malaysia Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 176 Malaysia Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 177 Rest of Asia Pacific Polytetrafluoroethylene Market, 2019 - 2022, USD Million

TABLE 178 Rest of Asia Pacific Polytetrafluoroethylene Market, 2023 - 2030, USD Million

TABLE 179 Rest of Asia Pacific Polytetrafluoroethylene Market, 2019 - 2022, Hundred Tonnes

TABLE 180 Rest of Asia Pacific Polytetrafluoroethylene Market, 2023 - 2030, Hundred Tonnes

TABLE 181 Rest of Asia Pacific Polytetrafluoroethylene Market by End-use, 2019 - 2022, USD Million

TABLE 182 Rest of Asia Pacific Polytetrafluoroethylene Market by End-use, 2023 - 2030, USD Million

TABLE 183 Rest of Asia Pacific Polytetrafluoroethylene Market by End-use, 2019 - 2022, Hundred Tonnes

TABLE 184 Rest of Asia Pacific Polytetrafluoroethylene Market by End-use, 2023 - 2030, Hundred Tonnes

TABLE 185 Rest of Asia Pacific Polytetrafluoroethylene Market by Form, 2019 - 2022, USD Million

TABLE 186 Rest of Asia Pacific Polytetrafluoroethylene Market by Form, 2023 - 2030, USD Million

TABLE 187 Rest of Asia Pacific Polytetrafluoroethylene Market by Form, 2019 - 2022, Hundred Tonnes

TABLE 188 Rest of Asia Pacific Polytetrafluoroethylene Market by Form, 2023 - 2030, Hundred Tonnes

TABLE 189 Rest of Asia Pacific Polytetrafluoroethylene Market by Application, 2019 - 2022, USD Million

TABLE 190 Rest of Asia Pacific Polytetrafluoroethylene Market by Application, 2023 - 2030, USD Million

TABLE 191 Rest of Asia Pacific Polytetrafluoroethylene Market by Application, 2019 - 2022, Hundred Tonnes

TABLE 192 Rest of Asia Pacific Polytetrafluoroethylene Market by Application, 2023 - 2030, Hundred Tonnes

TABLE 193 Key Information – The Chemours Company

TABLE 194 Key Information – daikin industries ltd.

TABLE 195 Key Information – 3M Company

TABLE 196 Key Information – Gujarat Fluorochemicals Limited

TABLE 197 Key Information – Dongyue Group Limited

TABLE 198 Key information – Arkema S.A.

TABLE 199 Key Information – Solvay SA

TABLE 200 Key Information –DuPont de Nemours, Inc.

TABLE 201 Key Information – Jiangsu Meilan Chemical Co., Ltd.

TABLE 202 Key Information – HaloPolymer, OJSC

List of Figures

FIG 1 Methodology for the research

FIG 2 Asia Pacific Polytetrafluoroethylene Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Polytetrafluoroethylene Market

FIG 4 Porter’s Five Forces Analysis - Polytetrafluoroethylene Market

FIG 5 Asia Pacific Polytetrafluoroethylene Market share by End-use, 2022

FIG 6 Asia Pacific Polytetrafluoroethylene Market share by End-use, 2030

FIG 7 Asia Pacific Polytetrafluoroethylene Market by End-use, 2019 - 2030, USD Million

FIG 8 Asia Pacific Polytetrafluoroethylene Market share by Form, 2022

FIG 9 Asia Pacific Polytetrafluoroethylene Market share by Form, 2030

FIG 10 Asia Pacific Polytetrafluoroethylene Market by Form, 2019 - 2030, USD Million

FIG 11 Asia Pacific Polytetrafluoroethylene Market share by Application, 2022

FIG 12 Asia Pacific Polytetrafluoroethylene Market share by Application, 2030

FIG 13 Asia Pacific Polytetrafluoroethylene Market by Application, 2019 - 2030, USD Million

FIG 14 Asia Pacific Polytetrafluoroethylene Market share by Country, 2022

FIG 15 Asia Pacific Polytetrafluoroethylene Market share by Country, 2030

FIG 16 Asia Pacific Polytetrafluoroethylene Market by Country, 2019 - 2030, USD Million

FIG 17 Swot Analysis: The Chemours Company

FIG 18 Swot Analysis: Daikin Industries Ltd.

FIG 19 SWOT Analysis: 3M Company

FIG 20 SWOT Analysis: Gujarat Fluorochemicals Limited

FIG 21 SWOT Analysis: Dongyue Group Limited

FIG 22 SWOT Analysis: Arkema S.A.

FIG 23 SWOT Analysis: Solvay SA

FIG 24 Swot Analysis: DuPont de Nemours, Inc.