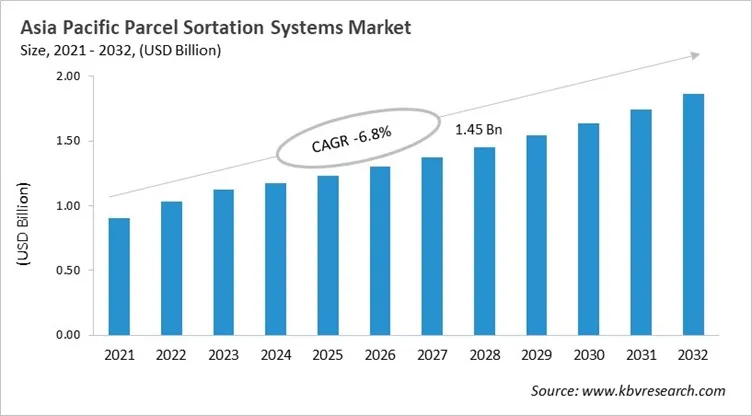

The Asia Pacific Parcel Sortation Systems Market would witness market growth of 6.1% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Parcel Sortation Systems Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $567.1 million by 2032. The Japan market is showcasing a CAGR of 4.9% during (2025 - 2032). Additionally, The India market would register a CAGR of 6.7% during (2025 - 2032). The China and India led the Asia Pacific Parcel Sortation Systems Market by Country with a market share of 34.4% and 15.4% in 2024. The Malaysia market is expected to witness a CAGR of 8.8% during throughout the forecast period.

Parcel sortation systems are very important for logistics and postal services in the Asia Pacific region. They help postal operators, courier companies, and e-commerce fulfillment centers move packages within and between countries. Their evolution started with manual and semi-automated processes in national postal services and moved on to conveyor-based and barcode-enabled systems as cities grew and digital commerce grew. The fast growth of online shopping in the 2010s sped up the use of automation, which led to more money being spent on high-speed parcel hubs. OEMs provided modular and scalable technologies to help with increasing volumes in different parts of the world. The COVID-19 pandemic made it even clearer how important it is to have automated processing that can handle anything. Today, there is a lot of automation in the market, and digital logistics platforms are deeply integrated into it.

Automation, centralized hubs, and digital integration are all important parts of the current trends in the parcel sortation market in Asia Pacific. To handle large and changing volumes of packages efficiently, logistics companies use automated systems that can handle a lot of packages at once. Hub-and-spoke models that use advanced sorting technologies make it easier to get things to people in big areas. Software-driven control systems, real-time monitoring, and analytics make things easier to see and help improve performance. There is a lot of competition between global and regional OEMs, and they all want to be able to grow, be reliable, and provide good customer service. Across the region, market strategies are still being shaped by modular designs, long-term partnerships, and solutions that focus on sustainability.

Based on Application, the market is segmented into E-commerce Fulfilment Centres, CEP Hubs, 3PL & Contract Logistics, Grocery & Food Distribution, Airports & Air-Cargo Terminals, and Other Application. Among various China Parcel Sortation Systems Market by Application; The E-commerce Fulfilment Centres market achieved a market size of USD $187.1 Million in 2024 and is expected to grow at a CAGR of 3.9 % during the forecast period. The Grocery & Food Distribution market is predicted to experience a CAGR of 5.6% throughout the forecast period from (2025 - 2032).

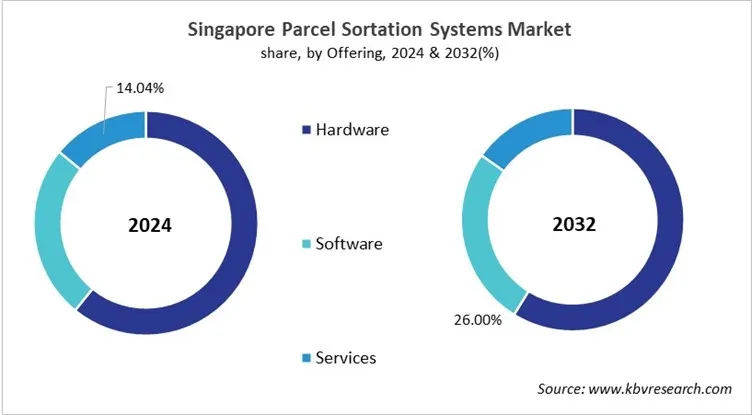

Based on Offering, the market is segmented into Hardware, Software, and Services. The report also covers geographical segmentation of Parcel Sortation Systems Market market. With a compound annual growth rate (CAGR) of 7.6% over the projection period, the Hardware Market, dominate the Singapore Parcel Sortation Systems Market by Offering in 2024 and would be a prominent market until 2032. The Software market is expected to witness a CAGR of 8.5% during (2025 - 2032).

Free Valuable Insights: The Parcel Sortation Systems Market is Predicted to reach USD 4.31 Billion by 2032, at a CAGR of 5.9%

China has the largest and most advanced parcel sorting systems market in the Asia Pacific region. This is because it has a lot of parcels and very centralized logistics hubs. Because of very high throughput needs, automation is a core infrastructure requirement rather than an upgrade for efficiency. The need for same-day and next-day delivery, the pressure on city workers, and the variety of parcel profiles all speed up the use of advanced sortation technologies. Ultra-high-throughput systems, deep software integration, and smart control architectures are all important trends in the market. As facilities grow, making the most of space and using less energy become increasingly important. There is a lot of competition, with strong domestic integrators and global OEMs. In China, buyers tend to choose systems that are proven, reliable, and easy to scale up.

By Type

By Application

By Throughput Capacity

By Offering

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.