The Asia Pacific Core Banking Software Market would witness market growth of 10.6% CAGR during the forecast period (2025-2032).

The China market dominated the Asia Pacific Core Banking Software Market by Country in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $1,519.2 million by 2032, growing at a CAGR of 8.3 % during the forecast period. The Japan market is registering a CAGR of 9.4% during (2025 - 2032). Additionally, The India market would showcase a CAGR of 11.3% during (2025 - 2032).

The rising demand for inclusive banking has propelled the development of solutions tailored to underserved markets, incorporating mobile-first designs, multilingual interfaces, and offline functionality. As digital identity, real-time payments, and decentralized finance continue to shape the financial services landscape, core banking software plays a foundational role in enabling institutions to remain competitive, agile, and compliant.

The market is characterized by intense competition, with traditional technology providers and new-age disruptors vying to deliver solutions that combine reliability, speed, and customization. Partnerships between core platform providers and cloud hyperscalers, cybersecurity firms, and regtech companies are further enriching the value proposition of these systems. As institutions pursue transformation agendas centered on customer empowerment and operational excellence, the demand for adaptive, intelligent, and integrative core banking platforms is expected to remain strong.

This Market in Asia Pacific is experiencing dynamic growth, driven by the region’s vast unbanked population, rapid smartphone penetration, and the rise of digital-first economies. Countries such as India, Indonesia, Vietnam, and the Philippines are witnessing a surge in digital banking initiatives, supported by government policies promoting financial inclusion and real-time payment infrastructures. A notable trend across the region is the expansion of mobile-centric banking systems, particularly in emerging economies where mobile devices often serve as the primary gateway to financial services. Core banking platforms are increasingly being designed to accommodate high transaction volumes, multilingual interfaces, and scalable cloud deployments to support these market demands. the Asia Pacific market is expected to see increased cross-border collaborations, particularly in ASEAN, for unified payment and settlement systems. Therefore, Asia Pacific’s core banking software market stands at the intersection of financial inclusion, digital innovation, and regional integration, promising significant opportunities for forward-thinking providers.

Free Valuable Insights: The Global Core Banking Software Market is Predict to reach USD 25.10 Billion by 2032, at a CAGR of 10.0%

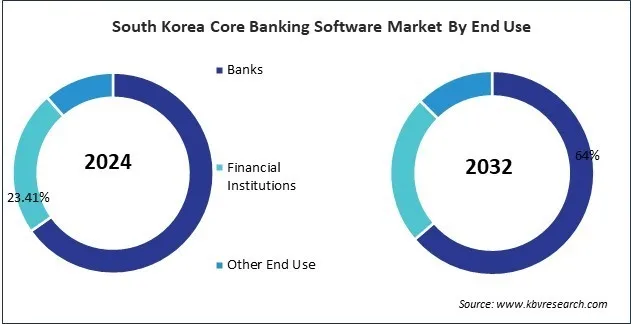

Based on Deployment, the market is segmented into Cloud and On-premise. Based on End Use, the market is segmented into Banks, Financial Institutions, and Other End Use. Based on Component, the market is segmented into Solution (Deposits, Loans, Enterprise Customer Solutions, and Other Solution Type) and Service (Professional Service and Managed Service). Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

By Deployment

By End Use

By Component

By Country

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.