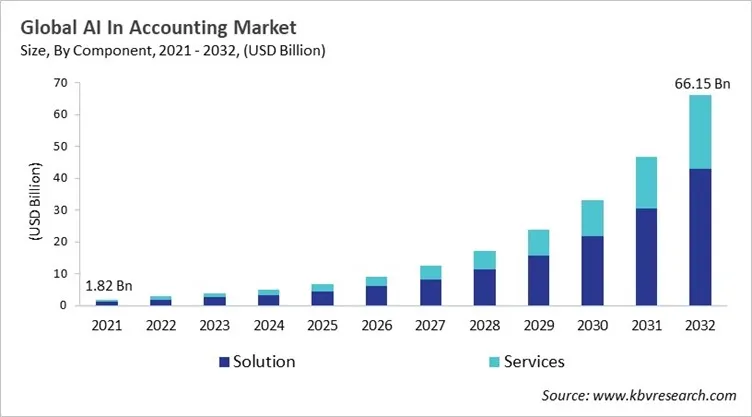

“Global AI In Accounting Market to reach a market value of USD 66.15 Billion by 2032 growing at a CAGR of 38.6%”

The Global AI In Accounting Market size is expected to reach USD 66.15 billion by 2032, rising at a market growth of 38.6% CAGR during the forecast period.

AI technologies such as machine learning and natural language processing have transformed the AI Accounting Market globally, from automating elementary operations to making smart financial decisions. Large software companies such as Intuit and Sage have combined AI assistants to their products thereby making work easier and ensuring that protocols are followed. Government bodies and businesses are utilizing AI technologies to detect fraud, run audits, and make financial forecasts. This is a component of a larger trend from automation to intelligent augmentation. Cloud computing plays a catalyst role since it offers the framework for AI applications, which can facilitate growth and work in real time with wider business systems.

Few key trends in the industry are the growing utilization of AI as a collaborative assistant, the rising adoption of cloud-native platforms, and the increasing requirement for explain ability and compliance with regulations. Oracle and SAP, two traditional companies, are increasing by utilizing multi-cloud methods. Coherently, start ups such as AppZen and MindBridge are disrupting things up with adaptable, flexible, niche solutions. At the same time, the top four accounting firms are using their knowledge to provide AI consulting and assurance services. As competition grows, the success of the company will center on its strength and ability to offer AI tools that are clear, safe, and scalable, and can be customized to meet the dynamic regulatory and operational requirements.

The COVID-19 pandemic had a big impact on the AI in accounting market because companies had trouble moving to digital platforms when they had to suddenly work from home. During the global economic downturn, many accounting departments, especially in small and medium-sized businesses, put off investing in AI in favor of keeping cash flow and core operations going. As access to AI and data science talent became limited, workforce shortages and reassignments made it even harder to get things done. AI solution providers also cut back on research and development and pushed back product launches. Customer acquisition slowed down because it took longer for customers to make decisions. AI was still a strategic priority, but the pandemic put a stop to its use in accounting for a short time. In conclusion, COVID-19 had a short-term bad effect on the growth of the AI in accounting market.

AI-powered tools offering continuous monitoring, predictive forecasting, and automatic compliance are transforming the way accounting works as there is a rising requirement for real-time financial acumen. Such solutions are far better than typical periodic reporting in helping businesses identify problems, predict cash flow, and make strategic decisions right away. With a lot of portfolio to offer, the AI accounting technologies present a complete scenario of the financial health of the organization. They deliver dynamic dashboards, capable of integrating with ERP and CRM systems, enhancing the transparency to investors. These benefits make them very important in today's fast-paced, highly regulated business world.

Apprehensions regarding data privacy and security are still a critical reason restricting the usage of AI in accounting because financial systems deal with sensitive private information such as payroll, taxes, and payments from clients. Huge datasets with personally detectable information are involved, and utilizing cloud-based AI platforms poses a risk of data theft by hackers. Cross-border regulatory concerns, old technologies, and insufficient cybersecurity regulations further create difficulties in deploying security. Numerous businesses are still reluctant to adopt AI because they lack robust data governance, encryption, and compliance rules. This restricts its usage to less sensitive sectors, thereby slowing down its wider acceptance.

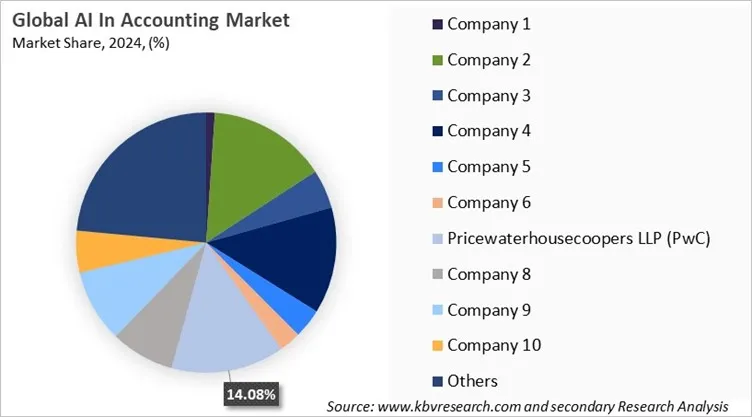

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Based on components, the AI in the Accounting Market is divided into Solutions and Services. The Solutions segment gained the largest market share in 2024, with 66.3%, followed by the Services segment. It demonstrates that businesses are increasingly choosing scalable, out-of-the-box platforms that come with continuing expert help.

Trend: AI in the accounting market is evolving with the growing demand for the unified integration of AI, data analytics, and cloud services. Unified development environments make deployment simpler and enable real-time decision-making across all business functions. These platforms also make it easier for those who aren't tech-savvy to utilize them by giving them no-code interfaces and pre-integrated services. This speeds up adoption on a large scale.

News: Microsoft introduced Azure AI Studio on June 6, 2024. It is a single AI development platform that brings together cognitive services, language models, and analytics.

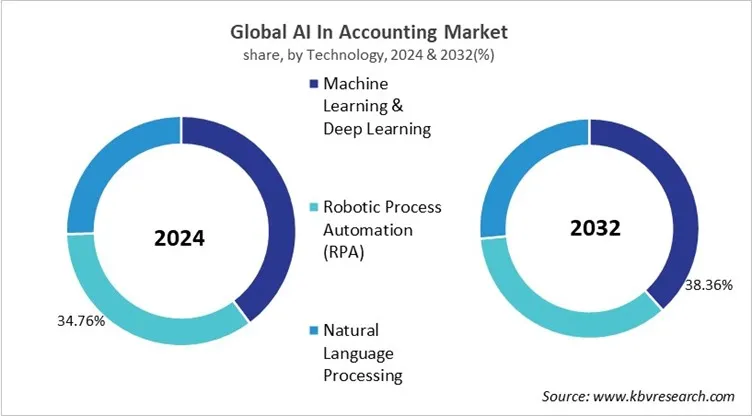

Based on the market segmentation by Technology, the AI in Accounting Market is segmented into Machine Learning & Deep Learning, Robotic Process Automation (RPA), and Natural Language Processing. The Machine Learning & Deep Learning segment contributed the largest revenue share of 39.8% in 2024, followed by the Robotic Process Automation (RPA) segment, displaying a rising enterprise demand for adaptive, intelligent, and automated financial solutions.

Trend: More businesses are using ML/DL to make their cash flow forecasts and financial plans more accurate. These algorithms use real-time transaction information, client behavior, and seasonal patterns to improve their predictive accuracy. This ability to adapt helps firms make faster, data-driven financial choices and reduces the need for manual data entry.

News: On April 24, 2024, Intuit added ML-based features to QuickBooks that let small businesses see real-time, self-learning estimates of a company's cash flow.

Free Valuable Insights: Global AI In Accounting Market size to reach USD 66.15 Billion by 2032

The regional scenario for the AI Accounting Market, globally, reveals strong growth throughout North America, Europe, Asia Pacific, and LAMEA, fuelled by changing levels of digital maturity and regulatory frameworks. North America leads the market due to early AI adoption, robust cloud infrastructure, and a strong presence of prominent vendors like Intuit and Oracle. Europe follows closely, emphasizing data privacy and compliance under regulations such as GDPR, prompting the development of localized AI solutions. Asia Pacific is witnessing rapid expansion, fueled by digital transformation in countries like China, India, and Japan, along with growing demand from SMEs. LAMEA shows emerging potential, particularly in financial hubs and government modernization programs, though infrastructure and regulatory gaps remain a challenge.

The AI Accounting Market, globally, is predicted to grow rapidly in North America, Europe, Asia Pacific, and LAMEA. This is because of different levels of digital development and regulations in each area. North America, as a regional market, is the industry leader owing to the fast adoption of AI since its advent, has a robust cloud infrastructure, and has large providers like Intuit and Oracle. Europe is next in line, emphasising data privacy and related regulatory rules such as GDPR. This has led to the framework of specialized AI solutions. Asia Pacific is growing swiftly owing to digital transformation in countries such as China, India, and Japan, along with the rising demand from small and medium-sized organizations. LAMEA has potential, especially in financial centers and government modernization efforts, but it still has problems with infrastructure and regulations.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 5.01 Billion |

| Market size forecast in 2032 | USD 66.15 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 38.6% from 2025 to 2032 |

| Number of Pages | 454 |

| Number of Tables | 372 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Technology, Application, Region |

| Country scope |

|

| Companies Included | XFO Financials Inc. (Vic.ai), Deloitte Touche Tohmatsu Limited, The Sage Group plc, Ernst & Young Global Limited, Xero Limited, Zoho Corporation Pvt. Ltd., Pricewaterhousecoopers LLP (PwC), Microsoft Corporation, KPMG International Limited and Oracle Corporation |

By Component

By Technology

By Application

By Geography

This Market size is expected to reach $66.15 Billion by 2032.

Operational Efficiency and Cost Savings through Automation are driving the Market in coming years, however, Data Privacy & Security Concerns restraints the growth of the Market.

XFO Financials Inc. (Vic.ai), Deloitte Touche Tohmatsu Limited, The Sage Group plc, Ernst & Young Global Limited, Xero Limited, Zoho Corporation Pvt. Ltd., Pricewaterhousecoopers LLP (PwC), Microsoft Corporation, KPMG International Limited and Oracle Corporation

The expected CAGR of this Market is 38.6 from 2023 to 2032.

The Automated Bookkeeping segment is leading the Market by Application in 2024; thereby, achieving a market value of USD 16.8 billion by 2032.

The North America market dominated the Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of USD 23.37 billion by 2032, growing at a CAGR of 37.7 % during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges