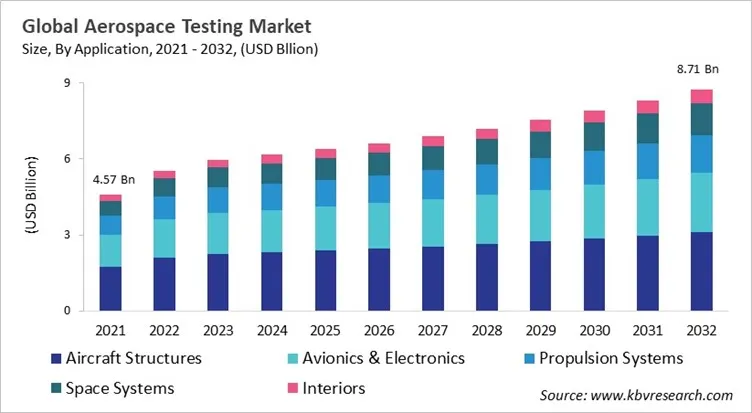

“Global Aerospace Testing Market to reach a market value of USD 8.71 Billion by 2032 growing at a CAGR of 4.6%”

The Global Aerospace Testing Market size is expected to reach USD 8.71 billion by 2032, rising at a market growth of 4.6% CAGR during the forecast period.

The aerospace testing market has transformed from basic government-led aviation checks to a complex system that balances compliance with regulations, OEM innovation, and specialized service providers. As aircraft design gets more complicated with jet engines, lightweight composites, and advanced avionics, the need for non-destructive testing (NDT), digital simulation tools, and automated inspection systems has grown. As global supply chains have come together, independent companies have taken over the testing responsibilities that used to be done in-house. At the same time, digitalization and automation have made it possible to test faster, more accurately, and at a lower cost throughout the aerospace lifecycle. Testing is very important for safety, performance, and reliability in aviation, defense, and space exploration today.

Some important trends in the market are the use of advanced inspection technologies for composite materials, the standardization of global standards to make supply chains more efficient, and the growth of testing into space exploration and defense modernization. The top companies are trying to grow their businesses around the world by putting money into automated NDT platforms and digital inspection systems, and by getting international accreditation to make sure they follow the rules. It is also important for companies to form strategic partnerships with government space programs and defense agencies so they can take advantage of opportunities in next-generation aerospace missions. OEM-affiliated providers use production alignment to shape the competitive landscape. Independent specialists focus on flexibility and innovation, while global firms compete on geographic presence, complex project capabilities, and strict quality standards.

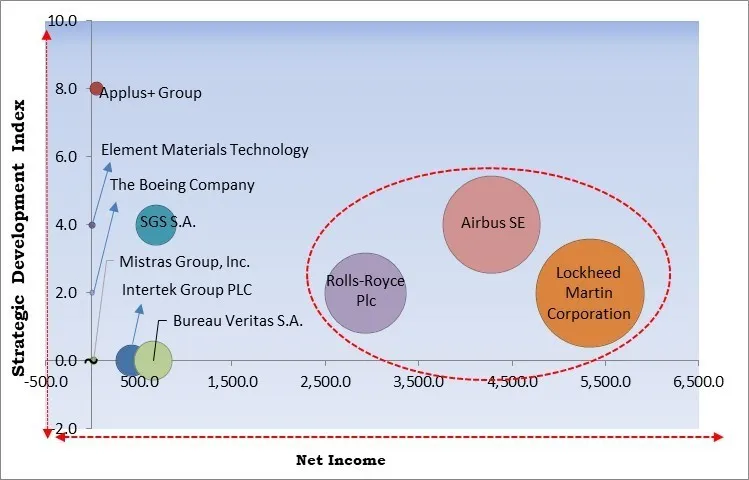

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. In 2024, September, Rolls-Royce Plc announced the partnership with easyJet, an airline to conduct full-scale hydrogen engine testing at NASA’s Stennis Space Center, advancing zero-carbon aviation technology. This program focuses on modifying the Pearl 15 engine for 100% hydrogen fuel, supporting Rolls-Royce’s net-zero goal by 2050 and sustainable aviation innovations. Additionally, In 2021, November, Lockheed Martin Corporation announced the partnership with Keysight Technologies to advance 5G solutions for aerospace and defense communications. Their 5G.MIL testbed supports secure, resilient connectivity across multiple domains, enabling rapid testing and validation of 5G technologies for mission-critical defense applications, enhancing cybersecurity and interoperability.

Based on the Analysis presented in the KBV Cardinal matrix; Lockheed Martin Corporation, Airbus SE, and Rolls-Royce Plc are the forerunners in the Aerospace Testing Market. Companies such as SGS S.A., Bureau Veritas S.A., and Intertek Group PLC are some of the key innovators in Aerospace Testing Market. In May, 2025, Airbus SE announced the partnership with GKN Aerospace to advance hydrogen-powered aviation by developing cryogenic cooling and electrical systems. Led by Airbus Tech Hub and part of the Dutch “Luchtvaart in Transitie” program, the initiative aims to mature liquid hydrogen technologies and establish new testing facilities to support future sustainable aircraft.

The COVID-19 pandemic hurt the aerospace testing market by lowering demand as airlines grounded their fleets and delayed deliveries of new planes. Testing companies had to deal with money problems, project delays, and problems with the supply chain that made it hard to get equipment and staff. Many facilities were only able to operate at half their normal capacity, which slowed down both commercial and defense programs. The sector got even weaker when the government moved money around in its budget and airlines put off signing contracts. Overall, uncertainty in aviation made people less likely to spend and invest, which greatly slowed the growth of the market during the pandemic. Thus, the COVID-19 pandemic had a negative impact on the market.

Free Valuable Insights: Global Aerospace Testing Market size to reach USD 8.71 Billion by 2032

Based on application, the aerospace testing market is characterized into aircraft structures, avionics & electronics, propulsion systems, space systems and interiors. The avionics & electronics segment attained 27% revenue share in the aerospace testing market in 2024. Avionics and electronics represent another key area of aerospace testing, covering systems such as navigation, communication, flight controls, and onboard sensors. As modern aircraft integrate advanced digital and automated technologies, testing becomes essential to ensure accuracy, safety, and resilience. With the rise of smart and connected aviation systems, reliability in avionics has become more important than ever. This makes the segment one of the fastest-evolving within the industry.

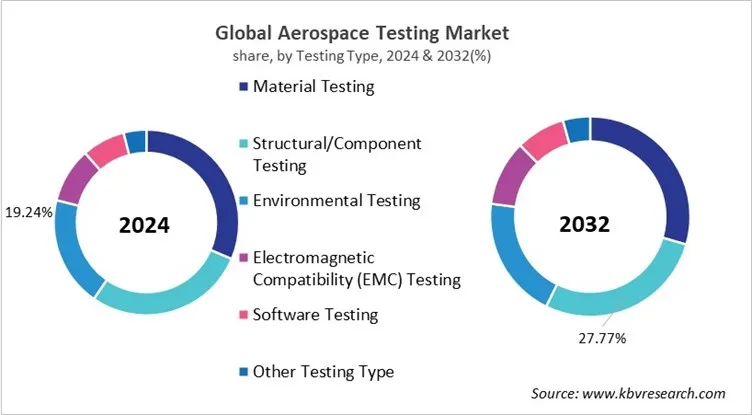

On the basis of testing type, the aerospace testing market is classified into material testing, structural/component testing, environmental testing, electromagnetic compatibility (EMC) testing, software testing, and others. The structural/component testing segment recorded 28% revenue share in the aerospace testing market in 2024. Structural and component testing is another significant segment, dedicated to assessing the performance of aircraft parts such as wings, fuselage sections, and landing gear. The goal is to confirm that these components meet regulatory standards and function safely under load and stress conditions.

Region-wise, the Aerospace testing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 38% revenue share in the aerospace testing market in 2024. North America is the biggest market for aerospace testing. The U.S. leads the way with its strong defense modernization programs, big commercial aerospace companies, and growing space exploration efforts. OEMs like Boeing, Lockheed Martin, and SpaceX keep the demand for non-destructive testing (NDT), structural fatigue analysis, and advanced simulation platforms high. Airbus, Eurofighter programs, and the European Space Agency (ESA) all help growth in Europe. The EU's focus on green aviation and lightweight composites, along with strict EASA rules, are driving investment in digital inspection technologies and testing frameworks that are required by law.

The Asia-Pacific region is growing quickly. China, India, and Japan are all putting a lot of money into their own aircraft programs, modernizing their defense fleets, and sending commercial missions into space. Government-backed aerospace hubs and rising demand for NDT and simulation services to help make next-gen aircraft are helping the region grow. Latin America is slowly building up its testing infrastructure to keep up with global aerospace supply chains, especially in Brazil's Embraer-driven ecosystem. The Middle East is making itself more competitive by putting money into MRO (maintenance, repair, overhaul) facilities and defense aerospace projects. Africa is still in the early stages, focusing on safety compliance and partnerships with global testing providers. Overall, new regions are using government policies, partnerships with original equipment manufacturers (OEMs), and defense spending to improve their aerospace testing abilities.

The aerospace testing market experiences intense competition due to rising demand for safety, reliability, and regulatory compliance in aircraft systems. Vendors compete by offering advanced testing solutions, automation, and simulation technologies that reduce costs and development timelines. Market rivalry is fueled by innovation in digital testing, non-destructive testing, and environmental simulations. Regional players challenge global leaders by providing cost-effective solutions, while collaborations and technology upgrades drive differentiation. High entry barriers and stringent certifications further intensify the competitive landscape.

| Report Attribute | Details |

|---|---|

| Market size value in 2025 | USD 6.37 Billion |

| Market size forecast in 2032 | USD 8.71 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 4.6% from 2025 to 2032 |

| Number of Pages | 608 |

| Number of Tables | 523 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Application, Testing Type, End Use, Aviation Type, Region |

| Country scope |

|

| Companies Included | Element Materials Technology (Temasek Holdings), SGS S.A., Intertek Group PLC, Applus+ Group, The Boeing Company, Lockheed Martin Corporation, Rolls-Royce Plc (Rolls-Royce Holdings Plc), Airbus SE, Mistras Group, Inc. and Bureau Veritas S.A. |

By Application

By Testing Type

By End Use

By Aviation Type

By Geography

This Market size is expected to reach USD 8.71 Billion billion by 2032.

The aerospace testing market is projected to grow at a CAGR of 4.6% between 2025 and 2032.

Rising demand for aircraft safety and reliability driven by technological advancements in aerospace components and systems.

Element Materials Technology (Temasek Holdings), SGS S.A., Intertek Group PLC, Applus+ Group, The Boeing Company, Lockheed Martin Corporation, Rolls-Royce Plc (Rolls-Royce Holdings Plc), Airbus SE, Mistras Group, Inc. and Bureau Veritas S.A.

The OEMs segment is leading the Global Aerospace Testing Market by End Use in 2024, thereby, achieving a market value of $2.23 billion by 2032.

The North America region dominated the Global Aerospace Testing Market by Region in 2024, and would continue to be a dominant market till 2032; thereby, achieving a market value of $3.17 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges