USA Treadmill Market Size, Share & Trends Analysis Report By Product Type (Electronic, and Manual), By End Use (Commercial, Residential, and Institutional), By Distribution Channel, Outlook and Forecast, 2023 - 2030

Published Date : 27-Mar-2024 | Pages: 71 | Formats: PDF |

COVID-19 Impact on the US Treadmill Market

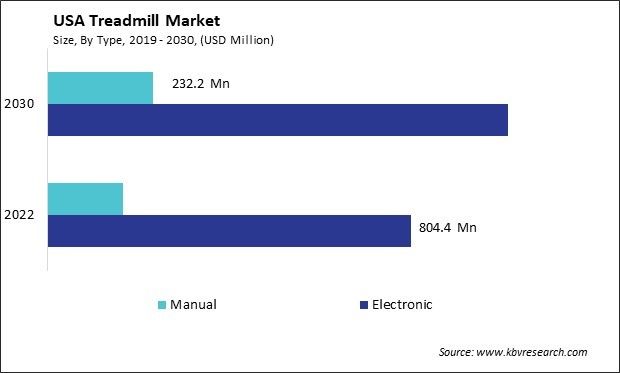

The USA Treadmill Market size is expected to reach $1.3 billion by 2030, rising at a market growth of 3.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,908.0 thousand units, experiencing a growth of 3.0% (2019-2022).

The treadmill market in the United States is a highly competitive and dynamic industry driven by the increasing awareness of health and fitness among the population. Numerous companies are actively involved in designing, manufacturing, and selling treadmills to cater to American consumers' diverse needs and preferences.

The pandemic-induced shift towards remote working influenced the treadmill market. With more people working from home, there was an increased focus on creating home-based fitness setups, further driving the demand for treadmills. The global health crisis led to lockdowns, restrictions on public gatherings, and the temporary closure of fitness facilities. As a result, there was a surge in demand during COVID-19 pandemic for home exercise equipment, including treadmills, as individuals sought alternative ways to stay active during the lockdowns.

Manufacturers in the U.S. are innovating to meet the evolving needs of consumers, introducing features such as interactive workouts, virtual training programs, and advanced tracking capabilities. This technological integration enhances the overall fitness experience, making treadmills appealing for those looking to shed excess weight and improve their overall health.

Market Trends

Treadmill Sales Surge Amidst Rising Obesity Rates

In the United States, the treadmill market has witnessed a surge in sales, paralleling the concerning rise in obesity rates across the nation. The obesity epidemic in the U.S. has become a pervasive health issue, with a significant portion of the population grappling with weight-related challenges. Sedentary lifestyles, high-calorie diets, and a lack of physical activity have contributed to the expansion of waistlines nationwide. As a result, individuals are increasingly turning to fitness equipment, such as treadmills, to address their health concerns.

Treadmills have gained immense popularity as a convenient and effective means of engaging in cardiovascular exercise within the confines of one's home. The demand for these machines has surged as Americans seek accessible options to incorporate physical activity into their daily routines. The treadmill market has responded to this demand with various models catering to different fitness levels and preferences. Health-conscious consumers are investing in treadmills as a proactive measure to combat the adverse effects of a sedentary lifestyle and obesity.

According to the Centers for Disease Control and Prevention, the surge in obesity rates in the United States has led to a substantial economic impact, with the estimated annual medical cost reaching nearly $173 billion in 2019 dollars. Adults grappling with obesity incurred medical expenses that were $1,861 higher compared to individuals with a healthy weight. This escalating concern over obesity has created a ripple effect, contributing to a burgeoning industry for treadmill market in the U.S. Hence, as Americans prioritize health, manufacturers' innovations in home fitness equipment, particularly treadmills, signify a concerted effort to address the nation's health challenges through accessible and advanced exercise solutions.

Rise Of Treadmills by Booming Gym Culture

In the United States, the treadmill market has experienced a significant surge in popularity, driven by the booming gym culture that continues to grow nationwide. This fitness trend reflects a societal shift towards a greater emphasis on health and well-being, with an increasing number of Americans adopting active lifestyles. One of the key drivers behind the expanding treadmill market is the rising awareness of the importance of regular exercise in maintaining a healthy lifestyle. Americans increasingly prioritize fitness, leading to a surge in gym memberships and home workout equipment purchases.

Treadmills, in particular, have gained immense popularity due to their versatility and convenience. The gym culture in the U.S. plays a pivotal role in shaping the treadmill market. Gyms, both large chains and boutique studios, have become social hubs where individuals gather to engage in various fitness activities. Treadmills have emerged as a staple in these establishments, catering to the diverse needs of fitness enthusiasts, from casual walkers to avid runners.

The competitive nature of the gym culture, coupled with a desire for advanced workout options, has fueled the demand for high-tech treadmills with features such as interactive screens, virtual training programs, and personalized fitness metrics. Thus, the treadmill market in the U.S. is thriving, propelled by the robust gym culture and a societal focus on health and fitness. As Americans prioritize their well-being, the demand for innovative and technologically advanced treadmills will likely persist, making it a dynamic and evolving segment within the broader fitness industry.

Competition Analysis

The treadmill market in the United States is a highly competitive and dynamic industry driven by the increasing awareness of health and fitness among the population. Numerous companies are actively involved in designing, manufacturing, and selling treadmills to cater to American consumers' diverse needs and preferences. One of the key players in the U.S. treadmill market is Peloton. Peloton is renowned for its innovative approach to fitness equipment, offering high-tech treadmills equipped with interactive screens for live and on-demand fitness classes. The company has gained a significant industry share by providing a unique and engaging fitness experience, combining hardware and software to create a comprehensive workout ecosystem.

NordicTrack is another prominent player in the U.S. treadmill market. Known for its extensive range of fitness equipment, NordicTrack offers a variety of treadmills with features such as incline and decline options, touchscreens, and interactive training programs. The brand has established a strong presence in the U.S. by focusing on high-end and budget-friendly treadmill options, appealing to a broad customer base.

Life Fitness is a well-established company that has been a leader in the fitness equipment industry for decades. With a commitment to creating durable and high-performance treadmills, Life Fitness targets commercial and residential industry. Their treadmills are known for their durability, advanced technology integration, and user-friendly interfaces, making them popular among fitness enthusiasts and gym owners.

ProForm, a brand under ICON Health & Fitness, is recognized for its affordable yet feature-rich treadmills. ProForm's products often incorporate the latest technology trends, such as iFit compatibility and immersive workout experiences. The brand caters to a diverse customer base, making fitness accessible to a wider audience.

Precor, now a part of Peloton, has a strong presence in the U.S. treadmill market. The company is known for its high-quality commercial-grade treadmills, commonly found in fitness centers, hotels, and corporate gyms. Precor's focus on durability and performance has contributed to its success in the commercial fitness sector. These companies operate in a competitive landscape where product innovation, technological integration, and customer engagement are crucial for success. The U.S. treadmill market has seen a surge in demand, especially with the rise of home-based fitness trends.

List of Key Companies Profiled

- Icon Health & Fitness, Inc. (IHF Holding, Inc.)

- Nautilus, Inc.

- True Fitness Technology, Inc.

- Life Fitness

- Technogym S.p.A

- Impulse (Qingdao) Health Tech Ltd. Co.

- LANDICE, Inc.

- Woodway USA, Inc.

- Johnson Health Tech Co., Ltd.

- TrueForm Runner

US Treadmill Market Report Segmentation

By Product Type

- Electronic

- Manual

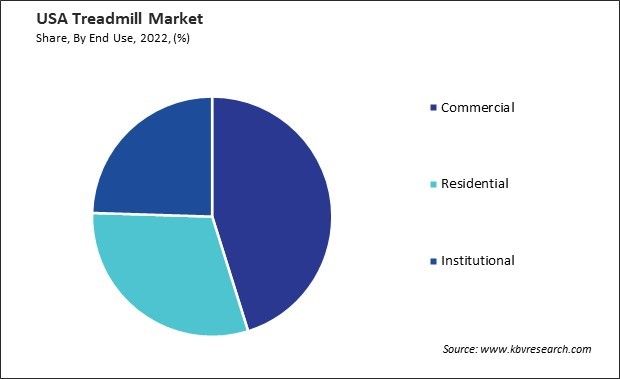

By End Use

- Commercial

- Residential

- Institutional

By Distribution Channel

- Specialty Store

- Franchise Store

- Online Store

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Treadmill Market, by Product Type

1.4.2 USA Treadmill Market, by End Use

1.4.3 USA Treadmill Market, by Distribution Channel

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.3 Porter’s Five Forces Analysis

Chapter 3. Strategy Deployed in Treadmill Market

Chapter 4. US Treadmill Market

4.1 US Treadmill Market by Product Type

4.2 US Treadmill Market by End Use

4.3 US Treadmill Market by Distribution Channel

Chapter 5. Company Profiles – Global Leaders

5.1 Icon Health & Fitness, Inc. (IHF Holding, Inc.)

5.1.1 Company Overview

5.1.2 SWOT Analysis

5.2 Nautilus, Inc.

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Segmental and Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Partnerships, Collaborations, and Agreements:

5.2.5.2 Product Launches and Product Expansions:

5.2.5.3 Acquisition and Mergers:

5.2.6 SWOT Analysis

5.3 True Fitness Technology, Inc.

5.3.1 Company Overview

5.3.2 Recent strategies and developments:

5.3.2.1 Acquisition and Mergers:

5.3.3 SWOT Analysis

5.4 Life Fitness

5.4.1 Company Overview

5.4.2 Recent strategies and developments:

5.4.2.1 Product Launches and Product Expansions:

5.4.3 SWOT Analysis

5.5 Technogym S.p.A.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 SWOT Analysis

5.6 Impulse (Qingdao) Health Tech Ltd. Co.

5.6.1 Company Overview

5.6.2 SWOT Analysis

5.7 LANDICE, Inc.

5.7.1 Company Overview

5.7.2 SWOT Analysis

5.8 Woodway USA, Inc.

5.8.1 Company Overview

5.8.2 Recent strategies and developments:

5.8.2.1 Partnerships, Collaborations, and Agreements:

5.8.3 SWOT Analysis

5.9 Johnson Health Tech Co., Ltd.

5.9.1 Company Overview

5.9.2 Recent strategies and developments:

5.9.2.1 Acquisition and Mergers:

5.9.3 SWOT Analysis

5.10. TrueForm Runner

5.10.1 Company Overview

5.10.2 SWOT Analysis

TABLE 2 US Treadmill Market, 2023 - 2030, USD Million

TABLE 3 US Treadmill Market, 2019 - 2022, Thousand Units

TABLE 4 US Treadmill Market, 2023 - 2030, Thousand Units

TABLE 5 US Treadmill Market by Product Type, 2019 - 2022, USD Million

TABLE 6 US Treadmill Market by Product Type, 2023 - 2030, USD Million

TABLE 7 US Treadmill Market by Product Type, 2019 - 2022, Thousand Units

TABLE 8 US Treadmill Market by Product Type, 2023 - 2030, Thousand Units

TABLE 9 US Treadmill Market by End Use, 2019 - 2022, USD Million

TABLE 10 US Treadmill Market by End Use, 2023 - 2030, USD Million

TABLE 11 US Treadmill Market by End Use, 2019 - 2022, Thousand Units

TABLE 12 US Treadmill Market by End Use, 2023 - 2030, Thousand Units

TABLE 13 US Treadmill Market by Distribution Channel, 2019 - 2022, USD Million

TABLE 14 US Treadmill Market by Distribution Channel, 2023 - 2030, USD Million

TABLE 15 US Treadmill Market by Distribution Channel, 2019 - 2022, Thousand Units

TABLE 16 US Treadmill Market by Distribution Channel, 2023 - 2030, Thousand Units

TABLE 17 Key Information – Icon Helath Fitness, inc.

TABLE 18 Key Information – Nautilas, Inc.

TABLE 19 Key Information – True Fitness Technology, Inc.

TABLE 20 Key Information – Life Fitness.

TABLE 21 Key Information – Technogym S.p.A.

TABLE 22 Key Information – Impulse (Qingdao) Health Tech Ltd. Co.

TABLE 23 Key Information – LANDICE, Inc.

TABLE 24 Key Information – Woodway USA, Inc.

TABLE 25 Key Information – johnson health tech co., ltd

TABLE 26 Key Information – TrueForm Runner

List of Figures

FIG 1 Methodology for the research

FIG 2 US Treadmill Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Treadmill Market

FIG 4 Porter’s Five Forces Analysis - Treadmill Market

FIG 5 US Treadmill Market Share by Product Type, 2022

FIG 6 US Treadmill Market Share by Product Type, 2022

FIG 7 US Treadmill Market by Product Type, 2019 - 2030, USD Million

FIG 8 US Treadmill Market Share by End Use, 2022

FIG 9 US Treadmill Market Share by End Use, 2030

FIG 10 US Treadmill Market by End Use, 2019 - 2030, USD Million

FIG 11 US Treadmill Market Share by Distribution Channel, 2022

FIG 12 US Treadmill Market Share by Distribution Channel, 2030

FIG 13 US Treadmill Market by Distribution Channel, 2019 - 2030, USD Million

FIG 14 SWOT Analysis: Icon Health & Fitness, Inc.

FIG 15 SWOT Analysis: Nautilus, Inc.

FIG 16 SWOT Analysis: True Fitness Technology, Inc.

FIG 17 SWOT Analysis: Life Fitness

FIG 18 SWOT Analysis: Technogym S.p.A.

FIG 19 SWOT Analysis: Impulse (Qingdao) Health Tech Ltd. Co.

FIG 20 SWOT Analysis: LANDICE, Inc.

FIG 21 SWOT Analysis: Woodway USA, Inc.

FIG 22 SWOT Analysis: Johnson Health Tech Co., Ltd

FIG 23 SWOT Analysis: TrueForm Runner