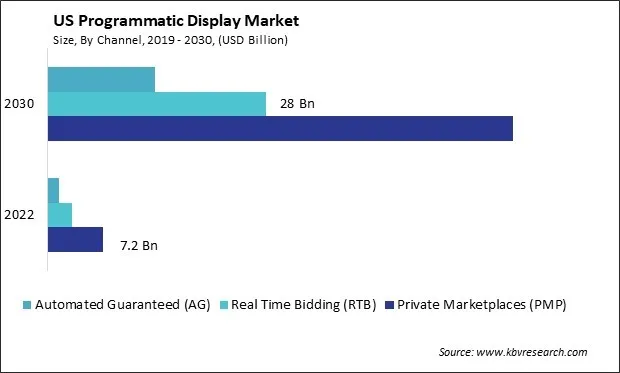

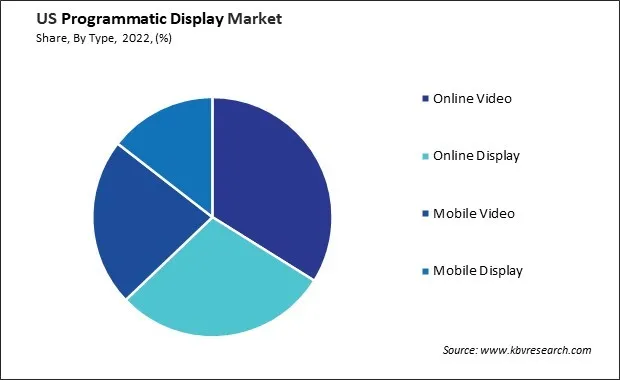

US Programmatic Display Market Size, Share & Trends Analysis Report By Channel (Private Marketplaces (PMP), Real Time Bidding (RTB), and Automated Guaranteed (AG)), By Type, and Forecast, 2023 - 2030

Published Date : 28-Oct-2024 |

Pages: 76 |

Report Format: PDF + Excel |

COVID-19 Impact on the US Programmatic Display Market

The US Programmatic Display Market size is expected to reach $102.3 billion by 2030, rising at a market growth of 31.3% CAGR during the forecast period.

The programmatic display market in the United States has grown substantially over the past few years. One key factor contributing to this growth is the widespread use of data-driven insights for audience targeting. Advertisers leverage vast amounts of data to identify and reach their target demographics with relevant content, enhancing their campaigns' effectiveness. Additionally, accessing a wide range of ad inventory across various websites and platforms further expands the reach and impact of programmatic display advertising.

Another driving force behind the expansion of the programmatic display market is the increasing popularity of mobile advertising. According to the United States Census Bureau, in 2021, tablet ownership in U.S. households with children surged by 22 % compared to those without children. This indicates a significant increase in the adoption of tablets within households with kids. Overall, 64% of U.S. households possessed a tablet in 2021, showcasing a widespread acceptance of this technology. With the proliferation of smartphones and tablets, Americans spend more time on mobile devices, creating new opportunities for advertisers to engage with their audience through mobile-optimized ads.

Furthermore, artificial intelligence and machine learning advancements have revolutionized programmatic advertising, enabling more sophisticated targeting and optimization capabilities in the U.S. By analyzing vast amounts of data in real-time, AI-powered algorithms identify patterns and trends, allowing advertisers to deliver highly personalized ads that resonate with their audience.

However, COVID-19 has significantly impacted the advertising industry, including the programmatic display market in the U.S. The pandemic has led to shifts in consumer behavior, with more people spending time online due to lockdowns and social distancing measures. As a result, there has been a surge in digital media consumption, creating challenges and opportunities for advertisers. While some industries have scaled back their advertising spend in response to economic uncertainty, others have increased their investment in digital channels to reach consumers spending more time online.

Market Trends

Rising adoption of programmatic display in financial services

The financial services sector in the United States has been experiencing a significant shift in marketing strategies, with a rising adoption of programmatic display advertising. One of the key drivers behind the growing adoption of programmatic display in the financial services industry is the increasing emphasis on precision targeting and personalized advertising. Financial institutions, including banks, insurance companies, and investment firms, leverage U.S. consumer data to create highly targeted campaigns that resonate with their target audiences.

According to the Select USA, in 2020, finance and insurance represented 8.3 % of U.S. GDP. In 2019, the United States exported $151.9 billion in financial services and insurance and had a $60 billion surplus in financial services and insurance trade. U.S. companies deliver tailored messages to specific demographics, interests, and behaviors using programmatic technology, ultimately driving higher engagement and conversion rates. Moreover, the ability to reach Americans across multiple devices and channels is another factor driving the adoption of programmatic displays in the financial sector. With consumers accessing financial information and services through various platforms such as desktops, smartphones, and tablets, advertisers need a seamless way to deliver consistent messaging across these touchpoints.

Additionally, the demand for greater transparency and accountability in advertising spending prompts financial services companies to embrace programmatic display. This level of transparency allows advertisers to optimize their campaigns in real time, reallocating the budget to the most effective channels and placements. Therefore, the financial services sector in the United States is increasingly turning to programmatic display advertising for precision targeting, personalized messaging, multi-channel reach, and enhanced transparency, driving higher engagement and optimization capabilities.

Increasing availability of data and analytics tools

In recent years, the programmatic display market in the United States has witnessed a significant surge in the availability of data and analytics tools, reshaping the digital advertising landscape. One of the key drivers behind this trend is the proliferation of data sources. With the rise of the internet and the widespread adoption of connected devices, there has been an explosion of data generated from various online activities such as browsing behavior, social media interactions, and transaction histories.

Moreover, advancements in analytics tools have empowered U.S. advertisers to extract actionable insights from this vast data pool. Sophisticated algorithms and machine learning techniques enable advertisers to analyze consumer behavior patterns, identify trends, and predict future outcomes accurately. This helps advertisers better understand their audience and also enables them to optimize their ad placements, creative messaging, and bidding strategies in real time.

Furthermore, integrating data and analytics into programmatic advertising platforms has streamlined the campaign management process. U.S. advertisers access comprehensive dashboards and reporting tools that provide real-time performance metrics and actionable recommendations. Hence, the surge in data availability and advancements in analytics tools have revolutionized the programmatic display market in the United States, empowering advertisers to make data-driven decisions and optimize their campaigns effectively.

Competition Analysis

The programmatic display market in the United States is a dynamic and rapidly evolving sector within the broader digital advertising landscape. One of the leading companies in the programmatic display market is Google, with its advertising platform, Google Ads. Leveraging its vast user data and sophisticated targeting algorithms, Google Ads allows advertisers to reach their target audiences across various websites, mobile apps, and other digital channels. With access to a massive network of publishers through Google Display Network, advertisers deploy highly targeted and personalized campaigns at scale, driving brand awareness and performance.

Another major player in the programmatic display space is Facebook, which has its advertising platform, Facebook Ads. With over 2.8 billion monthly active users, Facebook offers advertisers unparalleled reach and targeting capabilities. Through its advanced audience segmentation tools and machine learning algorithms, advertisers create highly tailored ad campaigns that resonate with their target demographics. Additionally, Facebook's acquisition of Instagram has expanded its advertising reach, allowing advertisers to engage with users across multiple popular social media platforms.

In addition to tech giants like Google and Facebook, numerous specialized ad tech companies focus exclusively on programmatic advertising. One such company is The Trade Desk, a leading demand-side platform (DSP) connecting advertisers with ad inventory across various publishers and exchanges. The Trade Desk offers advertisers advanced targeting options, real-time bidding capabilities, and detailed analytics to optimize their campaigns for maximum performance and ROI.

Another notable player in the programmatic display market is Amazon Advertising, which has rapidly grown to become a major force in digital advertising. With its vast e-commerce ecosystem and rich consumer data, Amazon offers advertisers unique opportunities to target shoppers at various stages of the purchase journey. Through its self-serve advertising platform, Amazon Advertising allows advertisers to create and manage display ad campaigns across Amazon-owned properties and third-party websites and apps.

Aside from these major players, many ad tech companies also provide specialized solutions and services within the programmatic display ecosystem. These companies include data management platforms (DMPs) like Adobe Audience Manager, supply-side platforms (SSPs) like Rubicon Project, and ad exchanges like OpenX. Each of these companies plays a crucial role in facilitating the buying and selling of ad inventory in real time, helping advertisers and publishers maximize the value of their digital advertising investments.

Overall, the programmatic display market in the United States is highly competitive and constantly evolving, driven by technological advancements, changes in consumer behavior, and shifts in advertising trends. As companies continue to innovate and adapt to these changes, the landscape of programmatic advertising likely remain fluid, with new players entering the programmatic display market and existing players expanding their offerings to stay ahead of the competition.

List of Key Companies Profiled

- AT&T, Inc.

- Verizon Communications, Inc.

- ROKU, INC.

- Google LLC (Alphabet Inc.)

- Adobe, Inc.

- Adform

- Magnite, Inc.

- MediaMath Inc.

- Connexity, Inc. (Taboola.com Ltd)

- Yahoo, Inc.

US Programmatic Display Market Report Segmentation

By Channel

- Private Marketplaces (PMP)

- Real Time Bidding (RTB)

- Automated Guaranteed (AG)

By Type

- Online Video

- Online Display

- Mobile Video

- Mobile Display

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Programmatic Display Market, by Channel

1.4.2 US Programmatic Display Market, by Type

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Opportunities

2.2.3 Market Restraints

2.2.4 Market Challenges

2.2.5 Market Trends

2.3 Porter’s Five Forces Analysis

Chapter 3. US Programmatic Display Market

3.1 US Programmatic Display Market by Channel

3.2 US Programmatic Display Market by Type

Chapter 4. Company Profiles – Global Leaders

4.1 AT&T, Inc.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expense

4.1.5 SWOT Analysis

4.2 Verizon Communications, Inc.

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Segmental Analysis

4.2.4 Recent strategies and developments:

4.2.4.1 Partnerships, Collaborations, and Agreements:

4.2.4.2 Product Launches and Product Expansions:

4.2.5 SWOT Analysis

4.3 ROKU, INC.

4.3.1 Company Overview

4.3.2 Financial Analysis

4.3.3 Segmental and Regional Analysis

4.3.4 Research & Development Expenses

4.3.5 Recent strategies and developments:

4.3.5.1 Partnerships, Collaborations, and Agreements:

4.3.5.2 Business Expansions:

4.3.6 SWOT Analysis

4.4 Google LLC (Alphabet Inc.)

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.4.4 Research & Development Expense

4.4.5 SWOT Analysis

4.5 Adobe, Inc.

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 Segmental and Regional Analysis

4.5.4 Research & Development Expense

4.5.5 SWOT Analysis

4.6 Adform

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.6.4 Research & Development Expenses

4.6.5 SWOT Analysis

4.7 Magnite, Inc.

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Regional Analysis

4.7.4 Recent strategies and developments:

4.7.4.1 Product Launches and Product Expansions:

4.7.5 SWOT Analysis

4.8 MediaMath Inc.

4.8.1 Company Overview

4.8.2 SWOT Analysis

4.9 Connexity, Inc. (Taboola.com Ltd)

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Regional Analysis

4.9.4 Research & Development Expenses

4.9.5 SWOT Analysis

4.10. Yahoo, Inc.

4.10.1 Company Overview

4.10.2 SWOT Analysis

TABLE 2 US Programmatic Display Market, 2023 - 2030, USD Million

TABLE 3 US Programmatic Display Market by Channel, 2019 - 2022, USD Million

TABLE 4 US Programmatic Display Market by Channel, 2023 - 2030, USD Million

TABLE 5 US Programmatic Display Market by Type, 2019 - 2022, USD Million

TABLE 6 US Programmatic Display Market by Type, 2023 - 2030, USD Million

TABLE 7 Key Information – AT&T, Inc.

TABLE 8 key information – Verizon Communications, Inc.

TABLE 9 Key Information – ROKU, INC.

TABLE 10 Key Information – Google LLC

TABLE 11 Key Information – Adobe, Inc.

TABLE 12 Key Information – Adform

TABLE 13 Key Information – Magnite, Inc.

TABLE 14 Key Information – MediaMath Inc.

TABLE 15 Key Information – Connexity, Inc.

TABLE 16 Key Information – Yahoo, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Programmatic Display Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Programmatic Display Market

FIG 4 Porter’s Five Forces Analysis - Programmatic Display Market

FIG 5 US Programmatic Display Market share by Channel, 2022

FIG 6 US Programmatic Display Market share by Channel, 2030

FIG 7 US Programmatic Display Market by Channel, 2019 - 2030, USD Million

FIG 8 US Programmatic Display Market share by Type, 2022

FIG 9 US Programmatic Display Market share by Type, 2030

FIG 10 US Programmatic Display Market by Type, 2019 - 2030, USD Million

FIG 11 SWOT Analysis: AT&T, Inc.

FIG 12 SWOT Analysis: Verizon Communications, Inc.

FIG 13 SWOT analysis: ROKU, INC.

FIG 14 SWOT Analysis: Google LLC

FIG 15 SWOT Analysis: Adobe, Inc.

FIG 16 SWOT analysis: Adform

FIG 17 SWOT analysis: Magnite, Inc.

FIG 18 SWOT analysis: MediaMath Inc.

FIG 19 SWOT analysis: Connexity, Inc.

FIG 20 SWOT analysis: Yahoo, Inc.