USA Optical Sensors Market Size, Share & Trends Analysis Report By Type (Intrinsic Sensor, and Extrinsic Sensor), By Application, By Sensor Type, By End-use, and Forecast, 2023 - 2030

Published Date : 22-Apr-2024 | Pages: 94 | Formats: PDF |

COVID-19 Impact on the US Optical Sensors Market

The USA Optical Sensors Market size is expected to reach $9.4 Billion by 2030, rising at a market growth of 8.2% CAGR during the forecast period.

The optical sensors market in the United States has witnessed substantial growth in recent years, driven by technological advancements, increasing demand for automation, and the growing adoption of smart devices across various industries. Optical sensors are integral to facial recognition technology in consumer electronics, enabling secure authentication and personalized user experiences. Additionally, the automotive industry's increasing focus on advanced driver assistance systems (ADAS) and autonomous vehicles has led to a surge in the adoption of LiDAR sensors, which rely on optical sensing technology for accurate mapping and object detection.

One of the primary drivers of the optical sensors market in the U.S. is the rising use of these sensors in smartphones, cameras, and other consumer electronic devices. The demand for high-resolution imaging, gesture recognition, and augmented reality features in smartphones has fueled the integration of advanced optical sensors. Additionally, the automotive sector has embraced optical sensors for applications like driver assistance systems, parking assistance, and gesture-controlled infotainment systems, contributing significantly to the industry’s growth.

The positive impact of COVID-19 on the optical sensors market in the U.S. has been notable. The pandemic accelerated digital transformation across various sectors, increasing reliance on technologies incorporating optical sensors. For instance, the demand for touchless technologies, such as gesture-controlled interfaces and contactless biometric systems, surged as hygiene and safety became paramount. This trend has driven the adoption of optical sensors in public spaces, healthcare facilities, and retail environments.

Market Trends

Expansion of manufacturing industry

The optic sensors market in the United States has witnessed a remarkable expansion, fueled primarily by the burgeoning manufacturing industry's adoption of cutting-edge technologies. One of the key drivers behind the growth of optic sensors in the U.S. manufacturing sector is the increasing demand for advanced sensing solutions to optimize production processes. The ability of these sensors to provide real-time data and feedback contributes to the reduction of defects and the enhancement of overall product quality in the U.S.

According to the National Institutes of Standards and Technology, in 2022, the manufacturing sector played a significant role in the U.S. economy, contributing $2.3 trillion, which accounted for 11.4% of the total U.S. This underscores the sector's pivotal role. Similarly, in the context of the industrial sensors market in the U.S., it played a substantial role, contributing significantly to the country's economic landscape.

In recent years, the aerospace and defense sectors in the United States have witnessed a substantial surge in the demand for optical sensors market, marking a significant evolution in the technological landscape. Technological advancements in optical sensor capabilities, such as improved resolution, sensitivity, and miniaturization, have spurred their incorporation into next-generation defense systems. The U.S. Department of Defense (DoD) has actively invested in research and development initiatives to enhance optical sensor technologies, fostering innovation and maintaining a competitive edge in the global defense landscape.

According to the International Trade Administration, the U.S. aerospace sector continues to produce the highest trade balance ($77.6 billion in 2019) and the second-highest level of exports ($148 billion) among all manufacturing industries. While total shipments of U.S. aircraft and parts witnessed a rise from 2010 to 2018, reaching $162 billion for nondefense shipments. Conversely, defense aircraft and parts shipments exhibited a more consistent trend over the past decade. This highlights the resilience and significance of the aerospace industry in the U.S. economy.

Moreover, the push towards energy efficiency and sustainability has led to the incorporation of optic sensors in the U.S. manufacturing industry's drive for green practices. These sensors contribute to the optimization of energy consumption, waste reduction, and environmental monitoring. Thus, the optic sensors market in the United States has experienced notable growth, driven by the manufacturing sector's adoption of advanced sensing solutions for process optimization.

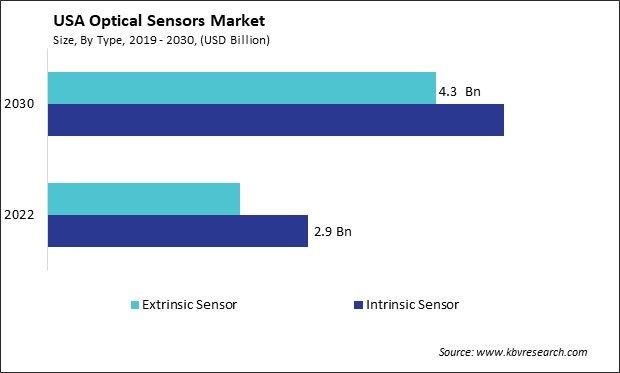

Increasing demand for intrinsic optical sensors

The optical sensors market in the United States has witnessed significant growth, with intrinsic optical sensors playing a pivotal role in various industries. The growing emphasis on environmental monitoring and sustainability has fueled the demand for intrinsic optical sensors in the U.S. These sensors are employed in environmental monitoring systems to measure parameters like air and water quality, contributing to efforts to understand better and mitigate the impact of human activities on the environment.

In industrial applications, intrinsic optical sensors are contributing to implementing "smart factories" in the U.S. These sensors are integrated into machinery and production lines to gather real-time data on processes, enabling better control and optimization of manufacturing operations. This enhances efficiency and also reduces downtime and maintenance costs in the U.S. Moreover, the U.S. government's focus on infrastructure development and smart city initiatives has created opportunities for intrinsic optical sensors in urban planning and management. These sensors are deployed for traffic monitoring, pedestrian safety, and environmental sensing, creating more sustainable and efficient urban environments.

In research and development, U.S. universities and technology companies are actively pushing the boundaries of intrinsic optical sensor capabilities. Ongoing research explores new materials, improved sensing techniques, and miniaturization, paving the way for future innovations in this dynamic field. Therefore, the United States is experiencing robust growth in the optical sensors market, driven by the widespread adoption of intrinsic optical sensors across industries, particularly in environmental monitoring, smart factories, and urban planning.

Competition Analysis

The United States plays a pivotal role in the optical sensors market, with numerous companies contributing to the development and advancement of this technology. One prominent player in the U.S. optical sensors market is Texas Instruments Incorporated. Known for its semiconductor and integrated circuit solutions, Texas Instruments manufactures optical sensors that find applications in industrial automation, automotive systems, and consumer electronics. The company's commitment to innovation and cutting-edge technology has solidified its position as a key player in the industry.

Another significant contributor to the U.S. optical sensors market is Analog Devices, Inc. The company designs and manufactures high-performance analog and digital signal processing solutions. Analog Devices' optical sensors cater to diverse applications, including healthcare, industrial automation, and automotive safety systems. Their state-of-the-art sensor technologies contribute to the development of advanced sensing solutions.

Lumentum Holdings Inc. is a leader in optical and photonic products, playing a crucial role in the U.S. The company's optical sensors find applications in telecommunications, data centers, and 3D sensing technologies. Lumentum's cutting-edge optical components contribute to the evolution of communication networks and emerging technologies, making it a key player in the industry.

Companies like Honeywell International Inc. are significantly contributing to healthcare and life sciences. Honeywell's optical sensors are used in medical and diagnostic equipment, providing precision and reliability. These sensors contribute to advancing healthcare technologies, ensuring accurate data for patient monitoring and diagnostics.

The automotive sector sees the involvement of companies like ON Semiconductor Corporation. The company specializes in energy-efficient semiconductor solutions, including optical sensors in automotive applications. These sensors contribute to developing advanced driver assistance systems (ADAS) and are crucial in improving vehicle safety.

The U.S. optical sensors market also witnesses the active participation of FLIR Systems, Inc., a company known for its thermal imaging solutions. FLIR's optical sensors, particularly those utilizing infrared technology, are applied in various sectors, including defense, surveillance, and industrial automation. These sensors enable users to detect and visualize thermal variations in their environments. Thus, the U.S. optical sensors market is characterized by diverse and innovative companies contributing to technological advancements across various industries.

List of Key Companies Profiled

- Honeywell International, Inc.

- Keyence Corporation

- Amphenol Corporation

- Cisco Systems, Inc.

- Texas Instruments, Inc.

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Rockwell Automation, Inc.

- Sick AG

- ams-OSRAM AG

US Optical Sensors Market Report Segmentation

By Type

- Intrinsic Sensor

- Extrinsic Sensor

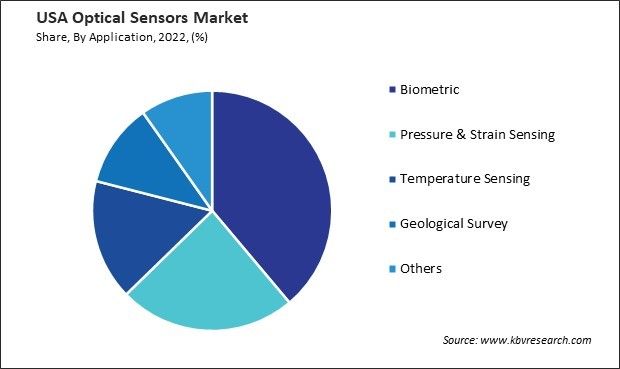

By Application

- Biometric

- Pressure & Strain Sensing

- Temperature Sensing

- Geological Survey

- Others

By Sensor Type

- Optical Temperature Sensors

- Photoelectric Sensor

- Fiber Optic Sensor

- Biomedical Sensors

- Displacement & Position Sensors

- Others

By End-use

- Consumer Electronics

- Healthcare

- Energy & Utility

- Manufacturing

- Automotive & Transportation

- Aerospace & Defense

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 US Optical Sensors Market, by Type

1.4.2 US Optical Sensors Market, by Application

1.4.3 US Optical Sensors Market, by Sensor Type

1.4.4 US Optical Sensors Market, by End-use

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.1.1.2 Competition Analysis

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.2.3 Market Opportunities

2.2.4 Market Challenges

2.2.1 Market Trends

Chapter 3. Competition Analysis – Global

3.1 Market Share Analysis, 2022

3.2 Porter’s Five Forces Analysis

Chapter 4. US Optical Sensors Market

4.1 US Optical Sensors Market by Type

4.2 US Optical Sensors Market by Application

4.3 US Optical Sensors Market by Sensor Type

4.4 US Optical Sensors Market by End-use

Chapter 5. Company Profiles -Global Leaders

5.1 Honeywell International, Inc.

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expenses

5.1.5 SWOT Analysis

5.2 Keyence Corporation

5.2.1 Company Overview

5.2.2 Financial Analysis

5.2.3 Regional Analysis

5.2.4 Research & Development Expenses

5.2.5 Recent strategies and developments:

5.2.5.1 Product Launches and Product Expansions:

5.2.6 SWOT Analysis

5.3 Amphenol Corporation

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Acquisition and Mergers:

5.3.6 SWOT Analysis

5.4 Cisco Systems, Inc.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Regional Analysis

5.4.4 Research & Development Expense

5.4.5 SWOT Analysis

5.5 Texas Instruments, Inc.

5.5.1 Company Overview

5.5.2 Financial Analysis

5.5.3 Segmental and Regional Analysis

5.5.4 Research & Development Expense

5.5.5 SWOT Analysis

5.6 Renesas Electronics Corporation

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental and Regional Analysis

5.6.4 Research & Development Expense

5.6.5 SWOT Analysis

5.7 STMicroelectronics N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 SWOT Analysis

5.8 Rockwell Automation, Inc.

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental and Regional Analysis

5.8.4 Research & Development Expenses

5.8.5 SWOT Analysis

5.9 Sick AG

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Product Launches and Product Expansions:

5.9.6 SWOT Analysis

5.1 ams-OSRAM AG

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expense

5.10.5 Recent strategies and developments:

5.10.5.1 Product Launches and Product Expansions:

5.10.6 SWOT Analysis

TABLE 2 US Optical Sensors Market, 2023 - 2030, USD Million

TABLE 3 US Optical Sensors Market by Type, 2019 - 2022, USD Million

TABLE 4 US Optical Sensors Market by Type, 2023 - 2030, USD Million

TABLE 5 US Optical Sensors Market by Type, 2019 - 2022, ThoUSnd Units

TABLE 6 US Optical Sensors Market by Type, 2023 - 2030, ThoUSnd Units

TABLE 7 US Optical Sensors Market by Application, 2019 - 2022, USD Million

TABLE 8 US Optical Sensors Market by Application, 2023 - 2030, USD Million

TABLE 9 US Optical Sensors Market by Sensor Type, 2019 - 2022, USD Million

TABLE 10 US Optical Sensors Market by Sensor Type, 2023 - 2030, USD Million

TABLE 11 US Optical Sensors Market by Sensor Type, 2019 - 2022, ThoUSnd Units

TABLE 12 US Optical Sensors Market by Sensor Type, 2023 - 2030, ThoUSnd Units

TABLE 13 US Optical Sensors Market by End-use, 2019 - 2022, USD Million

TABLE 14 US Optical Sensors Market by End-use, 2023 - 2030, USD Million

TABLE 15 US Optical Sensors Market by End-use, 2019 - 2022, ThoUSnd Units

TABLE 16 US Optical Sensors Market by End-use, 2023 - 2030, ThoUSnd Units

TABLE 17 Key Information – Honeywell International, Inc.

TABLE 18 key information – Keyence Corporation

TABLE 19 key information – Amphenol Corporation

TABLE 20 Key Information – Cisco Systems, Inc.

TABLE 21 Key Information – Texas Instruments, Inc.

TABLE 22 Key Information – Renesas Electronics Corporation

TABLE 23 Key Information – STMicroelectronics N.V.

TABLE 24 Key Information – Rockwell Automation, Inc.

TABLE 25 Key Information – Sick AG

TABLE 26 Key Information – ams-OSRAM AG

List of Figures

FIG 1 Methodology for the research

FIG 2 US Optical Sensors Market, 2019 - 2022, USD Million

FIG 3 Key Factors Impacting Optical Sensors Market

FIG 4 Market Share Analysis, 2022

FIG 5 Porter’s Five Forces Analysis – Optical sensors market

FIG 6 US Optical Sensors Market Share by Type, 2022

FIG 7 US Optical Sensors Market Share by Type, 2030

FIG 8 US Optical Sensors Market by Type, 2019 - 2030, USD Million

FIG 9 US Optical Sensors Market Share by Application, 2022

FIG 10 US Optical Sensors Market Share by Application, 2030

FIG 11 US Optical Sensors Market by Application, 2019 - 2030, USD Million

FIG 12 US Optical Sensors Market Share by Sensor Type, 2022

FIG 13 US Optical Sensors Market Share by Sensor Type, 2030

FIG 14 US Optical Sensors Market by Sensor Type, 2019 - 2030, USD Million

FIG 15 US Optical Sensors Market Share by End-use, 2022

FIG 16 US Optical Sensors Market Share by End-use, 2030

FIG 17 US Optical Sensors Market by End-use, 2019 - 2030, USD Million

FIG 18 SWOT Analysis: Honeywell international, inc.

FIG 19 SWOT Analysis: KEYENCE CORPORATION

FIG 20 SWOT Analysis: Amphenol Corporation

FIG 21 SWOT Analysis: Cisco Systems, Inc.

FIG 22 SWOT Analysis: Texas Instruments, Inc.

FIG 23 SWOT Analysis: Renesas Electronics Corporation

FIG 24 SWOT Analysis: STMicroelectronics N.V.

FIG 25 SWOT Analysis: Rockwell Automation, Inc.

FIG 26 SWOT Analysis: Sick AG

FIG 27 SWOT Analysis: ams-OSRAM AG