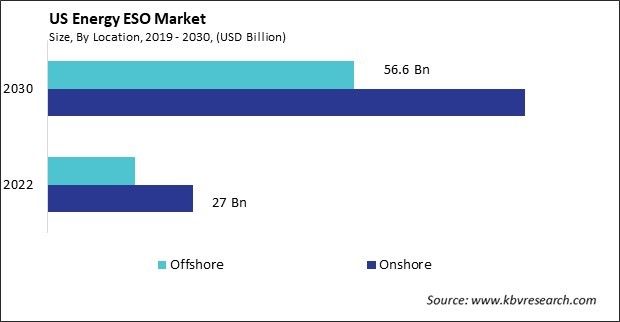

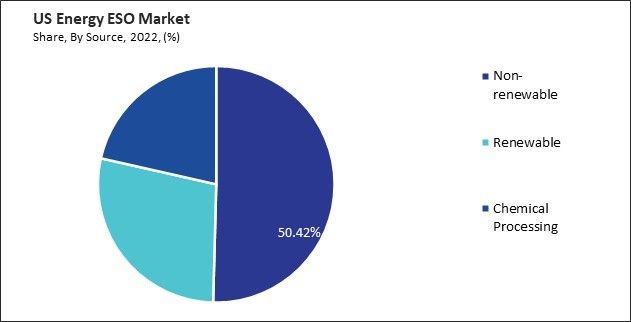

US Energy ESO Market Size, Share & Industry Trends Analysis Report By Location (Onshore, and Offshore), By Source (Non-renewable, Renewable, and Chemical Processing), By Service, Growth Forecast, 2023 - 2030

Published Date : 15-Feb-2024 | Pages: 71 | Formats: PDF |

COVID-19 Impact on the US Energy ESO Market

The USA Energy ESO Market size is expected to reach $144.8 billion by 2030, rising at a market growth of 16.4% CAGR during the forecast period.

The energy ESO market in the United States is undergoing a transformative evolution driven by the imperative for energy efficiency, grid resilience, and sustainability. This dynamic industry is characterized by a convergence of technological innovation, regulatory support, and a growing awareness of the need for comprehensive energy management solutions. Energy efficiency remains a primary driver in the U.S. energy ESO market, fueled by the dual goals of cost savings and environmental sustainability. Businesses and utilities increasingly recognize optimizing energy consumption's economic and environmental benefits. Energy efficiency measures, ranging from demand response programs to comprehensive energy management systems, are gaining prominence as firms seek to enhance operational efficiency.

Government policies and support mechanisms play a crucial role in driving the growth of the ESO market in the United States. At federal and state levels, energy storage is recognized for achieving broader energy goals, enhancing grid resilience, and facilitating the transition to a cleaner energy future. Incentives, tax credits, and regulatory frameworks are being put in place to encourage utilities, businesses, and other stakeholders to invest in and deploy energy storage optimization solutions.

As the U.S. energy ESO market continues to mature, the anticipated realization of economies of scale is poised to play a pivotal role in cost reduction. This cost-effectiveness is expected to enhance the accessibility of energy storage optimization solutions, making them more widely available for a broader range of applications. This trend aligns with the overarching goal of achieving a more sustainable and resilient energy infrastructure in the United States, with energy ESO technologies contributing significantly to grid stability and renewable energy integration. The energy ESO market is adapting to accommodate the intermittent nature of renewables, offering grid operators and businesses the tools to integrate and manage renewable energy resources effectively. The push towards a cleaner energy mix in the U.S. aligns with national and global sustainability objectives, influencing the direction of energy ESO strategies.

According to the U.S. Energy Information Administration, in 2022, renewable energy provided about 13%, or 13.18 quadrillion British thermal units (Btu), of total U.S. energy consumption. In 2022, the electric power sector reported about 61% of total U.S. renewable energy consumption, and about 21% of total U.S. electricity generation was from renewable energy sources.

Market Trends

Focus on demand response programs

Demand response (DR) programs are becoming increasingly crucial in the U.S. energy ESO market, significantly contributing to grid efficiency, reliability, and sustainability. A key trend is the growing prominence of these programs, addressing peak demand challenges and integrating renewable energy sources. Utilities utilize demand response to balance the grid, particularly during peak hours, optimizing overall system efficiency and preventing grid failures. Consumers benefit from financial incentives, such as reduced electricity costs, making participation economically attractive.

The evolving role of demand response is evident in its integration with the U.S. energy ESO market, going beyond traditional methods by incorporating energy optimization strategies like load forecasting and predictive analytics. Government support and regulatory frameworks play a significant role in fostering the growth of the DR program. Federal and state initiatives encourage demand response adoption as part of broader energy efficiency and grid modernization efforts. Incentives, mandates, and regulatory structures create an environment conducive to expanding and optimizing demand response initiatives. Thus, the increasing importance of demand response programs in the U.S. energy ESO market, driven by their role in addressing peak demand challenges and integrating renewables, underscores a pivotal trend.

Transformation of business models and sustainability integration

The U.S. energy ESO market is undergoing a transformative shift in business models, driven by changing customer expectations, technological advancements, and the move towards a resilient energy landscape. A notable trend is the emergence of Energy-as-a-Service (EaaS), enabling businesses to access energy optimization services without significant upfront investments. EaaS providers offer comprehensive solutions, lowering barriers for businesses and fostering collaborative relationships with aligned financial incentives.

Data analytics and advanced technologies like AI and ML are increasingly integrated into business models in the United States, allowing real-time analysis of vast datasets for accurate predictions, efficiency identification, and energy consumption optimization. These technologies enhance the intelligence and effectiveness of energy ESO solutions, providing clients with actionable insights and greater control.

Strategic partnerships play a pivotal role as energy ESO providers collaborate with technology companies, utilities, and stakeholders, creating comprehensive solutions in the U.S. that extend beyond traditional boundaries. These alliances promote innovation and ensure a holistic approach to energy management. Therefore, the transformative shift in the U.S. energy ESO market, marked by the rise of EaaS, integration of advanced technologies, and strategic partnerships, reflects a dynamic response to evolving customer needs and a resilient energy landscape.

Competition Analysis

The energy ESO market in the United States is characterized by robust competition driven by the imperative to address energy efficiency, grid reliability, and sustainability. Various players, from established utilities to innovative technology companies, are vying for prominence in this dynamic landscape. Major utilities and energy ESO providers, including industry giants like Duke Energy, Pacific Gas and Electric (PG&E), and Dominion Energy, are at the forefront of the competition. These established players leverage their extensive infrastructure, industry expertise, and diversified service portfolios to offer comprehensive energy ESO solutions. Technology companies specializing in energy management and optimization solutions also contribute to the competitive dynamics of the U.S. energy ESO market. Companies such as Schneider Electric, Siemens, and Honeywell are recognized for their advanced energy management systems, IoT-enabled devices, and data analytics platforms.

Companies like Enbala, EnerNOC, and CPower Energy Management are notable, offering specialized Demand Response and energy ESO solutions that cater to specific industry verticals or technological niches. The role of energy aggregators in the competition landscape is also noteworthy. Aggregators act as intermediaries between end-users and grid operators, enabling the participation of distributed energy resources (DERs) in energy ESO programs. Companies like Advanced Microgrid Solutions and Limejump are pivotal in optimizing and monetizing DERs, contributing to grid flexibility and reliability.

ESCOs, such as Ameresco and Johnson Controls, provide comprehensive energy solutions, including efficiency upgrades, infrastructure improvements, and demand response services in the U.S. Their comprehensive approach positions them as key players in the competitive energy ESO market, offering end-to-end solutions to diverse clients. Utilities often collaborate with technology companies, startups, and service providers to enhance energy ESO offerings. For instance, partnerships between utilities like Con Edison and technology companies like Google Nest illustrate the synergy between traditional energy providers and cutting-edge technology solutions, creating a more holistic approach to energy optimization.

List of Key Companies Profiled

- Semcon AB (Ratos AB)

- Assystem S.A

- Segula Holding

- Mott MacDonald Group Limited

- Quest Global Services Pte. Ltd

- Luxoft Holding, Inc. (DXC TECHNOLOGY COMPANY)

- Cyient Limited

- ESI Group

- ALTEN

- Altair Engineering, Inc. (IMG Companies, LLC)

US Energy ESO Market Report Segmentation

By Location

- Onshore

- Offshore

By Source

- Non-renewable

- Renewable

- Chemical Processing

By Service

- Structuring & Layout

- R&D & Designing

- Digitization

- Implementation & Maintenance

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Energy ESO Market, by Location

1.4.2 USA Energy ESO Market, by Source

1.4.3 USA Energy ESO Market, by Service

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Forces Analysis

Chapter 3. US Energy ESO Market by Location

3.1 US Energy ESO Market by Location

3.2 US Energy ESO Market by Source

3.3 US Energy ESO Market by Service

Chapter 4. Company Profiles – Global Leaders

4.1 Semcon AB (Ratos AB)

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.2 Assystem S.A

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 SWOT Analysis

4.3 Segula Holding

4.3.1 Company Overview

4.3.2 SWOT Analysis

4.4 Quest Global Services Pte. Ltd

4.4.1 Company Overview

4.4.2 SWOT Analysis

4.5 Mott MacDonald Group Limited

4.5.1 Company Overview

4.5.2 Financial Analysis

4.5.3 SWOT Analysis

4.6 Luxoft Holding, Inc. (DXC TECHNOLOGY COMPANY)

4.6.1 Company Overview

4.6.2 Financial Analysis

4.6.3 Segmental and Regional Analysis

4.7 Cyient Limited

4.7.1 Company Overview

4.7.2 Financial Analysis

4.7.3 Segmental and Regional Analysis

4.7.4 SWOT Analysis

4.8 ESI Group

4.8.1 Company Overview

4.8.2 Financial Analysis

4.8.3 Regional Analysis

4.8.4 Research & Development Expenses

4.8.5 SWOT Analysis

4.9 ALTEN

4.9.1 Company Overview

4.9.2 Financial Analysis

4.9.3 Regional Analysis

4.10. Altair Engineering, Inc. (IMG Companies, LLC)

4.10.1 Company Overview

4.10.2 Financial Analysis

4.10.3 Segmental and Regional Analysis

4.10.4 Research & Development Expenses

4.10.5 SWOT Analysis

TABLE 2 US Energy ESO Market, 2023 - 2030, USD Million

TABLE 3 US Energy ESO Market by Location, 2019 - 2022, USD Million

TABLE 4 US Energy ESO Market by Location, 2023 - 2030, USD Million

TABLE 5 US Energy ESO Market by Source, 2019 - 2022, USD Million

TABLE 6 US Energy ESO Market by Source, 2023 - 2030, USD Million

TABLE 7 US Energy ESO Market by Service, 2019 - 2022, USD Million

TABLE 8 US Energy ESO Market by Service, 2023 - 2030, USD Million

TABLE 9 Key Information – Semcon AB

TABLE 10 Key Information – Assystem S.A

TABLE 11 Key Information – Segula Holding

TABLE 12 Key Information – Quest Global Services Pte. Ltd

TABLE 13 Key Information – Mott MacDonald Group Limited

TABLE 14 Key Information – Luxoft Holding, Inc.

TABLE 15 Key Information – Cyient Limited

TABLE 16 Key Information – ESI Group

TABLE 17 Key Information – ALTEN

TABLE 18 Key Information – Altair Engineering, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 US Energy ESO Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Energy ESO Market

FIG 4 Porter’s Five Forces Analysis – Energy ESO Market

FIG 5 US Energy ESO Market share by Location, 2022

FIG 6 US Energy ESO Market share by Location, 2030

FIG 7 US Energy ESO Market by Location, 2019 - 2030, USD million

FIG 8 US Energy ESO Market share by Source, 2022

FIG 9 US Energy ESO Market share by Source, 2030

FIG 10 US Energy ESO Market by Source, 2019 - 2030, USD million

FIG 11 US Energy ESO Market share by Service, 2022

FIG 12 US Energy ESO Market share by Service, 2030

FIG 13 US Energy ESO Market by Service, 2019 - 2030, USD million

FIG 14 SWOT Analysis: Assystem S.A

FIG 15 SWOT Analysis: Segula Holding

FIG 16 SWOT Analysis: Quest Global Services Pte. Ltd

FIG 17 SWOT Analysis: Mott MacDonald Group Limited

FIG 18 SWOT Analysis: Cyient Limited

FIG 19 SWOT Analysis: ESI Group

FIG 20 SWOT Analysis: Altair Engineering, Inc.