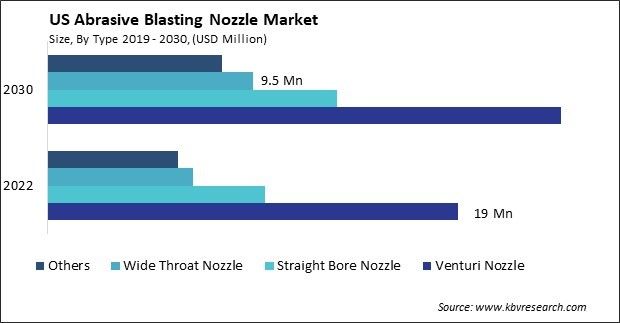

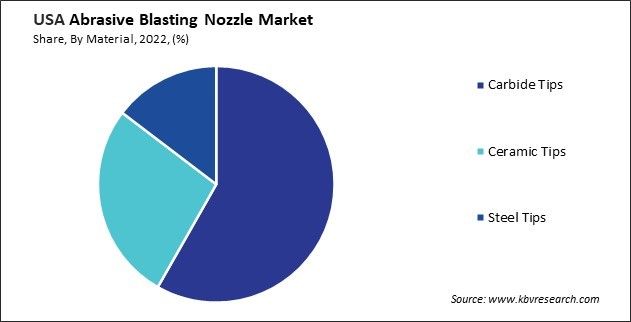

US Abrasive Blasting Nozzle Market Size, Share & IndUStry Trends Analysis Report By Type, By Material (Carbide Tips, Ceramic Tips, and Steel Tips), By Bore Size (3/8 Inch, 5/16 Inch, 7/16 Inch), By End-USe, Growth Forecast, 2023 - 2030

Published Date : 14-Feb-2024 | Pages: 54 | Formats: PDF |

COVID-19 Impact on the US Abrasive Blasting Nozzle Market

The USA Abrasive Blasting Nozzle Market size is expected to reach $54.6 million by 2030, rising at a market growth of 3.5% CAGR during the forecast period.

The abrasive blasting nozzle market in the United States is experiencing dynamic shifts influenced by several key factors. Technological advancements significantly impact the industry landscape in the United States, particularly in the development of nozzles that provide enhanced precision, durability, and efficiency during coating removal and surface preparation procedures. Economic conditions and infrastructure investments play a vital role in shaping the market trajectory, with fluctuations in these factors influencing the overall demand for the abrasive blasting nozzle market.

The incorporation of sensors and control systems in the abrasive blasting nozzle market in the U.S. represents a move towards enhanced efficiency and precision in applications that utilize abrasive materials. By leveraging smart nozzle technologies, industries can achieve better control over processes, leading to more accurate and targeted outcomes. Sensors allow for real-time data collection and feedback, enabling adjustments to be made promptly based on specific conditions. The optimization of abrasive usage is a key benefit associated with the adoption of smart nozzle technologies. By incorporating automation and digitalization, industries can achieve more precise control over the dispersion of abrasives, reducing waste and enhancing overall cost-effectiveness.

Market Trends

Industrial growth and maintenance

The industrial growth and maintenance of the abrasive blasting nozzle market in the United States are influenced by a confluence of factors that reflect the broader dynamics of manufacturing, construction, and infrastructure maintenance industries. Technological advancements in abrasive blasting nozzle design and materials are a cornerstone for industry growth as manufacturers continually innovate to enhance precision, durability, and efficiency in surface preparation processes. This technological evolution caters to the current demands of industries and positions the abrasive blasting sector as a critical player in addressing future challenges.

The regulatory landscape, particularly in terms of environmental and occupational safety standards, significantly impacts the abrasive blasting nozzle market in the U.S. as the nozzle manufacturers are compelled to align their products with sustainability practices, using eco-friendly abrasive materials and designing nozzles that minimize environmental impact. Compliance with safety regulations ensures the responsible use of abrasive blasting in various industries, contributing to the market's long-term viability.

Industrial infrastructure development and maintenance activities are pivotal drivers for the abrasive blasting nozzle market. As the U.S. continues to invest in its industrial and transportation infrastructure, the demand for surface preparation tools, including abrasive blasting nozzles, rises in tandem. This is particularly evident in sectors such as construction, where abrasive blasting is essential for preparing surfaces before coatings or repairs. Hence, in their capacity as an essential element in surface preparation procedures, these nozzles significantly influence the sustainability and effectiveness of various sectors, thereby guaranteeing their ongoing significance and contribution to the industrial environment of the nation.

Expansion of the oil and gas sector

One of the primary drivers of the U.S. abrasive blasting nozzle market is the remarkable growth in domestic oil and gas production, facilitated by advancements in extraction technologies such as hydraulic fracturing and horizontal drilling. Shale oil and gas output in the U.S. has surged, making it a prominent participant in the world energy scene. Moreover, geopolitical dynamics and a shift towards energy independence have prompted increased exploration and production activities within the nation. The desire to reduce dependence on foreign sources has led to substantial domestic oil and gas infrastructure investments. This expansion, in turn, necessitates using cutting-edge equipment and technology, including abrasive blasting nozzle, for efficient maintenance and refurbishment of oil and gas facilities.

According to the U.S. Energy Information Administration, about 8.33 million barrels per day (b/d) of petroleum were imported by the U.S. from 80 different nations in 20The U.S. exported about 9.52 million barrels of petrol U.S. to 180 nations and 4 U.S. territories in 2022. Roughly 3.60 million barrels of crude oil were exported daily, 38% of all gross petroleum exports from the United States. This indicates that the United States was a net petroleum exporter in 2022, with 1.19 million b/d.

Additionally, the supportive regulatory environment and policy measures are crucial in fostering the growth of the oil and gas sector. Pro-business policies, deregulation, and incentives for domestic production have incentivized companies to invest in exploration and extraction activities, driving demand for equipment like abrasive blasting nozzles for maintenance purposes.

The increasing focus on environmental sustainability has also influenced the industry. Technologies that reduce environmental effects are in greater demand as the oil and gas industry works to adopt more environmentally friendly practices. The abrasive blasting nozzle market in the U.S. enhances efficiency while reducing waste and emissions, which are becoming integral to this evolution. Hence, the expansion, supported by pro-business policies and a focus on environmental sustainability, has elevated the importance of cutting-edge equipment like abrasive blasting nozzles for efficient maintenance within the evolving U.S. energy landscape.

Competition Analysis

In the United States, the market for abrasive blasting nozzles is dominated by a number of major companies that offer a variety of products and solutions for a variety of applications. Prominent companies in this sector contribute to the competitiveness and innovation within the industry. Clemco Industries Corp., a renowned player in the abrasive blasting nozzle market, has likely been at the forefront of driving innovation and setting industry standards in the U.S. abrasive blasting nozzle market. With a history of manufacturing high-quality abrasive blasting equipment, including nozzles, Clemco has consistently strived to meet the needs of its customer base. Environmental sustainability is a crucial area where Clemco Industries Corp. has made substantial contributions. As regulatory requirements and customer preferences increasingly prioritize eco-friendly practices, Clemco has likely worked on developing abrasive blasting nozzles that minimize environmental impact.

Airblast AFC, a U.S.-based company, has emerged as a significant player in the competitive landscape of the abrasive blasting nozzle market. Specializing in blasting and painting equipment, Airblast AFC's commitment to providing comprehensive solutions for surface preparation positions it as a key contributor to the market. With a diverse product range, including advanced abrasive blasting nozzle, the company plays a vital role in meeting the demands of various industries. As the market continues to evolve, Airblast AFC's dedication to offering innovative and tailored solutions underscores its importance in shaping the trajectory of the abrasive blasting nozzle market in the United States.

With its long-standing reputation in the abrasive blasting nozzle market, Empire Abrasive Equipment Company has likely been instrumental in shaping the U.S. industry through innovation, customer-centric approaches, and a commitment to industry standards. Renowned for manufacturing high-quality abrasive blasting equipment, including nozzles, Empire has likely implemented strategic initiatives to stay ahead in this competitive landscape. Empire's commitment to customer satisfaction is likely evident in its comprehensive support services. This includes offering training programs, technical assistance, and efficient aftermarket services, ensuring that U.S. customers maximize the lifespan of their abrasive blasting nozzles.

List of Key Companies Profiled

- Kennametal Inc.

- Graco Inc. (Newell Brands Inc.)

- Elcometer Limited

- NLB Corporation (Interpump Group S.p.A.)

- Airblast B.V

- Sponge-Jet, Inc.

- Clemco Industries Corporation

- KEIR Manufacturing, Inc.

- AGSCO Corporation

US Abrasive Blasting Nozzle Market Report Segmentation

By Type

- Venturi Nozzle

- Straight Bore Nozzle

- Wide Throat Nozzle

- Others

By Material

- Carbide Tips

- Ceramic Tips

- Steel Tips

By Bore Size

- 3/8 Inch

- 5/16 Inch

- 7/16 Inch

- Others

By End-use

- Marine (Shipyard)

- Automotive

- Construction

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Abrasive Blasting Nozzle Market, by Type

1.4.2 USA Abrasive Blasting Nozzle Market, by Material

1.4.3 USA Abrasive Blasting Nozzle Market, by Bore Size

1.4.4 USA Abrasive Blasting Nozzle Market, by End-use

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

2.3 Porter’s Five Forces Analysis

Chapter 3. US Abrasive Blasting Nozzle Market

3.1 US Abrasive Blasting Nozzle Market by Type

3.2 US Abrasive Blasting Nozzle Market by Material

3.3 US Abrasive Blasting Nozzle Market by Bore Size

3.4 US Abrasive Blasting Nozzle Market by End-use

Chapter 4. Company Profiles – Global Leaders

4.1 Kennametal Inc.

4.1.1 Company Overview

4.1.2 Financial Analysis

4.1.3 Segmental and Regional Analysis

4.1.4 Research & Development Expenses

4.1.5 SWOT Analysis

4.2 Graco Inc. (Newell Brands Inc.)

4.2.1 Company Overview

4.2.2 Financial Analysis

4.2.3 Regional & Segmental Analysis

4.2.4 SWOT Analysis

4.3 Elcometer Limited

4.3.1 Company Overview

4.3.2 Recent strategies and developments:

4.3.2.1 Acquisition and Mergers:

4.4 NLB Corporation (Interpump Group S.p.A.)

4.4.1 Company Overview

4.4.2 Financial Analysis

4.4.3 Segmental and Regional Analysis

4.5 Airblast B.V.

4.5.1 Company Overview

4.6 Sponge-Jet, Inc.

4.6.1 Company Overview

4.7 Clemco Industries Corporation

4.7.1 Company Overview

4.8 KEIR Manufacturing, Inc.

4.8.1 Company Overview

4.9 AGSCO Corporation

4.9.1 Company Overview

TABLE 2 US Abrasive Blasting Nozzle Market, 2023 - 2030, USD Thousands

TABLE 3 US Abrasive Blasting Nozzle Market by Type, 2019 - 2022, USD Thousands

TABLE 4 US Abrasive Blasting Nozzle Market by Type, 2023 - 2030, USD Thousands

TABLE 5 US Abrasive Blasting Nozzle Market by Material, 2019 - 2022, USD Thousands

TABLE 6 US Abrasive Blasting Nozzle Market by Material, 2023 - 2030, USD Thousands

TABLE 7 US Abrasive Blasting Nozzle Market by Bore Size, 2019 - 2022, USD Thousands

TABLE 8 US Abrasive Blasting Nozzle Market by Bore Size, 2023 - 2030, USD Thousands

TABLE 9 US Abrasive Blasting Nozzle Market by End-use, 2019 - 2022, USD Thousands

TABLE 10 US Abrasive Blasting Nozzle Market by End-use, 2023 - 2030, USD Thousands

TABLE 11 Key Information – Kennametal Inc.

TABLE 12 Key information – Graco Inc.

TABLE 13 Key Information – Elcometer Limited

TABLE 14 Key Information – NLB Corporation

TABLE 15 Key Information – Airblast B.V.

TABLE 16 Key Information – Sponge-Jet, Inc.

TABLE 17 Key Information – Clemco Industries Corporation

TABLE 18 Key Information – KEIR Manufacturing, Inc.

TABLE 19 Key Information – AGSCO Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 US Abrasive Blasting Nozzle Market, 2019 - 2030, USD Thousands

FIG 3 Key Factors Impacting Abrasive Blasting Nozzle Market

FIG 4 Porter’s Five Forces Analysis – Abrasive Blasting Nozzle Market

FIG 5 US Abrasive Blasting Nozzle Market share by Type, 2022

FIG 6 US Abrasive Blasting Nozzle Market share by Type, 2030

FIG 7 US Abrasive Blasting Nozzle Market by Type, 2019 - 2030, USD Thousands

FIG 8 US Abrasive Blasting Nozzle Market share by Material, 2022

FIG 9 US Abrasive Blasting Nozzle Market share by Material, 2030

FIG 10 US Abrasive Blasting Nozzle Market by Material, 2023 - 2030, USD Thousands

FIG 11 US Abrasive Blasting Nozzle Market share by Bore Size, 2022

FIG 12 US Abrasive Blasting Nozzle Market share by Bore Size, 2022

FIG 13 US Abrasive Blasting Nozzle Market by Bore Size, 2019 - 2030, USD Thousands

FIG 14 US Abrasive Blasting Nozzle Market share by End-use, 2022

FIG 15 US Abrasive Blasting Nozzle Market share by End-use, 2030

FIG 16 US Abrasive Blasting Nozzle Market by End-use, 2019 - 2030, USD Thousands

FIG 17 SWOT Analysis: Kennametal Inc.

FIG 18 SWOT Analysis: Graco Inc.