Global Transcriptomics Market Size, Share & Industry Trends Analysis Report By Technology (q PCR, Microarrays, and Sequencing Technology), By Application, By Component, By Regional Outlook and Forecast, 2021 - 2027

Published Date : 30-Apr-2022 | Pages: 219 | Formats: PDF |

COVID-19 Impact on the Transcriptomics Market

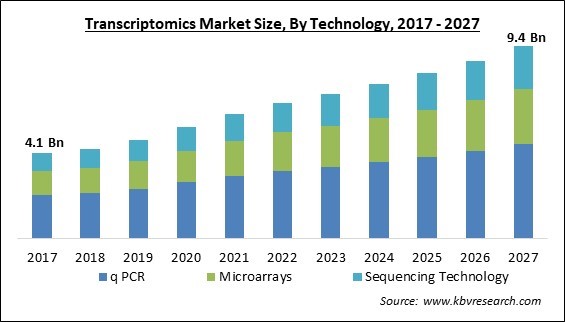

The Global Transcriptomics Market size is expected to reach $9.4 billion by 2027, rising at a market growth of 7.6% CAGR during the forecast period.

Transcriptomics is the study of RNA transcripts that depends on knowledge of next-generation sequencing technologies, which need RNA to be transcribed into complementary DNA before being sequenced. Microarrays and q PCR are among the technologies used. In addition, Microarrays are one of the most widely used tools in research labs. Quantitative reverse transcription, or q PCR, is a technique for detecting the presence and quantity of RNA by turning it into cDNA. It is named reverse transcription since it is carried out with the help of a polymerase chain reaction.

Microarrays, RNA sequencing, real-time polymerase chain reaction, RNA interference, expressed sequence tag (EST)-based technologies, SAGE, and other methods have been developed for transcriptome study. To study the quantity and sequences of RNA in a sample, RNA sequencing employs next-generation sequencing. Additionally, Microarray is a technique that detects gene expression in thousands of samples at once. The primary difference between RNA-sequencing and microarray is that RNA-sequencing recognizes every transcript in a sample, whereas microarray uses hybridization to detect just pre-set transcripts or genes. To identify and analyze a short sequence of RNA or DNA, the polymerase chain reaction method is used to create various copies of a single gene. Moreover, scientists can study diseases at the genome level using these tools. It also aids in the development of new clinical biomarkers, the identification of various molecular disorders, and the evaluation of various medications.

Some of the growth catalysts for the overall industry are a surge in demand for personalized medicine, increased pharmaceutical and biotechnology R&D expenditure, government investment for omics, rise in RNA sequencing applications, and development of new transcriptomics products by a large number of key players. In addition, the increased focus on biomarker identification and the massive demand for transcriptome in R&D activities has resulted in a spike in transcriptome output. According to the National Human Genome Research Institute, which is part of the National Institutes of Health (NIH), the Mammalian Gene Collection Initiative and the Mouse Transcriptome Project were two programs that generated transcriptome resources for researchers all over the world. These two models are critical for the study of human biology, which would drive market expansion.

COVID-19 Impact Analysis

The transcriptomics market is expected to grow positively as a result of the COVID-19 pandemic. The increased use of transcriptomics is due to the increased manufacture of vaccines like Covishield and Covaxin for COVID-19. NanoString Technologies Inc., for example, launched new technologies to evaluate the immune response in COVID-19 disease research in June 2020. As a result, the transcriptomics market is expected to grow throughout the projected period due to an increase in the development of novel medications and instruments. The outbreak of the COVID-19 pandemic has opened new avenues for market players. NanoString Technologies, Inc., for example, released the nCounter Host Response Gene Expression Panel in June 2020 for the investigation of immune system response during COVID-19 viral research.

Market driving Factors:

The massive demand for personalized medicine

Personalized medicine has entered conventional clinical practice and is transforming how many diseases are detected, classified, and treated. In addition, it has become a fundamental focus of research in the healthcare business. Oncology is one area where these gains are particularly noticeable. The number of tailored medications, therapies, and diagnostic items has grown since 2006, according to the Personalized Medicine Coalition report (2017), and this trend is projected to continue in the coming years. In addition, the demand for tailored treatment and RNA sequencing applications in transcriptomics is constantly growing. The expanding interest in outsourcing services, as well as the growing focus on biomarker research and toxicogenomic, are the key trends of the overall market.

Rising preference for biomarkers discovery

The identification of biomarkers, as well as their clinical uses, has improved drug discovery and development techniques for assessing medication toxicity and efficacy. In addition, biomarkers for diseases such as cancer, cardiovascular disease, and neurological diseases are crucial in gaining a better knowledge of the disease route and progression. The microarray technology employed in transcriptome analysis holds the possibility of allowing for widespread genetic disease research. Moreover, it also aids in the development of novel clinical biomarkers, the identification of novel molecular abnormalities, and therapeutic efficacy research. Tuberculosis is a global issue that affects millions of people, necessitating more efficient diagnosis, treatment response monitoring, and the development of more effective pharmacological therapies and vaccines.

Marketing Restraining Factor:

The scarcity of useful bioinformatics tools

For transcriptomic research, microarray experiments generate massive volumes of data. As a result, researchers frequently confront difficulties in interpreting results and utilizing available computational resources to handle data. In addition, transcriptomics data from RNA sequencing has low genome coverage and strong amplification bias, making data interpretation difficult, particularly without effective bioinformatics tools. Many of the methods that have been developed for bulk cell sequencing have not proven successful in analyzing transcriptomics data. This presents a number of obstacles, including difficulty in calling copy number changes, identifying mutant genes in tumor samples, rebuilding cell lineages, recovering low abundant transcripts, and enhancing the accuracy of transcript quantitative analysis.

Technology Outlook

Based on Technology, the market is segmented into q PCR, Microarrays, and Sequencing Technology. In 2020, the q PCR segment acquired the maximum revenue share of the Transcriptomics Market. This is due to an increase in the number of COVID-19 cases, increased usage of genetic testing, and increased demand for transcriptomics for drug discovery. Moreover, due to the growing use of PCR for COVID-19 diagnostic across the globe, real-time-PCR (qPCR) technology would continue to be a major segment. The technology is thought to be extremely sensitive and quantitative, making it one of the best ways for examining a small number of transcripts in a large number of samples. In addition, PCR allows for the identification of SARS-CoV-2 with a high degree of sensitivity, as well as the evaluation of viral RNA in a variety of clinical samples, the detection of SARS-CoV-2 mutations, and the evaluation of anti-SARS-CoV-2 medications.

Application Outlook

Based on Application, the market is segmented into Drug Discovery, Diagnostics & Disease Profiling, and Others. The Diagnostics and Disease Profiling segment collected a significant revenue share of the Transcriptomics Market in 2020. This is because the transcriptome records all RNA transcribed by the genome in a certain tissue or cell type, at a specific developmental stage, and under a specific physiological or pathological environment. As a result, transcriptome analysis not only allows to comprehend the human genome at the transcriptional level, but also gene structure and function, gene expression regulation, and genome plasticity. More crucially, it may reveal the essential changes in biological processes that cause human diseases, resulting in fresh instruments valuable not only for understanding their underlying mechanisms but also for molecular diagnosis and clinical treatment.

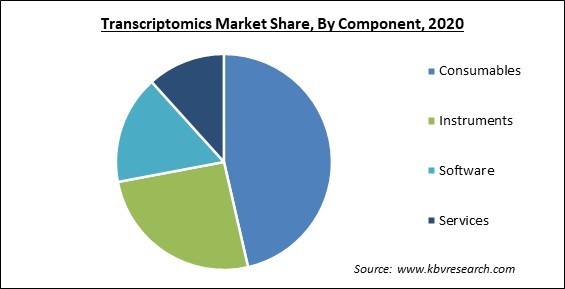

Component Outlook

Based on Component, the market is segmented into Consumables, Instruments, Software, and Services. In 2020, the Consumables segment procured the largest revenue share of the Transcriptomics Market. This is due to increased pharmaceutical R&D activities, increased need for drug development, and increased usage of transcriptomics products. Moreover, the growth of the segment can be attributed to the ongoing technological breakthroughs and the increasing availability of novel and cost-effective sequencing platforms.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 5.4 Billion |

| Market size forecast in 2027 | USD 9.4 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 7.6% from 2021 to 2027 |

| Number of Pages | 219 |

| Number of Tables | 363 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Component, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the North American region emerged as the leading region in the overall Transcriptomics Market by procuring the maximum revenue share. The high revenue share of the regional market is due to the rise in the number of different types of disease diagnoses, the presence of key players, the advancements in the healthcare industry, and the presence of new transcriptomics products in the region.

Free Valuable Insights: Global Transcriptomics Market size to reach USD 9.4 Billion by 2027

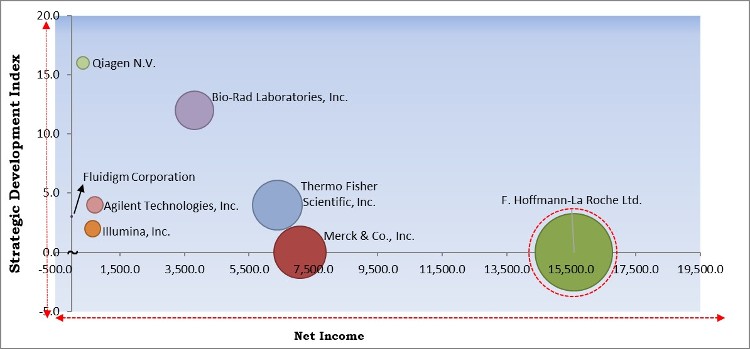

KBV Cardinal Matrix - Transcriptomics Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. is the major forerunner in the Transcriptomics Market. Companies such as Qiagen N.V., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fluidigm Corporation, Promega Corporation, General Electric (GE) Co., Merck & Co., Inc., Thermo Fisher Scientific, Inc., Illumina, Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., and Qiagen N.V.

Recent Strategies Deployed in Transcriptomics Market

» Partnerships, Collaborations and Agreements:

- Jan-2022: Illumina signed a co-development agreement with SomaLogic, a protein biomarker discovery and clinical diagnostics company. Through this agreement, the two companies would bring the SomaScan Proteomics Assay onto Illumina's current and future high throughput next-generation sequencing (NGS) platforms. Moreover, by integrating the power of high-plexity Somascan technology with Illumina's prevalent and future high throughput NGS platforms, scientists would be able to examine thousands of samples for more than 10,000 protein targets. In addition, the partnership would expand this capability over time through simple, automated analysis and cost efficiencies.

- Dec-2021: QIAGEN joined hands with Denovo Biopharma, a privately held biotech company providing a novel biomarker solution to personalize drug development. Following the collaboration, the two entities jointly develop a blood-based companion diagnostic (CDx) test to detect patients expressing Denovo Genomic Marker 1 (DGM1TM). Moreover, QIAGEN would develop a diagnostic assay that can identify the Denovo Genomic Marker 1 (DGM1TM) in DLBCL patients, a biomarker developed by Denovo that forecasts the responsiveness to DB102.

- Jun-2021: Bio-Rad Laboratories formed a partnership with Seegene, a global leader in multiplex molecular diagnostics, for the clinical development and commercialization of infectious disease molecular diagnostic products. Following the partnership, Seegene would offer diagnostic tests for use on Bio-Rad’s CFX96 Dx Real-Time PCR System for U.S. markets pending clinical development and clearance from The U.S. Food & Drug Administration (FDA).

» Acquisitions and Mergers:

- Apr-2021: Agilent Technologies took over Resolution Bioscience, a leader in the development and commercialization of next-generation sequencing (NGS)-based precision oncology solutions. The acquisition of Resolution Bioscience’s liquid biopsy-based diagnostic technologies aimed to support Agilent’s portfolio to biopharma and clinical diagnostics customers and propel the new growth avenues in the company’s diagnostics and genomics segment.

- Feb-2021: Thermo Fisher Scientific took over Mesa Biotech, a privately held point-of-care molecular diagnostic company. The acquisition aimed to integrate Thermo Fisher's operational excellence, access to raw materials, and existing distribution and sales channels with Mesa's innovative platform, with an aim to expand manufacturing volume, bring down cost and bring much-needed diagnostics to market faster and at a higher scale.

- Sep-2020: QIAGEN took over the remaining 80.1% of NeuMoDx Molecular, the diagnostics instruments company. Following the acquisition, QIAGEN enhanced its offerings of automated molecular testing solutions based on the proven PCR technology. Moreover, the complete integration of the NeuMoDx systems would enable QIAGEN to fulfill laboratory requirements in almost any setting for molecular diagnostics.

- Apr-2020: Bio-Rad Laboratories completed the acquisition of Celsee, a company that provides instruments and consumables for the isolation, detection, and analysis of single cells. Following the acquisition, Celsee's innovative products and technologies would expand the reach of Bio-Rad Laboratories into the rapidly rising world of precision medicine and single-cell analysis, both of which provided improved insight into disease, diagnosis, and treatment.

» Product Launches and Product Expansions:

- Nov-2021: QIAGEN rolled out StableScript to the OEM portfolio. The new product is a dynamic reverse transcriptase which is developed for utilization in one-step RT-qPCR and long-range RT-PCR and is available for bulk quantities. In addition, the advent of reverse transcriptases has enabled polymerase chain reaction (PCR) to be applied to RNA and the creation of cDNA libraries from mRNA. Cloning, sequencing, and characterization of RNA have all been made easier due to its commercial availability. This new StableScript addition to our OEM offering addresses significant concerns for many customers and can also help smaller biotechnology companies or laboratories manage supply chain issues that can arise during rapid growth.

- Jun-2021: QIAGEN introduced QIAprep& CRISPR Kit and CRISPR Q-Primer Solutions that enable scientists to examine edited genetic material with unrivaled speed and efficiency to identify how their interventions have altered the function of the DNA sequence in question. The new CRISPR Q-Primer Solutions and the QIAprep& CRISPR Kit offer scientists a sensitive, all-in-one approach for characterizing knock-outs and knock-ins generated by guide RNA (gRNA) and tiny insertions during gene editing. gene editing.

- May-2021: Bio-Rad Laboratories introduced SEQuoia RiboDepletion Kit, which enhances assay efficiency by removing irrelevant ribosomal RNA (rRNA) fragments from an RNA-Seq library. In addition, the SEQuoia RiboDepletion Kit is developed for genomics scientists targeting rare transcripts or working with a restricted or degraded sample. When compared to other approaches, the kit can keep RNA transcripts that might otherwise be lost.

Scope of the Study

Market Segments Covered in the Report:

By Technology

- q PCR

- Microarrays

- Sequencing Technology

By Application

- Drug Discovery

- Diagnostics & Disease Profiling

- Others

By Component

- Consumables

- Instruments

- Software

- Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Fluidigm Corporation

- Promega Corporation

- General Electric (GE) Co.

- Merck & Co., Inc.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Transcriptomics Market, by Technology

1.4.2 Global Transcriptomics Market, by Application

1.4.3 Global Transcriptomics Market, by Component

1.4.4 Global Transcriptomics Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2017-2021)

3.3.2 Key Strategic Move: (Acquisitions and Mergers: 2019, Jan – 2021, Apr) Leading Players

3.3.3 Key Strategic Move: (Product Launches ad Product Expansions: 2018, Mar – 2021, Nov) Leading Players

Chapter 4. Global Transcriptomics Market by Technology

4.1 Global q PCR Market by Region

4.2 Global Microarrays Market by Region

4.3 Global Sequencing Technology Market by Region

Chapter 5. Global Transcriptomics Market by Application

5.1 Global Drug Discovery Market by Region

5.2 Global Diagnostics & Disease Profiling Market by Region

5.3 Global Others Market by Region

Chapter 6. Global Transcriptomics Market by Component

6.1 Global Consumables Market by Region

6.2 Global Instruments Market by Region

6.3 Global Software Market by Region

6.4 Global Services Market by Region

Chapter 7. Global Transcriptomics Market by Region

7.1 North America Transcriptomics Market

7.1.1 North America Transcriptomics Market by Technology

7.1.1.1 North America q PCR Market by Country

7.1.1.2 North America Microarrays Market by Country

7.1.1.3 North America Sequencing Technology Market by Country

7.1.2 North America Transcriptomics Market by Application

7.1.2.1 North America Drug Discovery Market by Country

7.1.2.2 North America Diagnostics & Disease Profiling Market by Country

7.1.2.3 North America Others Market by Country

7.1.3 North America Transcriptomics Market by Component

7.1.3.1 North America Consumables Market by Country

7.1.3.2 North America Instruments Market by Country

7.1.3.3 North America Software Market by Country

7.1.3.4 North America Services Market by Country

7.1.4 North America Transcriptomics Market by Country

7.1.4.1 US Transcriptomics Market

7.1.4.1.1 US Transcriptomics Market by Technology

7.1.4.1.2 US Transcriptomics Market by Application

7.1.4.1.3 US Transcriptomics Market by Component

7.1.4.2 Canada Transcriptomics Market

7.1.4.2.1 Canada Transcriptomics Market by Technology

7.1.4.2.2 Canada Transcriptomics Market by Application

7.1.4.2.3 Canada Transcriptomics Market by Component

7.1.4.3 Mexico Transcriptomics Market

7.1.4.3.1 Mexico Transcriptomics Market by Technology

7.1.4.3.2 Mexico Transcriptomics Market by Application

7.1.4.3.3 Mexico Transcriptomics Market by Component

7.1.4.4 Rest of North America Transcriptomics Market

7.1.4.4.1 Rest of North America Transcriptomics Market by Technology

7.1.4.4.2 Rest of North America Transcriptomics Market by Application

7.1.4.4.3 Rest of North America Transcriptomics Market by Component

7.2 Europe Transcriptomics Market

7.2.1 Europe Transcriptomics Market by Technology

7.2.1.1 Europe q PCR Market by Country

7.2.1.2 Europe Microarrays Market by Country

7.2.1.3 Europe Sequencing Technology Market by Country

7.2.2 Europe Transcriptomics Market by Application

7.2.2.1 Europe Drug Discovery Market by Country

7.2.2.2 Europe Diagnostics & Disease Profiling Market by Country

7.2.2.3 Europe Others Market by Country

7.2.3 Europe Transcriptomics Market by Component

7.2.3.1 Europe Consumables Market by Country

7.2.3.2 Europe Instruments Market by Country

7.2.3.3 Europe Software Market by Country

7.2.3.4 Europe Services Market by Country

7.2.4 Europe Transcriptomics Market by Country

7.2.4.1 Germany Transcriptomics Market

7.2.4.1.1 Germany Transcriptomics Market by Technology

7.2.4.1.2 Germany Transcriptomics Market by Application

7.2.4.1.3 Germany Transcriptomics Market by Component

7.2.4.2 UK Transcriptomics Market

7.2.4.2.1 UK Transcriptomics Market by Technology

7.2.4.2.2 UK Transcriptomics Market by Application

7.2.4.2.3 UK Transcriptomics Market by Component

7.2.4.3 France Transcriptomics Market

7.2.4.3.1 France Transcriptomics Market by Technology

7.2.4.3.2 France Transcriptomics Market by Application

7.2.4.3.3 France Transcriptomics Market by Component

7.2.4.4 Russia Transcriptomics Market

7.2.4.4.1 Russia Transcriptomics Market by Technology

7.2.4.4.2 Russia Transcriptomics Market by Application

7.2.4.4.3 Russia Transcriptomics Market by Component

7.2.4.5 Spain Transcriptomics Market

7.2.4.5.1 Spain Transcriptomics Market by Technology

7.2.4.5.2 Spain Transcriptomics Market by Application

7.2.4.5.3 Spain Transcriptomics Market by Component

7.2.4.6 Italy Transcriptomics Market

7.2.4.6.1 Italy Transcriptomics Market by Technology

7.2.4.6.2 Italy Transcriptomics Market by Application

7.2.4.6.3 Italy Transcriptomics Market by Component

7.2.4.7 Rest of Europe Transcriptomics Market

7.2.4.7.1 Rest of Europe Transcriptomics Market by Technology

7.2.4.7.2 Rest of Europe Transcriptomics Market by Application

7.2.4.7.3 Rest of Europe Transcriptomics Market by Component

7.3 Asia Pacific Transcriptomics Market

7.3.1 Asia Pacific Transcriptomics Market by Technology

7.3.1.1 Asia Pacific q PCR Market by Country

7.3.1.2 Asia Pacific Microarrays Market by Country

7.3.1.3 Asia Pacific Sequencing Technology Market by Country

7.3.2 Asia Pacific Transcriptomics Market by Application

7.3.2.1 Asia Pacific Drug Discovery Market by Country

7.3.2.2 Asia Pacific Diagnostics & Disease Profiling Market by Country

7.3.2.3 Asia Pacific Others Market by Country

7.3.3 Asia Pacific Transcriptomics Market by Component

7.3.3.1 Asia Pacific Consumables Market by Country

7.3.3.2 Asia Pacific Instruments Market by Country

7.3.3.3 Asia Pacific Software Market by Country

7.3.3.4 Asia Pacific Services Market by Country

7.3.4 Asia Pacific Transcriptomics Market by Country

7.3.4.1 China Transcriptomics Market

7.3.4.1.1 China Transcriptomics Market by Technology

7.3.4.1.2 China Transcriptomics Market by Application

7.3.4.1.3 China Transcriptomics Market by Component

7.3.4.2 Japan Transcriptomics Market

7.3.4.2.1 Japan Transcriptomics Market by Technology

7.3.4.2.2 Japan Transcriptomics Market by Application

7.3.4.2.3 Japan Transcriptomics Market by Component

7.3.4.3 India Transcriptomics Market

7.3.4.3.1 India Transcriptomics Market by Technology

7.3.4.3.2 India Transcriptomics Market by Application

7.3.4.3.3 India Transcriptomics Market by Component

7.3.4.4 South Korea Transcriptomics Market

7.3.4.4.1 South Korea Transcriptomics Market by Technology

7.3.4.4.2 South Korea Transcriptomics Market by Application

7.3.4.4.3 South Korea Transcriptomics Market by Component

7.3.4.5 Singapore Transcriptomics Market

7.3.4.5.1 Singapore Transcriptomics Market by Technology

7.3.4.5.2 Singapore Transcriptomics Market by Application

7.3.4.5.3 Singapore Transcriptomics Market by Component

7.3.4.6 Malaysia Transcriptomics Market

7.3.4.6.1 Malaysia Transcriptomics Market by Technology

7.3.4.6.2 Malaysia Transcriptomics Market by Application

7.3.4.6.3 Malaysia Transcriptomics Market by Component

7.3.4.7 Rest of Asia Pacific Transcriptomics Market

7.3.4.7.1 Rest of Asia Pacific Transcriptomics Market by Technology

7.3.4.7.2 Rest of Asia Pacific Transcriptomics Market by Application

7.3.4.7.3 Rest of Asia Pacific Transcriptomics Market by Component

7.4 LAMEA Transcriptomics Market

7.4.1 LAMEA Transcriptomics Market by Technology

7.4.1.1 LAMEA q PCR Market by Country

7.4.1.2 LAMEA Microarrays Market by Country

7.4.1.3 LAMEA Sequencing Technology Market by Country

7.4.2 LAMEA Transcriptomics Market by Application

7.4.2.1 LAMEA Drug Discovery Market by Country

7.4.2.2 LAMEA Diagnostics & Disease Profiling Market by Country

7.4.2.3 LAMEA Others Market by Country

7.4.3 LAMEA Transcriptomics Market by Component

7.4.3.1 LAMEA Consumables Market by Country

7.4.3.2 LAMEA Instruments Market by Country

7.4.3.3 LAMEA Software Market by Country

7.4.3.4 LAMEA Services Market by Country

7.4.4 LAMEA Transcriptomics Market by Country

7.4.4.1 Brazil Transcriptomics Market

7.4.4.1.1 Brazil Transcriptomics Market by Technology

7.4.4.1.2 Brazil Transcriptomics Market by Application

7.4.4.1.3 Brazil Transcriptomics Market by Component

7.4.4.2 Argentina Transcriptomics Market

7.4.4.2.1 Argentina Transcriptomics Market by Technology

7.4.4.2.2 Argentina Transcriptomics Market by Application

7.4.4.2.3 Argentina Transcriptomics Market by Component

7.4.4.3 UAE Transcriptomics Market

7.4.4.3.1 UAE Transcriptomics Market by Technology

7.4.4.3.2 UAE Transcriptomics Market by Application

7.4.4.3.3 UAE Transcriptomics Market by Component

7.4.4.4 Saudi Arabia Transcriptomics Market

7.4.4.4.1 Saudi Arabia Transcriptomics Market by Technology

7.4.4.4.2 Saudi Arabia Transcriptomics Market by Application

7.4.4.4.3 Saudi Arabia Transcriptomics Market by Component

7.4.4.5 South Africa Transcriptomics Market

7.4.4.5.1 South Africa Transcriptomics Market by Technology

7.4.4.5.2 South Africa Transcriptomics Market by Application

7.4.4.5.3 South Africa Transcriptomics Market by Component

7.4.4.6 Nigeria Transcriptomics Market

7.4.4.6.1 Nigeria Transcriptomics Market by Technology

7.4.4.6.2 Nigeria Transcriptomics Market by Application

7.4.4.6.3 Nigeria Transcriptomics Market by Component

7.4.4.7 Rest of LAMEA Transcriptomics Market

7.4.4.7.1 Rest of LAMEA Transcriptomics Market by Technology

7.4.4.7.2 Rest of LAMEA Transcriptomics Market by Application

7.4.4.7.3 Rest of LAMEA Transcriptomics Market by Component

Chapter 8. Company Profiles

8.1 Fluidigm Corporation

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.2 Promega Corporation

8.2.1 Company Overview

8.3 General Electric (GE) Co. (GE Healthcare)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.4 Merck & Co., Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.5 Thermo Fisher Scientific, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Research & Development Expense

8.5.5 Recent strategies and developments:

8.5.5.1 Acquisition and Mergers:

8.5.6 SWOT Analysis

8.6 Illumina, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Regional Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Partnerships, Collaborations, and Agreements:

8.7 Bio-Rad laboratories, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expenses

8.7.5 Recent strategies and developments:

8.7.5.1 Partnerships, Collaborations, and Agreements:

8.7.5.2 Product Launches and Product Expansions:

8.7.5.3 Acquisition and Mergers:

8.8 Agilent Technologies, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental and Regional Analysis

8.8.4 Research & Development Expense

8.8.5 Recent strategies and developments:

8.8.5.1 Acquisition and Mergers:

8.9 F. Hoffmann-La Roche Ltd.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.9.4 Research & Development Expense

8.10. Qiagen N.V.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Regional Analysis

8.10.4 Research & Development Expense

8.10.5 Recent strategies and developments:

8.10.5.1 Partnerships, Collaborations, and Agreements:

8.10.5.2 Product Launches and Product Expansions:

8.10.5.3 Acquisition and Mergers:

TABLE 2 Global Transcriptomics Market, 2021 - 2027, USD Million

TABLE 3 Partnerships, Collaborations and Agreements – Transcriptomics Market

TABLE 4 Product Launches And Product Expansions – Transcriptomics Market

TABLE 5 Acquisition and Mergers– Transcriptomics Market

TABLE 6 Global Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 7 Global Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 8 Global q PCR Market by Region, 2017 - 2020, USD Million

TABLE 9 Global q PCR Market by Region, 2021 - 2027, USD Million

TABLE 10 Global Microarrays Market by Region, 2017 - 2020, USD Million

TABLE 11 Global Microarrays Market by Region, 2021 - 2027, USD Million

TABLE 12 Global Sequencing Technology Market by Region, 2017 - 2020, USD Million

TABLE 13 Global Sequencing Technology Market by Region, 2021 - 2027, USD Million

TABLE 14 Global Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 15 Global Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 16 Global Drug Discovery Market by Region, 2017 - 2020, USD Million

TABLE 17 Global Drug Discovery Market by Region, 2021 - 2027, USD Million

TABLE 18 Global Diagnostics & Disease Profiling Market by Region, 2017 - 2020, USD Million

TABLE 19 Global Diagnostics & Disease Profiling Market by Region, 2021 - 2027, USD Million

TABLE 20 Global Others Market by Region, 2017 - 2020, USD Million

TABLE 21 Global Others Market by Region, 2021 - 2027, USD Million

TABLE 22 Global Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 23 Global Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 24 Global Consumables Market by Region, 2017 - 2020, USD Million

TABLE 25 Global Consumables Market by Region, 2021 - 2027, USD Million

TABLE 26 Global Instruments Market by Region, 2017 - 2020, USD Million

TABLE 27 Global Instruments Market by Region, 2021 - 2027, USD Million

TABLE 28 Global Software Market by Region, 2017 - 2020, USD Million

TABLE 29 Global Software Market by Region, 2021 - 2027, USD Million

TABLE 30 Global Services Market by Region, 2017 - 2020, USD Million

TABLE 31 Global Services Market by Region, 2021 - 2027, USD Million

TABLE 32 Global Transcriptomics Market by Region, 2017 - 2020, USD Million

TABLE 33 Global Transcriptomics Market by Region, 2021 - 2027, USD Million

TABLE 34 North America Transcriptomics Market, 2017 - 2020, USD Million

TABLE 35 North America Transcriptomics Market, 2021 - 2027, USD Million

TABLE 36 North America Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 37 North America Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 38 North America q PCR Market by Country, 2017 - 2020, USD Million

TABLE 39 North America q PCR Market by Country, 2021 - 2027, USD Million

TABLE 40 North America Microarrays Market by Country, 2017 - 2020, USD Million

TABLE 41 North America Microarrays Market by Country, 2021 - 2027, USD Million

TABLE 42 North America Sequencing Technology Market by Country, 2017 - 2020, USD Million

TABLE 43 North America Sequencing Technology Market by Country, 2021 - 2027, USD Million

TABLE 44 North America Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 45 North America Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 46 North America Drug Discovery Market by Country, 2017 - 2020, USD Million

TABLE 47 North America Drug Discovery Market by Country, 2021 - 2027, USD Million

TABLE 48 North America Diagnostics & Disease Profiling Market by Country, 2017 - 2020, USD Million

TABLE 49 North America Diagnostics & Disease Profiling Market by Country, 2021 - 2027, USD Million

TABLE 50 North America Others Market by Country, 2017 - 2020, USD Million

TABLE 51 North America Others Market by Country, 2021 - 2027, USD Million

TABLE 52 North America Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 53 North America Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 54 North America Consumables Market by Country, 2017 - 2020, USD Million

TABLE 55 North America Consumables Market by Country, 2021 - 2027, USD Million

TABLE 56 North America Instruments Market by Country, 2017 - 2020, USD Million

TABLE 57 North America Instruments Market by Country, 2021 - 2027, USD Million

TABLE 58 North America Software Market by Country, 2017 - 2020, USD Million

TABLE 59 North America Software Market by Country, 2021 - 2027, USD Million

TABLE 60 North America Services Market by Country, 2017 - 2020, USD Million

TABLE 61 North America Services Market by Country, 2021 - 2027, USD Million

TABLE 62 North America Transcriptomics Market by Country, 2017 - 2020, USD Million

TABLE 63 North America Transcriptomics Market by Country, 2021 - 2027, USD Million

TABLE 64 US Transcriptomics Market, 2017 - 2020, USD Million

TABLE 65 US Transcriptomics Market, 2021 - 2027, USD Million

TABLE 66 US Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 67 US Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 68 US Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 69 US Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 70 US Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 71 US Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 72 Canada Transcriptomics Market, 2017 - 2020, USD Million

TABLE 73 Canada Transcriptomics Market, 2021 - 2027, USD Million

TABLE 74 Canada Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 75 Canada Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 76 Canada Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 77 Canada Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 78 Canada Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 79 Canada Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 80 Mexico Transcriptomics Market, 2017 - 2020, USD Million

TABLE 81 Mexico Transcriptomics Market, 2021 - 2027, USD Million

TABLE 82 Mexico Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 83 Mexico Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 84 Mexico Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 85 Mexico Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 86 Mexico Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 87 Mexico Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 88 Rest of North America Transcriptomics Market, 2017 - 2020, USD Million

TABLE 89 Rest of North America Transcriptomics Market, 2021 - 2027, USD Million

TABLE 90 Rest of North America Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 91 Rest of North America Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 92 Rest of North America Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 93 Rest of North America Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 94 Rest of North America Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 95 Rest of North America Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 96 Europe Transcriptomics Market, 2017 - 2020, USD Million

TABLE 97 Europe Transcriptomics Market, 2021 - 2027, USD Million

TABLE 98 Europe Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 99 Europe Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 100 Europe q PCR Market by Country, 2017 - 2020, USD Million

TABLE 101 Europe q PCR Market by Country, 2021 - 2027, USD Million

TABLE 102 Europe Microarrays Market by Country, 2017 - 2020, USD Million

TABLE 103 Europe Microarrays Market by Country, 2021 - 2027, USD Million

TABLE 104 Europe Sequencing Technology Market by Country, 2017 - 2020, USD Million

TABLE 105 Europe Sequencing Technology Market by Country, 2021 - 2027, USD Million

TABLE 106 Europe Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 107 Europe Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 108 Europe Drug Discovery Market by Country, 2017 - 2020, USD Million

TABLE 109 Europe Drug Discovery Market by Country, 2021 - 2027, USD Million

TABLE 110 Europe Diagnostics & Disease Profiling Market by Country, 2017 - 2020, USD Million

TABLE 111 Europe Diagnostics & Disease Profiling Market by Country, 2021 - 2027, USD Million

TABLE 112 Europe Others Market by Country, 2017 - 2020, USD Million

TABLE 113 Europe Others Market by Country, 2021 - 2027, USD Million

TABLE 114 Europe Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 115 Europe Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 116 Europe Consumables Market by Country, 2017 - 2020, USD Million

TABLE 117 Europe Consumables Market by Country, 2021 - 2027, USD Million

TABLE 118 Europe Instruments Market by Country, 2017 - 2020, USD Million

TABLE 119 Europe Instruments Market by Country, 2021 - 2027, USD Million

TABLE 120 Europe Software Market by Country, 2017 - 2020, USD Million

TABLE 121 Europe Software Market by Country, 2021 - 2027, USD Million

TABLE 122 Europe Services Market by Country, 2017 - 2020, USD Million

TABLE 123 Europe Services Market by Country, 2021 - 2027, USD Million

TABLE 124 Europe Transcriptomics Market by Country, 2017 - 2020, USD Million

TABLE 125 Europe Transcriptomics Market by Country, 2021 - 2027, USD Million

TABLE 126 Germany Transcriptomics Market, 2017 - 2020, USD Million

TABLE 127 Germany Transcriptomics Market, 2021 - 2027, USD Million

TABLE 128 Germany Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 129 Germany Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 130 Germany Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 131 Germany Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 132 Germany Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 133 Germany Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 134 UK Transcriptomics Market, 2017 - 2020, USD Million

TABLE 135 UK Transcriptomics Market, 2021 - 2027, USD Million

TABLE 136 UK Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 137 UK Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 138 UK Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 139 UK Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 140 UK Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 141 UK Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 142 France Transcriptomics Market, 2017 - 2020, USD Million

TABLE 143 France Transcriptomics Market, 2021 - 2027, USD Million

TABLE 144 France Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 145 France Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 146 France Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 147 France Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 148 France Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 149 France Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 150 Russia Transcriptomics Market, 2017 - 2020, USD Million

TABLE 151 Russia Transcriptomics Market, 2021 - 2027, USD Million

TABLE 152 Russia Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 153 Russia Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 154 Russia Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 155 Russia Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 156 Russia Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 157 Russia Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 158 Spain Transcriptomics Market, 2017 - 2020, USD Million

TABLE 159 Spain Transcriptomics Market, 2021 - 2027, USD Million

TABLE 160 Spain Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 161 Spain Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 162 Spain Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 163 Spain Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 164 Spain Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 165 Spain Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 166 Italy Transcriptomics Market, 2017 - 2020, USD Million

TABLE 167 Italy Transcriptomics Market, 2021 - 2027, USD Million

TABLE 168 Italy Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 169 Italy Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 170 Italy Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 171 Italy Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 172 Italy Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 173 Italy Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 174 Rest of Europe Transcriptomics Market, 2017 - 2020, USD Million

TABLE 175 Rest of Europe Transcriptomics Market, 2021 - 2027, USD Million

TABLE 176 Rest of Europe Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 177 Rest of Europe Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 178 Rest of Europe Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 179 Rest of Europe Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 180 Rest of Europe Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 181 Rest of Europe Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 182 Asia Pacific Transcriptomics Market, 2017 - 2020, USD Million

TABLE 183 Asia Pacific Transcriptomics Market, 2021 - 2027, USD Million

TABLE 184 Asia Pacific Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 185 Asia Pacific Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 186 Asia Pacific q PCR Market by Country, 2017 - 2020, USD Million

TABLE 187 Asia Pacific q PCR Market by Country, 2021 - 2027, USD Million

TABLE 188 Asia Pacific Microarrays Market by Country, 2017 - 2020, USD Million

TABLE 189 Asia Pacific Microarrays Market by Country, 2021 - 2027, USD Million

TABLE 190 Asia Pacific Sequencing Technology Market by Country, 2017 - 2020, USD Million

TABLE 191 Asia Pacific Sequencing Technology Market by Country, 2021 - 2027, USD Million

TABLE 192 Asia Pacific Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 193 Asia Pacific Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 194 Asia Pacific Drug Discovery Market by Country, 2017 - 2020, USD Million

TABLE 195 Asia Pacific Drug Discovery Market by Country, 2021 - 2027, USD Million

TABLE 196 Asia Pacific Diagnostics & Disease Profiling Market by Country, 2017 - 2020, USD Million

TABLE 197 Asia Pacific Diagnostics & Disease Profiling Market by Country, 2021 - 2027, USD Million

TABLE 198 Asia Pacific Others Market by Country, 2017 - 2020, USD Million

TABLE 199 Asia Pacific Others Market by Country, 2021 - 2027, USD Million

TABLE 200 Asia Pacific Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 201 Asia Pacific Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 202 Asia Pacific Consumables Market by Country, 2017 - 2020, USD Million

TABLE 203 Asia Pacific Consumables Market by Country, 2021 - 2027, USD Million

TABLE 204 Asia Pacific Instruments Market by Country, 2017 - 2020, USD Million

TABLE 205 Asia Pacific Instruments Market by Country, 2021 - 2027, USD Million

TABLE 206 Asia Pacific Software Market by Country, 2017 - 2020, USD Million

TABLE 207 Asia Pacific Software Market by Country, 2021 - 2027, USD Million

TABLE 208 Asia Pacific Services Market by Country, 2017 - 2020, USD Million

TABLE 209 Asia Pacific Services Market by Country, 2021 - 2027, USD Million

TABLE 210 Asia Pacific Transcriptomics Market by Country, 2017 - 2020, USD Million

TABLE 211 Asia Pacific Transcriptomics Market by Country, 2021 - 2027, USD Million

TABLE 212 China Transcriptomics Market, 2017 - 2020, USD Million

TABLE 213 China Transcriptomics Market, 2021 - 2027, USD Million

TABLE 214 China Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 215 China Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 216 China Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 217 China Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 218 China Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 219 China Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 220 Japan Transcriptomics Market, 2017 - 2020, USD Million

TABLE 221 Japan Transcriptomics Market, 2021 - 2027, USD Million

TABLE 222 Japan Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 223 Japan Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 224 Japan Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 225 Japan Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 226 Japan Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 227 Japan Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 228 India Transcriptomics Market, 2017 - 2020, USD Million

TABLE 229 India Transcriptomics Market, 2021 - 2027, USD Million

TABLE 230 India Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 231 India Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 232 India Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 233 India Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 234 India Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 235 India Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 236 South Korea Transcriptomics Market, 2017 - 2020, USD Million

TABLE 237 South Korea Transcriptomics Market, 2021 - 2027, USD Million

TABLE 238 South Korea Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 239 South Korea Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 240 South Korea Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 241 South Korea Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 242 South Korea Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 243 South Korea Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 244 Singapore Transcriptomics Market, 2017 - 2020, USD Million

TABLE 245 Singapore Transcriptomics Market, 2021 - 2027, USD Million

TABLE 246 Singapore Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 247 Singapore Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 248 Singapore Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 249 Singapore Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 250 Singapore Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 251 Singapore Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 252 Malaysia Transcriptomics Market, 2017 - 2020, USD Million

TABLE 253 Malaysia Transcriptomics Market, 2021 - 2027, USD Million

TABLE 254 Malaysia Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 255 Malaysia Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 256 Malaysia Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 257 Malaysia Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 258 Malaysia Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 259 Malaysia Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 260 Rest of Asia Pacific Transcriptomics Market, 2017 - 2020, USD Million

TABLE 261 Rest of Asia Pacific Transcriptomics Market, 2021 - 2027, USD Million

TABLE 262 Rest of Asia Pacific Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 263 Rest of Asia Pacific Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 264 Rest of Asia Pacific Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 265 Rest of Asia Pacific Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 266 Rest of Asia Pacific Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 267 Rest of Asia Pacific Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 268 LAMEA Transcriptomics Market, 2017 - 2020, USD Million

TABLE 269 LAMEA Transcriptomics Market, 2021 - 2027, USD Million

TABLE 270 LAMEA Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 271 LAMEA Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 272 LAMEA q PCR Market by Country, 2017 - 2020, USD Million

TABLE 273 LAMEA q PCR Market by Country, 2021 - 2027, USD Million

TABLE 274 LAMEA Microarrays Market by Country, 2017 - 2020, USD Million

TABLE 275 LAMEA Microarrays Market by Country, 2021 - 2027, USD Million

TABLE 276 LAMEA Sequencing Technology Market by Country, 2017 - 2020, USD Million

TABLE 277 LAMEA Sequencing Technology Market by Country, 2021 - 2027, USD Million

TABLE 278 LAMEA Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 279 LAMEA Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 280 LAMEA Drug Discovery Market by Country, 2017 - 2020, USD Million

TABLE 281 LAMEA Drug Discovery Market by Country, 2021 - 2027, USD Million

TABLE 282 LAMEA Diagnostics & Disease Profiling Market by Country, 2017 - 2020, USD Million

TABLE 283 LAMEA Diagnostics & Disease Profiling Market by Country, 2021 - 2027, USD Million

TABLE 284 LAMEA Others Market by Country, 2017 - 2020, USD Million

TABLE 285 LAMEA Others Market by Country, 2021 - 2027, USD Million

TABLE 286 LAMEA Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 287 LAMEA Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 288 LAMEA Consumables Market by Country, 2017 - 2020, USD Million

TABLE 289 LAMEA Consumables Market by Country, 2021 - 2027, USD Million

TABLE 290 LAMEA Instruments Market by Country, 2017 - 2020, USD Million

TABLE 291 LAMEA Instruments Market by Country, 2021 - 2027, USD Million

TABLE 292 LAMEA Software Market by Country, 2017 - 2020, USD Million

TABLE 293 LAMEA Software Market by Country, 2021 - 2027, USD Million

TABLE 294 LAMEA Services Market by Country, 2017 - 2020, USD Million

TABLE 295 LAMEA Services Market by Country, 2021 - 2027, USD Million

TABLE 296 LAMEA Transcriptomics Market by Country, 2017 - 2020, USD Million

TABLE 297 LAMEA Transcriptomics Market by Country, 2021 - 2027, USD Million

TABLE 298 Brazil Transcriptomics Market, 2017 - 2020, USD Million

TABLE 299 Brazil Transcriptomics Market, 2021 - 2027, USD Million

TABLE 300 Brazil Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 301 Brazil Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 302 Brazil Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 303 Brazil Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 304 Brazil Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 305 Brazil Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 306 Argentina Transcriptomics Market, 2017 - 2020, USD Million

TABLE 307 Argentina Transcriptomics Market, 2021 - 2027, USD Million

TABLE 308 Argentina Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 309 Argentina Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 310 Argentina Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 311 Argentina Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 312 Argentina Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 313 Argentina Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 314 UAE Transcriptomics Market, 2017 - 2020, USD Million

TABLE 315 UAE Transcriptomics Market, 2021 - 2027, USD Million

TABLE 316 UAE Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 317 UAE Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 318 UAE Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 319 UAE Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 320 UAE Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 321 UAE Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 322 Saudi Arabia Transcriptomics Market, 2017 - 2020, USD Million

TABLE 323 Saudi Arabia Transcriptomics Market, 2021 - 2027, USD Million

TABLE 324 Saudi Arabia Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 325 Saudi Arabia Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 326 Saudi Arabia Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 327 Saudi Arabia Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 328 Saudi Arabia Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 329 Saudi Arabia Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 330 South Africa Transcriptomics Market, 2017 - 2020, USD Million

TABLE 331 South Africa Transcriptomics Market, 2021 - 2027, USD Million

TABLE 332 South Africa Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 333 South Africa Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 334 South Africa Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 335 South Africa Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 336 South Africa Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 337 South Africa Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 338 Nigeria Transcriptomics Market, 2017 - 2020, USD Million

TABLE 339 Nigeria Transcriptomics Market, 2021 - 2027, USD Million

TABLE 340 Nigeria Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 341 Nigeria Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 342 Nigeria Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 343 Nigeria Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 344 Nigeria Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 345 Nigeria Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 346 Rest of LAMEA Transcriptomics Market, 2017 - 2020, USD Million

TABLE 347 Rest of LAMEA Transcriptomics Market, 2021 - 2027, USD Million

TABLE 348 Rest of LAMEA Transcriptomics Market by Technology, 2017 - 2020, USD Million

TABLE 349 Rest of LAMEA Transcriptomics Market by Technology, 2021 - 2027, USD Million

TABLE 350 Rest of LAMEA Transcriptomics Market by Application, 2017 - 2020, USD Million

TABLE 351 Rest of LAMEA Transcriptomics Market by Application, 2021 - 2027, USD Million

TABLE 352 Rest of LAMEA Transcriptomics Market by Component, 2017 - 2020, USD Million

TABLE 353 Rest of LAMEA Transcriptomics Market by Component, 2021 - 2027, USD Million

TABLE 354 Key Information – Fluidigm Corporation

TABLE 355 key Information – Promega Corporation

TABLE 356 Key Information – General Electric (GE) Co.

TABLE 357 KEY INFORMATION - MERCK & CO., INC.

TABLE 358 Key Information – Thermo Fisher Scientific, Inc.

TABLE 359 key information – Illumina, Inc.

TABLE 360 Key Information – Bio-Rad Laboratories, Inc.

TABLE 361 key Information – Agilent Technologies, Inc.

TABLE 362 key information – F. Hoffmann-La Roche Ltd.

TABLE 363 Key Information – Qiagen N.V.

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2017-2021)

FIG 4 Key Strategic Move: (Acquisitions and Mergers: 2019, Jan – 2021, Apr) Leading Players

FIG 5 Key Strategic Move: (Product Launches ad Product Expansions: 2018, Mar – 2021, Nov) Leading Players

FIG 6 Global Transcriptomics Market Share by Technology, 2017

FIG 7 Global Transcriptomics Market Share by Technology, 2027

FIG 8 Global Transcriptomics Market by Technology, 2017 - 2027, USD Million

FIG 9 Global Transcriptomics Market Share by Application, 2020

FIG 10 Global Transcriptomics Market Share by Application, 2027

FIG 11 Global Transcriptomics Market by Application, 2017 - 2027, USD Million

FIG 12 Global Transcriptomics Market Share by Component, 2020

FIG 13 Global Transcriptomics Market Share by Component, 2027

FIG 14 Global Transcriptomics Market by Component, 2017 - 2027, USD Million

FIG 15 Global Transcriptomics Market Share by Region, 2020

FIG 16 Global Transcriptomics Market Share by Region, 2027

FIG 17 Global Transcriptomics Market by Region, 2017 - 2027, USD Million

FIG 18 Swot analysis: thermo fisher scientific, inc.

FIG 19 Recent strategies and developments: Bio-Rad Laboratories, Inc.

FIG 20 Recent strategies and developments: Qiagen N.V.