Global Trade Surveillance Systems Market Size, Share & Industry Trends Analysis Report By Deployment Mode, By Organization Size, By Vertical, By Component, By Solutions Type, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-May-2022 | Pages: 298 | Formats: PDF |

COVID-19 Impact on the Trade Surveillance Systems Market

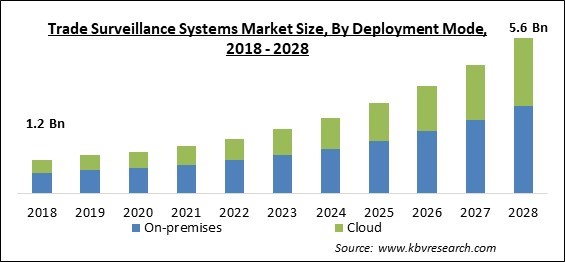

The Global Trade Surveillance Systems Market size is expected to reach $5.6 Billion by 2028, rising at a market growth of 18.9% CAGR during the forecast period.

The establishment of a surveillance system to examine manipulative or unlawful trading practices in the security markets is known as trade surveillance. By monitoring & detecting trading actions, trade surveillance aids in the maintenance of orderly markets. Cross-market, market manipulation, trade violence, cross-asset research, & pre- and post-trade checks to ensure the fairness & accuracy of transactions in an organization are just a few examples.

A trade surveillance system is a sophisticated software solution that monitors and detects suspected market manipulation & other financial crimes. It detects illegal or immoral trading practices like fraud, behavioral patterning, market manipulation, unauthorized disclosure, insider trading, money laundering, & unsuitable investments by gathering & analyzing trade data.

It is vital to have the right trade surveillance systems in place to make sure the prevention & investigation of abusive, manipulative, or criminal trading practices. The full depth of the order book, market and cross asset-class views of trades entered by the business under investigation, and examination of complete audit trails of orders & trades in suspected cases are just a few of the primary application areas for such a system.

Trading has become more complicated in financial businesses as the number of financial instruments has grown. The increased number of transactions necessitates the requirement for financial service organizations to monitor transactions under rules like MiFID II, MAR, and Dodd-Frank. Financial firms must adopt trade monitoring systems, according to SteelEye, not only to guarantee that they are complying with legislation but also to limit the danger of fraudulent misconduct and defend their brand. Compliance officers are also responsible for monitoring and evaluating the company's trading behavior under the Markets Abuse Regulation (MAR).

COVID-19 Impact Analysis

The COVID-19 pandemic has had a moderate impact on the trade surveillance system industry, due to high pressure on businesses to preserve essential data in the event of a pandemic and a drop in end-user spending. Moreover, there is a lot of volatility in the market as a result of the worldwide shutdown, and corporations are having a hard time monitoring numerous questionable trading activities. As a result, many companies are using trade surveillance systems to monitor multiple questionable actions during the pandemic condition and to regulate skyrocketing market volumes, which is supporting market growth. In addition, some market players are investing extensively in increasing product quality, which is assisting them in gaining market share in developing countries around the world. As a result, the market for trade surveillance systems is developing due to an increasing number of such advances among the market's main competitors.

Market Growth Factors

Unification of AI & ML in Trade Surveillance Systems

Voice, video, and other forms of technological communication must be monitored in order to detect fraudulent behavior among traders. To disclose genuine intent, AI-based systems can contextualize information based on tone, jargon, slang, idioms, and code words. Risk scores are assigned automatically for individual transactions, market actors, asset classes, and marketplaces based on this surveillance. Nasdaq, for instance, employs AI-based systems to spot complex correlations and patterns, as well as new sorts of market manipulations, across roughly 60 marketplaces and over 160 global participants. AI-based solutions assign risk rankings based on a variety of factors, allowing for better event prioritization and grouping.

Increased Government Regulations & Laws to Limit Insider Trading

Insider trading is a criminal offense in the United States that involves both monetary & jail penalties. After receiving critical information, the Securities and Exchange Commission's (SEC) enforcement section conducts a thorough investigation into a possible securities violation. The SEC builds a case through interviewing witnesses, reviewing trade records & data, subpoenaing phone records, and other means. In recent years, the SEC has employed a diverse set of instruments and techniques to combat insider trading. In the landmark Galleon Group case, wiretaps were used for the first time to incriminate numerous people in a wide-ranging insider-trading conspiracy.

Market Restraining Factors

Concerns about compliance non-standardization, worldwide regulations, and cost-benefit ratio

The government organizations and relevant authorities from various countries have worked to enforce severe regulations to reduce financial fraud and cybercrime. Advances in cybercrime have prompted authorities to update their legislation regularly. Regulators in different regions are always changing and evolving, posing problems for trade surveillance management suppliers to cope with and improve their solutions to adhere to the various requirements. Advances in the trading technology, as well as cross-border trading, have prompted the financial institution to keep a tight check on every transaction to avoid the incurring hefty fines as a result of regulatory violations.

Deployment Mode Outlook

Based on Deployment Mode, the market is segmented into On-premises and Cloud. The Cloud-based segment procured a substantial revenue share in the trade surveillance market in 2021. Because of the convenience of digitalization and quick accessibility, cloud-based trading surveillance systems are fast evolving. However, as the number of cloud-based trading activities grows, so does the requirement for trading surveillance. Owing to the many advantages it provides, cloud-based trade surveillance solutions are gaining a lot more traction currently. Since it encourages digitalization, cloud-based trading activity is emerging as a new emerging trend in trade. In addition, the market for cloud-based trade surveillance systems is growing due to increased use among small, medium, and big businesses as well as freelancers. The cloud-based trade surveillance solution aids in the transformation of these businesses' application development, infrastructure, deployment, and delivery processes, while also enhancing efficiency and reducing storage costs drastically.

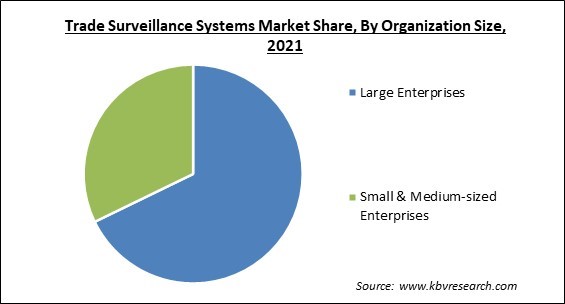

Organization Size Outlook

Based on Organization Size, the market is segmented into Large Enterprises and Small & Medium-sized Enterprises. The Large Enterprises acquired the highest revenue share in the trade surveillance market in 2021. Large firms are defined as businesses with more than a thousand employees. Due to the need for a modern, holistic approach to trade surveillance, as well as extensive functional and regulatory coverage and the flexibility to fulfill the needs of today's complex business environment, large enterprises have adopted trade surveillance systems at a faster rate.

Vertical Outlook

Based on Vertical, the market is segmented into Banking, Capital Markets, and Others. The capital market segment garnered a substantial revenue share in the trade surveillance market in 2021. As the capital/security markets have developed, traders have discovered new ways to manipulate prices, resulting in a loss of investor confidence and a deterioration of market integrity. Trade surveillance in the financial sector is defined as the process of monitoring & investigating an organization's trading conduct that directly or indirectly involves market abuse or market manipulation, which could result in legal action, criminal charges, or even corporate closure.

Component Outlook

Based on Component, the market is segmented into Solutions and Services. Based on Solutions Type, the market is segmented into Reporting & Monitoring, Surveillance & Analytics, Risk & Compliance, Case Management, and Others. The solutions segment acquired the highest revenue share in the trade surveillance market in 2021. This is due to an increase in the demand for upgrading firm performance and analyzing large volumes of data from multiple locations, both of which improve the efficiency of trade surveillance systems. Trade surveillance systems can help businesses in a variety of ways, involving data optimization, better compliance management, and easier case management. Enterprises are also using trade surveillance systems solutions to automate, improve, and manage the surveillance process to improve capabilities and efficiency.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 5.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 18.9% from 2022 to 2028 |

| Number of Pages | 298 |

| Number of Tables | 523 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment Mode, Organization Size, Component, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Europe emerged as the leading region in the trade surveillance systems market with the highest revenue share in 2021. The existence of the bulk of telecom system integrators is one of the primary reasons driving the growth of the trade surveillance system market in this region. Additionally, technological developments in security systems, as well as a rise in strict rules and regulatory compliance, all lead to the enhancement of the European trade surveillance system market.

Free Valuable Insights: Global Trade Surveillance Systems Market size to reach USD 5.6 Billion by 2028

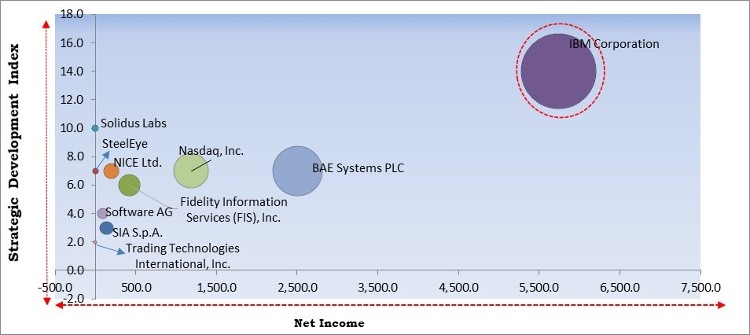

KBV Cardinal Matrix - Trade Surveillance Systems Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; IBM Corporation are the forerunners in the Trade Surveillance Systems Market. Companies such as BAE Systems PLC, Nasdaq, Inc., Fidelity Information Services (FIS), Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Software AG, NICE Ltd., Nasdaq, Inc., Fidelity Information Services (FIS), Inc., BAE Systems PLC, SIA S.p.A. (Nexi Group), SteelEye Limited, Solidus Labs, Inc., and Trading Technologies International, Inc.

Recent Strategies Deployed in Trade Surveillance Systems Market

» Partnerships, Collaborations and Agreements

- Feb-2022: Solidus Labs came into partnership with CoinDCX, India’s first crypto unicorn, and the nation’s safest crypto exchange. This partnership aimed to safeguard the users from known forms of market abuse and the bulk of emerging crypto-specific risks.

- Sep-2021: NICE today expanded its partnership with Cloud9 Technologies, a core brand of leading financial markets’ infrastructure and technology company Symphony. This expanded partnership aimed to unify its cloud compliance suite with Cloud9’s voice trading platform. This partnership would enable financial services organizations to enhance C9’s next-generation cloud-based solution which digitally transforms voice trading with NICE’s cloud compliance solutions to assist adherence with relevant global regulations around capturing and surveilling Cloud9 interactions.

- Jun-2021: Fidelity Information Services came into a partnership with C3 AI, a top enterprise AI software provider for building enterprise-scale AI applications and boosting digital transformation. This partnership aimed to assist capital markets firms to tap into the power of their organizational data to raise efficiency and better handle regulatory compliance and risk.

- Jan-2021: Solidus Labs formed a partnership with Bittrex, the leading U.S based blockchain platform, and a global leader in digital asset exchange. This partnership aimed for, Bittrex to use Solidus Labs' crypto-native risk monitoring and market surveillance software to safeguard its users from market abuse, ensure market integrity, and deal with evolving regulatory requirements.

- Jul-2020: SteelEye formed a partnership with Cloud9 Technologies, a trading and compliance technology provider. This partnership aimed to overcome obstacles in regulatory needs for voice trading. Further, this partnership between these two companies would allow firms to capture their Cloud9 voice trade data within SteelEye’s compliance platform and overlay their data with voice communications to identify market abuse risks with the least effort.

» Product Launches and Product Expansions

- Apr-2022: SteelEye unveiled a new Order Book Replay service. This product launch aimed to facilitate more accurate and robust market abuse surveillance.

- Mar-2022: Solidus Labs unveiled HALO, the first automated, comprehensive, and testable trade surveillance and market integrity hub tailored for digital assets. HALO is a revolution in the digital asset compliance technology space, set to enable mainstream adoption. This product launch aimed to safeguard businesses from a growing range of crypto-specific risks.

- Aug-2021: IBM launched a new IBM Telum Processor, built to bring deep learning inference to enterprise workloads to aid address fraud in real-time. Telum is IBM's first processor that consists of on-chip acceleration for AI inferencing while a transaction is taking place. IBM Telum Processor's on-chip hardware acceleration is built to aid customers to get business insights at scale over banking, finance, insurance applications, trading, and customer interactions.

- Mar-2021: IBM unveiled a new and improved service created to assist organizations to handle their cloud security strategy, policies, and controls over hybrid cloud environments. These enhanced services bring together IBM, cloud-native, and third-party technologies with IBM expertise to assist organizations to build integrated security approaches over their cloud ecosystems.

- Nov-2020: Solidus released its solution for shared-surveillance of crypto markets. This product launch aimed to detect price and volume manipulation taking place over different digital asset exchanges simultaneously. Further, the aim is to work towards a multi-exchange data consortium meant to share information and eliminate bad actors in a process to bring even more transparency to digital asset markets and enable regulated growth.

- Nov-2020: SIA introduced a new digital service for banks, payment service providers, and other financial institutions all over Europe. This initiative is supported by RiskShield, an advanced risk-evaluation system developed by INFORM, a Germany-based company. This product launch aimed to allow customers of SIA to speed up the authentication process for online payments, in line with PSD2 security standards.

- Jan-2020: Nasdaq released a data discovery tool within its trade surveillance service used by major banks. This product launch aimed to assist compliance teams in better managing trading activity. This data discovery tool would also be released over the operator’s other market technology platforms.

» Acquisitions and Mergers

- Apr-2022: Software AG took over StreamSets, a leading data integration platform provider to build smart data pipelines needed to power DataOps over hybrid and multi-cloud architectures. This acquisition aimed to enable organizations to better unlock and capture value from data as it travels between on-premise applications, SaaS applications, data streams, legacy data stores, and cloud data platforms like Databricks, Amazon RedShift, and Snowflake. Further, this integrated hybrid iPaaS platform will deliver consolidated, conformed, continuous data to smart applications and the connected enterprise. This acquisition was followed by approval.

- Mar-2022: BAE Systems took over Bohemia Interactive Simulations, a global developer of advanced military training and simulation software. This acquisition aimed to expand modeling and simulation capabilities in a ‘growing market for global military training’. In addition, Bohemia would join BAE System's Intelligence & Security sector.

- Nov-2021: IBM signed an agreement to acquire ReaQta, a powerful Active Defense Intelligence Platform. This acquisition would expand IBM's capabilities in the extended detection and response (XDR) market, matching IBM's strategy to provide security with an open approach that extends over disparate tools, data, and hybrid cloud environments.

- Feb-2021: Nasdaq took over Verafin, an industry pioneer in anti-financial crime management solutions. This acquisition aimed to accelerate Nasdaq’s ongoing evolution into a leading SaaS technology provider and substantially strengthen its present regulatory and anti-financial crime solutions.

Scope of the Study

Market Segments Covered in the Report:

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises

By Vertical

- Banking

- Capital Markets

- Others

By Component

- Solutions

- Reporting & Monitoring

- Surveillance & Analytics

- Risk & Compliance

- Case Management

- Others

- Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- Software AG

- NICE Ltd.

- Nasdaq, Inc.

- Fidelity Information Services (FIS), Inc.

- BAE Systems PLC

- SIA S.p.A. (Nexi Group)

- SteelEye Limited

- Solidus Labs, Inc.

- Trading Technologies International, Inc.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Trade Surveillance Systems Market, by Deployment Mode

1.4.2 Global Trade Surveillance Systems Market, by Organization Size

1.4.3 Global Trade Surveillance Systems Market, by Vertical

1.4.4 Global Trade Surveillance Systems Market, by Component

1.4.5 Global Trade Surveillance Systems Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2019, Apr – 2022, Apr) Leading Players

Chapter 4. Global Trade Surveillance Systems Market by Deployment Mode

4.1 Global On-premises Market by Region

4.2 Global Cloud Market by Region

Chapter 5. Global Trade Surveillance Systems Market by Organization Size

5.1 Global Large Enterprises Market by Region

5.2 Global Small & Medium-sized Enterprises Market by Region

Chapter 6. Global Trade Surveillance Systems Market by Vertical

6.1 Global Banking Market by Region

6.2 Global Capital Markets Market by Region

6.3 Global Others Market by Region

Chapter 7. Global Trade Surveillance Systems Market by Component

7.1 Global Solutions Market by Region

7.2 Global Trade Surveillance Systems Market by Solutions Type

7.2.1 Global Reporting & Monitoring Market by Region

7.2.2 Global Surveillance & Analytics Market by Region

7.2.3 Global Risk & Compliance Market by Region

7.2.4 Global Case Management Market by Region

7.2.5 Global Others Market by Region

7.3 Global Services Market by Region

Chapter 8. Global Trade Surveillance Systems Market by Region

8.1 North America Trade Surveillance Systems Market

8.1.1 North America Trade Surveillance Systems Market by Deployment Mode

8.1.1.1 North America On-premises Market by Country

8.1.1.2 North America Cloud Market by Country

8.1.2 North America Trade Surveillance Systems Market by Organization Size

8.1.2.1 North America Large Enterprises Market by Country

8.1.2.2 North America Small & Medium-sized Enterprises Market by Country

8.1.3 North America Trade Surveillance Systems Market by Vertical

8.1.3.1 North America Banking Market by Country

8.1.3.2 North America Capital Markets Market by Country

8.1.3.3 North America Others Market by Country

8.1.4 North America Trade Surveillance Systems Market by Component

8.1.4.1 North America Solutions Market by Country

8.1.4.2 North America Trade Surveillance Systems Market by Solutions Type

8.1.4.2.1 North America Reporting & Monitoring Market by Country

8.1.4.2.2 North America Surveillance & Analytics Market by Country

8.1.4.2.3 North America Risk & Compliance Market by Country

8.1.4.2.4 North America Case Management Market by Country

8.1.4.2.5 North America Others Market by Country

8.1.4.3 North America Services Market by Country

8.1.5 North America Trade Surveillance Systems Market by Country

8.1.5.1 US Trade Surveillance Systems Market

8.1.5.1.1 US Trade Surveillance Systems Market by Deployment Mode

8.1.5.1.2 US Trade Surveillance Systems Market by Organization Size

8.1.5.1.3 US Trade Surveillance Systems Market by Vertical

8.1.5.1.4 US Trade Surveillance Systems Market by Component

8.1.5.2 Canada Trade Surveillance Systems Market

8.1.5.2.1 Canada Trade Surveillance Systems Market by Deployment Mode

8.1.5.2.2 Canada Trade Surveillance Systems Market by Organization Size

8.1.5.2.3 Canada Trade Surveillance Systems Market by Vertical

8.1.5.2.4 Canada Trade Surveillance Systems Market by Component

8.1.5.3 Mexico Trade Surveillance Systems Market

8.1.5.3.1 Mexico Trade Surveillance Systems Market by Deployment Mode

8.1.5.3.2 Mexico Trade Surveillance Systems Market by Organization Size

8.1.5.3.3 Mexico Trade Surveillance Systems Market by Vertical

8.1.5.3.4 Mexico Trade Surveillance Systems Market by Component

8.1.5.4 Rest of North America Trade Surveillance Systems Market

8.1.5.4.1 Rest of North America Trade Surveillance Systems Market by Deployment Mode

8.1.5.4.2 Rest of North America Trade Surveillance Systems Market by Organization Size

8.1.5.4.3 Rest of North America Trade Surveillance Systems Market by Vertical

8.1.5.4.4 Rest of North America Trade Surveillance Systems Market by Component

8.2 Europe Trade Surveillance Systems Market

8.2.1 Europe Trade Surveillance Systems Market by Deployment Mode

8.2.1.1 Europe On-premises Market by Country

8.2.1.2 Europe Cloud Market by Country

8.2.2 Europe Trade Surveillance Systems Market by Organization Size

8.2.2.1 Europe Large Enterprises Market by Country

8.2.2.2 Europe Small & Medium-sized Enterprises Market by Country

8.2.3 Europe Trade Surveillance Systems Market by Vertical

8.2.3.1 Europe Banking Market by Country

8.2.3.2 Europe Capital Markets Market by Country

8.2.3.3 Europe Others Market by Country

8.2.4 Europe Trade Surveillance Systems Market by Component

8.2.4.1 Europe Solutions Market by Country

8.2.4.2 Europe Trade Surveillance Systems Market by Solutions Type

8.2.4.2.1 Europe Reporting & Monitoring Market by Country

8.2.4.2.2 Europe Surveillance & Analytics Market by Country

8.2.4.2.3 Europe Risk & Compliance Market by Country

8.2.4.2.4 Europe Case Management Market by Country

8.2.4.2.5 Europe Others Market by Country

8.2.4.3 Europe Services Market by Country

8.2.5 Europe Trade Surveillance Systems Market by Country

8.2.5.1 Germany Trade Surveillance Systems Market

8.2.5.1.1 Germany Trade Surveillance Systems Market by Deployment Mode

8.2.5.1.2 Germany Trade Surveillance Systems Market by Organization Size

8.2.5.1.3 Germany Trade Surveillance Systems Market by Vertical

8.2.5.1.4 Germany Trade Surveillance Systems Market by Component

8.2.5.2 UK Trade Surveillance Systems Market

8.2.5.2.1 UK Trade Surveillance Systems Market by Deployment Mode

8.2.5.2.2 UK Trade Surveillance Systems Market by Organization Size

8.2.5.2.3 UK Trade Surveillance Systems Market by Vertical

8.2.5.2.4 UK Trade Surveillance Systems Market by Component

8.2.5.3 France Trade Surveillance Systems Market

8.2.5.3.1 France Trade Surveillance Systems Market by Deployment Mode

8.2.5.3.2 France Trade Surveillance Systems Market by Organization Size

8.2.5.3.3 France Trade Surveillance Systems Market by Vertical

8.2.5.3.4 France Trade Surveillance Systems Market by Component

8.2.5.4 Russia Trade Surveillance Systems Market

8.2.5.4.1 Russia Trade Surveillance Systems Market by Deployment Mode

8.2.5.4.2 Russia Trade Surveillance Systems Market by Organization Size

8.2.5.4.3 Russia Trade Surveillance Systems Market by Vertical

8.2.5.4.4 Russia Trade Surveillance Systems Market by Component

8.2.5.5 Spain Trade Surveillance Systems Market

8.2.5.5.1 Spain Trade Surveillance Systems Market by Deployment Mode

8.2.5.5.2 Spain Trade Surveillance Systems Market by Organization Size

8.2.5.5.3 Spain Trade Surveillance Systems Market by Vertical

8.2.5.5.4 Spain Trade Surveillance Systems Market by Component

8.2.5.6 Italy Trade Surveillance Systems Market

8.2.5.6.1 Italy Trade Surveillance Systems Market by Deployment Mode

8.2.5.6.2 Italy Trade Surveillance Systems Market by Organization Size

8.2.5.6.3 Italy Trade Surveillance Systems Market by Vertical

8.2.5.6.4 Italy Trade Surveillance Systems Market by Component

8.2.5.7 Rest of Europe Trade Surveillance Systems Market

8.2.5.7.1 Rest of Europe Trade Surveillance Systems Market by Deployment Mode

8.2.5.7.2 Rest of Europe Trade Surveillance Systems Market by Organization Size

8.2.5.7.3 Rest of Europe Trade Surveillance Systems Market by Vertical

8.2.5.7.4 Rest of Europe Trade Surveillance Systems Market by Component

8.3 Asia Pacific Trade Surveillance Systems Market

8.3.1 Asia Pacific Trade Surveillance Systems Market by Deployment Mode

8.3.1.1 Asia Pacific On-premises Market by Country

8.3.1.2 Asia Pacific Cloud Market by Country

8.3.2 Asia Pacific Trade Surveillance Systems Market by Organization Size

8.3.2.1 Asia Pacific Large Enterprises Market by Country

8.3.2.2 Asia Pacific Small & Medium-sized Enterprises Market by Country

8.3.3 Asia Pacific Trade Surveillance Systems Market by Vertical

8.3.3.1 Asia Pacific Banking Market by Country

8.3.3.2 Asia Pacific Capital Markets Market by Country

8.3.3.3 Asia Pacific Others Market by Country

8.3.4 Asia Pacific Trade Surveillance Systems Market by Component

8.3.4.1 Asia Pacific Solutions Market by Country

8.3.4.2 Asia Pacific Trade Surveillance Systems Market by Solutions Type

8.3.4.2.1 Asia Pacific Reporting & Monitoring Market by Country

8.3.4.2.2 Asia Pacific Surveillance & Analytics Market by Country

8.3.4.2.3 Asia Pacific Risk & Compliance Market by Country

8.3.4.2.4 Asia Pacific Case Management Market by Country

8.3.4.2.5 Asia Pacific Others Market by Country

8.3.4.3 Asia Pacific Services Market by Country

8.3.5 Asia Pacific Trade Surveillance Systems Market by Country

8.3.5.1 China Trade Surveillance Systems Market

8.3.5.1.1 China Trade Surveillance Systems Market by Deployment Mode

8.3.5.1.2 China Trade Surveillance Systems Market by Organization Size

8.3.5.1.3 China Trade Surveillance Systems Market by Vertical

8.3.5.1.4 China Trade Surveillance Systems Market by Component

8.3.5.2 Japan Trade Surveillance Systems Market

8.3.5.2.1 Japan Trade Surveillance Systems Market by Deployment Mode

8.3.5.2.2 Japan Trade Surveillance Systems Market by Organization Size

8.3.5.2.3 Japan Trade Surveillance Systems Market by Vertical

8.3.5.2.4 Japan Trade Surveillance Systems Market by Component

8.3.5.3 India Trade Surveillance Systems Market

8.3.5.3.1 India Trade Surveillance Systems Market by Deployment Mode

8.3.5.3.2 India Trade Surveillance Systems Market by Organization Size

8.3.5.3.3 India Trade Surveillance Systems Market by Vertical

8.3.5.3.4 India Trade Surveillance Systems Market by Component

8.3.5.4 South Korea Trade Surveillance Systems Market

8.3.5.4.1 South Korea Trade Surveillance Systems Market by Deployment Mode

8.3.5.4.2 South Korea Trade Surveillance Systems Market by Organization Size

8.3.5.4.3 South Korea Trade Surveillance Systems Market by Vertical

8.3.5.4.4 South Korea Trade Surveillance Systems Market by Component

8.3.5.5 Singapore Trade Surveillance Systems Market

8.3.5.5.1 Singapore Trade Surveillance Systems Market by Deployment Mode

8.3.5.5.2 Singapore Trade Surveillance Systems Market by Organization Size

8.3.5.5.3 Singapore Trade Surveillance Systems Market by Vertical

8.3.5.5.4 Singapore Trade Surveillance Systems Market by Component

8.3.5.6 Malaysia Trade Surveillance Systems Market

8.3.5.6.1 Malaysia Trade Surveillance Systems Market by Deployment Mode

8.3.5.6.2 Malaysia Trade Surveillance Systems Market by Organization Size

8.3.5.6.3 Malaysia Trade Surveillance Systems Market by Vertical

8.3.5.6.4 Malaysia Trade Surveillance Systems Market by Component

8.3.5.7 Rest of Asia Pacific Trade Surveillance Systems Market

8.3.5.7.1 Rest of Asia Pacific Trade Surveillance Systems Market by Deployment Mode

8.3.5.7.2 Rest of Asia Pacific Trade Surveillance Systems Market by Organization Size

8.3.5.7.3 Rest of Asia Pacific Trade Surveillance Systems Market by Vertical

8.3.5.7.4 Rest of Asia Pacific Trade Surveillance Systems Market by Component

8.4 LAMEA Trade Surveillance Systems Market

8.4.1 LAMEA Trade Surveillance Systems Market by Deployment Mode

8.4.1.1 LAMEA On-premises Market by Country

8.4.1.2 LAMEA Cloud Market by Country

8.4.2 LAMEA Trade Surveillance Systems Market by Organization Size

8.4.2.1 LAMEA Large Enterprises Market by Country

8.4.2.2 LAMEA Small & Medium-sized Enterprises Market by Country

8.4.3 LAMEA Trade Surveillance Systems Market by Vertical

8.4.3.1 LAMEA Banking Market by Country

8.4.3.2 LAMEA Capital Markets Market by Country

8.4.3.3 LAMEA Others Market by Country

8.4.4 LAMEA Trade Surveillance Systems Market by Component

8.4.4.1 LAMEA Solutions Market by Country

8.4.4.2 LAMEA Trade Surveillance Systems Market by Solutions Type

8.4.4.2.1 LAMEA Reporting & Monitoring Market by Country

8.4.4.2.2 LAMEA Surveillance & Analytics Market by Country

8.4.4.2.3 LAMEA Risk & Compliance Market by Country

8.4.4.2.4 LAMEA Case Management Market by Country

8.4.4.2.5 LAMEA Others Market by Country

8.4.4.3 LAMEA Services Market by Country

8.4.5 LAMEA Trade Surveillance Systems Market by Country

8.4.5.1 Brazil Trade Surveillance Systems Market

8.4.5.1.1 Brazil Trade Surveillance Systems Market by Deployment Mode

8.4.5.1.2 Brazil Trade Surveillance Systems Market by Organization Size

8.4.5.1.3 Brazil Trade Surveillance Systems Market by Vertical

8.4.5.1.4 Brazil Trade Surveillance Systems Market by Component

8.4.5.2 Argentina Trade Surveillance Systems Market

8.4.5.2.1 Argentina Trade Surveillance Systems Market by Deployment Mode

8.4.5.2.2 Argentina Trade Surveillance Systems Market by Organization Size

8.4.5.2.3 Argentina Trade Surveillance Systems Market by Vertical

8.4.5.2.4 Argentina Trade Surveillance Systems Market by Component

8.4.5.3 UAE Trade Surveillance Systems Market

8.4.5.3.1 UAE Trade Surveillance Systems Market by Deployment Mode

8.4.5.3.2 UAE Trade Surveillance Systems Market by Organization Size

8.4.5.3.3 UAE Trade Surveillance Systems Market by Vertical

8.4.5.3.4 UAE Trade Surveillance Systems Market by Component

8.4.5.4 Saudi Arabia Trade Surveillance Systems Market

8.4.5.4.1 Saudi Arabia Trade Surveillance Systems Market by Deployment Mode

8.4.5.4.2 Saudi Arabia Trade Surveillance Systems Market by Organization Size

8.4.5.4.3 Saudi Arabia Trade Surveillance Systems Market by Vertical

8.4.5.4.4 Saudi Arabia Trade Surveillance Systems Market by Component

8.4.5.5 South Africa Trade Surveillance Systems Market

8.4.5.5.1 South Africa Trade Surveillance Systems Market by Deployment Mode

8.4.5.5.2 South Africa Trade Surveillance Systems Market by Organization Size

8.4.5.5.3 South Africa Trade Surveillance Systems Market by Vertical

8.4.5.5.4 South Africa Trade Surveillance Systems Market by Component

8.4.5.6 Nigeria Trade Surveillance Systems Market

8.4.5.6.1 Nigeria Trade Surveillance Systems Market by Deployment Mode

8.4.5.6.2 Nigeria Trade Surveillance Systems Market by Organization Size

8.4.5.6.3 Nigeria Trade Surveillance Systems Market by Vertical

8.4.5.6.4 Nigeria Trade Surveillance Systems Market by Component

8.4.5.7 Rest of LAMEA Trade Surveillance Systems Market

8.4.5.7.1 Rest of LAMEA Trade Surveillance Systems Market by Deployment Mode

8.4.5.7.2 Rest of LAMEA Trade Surveillance Systems Market by Organization Size

8.4.5.7.3 Rest of LAMEA Trade Surveillance Systems Market by Vertical

8.4.5.7.4 Rest of LAMEA Trade Surveillance Systems Market by Component

Chapter 9. Company Profiles

9.1 IBM Corporation

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Regional & Segmental Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Product Launches and Product Expansions:

9.1.5.2 Acquisition and Mergers:

9.2 Software AG

9.2.1 Company Overview

9.2.5 Recent strategies and developments:

9.2.5.1 Acquisition and Mergers:

9.3 NICE Ltd.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expenses

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.5.2 Product Launches and Product Expansions:

9.4 Nasdaq, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Recent strategies and developments:

9.4.4.1 Product Launches and Product Expansions:

9.4.4.2 Acquisition and Mergers:

9.5 Fidelity Information Services (FIS), Inc.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Segmental and Regional Analysis

9.5.4 Recent strategies and developments:

9.5.4.1 Partnerships, Collaborations, and Agreements:

9.5.4.2 Acquisition and Mergers:

9.6 BAE Systems PLC

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Research & Development Expenses

9.6.5 Recent strategies and developments:

9.6.5.1 Product Launches and Product Expansions:

9.6.5.2 Acquisition and Mergers:

9.6.6 SWOT Analysis

9.7 SIA S.p.A. (Nexi Group)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Recent strategies and developments:

9.8 SteelEye Limited

9.8.1 Company Overview

9.8.2 Recent strategies and developments:

9.9 Solidus Labs, Inc.

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Partnerships, Collaborations, and Agreements:

9.9.2.2 Product Launches and Product Expansions:

9.10. Trading Technologies International, Inc.

9.10.1 Company Overview

9.10.2 Recent strategies and developments:

9.10.2.1 Partnerships, Collaborations, and Agreements:

TABLE 2 Global Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Trade Surveillance Systems Market

TABLE 4 Product Launches And Product Expansions– Trade Surveillance Systems Market

TABLE 5 Acquisition and Mergers– Trade Surveillance Systems Market

TABLE 6 Global Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 7 Global Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 8 Global On-premises Market by Region, 2018 - 2021, USD Million

TABLE 9 Global On-premises Market by Region, 2022 - 2028, USD Million

TABLE 10 Global Cloud Market by Region, 2018 - 2021, USD Million

TABLE 11 Global Cloud Market by Region, 2022 - 2028, USD Million

TABLE 12 Global Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 13 Global Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 14 Global Large Enterprises Market by Region, 2018 - 2021, USD Million

TABLE 15 Global Large Enterprises Market by Region, 2022 - 2028, USD Million

TABLE 16 Global Small & Medium-sized Enterprises Market by Region, 2018 - 2021, USD Million

TABLE 17 Global Small & Medium-sized Enterprises Market by Region, 2022 - 2028, USD Million

TABLE 18 Global Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 19 Global Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 20 Global Banking Market by Region, 2018 - 2021, USD Million

TABLE 21 Global Banking Market by Region, 2022 - 2028, USD Million

TABLE 22 Global Capital Markets Market by Region, 2018 - 2021, USD Million

TABLE 23 Global Capital Markets Market by Region, 2022 - 2028, USD Million

TABLE 24 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 25 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 26 Global Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 27 Global Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 28 Global Solutions Market by Region, 2018 - 2021, USD Million

TABLE 29 Global Solutions Market by Region, 2022 - 2028, USD Million

TABLE 30 Global Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 31 Global Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 32 Global Reporting & Monitoring Market by Region, 2018 - 2021, USD Million

TABLE 33 Global Reporting & Monitoring Market by Region, 2022 - 2028, USD Million

TABLE 34 Global Surveillance & Analytics Market by Region, 2018 - 2021, USD Million

TABLE 35 Global Surveillance & Analytics Market by Region, 2022 - 2028, USD Million

TABLE 36 Global Risk & Compliance Market by Region, 2018 - 2021, USD Million

TABLE 37 Global Risk & Compliance Market by Region, 2022 - 2028, USD Million

TABLE 38 Global Case Management Market by Region, 2018 - 2021, USD Million

TABLE 39 Global Case Management Market by Region, 2022 - 2028, USD Million

TABLE 40 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 41 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 42 Global Services Market by Region, 2018 - 2021, USD Million

TABLE 43 Global Services Market by Region, 2022 - 2028, USD Million

TABLE 44 Global Trade Surveillance Systems Market by Region, 2018 - 2021, USD Million

TABLE 45 Global Trade Surveillance Systems Market by Region, 2022 - 2028, USD Million

TABLE 46 North America Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 47 North America Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 48 North America Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 49 North America Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 50 North America On-premises Market by Country, 2018 - 2021, USD Million

TABLE 51 North America On-premises Market by Country, 2022 - 2028, USD Million

TABLE 52 North America Cloud Market by Country, 2018 - 2021, USD Million

TABLE 53 North America Cloud Market by Country, 2022 - 2028, USD Million

TABLE 54 North America Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 55 North America Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 56 North America Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 57 North America Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 58 North America Small & Medium-sized Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 59 North America Small & Medium-sized Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 60 North America Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 61 North America Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 62 North America Banking Market by Country, 2018 - 2021, USD Million

TABLE 63 North America Banking Market by Country, 2022 - 2028, USD Million

TABLE 64 North America Capital Markets Market by Country, 2018 - 2021, USD Million

TABLE 65 North America Capital Markets Market by Country, 2022 - 2028, USD Million

TABLE 66 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 67 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 68 North America Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 69 North America Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 70 North America Solutions Market by Country, 2018 - 2021, USD Million

TABLE 71 North America Solutions Market by Country, 2022 - 2028, USD Million

TABLE 72 North America Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 73 North America Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 74 North America Reporting & Monitoring Market by Country, 2018 - 2021, USD Million

TABLE 75 North America Reporting & Monitoring Market by Country, 2022 - 2028, USD Million

TABLE 76 North America Surveillance & Analytics Market by Country, 2018 - 2021, USD Million

TABLE 77 North America Surveillance & Analytics Market by Country, 2022 - 2028, USD Million

TABLE 78 North America Risk & Compliance Market by Country, 2018 - 2021, USD Million

TABLE 79 North America Risk & Compliance Market by Country, 2022 - 2028, USD Million

TABLE 80 North America Case Management Market by Country, 2018 - 2021, USD Million

TABLE 81 North America Case Management Market by Country, 2022 - 2028, USD Million

TABLE 82 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 83 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 84 North America Services Market by Country, 2018 - 2021, USD Million

TABLE 85 North America Services Market by Country, 2022 - 2028, USD Million

TABLE 86 North America Trade Surveillance Systems Market by Country, 2018 - 2021, USD Million

TABLE 87 North America Trade Surveillance Systems Market by Country, 2022 - 2028, USD Million

TABLE 88 US Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 89 US Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 90 US Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 91 US Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 92 US Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 93 US Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 94 US Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 95 US Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 96 US Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 97 US Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 98 US Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 99 US Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 100 Canada Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 101 Canada Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 102 Canada Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 103 Canada Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 104 Canada Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 105 Canada Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 106 Canada Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 107 Canada Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 108 Canada Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 109 Canada Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 110 Canada Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 111 Canada Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 112 Mexico Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 113 Mexico Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 114 Mexico Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 115 Mexico Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 116 Mexico Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 117 Mexico Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 118 Mexico Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 119 Mexico Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 120 Mexico Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 121 Mexico Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 122 Mexico Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 123 Mexico Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 124 Rest of North America Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 125 Rest of North America Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 126 Rest of North America Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 127 Rest of North America Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 128 Rest of North America Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 129 Rest of North America Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 130 Rest of North America Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 131 Rest of North America Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 132 Rest of North America Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 133 Rest of North America Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 134 Rest of North America Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 135 Rest of North America Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 136 Europe Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 137 Europe Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 138 Europe Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 139 Europe Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 140 Europe On-premises Market by Country, 2018 - 2021, USD Million

TABLE 141 Europe On-premises Market by Country, 2022 - 2028, USD Million

TABLE 142 Europe Cloud Market by Country, 2018 - 2021, USD Million

TABLE 143 Europe Cloud Market by Country, 2022 - 2028, USD Million

TABLE 144 Europe Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 145 Europe Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 146 Europe Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 147 Europe Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 148 Europe Small & Medium-sized Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 149 Europe Small & Medium-sized Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 150 Europe Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 151 Europe Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 152 Europe Banking Market by Country, 2018 - 2021, USD Million

TABLE 153 Europe Banking Market by Country, 2022 - 2028, USD Million

TABLE 154 Europe Capital Markets Market by Country, 2018 - 2021, USD Million

TABLE 155 Europe Capital Markets Market by Country, 2022 - 2028, USD Million

TABLE 156 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 157 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 158 Europe Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 159 Europe Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 160 Europe Solutions Market by Country, 2018 - 2021, USD Million

TABLE 161 Europe Solutions Market by Country, 2022 - 2028, USD Million

TABLE 162 Europe Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 163 Europe Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 164 Europe Reporting & Monitoring Market by Country, 2018 - 2021, USD Million

TABLE 165 Europe Reporting & Monitoring Market by Country, 2022 - 2028, USD Million

TABLE 166 Europe Surveillance & Analytics Market by Country, 2018 - 2021, USD Million

TABLE 167 Europe Surveillance & Analytics Market by Country, 2022 - 2028, USD Million

TABLE 168 Europe Risk & Compliance Market by Country, 2018 - 2021, USD Million

TABLE 169 Europe Risk & Compliance Market by Country, 2022 - 2028, USD Million

TABLE 170 Europe Case Management Market by Country, 2018 - 2021, USD Million

TABLE 171 Europe Case Management Market by Country, 2022 - 2028, USD Million

TABLE 172 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 173 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 174 Europe Services Market by Country, 2018 - 2021, USD Million

TABLE 175 Europe Services Market by Country, 2022 - 2028, USD Million

TABLE 176 Europe Trade Surveillance Systems Market by Country, 2018 - 2021, USD Million

TABLE 177 Europe Trade Surveillance Systems Market by Country, 2022 - 2028, USD Million

TABLE 178 Germany Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 179 Germany Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 180 Germany Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 181 Germany Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 182 Germany Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 183 Germany Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 184 Germany Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 185 Germany Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 186 Germany Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 187 Germany Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 188 Germany Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 189 Germany Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 190 UK Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 191 UK Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 192 UK Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 193 UK Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 194 UK Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 195 UK Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 196 UK Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 197 UK Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 198 UK Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 199 UK Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 200 UK Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 201 UK Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 202 France Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 203 France Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 204 France Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 205 France Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 206 France Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 207 France Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 208 France Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 209 France Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 210 France Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 211 France Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 212 France Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 213 France Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 214 Russia Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 215 Russia Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 216 Russia Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 217 Russia Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 218 Russia Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 219 Russia Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 220 Russia Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 221 Russia Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 222 Russia Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 223 Russia Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 224 Russia Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 225 Russia Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 226 Spain Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 227 Spain Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 228 Spain Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 229 Spain Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 230 Spain Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 231 Spain Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 232 Spain Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 233 Spain Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 234 Spain Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 235 Spain Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 236 Spain Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 237 Spain Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 238 Italy Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 239 Italy Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 240 Italy Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 241 Italy Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 242 Italy Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 243 Italy Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 244 Italy Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 245 Italy Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 246 Italy Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 247 Italy Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 248 Italy Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 249 Italy Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 250 Rest of Europe Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 251 Rest of Europe Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 252 Rest of Europe Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 253 Rest of Europe Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 254 Rest of Europe Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 255 Rest of Europe Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 256 Rest of Europe Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 257 Rest of Europe Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 258 Rest of Europe Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 259 Rest of Europe Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 260 Rest of Europe Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 261 Rest of Europe Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 262 Asia Pacific Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 263 Asia Pacific Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 264 Asia Pacific Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 265 Asia Pacific Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 266 Asia Pacific On-premises Market by Country, 2018 - 2021, USD Million

TABLE 267 Asia Pacific On-premises Market by Country, 2022 - 2028, USD Million

TABLE 268 Asia Pacific Cloud Market by Country, 2018 - 2021, USD Million

TABLE 269 Asia Pacific Cloud Market by Country, 2022 - 2028, USD Million

TABLE 270 Asia Pacific Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 271 Asia Pacific Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 272 Asia Pacific Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 273 Asia Pacific Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 274 Asia Pacific Small & Medium-sized Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 275 Asia Pacific Small & Medium-sized Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 276 Asia Pacific Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 277 Asia Pacific Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 278 Asia Pacific Banking Market by Country, 2018 - 2021, USD Million

TABLE 279 Asia Pacific Banking Market by Country, 2022 - 2028, USD Million

TABLE 280 Asia Pacific Capital Markets Market by Country, 2018 - 2021, USD Million

TABLE 281 Asia Pacific Capital Markets Market by Country, 2022 - 2028, USD Million

TABLE 282 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 283 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 284 Asia Pacific Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 285 Asia Pacific Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 286 Asia Pacific Solutions Market by Country, 2018 - 2021, USD Million

TABLE 287 Asia Pacific Solutions Market by Country, 2022 - 2028, USD Million

TABLE 288 Asia Pacific Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 289 Asia Pacific Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 290 Asia Pacific Reporting & Monitoring Market by Country, 2018 - 2021, USD Million

TABLE 291 Asia Pacific Reporting & Monitoring Market by Country, 2022 - 2028, USD Million

TABLE 292 Asia Pacific Surveillance & Analytics Market by Country, 2018 - 2021, USD Million

TABLE 293 Asia Pacific Surveillance & Analytics Market by Country, 2022 - 2028, USD Million

TABLE 294 Asia Pacific Risk & Compliance Market by Country, 2018 - 2021, USD Million

TABLE 295 Asia Pacific Risk & Compliance Market by Country, 2022 - 2028, USD Million

TABLE 296 Asia Pacific Case Management Market by Country, 2018 - 2021, USD Million

TABLE 297 Asia Pacific Case Management Market by Country, 2022 - 2028, USD Million

TABLE 298 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 299 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 300 Asia Pacific Services Market by Country, 2018 - 2021, USD Million

TABLE 301 Asia Pacific Services Market by Country, 2022 - 2028, USD Million

TABLE 302 Asia Pacific Trade Surveillance Systems Market by Country, 2018 - 2021, USD Million

TABLE 303 Asia Pacific Trade Surveillance Systems Market by Country, 2022 - 2028, USD Million

TABLE 304 China Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 305 China Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 306 China Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 307 China Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 308 China Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 309 China Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 310 China Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 311 China Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 312 China Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 313 China Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 314 China Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 315 China Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 316 Japan Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 317 Japan Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 318 Japan Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 319 Japan Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 320 Japan Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 321 Japan Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 322 Japan Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 323 Japan Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 324 Japan Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 325 Japan Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 326 Japan Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 327 Japan Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 328 India Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 329 India Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 330 India Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 331 India Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 332 India Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 333 India Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 334 India Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 335 India Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 336 India Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 337 India Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 338 India Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 339 India Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 340 South Korea Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 341 South Korea Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 342 South Korea Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 343 South Korea Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 344 South Korea Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 345 South Korea Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 346 South Korea Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 347 South Korea Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 348 South Korea Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 349 South Korea Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 350 South Korea Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 351 South Korea Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 352 Singapore Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 353 Singapore Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 354 Singapore Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 355 Singapore Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 356 Singapore Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 357 Singapore Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 358 Singapore Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 359 Singapore Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 360 Singapore Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 361 Singapore Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 362 Singapore Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 363 Singapore Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 364 Malaysia Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 365 Malaysia Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 366 Malaysia Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 367 Malaysia Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 368 Malaysia Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 369 Malaysia Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 370 Malaysia Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 371 Malaysia Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 372 Malaysia Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 373 Malaysia Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 374 Malaysia Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 375 Malaysia Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 376 Rest of Asia Pacific Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 377 Rest of Asia Pacific Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 378 Rest of Asia Pacific Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 379 Rest of Asia Pacific Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 380 Rest of Asia Pacific Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 381 Rest of Asia Pacific Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 382 Rest of Asia Pacific Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 383 Rest of Asia Pacific Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 384 Rest of Asia Pacific Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 385 Rest of Asia Pacific Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 386 Rest of Asia Pacific Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 387 Rest of Asia Pacific Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 388 LAMEA Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 389 LAMEA Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 390 LAMEA Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 391 LAMEA Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 392 LAMEA On-premises Market by Country, 2018 - 2021, USD Million

TABLE 393 LAMEA On-premises Market by Country, 2022 - 2028, USD Million

TABLE 394 LAMEA Cloud Market by Country, 2018 - 2021, USD Million

TABLE 395 LAMEA Cloud Market by Country, 2022 - 2028, USD Million

TABLE 396 LAMEA Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 397 LAMEA Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 398 LAMEA Large Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 399 LAMEA Large Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 400 LAMEA Small & Medium-sized Enterprises Market by Country, 2018 - 2021, USD Million

TABLE 401 LAMEA Small & Medium-sized Enterprises Market by Country, 2022 - 2028, USD Million

TABLE 402 LAMEA Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 403 LAMEA Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 404 LAMEA Banking Market by Country, 2018 - 2021, USD Million

TABLE 405 LAMEA Banking Market by Country, 2022 - 2028, USD Million

TABLE 406 LAMEA Capital Markets Market by Country, 2018 - 2021, USD Million

TABLE 407 LAMEA Capital Markets Market by Country, 2022 - 2028, USD Million

TABLE 408 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 409 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 410 LAMEA Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 411 LAMEA Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 412 LAMEA Solutions Market by Country, 2018 - 2021, USD Million

TABLE 413 LAMEA Solutions Market by Country, 2022 - 2028, USD Million

TABLE 414 LAMEA Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 415 LAMEA Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 416 LAMEA Reporting & Monitoring Market by Country, 2018 - 2021, USD Million

TABLE 417 LAMEA Reporting & Monitoring Market by Country, 2022 - 2028, USD Million

TABLE 418 LAMEA Surveillance & Analytics Market by Country, 2018 - 2021, USD Million

TABLE 419 LAMEA Surveillance & Analytics Market by Country, 2022 - 2028, USD Million

TABLE 420 LAMEA Risk & Compliance Market by Country, 2018 - 2021, USD Million

TABLE 421 LAMEA Risk & Compliance Market by Country, 2022 - 2028, USD Million

TABLE 422 LAMEA Case Management Market by Country, 2018 - 2021, USD Million

TABLE 423 LAMEA Case Management Market by Country, 2022 - 2028, USD Million

TABLE 424 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 425 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 426 LAMEA Services Market by Country, 2018 - 2021, USD Million

TABLE 427 LAMEA Services Market by Country, 2022 - 2028, USD Million

TABLE 428 LAMEA Trade Surveillance Systems Market by Country, 2018 - 2021, USD Million

TABLE 429 LAMEA Trade Surveillance Systems Market by Country, 2022 - 2028, USD Million

TABLE 430 Brazil Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 431 Brazil Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 432 Brazil Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 433 Brazil Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 434 Brazil Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million

TABLE 435 Brazil Trade Surveillance Systems Market by Organization Size, 2022 - 2028, USD Million

TABLE 436 Brazil Trade Surveillance Systems Market by Vertical, 2018 - 2021, USD Million

TABLE 437 Brazil Trade Surveillance Systems Market by Vertical, 2022 - 2028, USD Million

TABLE 438 Brazil Trade Surveillance Systems Market by Component, 2018 - 2021, USD Million

TABLE 439 Brazil Trade Surveillance Systems Market by Component, 2022 - 2028, USD Million

TABLE 440 Brazil Trade Surveillance Systems Market by Solutions Type, 2018 - 2021, USD Million

TABLE 441 Brazil Trade Surveillance Systems Market by Solutions Type, 2022 - 2028, USD Million

TABLE 442 Argentina Trade Surveillance Systems Market, 2018 - 2021, USD Million

TABLE 443 Argentina Trade Surveillance Systems Market, 2022 - 2028, USD Million

TABLE 444 Argentina Trade Surveillance Systems Market by Deployment Mode, 2018 - 2021, USD Million

TABLE 445 Argentina Trade Surveillance Systems Market by Deployment Mode, 2022 - 2028, USD Million

TABLE 446 Argentina Trade Surveillance Systems Market by Organization Size, 2018 - 2021, USD Million