Global Surgical Stapling Devices Market Size, Share & Industry Trends Analysis Report By Type (Reusable and Disposable), By Product Type (Manual and Powered), By End-use (Hospitals and Ambulatory Surgical Centers), By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-Mar-2023 | Pages: 193 | Formats: PDF |

COVID-19 Impact on the Surgical Stapling Devices Market

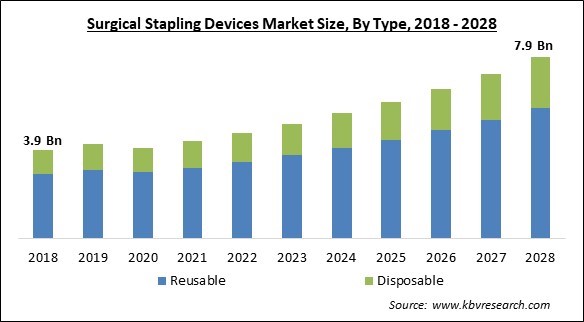

The Global Surgical Stapling Devices Market size is expected to reach $7.9 billion by 2028, rising at a market growth of 9.4% CAGR during the forecast period.

Surgical stapling devices apply surgical staples instead of sutures to heal skin wounds or keep tissue together. When operating time is an issue and aesthetic closure is not a top priority, surgical staples may help close injuries quickly. There are now three main categories of mechanical staplers for open and endoscopic surgery: linear, circular, and endoscopic surgical staplers.

Several novel surgical equipment and gadgets are now available because of technological advancements in various scientific fields. To enhance patient outcomes, surgeons can create novel surgical procedures due to the constant introduction of new instruments and the ongoing technological advances in already-existing technologies.

In many instances, surgeons may need to learn the scientific or clinical foundation for the best use of these technologies or how to benefit from any particular advantages a specific technology may have. So, even if the devices work well, surgeons may often depend on their expertise, judgment, or anecdotal evidence for better results.

Equipment that is often employed during surgical operations and is also undergoing a nearly continual state of technological evolution is the surgical stapler. While these tools are adaptable and practical, there have been well-reported instances of staple line leaks that resulted in postoperative difficulties, many of which were caused by problems unrelated to ischemia.

In operations, particularly challenging ones like gynecologic, gastrointestinal, & bariatric procedures, surgical stapling instruments are becoming more and more crucial. In addition, the use of surgical stapling devices facilitates the development of novel surgical techniques, the alteration of existing procedures, and the enhancement of clinical results. The increasing demand for less invasive treatments globally drives the expansion of the surgical stapling devices market.

COVID-19 Impact Analysis

The lockdown compelled many hospitals to stop their outpatient departments for situations other than emergencies, which had a significant impact on the market for surgical stapling devices. Social exclusion, population control, and restricted clinic access substantially influenced the market. However, the market is anticipated to grow significantly after the lockdown restrictions are lifted as significant manufacturers are concentrating on introducing technologically cutting-edge items to increase their market share. Also, with production getting back on track, and the resume in surgical procedures which is increasing the demand, the surgical stapling devices market will start to expand again after the pandemic.

Market Growth Factors

The technological betterment of surgical stapling devices

Technological developments in surgical staples and related staples have significantly impacted the acceptance of surgical stapling devices by healthcare practitioners. With the introduction of powered surgical staplers, the time needed to seal the wound after surgery has decreased, minimizing problems and blood loss. In clinical testing, the powered surgical stapler performed better in the speed of healing and decreased discomfort. Hence, it is anticipated that the technical benefits offered by surgical stapling devices will drive market growth.

Rising prevalence of chronic diseases

Due to the rise in chronic illnesses like cancer during the last several years, there has also been an increase in the number of visits to ambulatory surgical facilities. Moreover, it is predicted that the market for surgical staplers will grow throughout the projection years due to the rise in laparoscopic treatments chosen by patients. The decreasing cost, shorter hospital stays, and increasing popularity of laparoscopic operations are all due to these factors. Hence with the high prevalence of chronic cases and the rising popularity of laparoscopic operations, the market growth for surgical stapling devices will surge.

Market Restraining Factors

Common issues with surgical staplers

Opening of the staple line at a wound site, faulty staples that result in insufficient sealing, defective or jammed staplers, failing to shoot a staple from a stapler, staples that were improperly positioned on the wrong tissue spot using a staple that is the incorrect size for a particular application are some of the common issues associated with the usage of stapling devices. These frequent issues may result in surgical staple wounds, lengthening healing time and exposing the patient to higher medical and rehabilitation expenses. These issues with the stapling devices are expected to restrict their market expansion.

Product Type Outlook

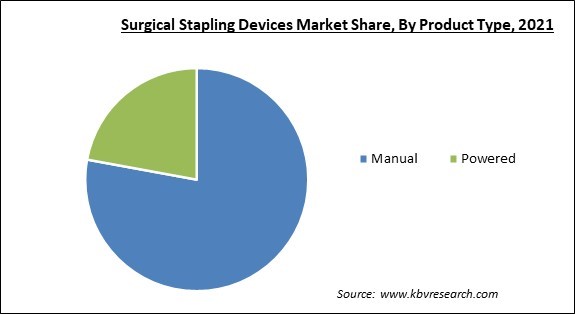

Based on product type, the surgical stapling devices market is segmented into powered and manual. The powered segment acquired a significant revenue share in the surgical stapling devices market in 2021. This is due to their simplicity of wound closure without requiring physical effort. Medical professionals now have more options due to the availability of powered surgical stapling devices in various sizes. In addition, the escalating technical advancements, product launches, and firms' increased emphasis on developing powered stapling devices are among other factors which are anticipated to boost the segment growth.

Type Outlook

On the basis of type, the surgical stapling devices market is divided into disposable and reusable. The reusable segment held the highest revenue share in the surgical stapling devices market in 2021. This is because reusable surgical stapling instruments may be used on several patients after sterilizing. Due to the product's low cost, the category is expected to have a bigger share in developing countries. Furthermore, the introduction of surgical stapling devices combined with absorbable staplers is projected to boost the segment expansion in the projected period.

End Use Outlook

By end-use, the surgical stapling devices market is classified into hospitals and ambulatory surgical centers. The hospitals segment witnessed the largest revenue share in the surgical stapling devices market in 2021. This is because hospitals are seeing a significant trend that points to a move towards clinical efficiency models, including robotic surgery. Minimally invasive procedures benefit from robotic surgery. The hospitals have well-trained staff and high-tech devices, which ensures a safe and successful procedure. Also, the hospital category is anticipated to maintain its dominance due to favorable reimbursement conditions for different methods during the projection period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.3 Billion |

| Market size forecast in 2028 | USD 7.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.4% from 2022 to 2028 |

| Number of Pages | 193 |

| Number of Table | 325 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, End-use, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Region-wise, the surgical stapling devices market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the surgical stapling devices market in 2021. This is owing to the employment of cutting-edge technology and minimally invasive procedures with the rising number of total operations. In addition, the greatest obesity prevalence in the world, the local presence of multinational corporations, and the government's clearance for minimally invasive operations are other factors contributing to the large market share.

Free Valuable Insights: Global Surgical Stapling Devices Market size to reach USD 7.9 Billion by 2028

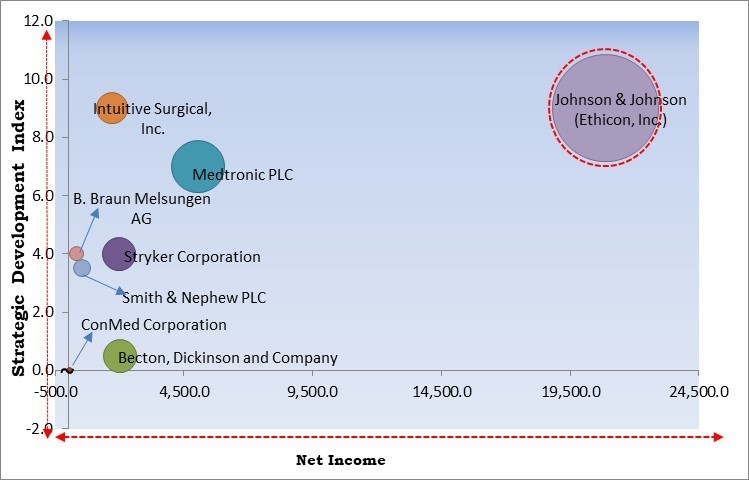

KBV Cardinal Matrix - Surgical Stapling Devices Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson (Ethicon, Inc.) is the forerunner in the Surgical Stapling Devices Market. Companies such as Intuitive Surgical, Inc., Medtronic PLC, and Stryker Corporation are some of the key innovators in Surgical Stapling Devices Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Stryker Corporation, Medtronic PLC, BioPro, Inc., ConMed Corporation, Smith & Nephew PLC, Intuitive Surgical, Inc., Johnson & Johnson (Ethicon, Inc.), B. Braun Melsungen AG, Becton, Dickinson and Company and Meril Life Science Private Limited.

Strategies deployed in Surgical Stapling Devices Market

» Partnerships, Collaborations and Agreements:

• May-2022: Intuitive teamed up with Creo Medical Group, a UK-based medical device company. The collaboration includes optimizing Creo's products to make them consistent with Intuitive's robotic technology.

» Product Launches and Product Expansions:

- Jun-2022: Ethicon, part of Johnson & Johnson introduced the ECHELON 3000 Stapler intended to use in resection, transection, and creation of anastomoses. The ECHELON 3000 is available in 45mm and 60mm staplers. The new stapler is a single-patient-use, sterile, that can cut and staple both at the same time.

- May-2022: Stryker introduced the EasyFuse Dynamic Compression System, which will be a part of Stryker's foot and ankle product portfolio. The new staple system is developed using a nickel-titanium alloy metal, known as nitinol. The EasyFuse Dynamic Compression System decreases complexity in surgeries. The newly launched product features, a wide staple bridge, an intuitively developed inserter, and sterile-packed instrumentation.

- Jun-2021: Intuitive unveiled SureForm, a robotic-assisted surgical stapler SureForm. The surgical stapler comes with SmartFire technology, an integrated software. The SureForm allows the surgeon to simultaneously fire the stapler from the console itself, and perform the RAS procedure. Further, the launch of the robot-assisted stapler reflects the company's advancement towards simplification of the surgery procedure.

- Mar-2021: Ethicon, part of Johnson & Johnson launched ECHELON+ Stapler equipped with Gripping Surface Technology (GST) Reloads. The new surgical stapler is developed to enhance staple line security, and lower complications. The stapler is equipped with a new motor with dynamic firing and a restructured ECHELON+Anvil.

- Dec-2020: Medtronic launched Tri-Staple EEA Circular Stapler in India. The 3-row circular stapler is equipped with Medtronic's Tri-Staple technology and has multiple height staples. The new circular stapler is intended to use in colorectal procedures. Additionally, the device is also equipped with enhanced tactile and audible feedback that allows clinicians to make a better informed decisions in the operating room.

- Feb-2020: Smith+Nephew introduced the CORI Surgical system. The new surgical systems are intended to enhance outcomes during knee arthroplasty, and also increase accuracy. Additionally, the CORI system is portable and easy to move from one theatre to the other.

» Acquisitions and Mergers:

- Sep-2022: B. Braun took over Clik-FIX Catheter Securement Devices from Starboard Medical. The acquisition includes a Clik-FIX Peripheral catheter securement device, Clik-FIX Universal catheter securement device, a Clik-FIX Neonatal PICC catheter securement device, and Clik-FIX PICC/Central catheter securement device. The combination of the Clik-FIX portfolio and B.Braun's competence and deep knowledge enables the acquirer to fulfill the growing needs of its clients and further strengthens its market position in the IV therapy market.

- Nov-2020: Medtronic took over Medicrea, a France-based company primarily into developing, manufacturing, and marketing orthopedic implants intended for spinal surgery. This acquisition would reinforce Medtronic's position in personalized implants' AI-based prediction and planning capabilities.

» Geographical Expansions:

- Nov-2022: Becton, Dickinson, and Company (BD) expanded its global footprint by setting up a new manufacturing facility in Tijuana, Mexico. The new facility would primarily manufacture devices and technologies. The establishment of the new facility demonstrates BD's devotion to Mexico and its strong relationship with communities across Mexico. This new plant would further simplify BD's operations by integrating a distribution center, a manufacturing site, and the transportation of products to the end consumer all in one place.

- Aug-2022: Stryker opened a new facility in Ireland. The new high-tech facility is a 156,000-square-foot facility, which would reinforce the company's market position in additive manufacturing.

- Jun-2022: Smith+Nephew opened a new manufacturing and R&D facility in Hull, United Kingdom. The new facility is intended for its advanced wound management franchise. The establishment of the new facility reflects the company's commitment to the UK and to building a leading market position in advanced wound management.

- Jun-2022: Stryker expanded its global footprint by setting up a new R&D facility in Haryana, India. The new 150,000-square-foot facility would advance innovation. Further, Stryker’s Global Technology Centre (SGTC) reinforces the company's potential to develop and design new products and solutions.

» Trials and Approvals:

- Dec-2021: Intuitive received FDA approval for its SureForm 30. SureForm 30 is an 8 mm curved-tip stapler. The curved stapler is intended to use in thoracic, general, pediatric, urologic, and gynecologic surgeries.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Reusable

- Disposable

By Product Type

- Manual

- Powered

By End-use

- Hospitals

- Ambulatory Surgical Centers

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Stryker Corporation

- Medtronic PLC

- BioPro, Inc.

- ConMed Corporation

- Smith & Nephew PLC

- Intuitive Surgical, Inc.

- Johnson & Johnson (Ethicon, Inc.)

- B.Braun Melsungen AG

- Becton, Dickinson and Company

- Meril Life Science Private Limited

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Surgical Stapling Devices Market, by Type

1.4.2 Global Surgical Stapling Devices Market, by Product Type

1.4.3 Global Surgical Stapling Devices Market, by End-use

1.4.4 Global Surgical Stapling Devices Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market composition & scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Approvals and Trials

3.2.5 Geographical Expansions

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Product Launches and Product Expansions : 2019, Sep – 2022, Jun) Leading Players

Chapter 4. Global Surgical Stapling Devices Market by Type

4.1 Global Reusable Market by Region

4.2 Global Disposable Market by Region

Chapter 5. Global Surgical Stapling Devices Market by Product Type

5.1 Global Manual Market by Region

5.2 Global Powered Market by Region

Chapter 6. Global Surgical Stapling Devices Market by End-use

6.1 Global Hospitals Market by Region

6.2 Global Ambulatory Surgical Centers Market by Region

Chapter 7. Global Surgical Stapling Devices Market by Region

7.1 North America Surgical Stapling Devices Market

7.1.1 North America Surgical Stapling Devices Market by Type

7.1.1.1 North America Reusable Market by Country

7.1.1.2 North America Disposable Market by Country

7.1.2 North America Surgical Stapling Devices Market by Product Type

7.1.2.1 North America Manual Market by Country

7.1.2.2 North America Powered Market by Country

7.1.3 North America Surgical Stapling Devices Market by End-use

7.1.3.1 North America Hospitals Market by Country

7.1.3.2 North America Ambulatory Surgical Centers Market by Country

7.1.4 North America Surgical Stapling Devices Market by Country

7.1.4.1 US Surgical Stapling Devices Market

7.1.4.1.1 US Surgical Stapling Devices Market by Type

7.1.4.1.2 US Surgical Stapling Devices Market by Product Type

7.1.4.1.3 US Surgical Stapling Devices Market by End-use

7.1.4.2 Canada Surgical Stapling Devices Market

7.1.4.2.1 Canada Surgical Stapling Devices Market by Type

7.1.4.2.2 Canada Surgical Stapling Devices Market by Product Type

7.1.4.2.3 Canada Surgical Stapling Devices Market by End-use

7.1.4.3 Mexico Surgical Stapling Devices Market

7.1.4.3.1 Mexico Surgical Stapling Devices Market by Type

7.1.4.3.2 Mexico Surgical Stapling Devices Market by Product Type

7.1.4.3.3 Mexico Surgical Stapling Devices Market by End-use

7.1.4.4 Rest of North America Surgical Stapling Devices Market

7.1.4.4.1 Rest of North America Surgical Stapling Devices Market by Type

7.1.4.4.2 Rest of North America Surgical Stapling Devices Market by Product Type

7.1.4.4.3 Rest of North America Surgical Stapling Devices Market by End-use

7.2 Europe Surgical Stapling Devices Market

7.2.1 Europe Surgical Stapling Devices Market by Type

7.2.1.1 Europe Reusable Market by Country

7.2.1.2 Europe Disposable Market by Country

7.2.2 Europe Surgical Stapling Devices Market by Product Type

7.2.2.1 Europe Manual Market by Country

7.2.2.2 Europe Powered Market by Country

7.2.3 Europe Surgical Stapling Devices Market by End-use

7.2.3.1 Europe Hospitals Market by Country

7.2.3.2 Europe Ambulatory Surgical Centers Market by Country

7.2.4 Europe Surgical Stapling Devices Market by Country

7.2.4.1 Germany Surgical Stapling Devices Market

7.2.4.1.1 Germany Surgical Stapling Devices Market by Type

7.2.4.1.2 Germany Surgical Stapling Devices Market by Product Type

7.2.4.1.3 Germany Surgical Stapling Devices Market by End-use

7.2.4.2 UK Surgical Stapling Devices Market

7.2.4.2.1 UK Surgical Stapling Devices Market by Type

7.2.4.2.2 UK Surgical Stapling Devices Market by Product Type

7.2.4.2.3 UK Surgical Stapling Devices Market by End-use

7.2.4.3 France Surgical Stapling Devices Market

7.2.4.3.1 France Surgical Stapling Devices Market by Type

7.2.4.3.2 France Surgical Stapling Devices Market by Product Type

7.2.4.3.3 France Surgical Stapling Devices Market by End-use

7.2.4.4 Russia Surgical Stapling Devices Market

7.2.4.4.1 Russia Surgical Stapling Devices Market by Type

7.2.4.4.2 Russia Surgical Stapling Devices Market by Product Type

7.2.4.4.3 Russia Surgical Stapling Devices Market by End-use

7.2.4.5 Spain Surgical Stapling Devices Market

7.2.4.5.1 Spain Surgical Stapling Devices Market by Type

7.2.4.5.2 Spain Surgical Stapling Devices Market by Product Type

7.2.4.5.3 Spain Surgical Stapling Devices Market by End-use

7.2.4.6 Italy Surgical Stapling Devices Market

7.2.4.6.1 Italy Surgical Stapling Devices Market by Type

7.2.4.6.2 Italy Surgical Stapling Devices Market by Product Type

7.2.4.6.3 Italy Surgical Stapling Devices Market by End-use

7.2.4.7 Rest of Europe Surgical Stapling Devices Market

7.2.4.7.1 Rest of Europe Surgical Stapling Devices Market by Type

7.2.4.7.2 Rest of Europe Surgical Stapling Devices Market by Product Type

7.2.4.7.3 Rest of Europe Surgical Stapling Devices Market by End-use

7.3 Asia Pacific Surgical Stapling Devices Market

7.3.1 Asia Pacific Surgical Stapling Devices Market by Type

7.3.1.1 Asia Pacific Reusable Market by Country

7.3.1.2 Asia Pacific Disposable Market by Country

7.3.2 Asia Pacific Surgical Stapling Devices Market by Product Type

7.3.2.1 Asia Pacific Manual Market by Country

7.3.2.2 Asia Pacific Powered Market by Country

7.3.3 Asia Pacific Surgical Stapling Devices Market by End-use

7.3.3.1 Asia Pacific Hospitals Market by Country

7.3.3.2 Asia Pacific Ambulatory Surgical Centers Market by Country

7.3.4 Asia Pacific Surgical Stapling Devices Market by Country

7.3.4.1 China Surgical Stapling Devices Market

7.3.4.1.1 China Surgical Stapling Devices Market by Type

7.3.4.1.2 China Surgical Stapling Devices Market by Product Type

7.3.4.1.3 China Surgical Stapling Devices Market by End-use

7.3.4.2 Japan Surgical Stapling Devices Market

7.3.4.2.1 Japan Surgical Stapling Devices Market by Type

7.3.4.2.2 Japan Surgical Stapling Devices Market by Product Type

7.3.4.2.3 Japan Surgical Stapling Devices Market by End-use

7.3.4.3 India Surgical Stapling Devices Market

7.3.4.3.1 India Surgical Stapling Devices Market by Type

7.3.4.3.2 India Surgical Stapling Devices Market by Product Type

7.3.4.3.3 India Surgical Stapling Devices Market by End-use

7.3.4.4 South Korea Surgical Stapling Devices Market

7.3.4.4.1 South Korea Surgical Stapling Devices Market by Type

7.3.4.4.2 South Korea Surgical Stapling Devices Market by Product Type

7.3.4.4.3 South Korea Surgical Stapling Devices Market by End-use

7.3.4.5 Singapore Surgical Stapling Devices Market

7.3.4.5.1 Singapore Surgical Stapling Devices Market by Type

7.3.4.5.2 Singapore Surgical Stapling Devices Market by Product Type

7.3.4.5.3 Singapore Surgical Stapling Devices Market by End-use

7.3.4.6 Malaysia Surgical Stapling Devices Market

7.3.4.6.1 Malaysia Surgical Stapling Devices Market by Type

7.3.4.6.2 Malaysia Surgical Stapling Devices Market by Product Type

7.3.4.6.3 Malaysia Surgical Stapling Devices Market by End-use

7.3.4.7 Rest of Asia Pacific Surgical Stapling Devices Market

7.3.4.7.1 Rest of Asia Pacific Surgical Stapling Devices Market by Type

7.3.4.7.2 Rest of Asia Pacific Surgical Stapling Devices Market by Product Type

7.3.4.7.3 Rest of Asia Pacific Surgical Stapling Devices Market by End-use

7.4 LAMEA Surgical Stapling Devices Market

7.4.1 LAMEA Surgical Stapling Devices Market by Type

7.4.1.1 LAMEA Reusable Market by Country

7.4.1.2 LAMEA Disposable Market by Country

7.4.2 LAMEA Surgical Stapling Devices Market by Product Type

7.4.2.1 LAMEA Manual Market by Country

7.4.2.2 LAMEA Powered Market by Country

7.4.3 LAMEA Surgical Stapling Devices Market by End-use

7.4.3.1 LAMEA Hospitals Market by Country

7.4.3.2 LAMEA Ambulatory Surgical Centers Market by Country

7.4.4 LAMEA Surgical Stapling Devices Market by Country

7.4.4.1 Brazil Surgical Stapling Devices Market

7.4.4.1.1 Brazil Surgical Stapling Devices Market by Type

7.4.4.1.2 Brazil Surgical Stapling Devices Market by Product Type

7.4.4.1.3 Brazil Surgical Stapling Devices Market by End-use

7.4.4.2 Argentina Surgical Stapling Devices Market

7.4.4.2.1 Argentina Surgical Stapling Devices Market by Type

7.4.4.2.2 Argentina Surgical Stapling Devices Market by Product Type

7.4.4.2.3 Argentina Surgical Stapling Devices Market by End-use

7.4.4.3 UAE Surgical Stapling Devices Market

7.4.4.3.1 UAE Surgical Stapling Devices Market by Type

7.4.4.3.2 UAE Surgical Stapling Devices Market by Product Type

7.4.4.3.3 UAE Surgical Stapling Devices Market by End-use

7.4.4.4 Saudi Arabia Surgical Stapling Devices Market

7.4.4.4.1 Saudi Arabia Surgical Stapling Devices Market by Type

7.4.4.4.2 Saudi Arabia Surgical Stapling Devices Market by Product Type

7.4.4.4.3 Saudi Arabia Surgical Stapling Devices Market by End-use

7.4.4.5 South Africa Surgical Stapling Devices Market

7.4.4.5.1 South Africa Surgical Stapling Devices Market by Type

7.4.4.5.2 South Africa Surgical Stapling Devices Market by Product Type

7.4.4.5.3 South Africa Surgical Stapling Devices Market by End-use

7.4.4.6 Nigeria Surgical Stapling Devices Market

7.4.4.6.1 Nigeria Surgical Stapling Devices Market by Type

7.4.4.6.2 Nigeria Surgical Stapling Devices Market by Product Type

7.4.4.6.3 Nigeria Surgical Stapling Devices Market by End-use

7.4.4.7 Rest of LAMEA Surgical Stapling Devices Market

7.4.4.7.1 Rest of LAMEA Surgical Stapling Devices Market by Type

7.4.4.7.2 Rest of LAMEA Surgical Stapling Devices Market by Product Type

7.4.4.7.3 Rest of LAMEA Surgical Stapling Devices Market by End-use

Chapter 8. Company Profiles

8.1 Medtronic PLC

8.1.1 Company overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.5.2 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 Intuitive Surgical, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.5.2 Product Launches and Product Expansions:

8.2.5.3 Approvals and Trials:

8.3 Stryker Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Product Launches and Product Expansions:

8.3.5.2 Geographical Expansions:

8.4 B. Braun Melsungen AG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 Recent strategies and developments:

8.4.5.1 Acquisition and Mergers:

8.5 Johnson & Johnson (Ethicon, Inc.)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental &Regional Analysis

8.5.4 Research & Development Expenses

8.5.5 Recent strategies and developments:

8.5.5.1 Product Launches and Product Expansions:

8.6 Smith & Nephew PLC

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Regional and Segmental Analysis

8.6.4 Research & Development Expense

8.6.5 Recent strategies and developments:

8.6.5.1 Product Launches and Product Expansions:

8.6.5.2 Geographical Expansions:

8.7 Becton, Dickinson and Company

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Geographical Expansions:

8.8 ConMed Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Product Category and Regional Analysis

8.8.4 Research & Development Expense

8.9 BioPro, Inc.

8.9.1 Company Overview

8.10. Meril Life Sciences Private Limited

8.10.1 Company Overview

TABLE 2 Global Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Surgical Stapling Devices Market

TABLE 4 Product Launches And Product Expansions– Surgical Stapling Devices Market

TABLE 5 Acquisition and Mergers– Surgical Stapling Devices Market

TABLE 6 Approvals and trials – Surgical Stapling Devices Market

TABLE 7 geographical expansions – Surgical Stapling Devices Market

TABLE 8 Global Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 9 Global Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 10 Global Reusable Market by Region, 2018 - 2021, USD Million

TABLE 11 Global Reusable Market by Region, 2022 - 2028, USD Million

TABLE 12 Global Disposable Market by Region, 2018 - 2021, USD Million

TABLE 13 Global Disposable Market by Region, 2022 - 2028, USD Million

TABLE 14 Global Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 15 Global Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 16 Global Manual Market by Region, 2018 - 2021, USD Million

TABLE 17 Global Manual Market by Region, 2022 - 2028, USD Million

TABLE 18 Global Powered Market by Region, 2018 - 2021, USD Million

TABLE 19 Global Powered Market by Region, 2022 - 2028, USD Million

TABLE 20 Global Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 21 Global Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 22 Global Hospitals Market by Region, 2018 - 2021, USD Million

TABLE 23 Global Hospitals Market by Region, 2022 - 2028, USD Million

TABLE 24 Global Ambulatory Surgical Centers Market by Region, 2018 - 2021, USD Million

TABLE 25 Global Ambulatory Surgical Centers Market by Region, 2022 - 2028, USD Million

TABLE 26 Global Surgical Stapling Devices Market by Region, 2018 - 2021, USD Million

TABLE 27 Global Surgical Stapling Devices Market by Region, 2022 - 2028, USD Million

TABLE 28 North America Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 29 North America Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 30 North America Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 31 North America Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 32 North America Reusable Market by Country, 2018 - 2021, USD Million

TABLE 33 North America Reusable Market by Country, 2022 - 2028, USD Million

TABLE 34 North America Disposable Market by Country, 2018 - 2021, USD Million

TABLE 35 North America Disposable Market by Country, 2022 - 2028, USD Million

TABLE 36 North America Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 37 North America Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 38 North America Manual Market by Country, 2018 - 2021, USD Million

TABLE 39 North America Manual Market by Country, 2022 - 2028, USD Million

TABLE 40 North America Powered Market by Country, 2018 - 2021, USD Million

TABLE 41 North America Powered Market by Country, 2022 - 2028, USD Million

TABLE 42 North America Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 43 North America Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 44 North America Hospitals Market by Country, 2018 - 2021, USD Million

TABLE 45 North America Hospitals Market by Country, 2022 - 2028, USD Million

TABLE 46 North America Ambulatory Surgical Centers Market by Country, 2018 - 2021, USD Million

TABLE 47 North America Ambulatory Surgical Centers Market by Country, 2022 - 2028, USD Million

TABLE 48 North America Surgical Stapling Devices Market by Country, 2018 - 2021, USD Million

TABLE 49 North America Surgical Stapling Devices Market by Country, 2022 - 2028, USD Million

TABLE 50 US Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 51 US Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 52 US Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 53 US Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 54 US Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 55 US Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 56 US Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 57 US Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 58 Canada Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 59 Canada Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 60 Canada Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 61 Canada Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 62 Canada Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 63 Canada Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 64 Canada Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 65 Canada Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 66 Mexico Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 67 Mexico Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 68 Mexico Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 69 Mexico Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 70 Mexico Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 71 Mexico Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 72 Mexico Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 73 Mexico Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 74 Rest of North America Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 75 Rest of North America Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 76 Rest of North America Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 77 Rest of North America Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 78 Rest of North America Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 79 Rest of North America Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 80 Rest of North America Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 81 Rest of North America Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 82 Europe Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 83 Europe Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 84 Europe Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 85 Europe Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 86 Europe Reusable Market by Country, 2018 - 2021, USD Million

TABLE 87 Europe Reusable Market by Country, 2022 - 2028, USD Million

TABLE 88 Europe Disposable Market by Country, 2018 - 2021, USD Million

TABLE 89 Europe Disposable Market by Country, 2022 - 2028, USD Million

TABLE 90 Europe Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 91 Europe Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 92 Europe Manual Market by Country, 2018 - 2021, USD Million

TABLE 93 Europe Manual Market by Country, 2022 - 2028, USD Million

TABLE 94 Europe Powered Market by Country, 2018 - 2021, USD Million

TABLE 95 Europe Powered Market by Country, 2022 - 2028, USD Million

TABLE 96 Europe Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 97 Europe Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 98 Europe Hospitals Market by Country, 2018 - 2021, USD Million

TABLE 99 Europe Hospitals Market by Country, 2022 - 2028, USD Million

TABLE 100 Europe Ambulatory Surgical Centers Market by Country, 2018 - 2021, USD Million

TABLE 101 Europe Ambulatory Surgical Centers Market by Country, 2022 - 2028, USD Million

TABLE 102 Europe Surgical Stapling Devices Market by Country, 2018 - 2021, USD Million

TABLE 103 Europe Surgical Stapling Devices Market by Country, 2022 - 2028, USD Million

TABLE 104 Germany Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 105 Germany Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 106 Germany Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 107 Germany Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 108 Germany Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 109 Germany Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 110 Germany Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 111 Germany Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 112 UK Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 113 UK Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 114 UK Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 115 UK Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 116 UK Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 117 UK Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 118 UK Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 119 UK Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 120 France Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 121 France Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 122 France Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 123 France Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 124 France Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 125 France Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 126 France Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 127 France Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 128 Russia Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 129 Russia Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 130 Russia Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 131 Russia Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 132 Russia Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 133 Russia Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 134 Russia Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 135 Russia Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 136 Spain Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 137 Spain Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 138 Spain Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 139 Spain Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 140 Spain Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 141 Spain Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 142 Spain Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 143 Spain Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 144 Italy Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 145 Italy Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 146 Italy Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 147 Italy Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 148 Italy Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 149 Italy Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 150 Italy Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 151 Italy Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 152 Rest of Europe Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 153 Rest of Europe Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 154 Rest of Europe Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 155 Rest of Europe Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 156 Rest of Europe Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 157 Rest of Europe Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 158 Rest of Europe Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 159 Rest of Europe Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 160 Asia Pacific Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 161 Asia Pacific Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 162 Asia Pacific Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 163 Asia Pacific Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 164 Asia Pacific Reusable Market by Country, 2018 - 2021, USD Million

TABLE 165 Asia Pacific Reusable Market by Country, 2022 - 2028, USD Million

TABLE 166 Asia Pacific Disposable Market by Country, 2018 - 2021, USD Million

TABLE 167 Asia Pacific Disposable Market by Country, 2022 - 2028, USD Million

TABLE 168 Asia Pacific Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 169 Asia Pacific Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 170 Asia Pacific Manual Market by Country, 2018 - 2021, USD Million

TABLE 171 Asia Pacific Manual Market by Country, 2022 - 2028, USD Million

TABLE 172 Asia Pacific Powered Market by Country, 2018 - 2021, USD Million

TABLE 173 Asia Pacific Powered Market by Country, 2022 - 2028, USD Million

TABLE 174 Asia Pacific Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 175 Asia Pacific Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 176 Asia Pacific Hospitals Market by Country, 2018 - 2021, USD Million

TABLE 177 Asia Pacific Hospitals Market by Country, 2022 - 2028, USD Million

TABLE 178 Asia Pacific Ambulatory Surgical Centers Market by Country, 2018 - 2021, USD Million

TABLE 179 Asia Pacific Ambulatory Surgical Centers Market by Country, 2022 - 2028, USD Million

TABLE 180 Asia Pacific Surgical Stapling Devices Market by Country, 2018 - 2021, USD Million

TABLE 181 Asia Pacific Surgical Stapling Devices Market by Country, 2022 - 2028, USD Million

TABLE 182 China Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 183 China Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 184 China Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 185 China Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 186 China Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 187 China Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 188 China Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 189 China Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 190 Japan Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 191 Japan Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 192 Japan Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 193 Japan Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 194 Japan Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 195 Japan Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 196 Japan Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 197 Japan Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 198 India Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 199 India Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 200 India Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 201 India Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 202 India Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 203 India Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 204 India Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 205 India Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 206 South Korea Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 207 South Korea Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 208 South Korea Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 209 South Korea Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 210 South Korea Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 211 South Korea Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 212 South Korea Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 213 South Korea Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 214 Singapore Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 215 Singapore Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 216 Singapore Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 217 Singapore Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 218 Singapore Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 219 Singapore Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 220 Singapore Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 221 Singapore Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 222 Malaysia Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 223 Malaysia Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 224 Malaysia Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 225 Malaysia Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 226 Malaysia Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 227 Malaysia Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 228 Malaysia Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 229 Malaysia Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 230 Rest of Asia Pacific Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 231 Rest of Asia Pacific Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 232 Rest of Asia Pacific Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 233 Rest of Asia Pacific Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 234 Rest of Asia Pacific Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 235 Rest of Asia Pacific Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 236 Rest of Asia Pacific Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 237 Rest of Asia Pacific Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 238 LAMEA Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 239 LAMEA Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 240 LAMEA Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 241 LAMEA Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 242 LAMEA Reusable Market by Country, 2018 - 2021, USD Million

TABLE 243 LAMEA Reusable Market by Country, 2022 - 2028, USD Million

TABLE 244 LAMEA Disposable Market by Country, 2018 - 2021, USD Million

TABLE 245 LAMEA Disposable Market by Country, 2022 - 2028, USD Million

TABLE 246 LAMEA Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 247 LAMEA Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 248 LAMEA Manual Market by Country, 2018 - 2021, USD Million

TABLE 249 LAMEA Manual Market by Country, 2022 - 2028, USD Million

TABLE 250 LAMEA Powered Market by Country, 2018 - 2021, USD Million

TABLE 251 LAMEA Powered Market by Country, 2022 - 2028, USD Million

TABLE 252 LAMEA Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 253 LAMEA Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 254 LAMEA Hospitals Market by Country, 2018 - 2021, USD Million

TABLE 255 LAMEA Hospitals Market by Country, 2022 - 2028, USD Million

TABLE 256 LAMEA Ambulatory Surgical Centers Market by Country, 2018 - 2021, USD Million

TABLE 257 LAMEA Ambulatory Surgical Centers Market by Country, 2022 - 2028, USD Million

TABLE 258 LAMEA Surgical Stapling Devices Market by Country, 2018 - 2021, USD Million

TABLE 259 LAMEA Surgical Stapling Devices Market by Country, 2022 - 2028, USD Million

TABLE 260 Brazil Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 261 Brazil Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 262 Brazil Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 263 Brazil Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 264 Brazil Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 265 Brazil Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 266 Brazil Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 267 Brazil Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 268 Argentina Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 269 Argentina Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 270 Argentina Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 271 Argentina Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 272 Argentina Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 273 Argentina Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 274 Argentina Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 275 Argentina Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 276 UAE Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 277 UAE Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 278 UAE Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 279 UAE Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 280 UAE Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 281 UAE Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 282 UAE Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 283 UAE Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 284 Saudi Arabia Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 285 Saudi Arabia Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 286 Saudi Arabia Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 287 Saudi Arabia Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 288 Saudi Arabia Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 289 Saudi Arabia Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 290 Saudi Arabia Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 291 Saudi Arabia Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 292 South Africa Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 293 South Africa Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 294 South Africa Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 295 South Africa Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 296 South Africa Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 297 South Africa Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 298 South Africa Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 299 South Africa Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 300 Nigeria Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 301 Nigeria Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 302 Nigeria Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 303 Nigeria Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 304 Nigeria Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 305 Nigeria Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 306 Nigeria Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 307 Nigeria Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 308 Rest of LAMEA Surgical Stapling Devices Market, 2018 - 2021, USD Million

TABLE 309 Rest of LAMEA Surgical Stapling Devices Market, 2022 - 2028, USD Million

TABLE 310 Rest of LAMEA Surgical Stapling Devices Market by Type, 2018 - 2021, USD Million

TABLE 311 Rest of LAMEA Surgical Stapling Devices Market by Type, 2022 - 2028, USD Million

TABLE 312 Rest of LAMEA Surgical Stapling Devices Market by Product Type, 2018 - 2021, USD Million

TABLE 313 Rest of LAMEA Surgical Stapling Devices Market by Product Type, 2022 - 2028, USD Million

TABLE 314 Rest of LAMEA Surgical Stapling Devices Market by End-use, 2018 - 2021, USD Million

TABLE 315 Rest of LAMEA Surgical Stapling Devices Market by End-use, 2022 - 2028, USD Million

TABLE 316 Key Information – Medtronic PLC

TABLE 317 Key Information –Intuitive Surgical, Inc.

TABLE 318 key Information – Stryker Corporation

TABLE 319 key Information – B. Braun Melsungen AG

TABLE 320 Key information –Johnson & Johnson

TABLE 321 key Information – Smith & Nephew PLC

TABLE 322 Key information – Becton, Dickinson and Company

TABLE 323 key Information – ConMed Corporation

TABLE 324 Key Information – BioPro, Inc.

TABLE 325 Key Information – Meril Life Sciences Private Limited

List of Figures

FIG 1 Methodology for the research

FIG 2 KBV Cardinal Matrix

FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

FIG 4 Key Strategic Move: (Product Launches and Product Expansions : 2019, Sep – 2022, Jun) Leading Players

FIG 5 Global Surgical Stapling Devices Market share by Type, 2021

FIG 6 Global Surgical Stapling Devices Market share by Type, 2028

FIG 7 Global Surgical Stapling Devices Market by Type, 2018 - 2028, USD Million

FIG 8 Global Surgical Stapling Devices Market share by Product Type, 2021

FIG 9 Global Surgical Stapling Devices Market share by Product Type, 2028

FIG 10 Global Surgical Stapling Devices Market by Product Type, 2018 - 2028, USD Million

FIG 11 Global Surgical Stapling Devices Market share by End-use, 2021

FIG 12 Global Surgical Stapling Devices Market share by End-use, 2028

FIG 13 Global Surgical Stapling Devices Market by End-use, 2018 - 2028, USD Million

FIG 14 Global Surgical Stapling Devices Market share by Region, 2021

FIG 15 Global Surgical Stapling Devices Market share by Region, 2028

FIG 16 Global Surgical Stapling Devices Market by Region, 2018 - 2028, USD Million

FIG 17 Swot analysis: Medtronic plc

FIG 18 Recent strategies and developments: Intuitive Surgical, Inc.

FIG 19 Recent strategies and developments: Stryker Corporation