Global Sensor Testing Market Size, Share & Industry Trends Analysis Report By Offering (Hardware and Software), By Sensor Type (Analog Sensor and Digital Sensor), By Application, By Regional Outlook and Forecast, 2023 - 2030

Published Date : 30-Sep-2023 | Pages: 257 | Formats: PDF |

COVID-19 Impact on the Sensor Testing Market

The Global Sensor Testing Market size is expected to reach $2.7 billion by 2030, rising at a market growth of 6.2% CAGR during the forecast period.

Testing providers evaluate new sensor technologies and ensure their suitability for aerospace applications. Consequently, the Aerospace market $329.0 million revenue in the market in 2022. The aerospace segment continually seeks innovative sensor technologies to enhance aircraft performance, safety, and efficiency. Aerospace applications require a wide range of sensors, including pressure, temperature, inertial, and radar sensors. Each sensor type has unique testing requirements, leading to a demand for diverse testing capabilities. The aerospace segment's stringent quality and safety standards and continuous demand for advanced sensor technologies drive the expansion of the market. As aerospace technologies evolve and diversify, the need for comprehensive and specialized sensor testing services is expected to grow significantly.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2022, TE Connectivity Ltd. completed the acquisition of Linx Technologies, to bolster and enhance its capabilities in the IoT space, particularly in the realm of antennas and RF connectors, thus broadening TE's already extensive range of connectivity products. Additionally, In July, 2022, Advantest Corporation completed the acquisition of Collaudi Elettronici Automatizzati S.r.l. (CREA), , to incorporate CREA's products into its portfolio, complementing its existing lineup of analog and mixed-signal test systems.

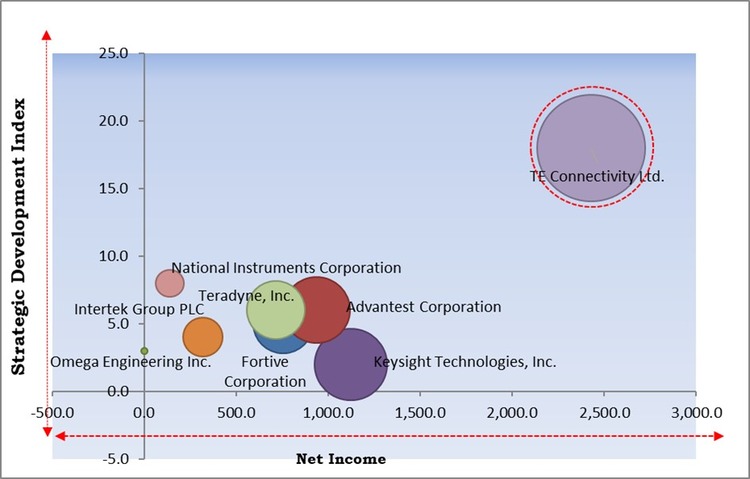

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; TE Connectivity Ltd. is the forerunner in the Market. In January, 2021, Teradyne, Inc. teamed up with Syntiant, a technology company specializing in advanced artificial intelligence solutions. Through this collaboration, both companies would work together to accelerate the development of innovative Artificial Intelligence Neural Decision Processors, to bring this technology to the market. Companies such as Keysight Technologies, Inc, Advantest Corporation, Fortive Corporation, are some of the key innovators in the Market.

Market Growth Factors

Growing Technological Advancements

The rapid pace of technological innovation and the increasing complexity of sensor systems create a continual demand for advanced sensor testing solutions. As industries across the board rely on sensors for data collection, automation, and decision-making, the growth of the market is expected to remain strong. Companies provide cutting-edge testing equipment, software, and services that keep pace with evolving sensor technology are well-positioned to capitalize on this growth. The development of sensor- and industry-specific testing solutions is enabled by technological advancements. Technological advancements enhance the capabilities of testing equipment and methods, leading to improved quality assurance for sensor manufacturers. This is crucial for maintaining product quality and reliability. All these factors will uplift the market in upcoming years.

Increasing Demand for Miniaturization

Miniaturization refers to making sensors smaller and more compact while maintaining or improving their performance. Many applications, such as wearable devices, medical implants, and automotive sensors, have limited physical space for sensors. Miniaturization allows for the integration of sensors into smaller form factors. In applications like aerospace and automotive, reducing weight is crucial for fuel efficiency and overall system performance. Smaller and lighter sensors contribute to weight savings. Advances in microtechnology and nanotechnology have led to the development of susceptible miniaturized sensors that detect and measure a wide range of physical and chemical properties. The demand for miniaturization in sensor testing will remain a significant and ongoing trend that will drive the growth of the market in the coming years.

Market Restraining Factors

High Price of Sensor Testing Equipment

The high upfront costs associated with purchasing specialized sensor testing equipment can be a significant entry barrier for new players in the market. Small and startup testing companies struggle to acquire the necessary equipment, limiting competition and innovation in the industry. Sensor manufacturers and end-users will likely face higher testing costs when specialized equipment is expensive. These increased costs impact the profitability of manufacturing processes and be passed on to consumers, making products with sensors more expensive. The cost of cutting-edge sensor testing equipment limit access to the latest testing technologies and methodologies. This hinder companies' ability to provide cutting-edge testing services, leading to outmoded testing procedures. These factors pose a challenge for the market.

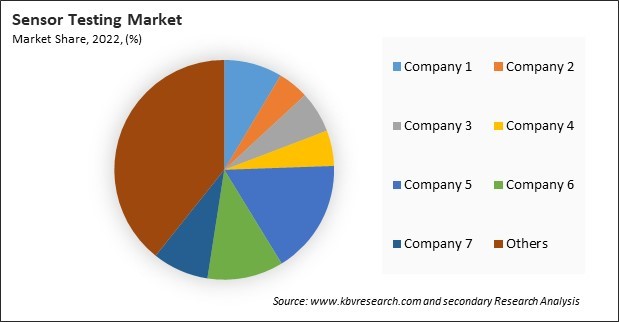

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

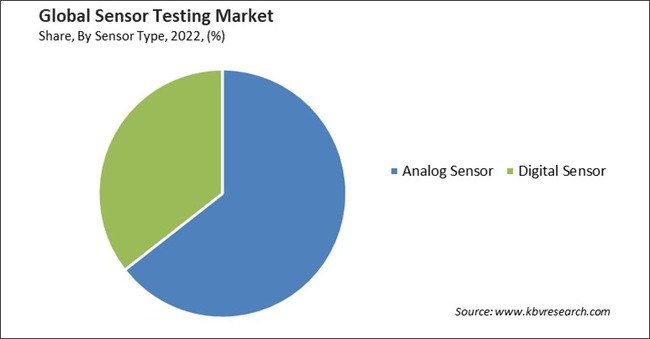

Sensor Type Outlook

Based on sensor type, the market is classified into analog sensor and digital sensor. The digital sensor segment acquired a substantial revenue share in the market in 2022. Digital sensors are extensively used in various industries and applications, including consumer electronics, automotive, industrial automation, IoT devices, and more. Their widespread adoption means a consistently high demand for testing services. Digital sensors come in various types, each with unique characteristics and testing requirements. This complexity and diversity led to the developing of specialized testing equipment and methodologies tailored to different digital sensor categories. The demand for accurate, reliable, and interoperable digital sensors will continue to fuel the need for comprehensive sensor testing services and solutions.

Offering Outlook

By offering, the market is bifurcated into hardware and software. In 2022, the hardware segment held the highest revenue share in the market. To precisely measure and evaluate the performance of sensors, it is necessary to employ specialized hardware components and apparatus during sensor testing. These hardware tools offer interface, control, and measurement capabilities to ensure accurate and consistent test results. The hardware employed in sensor testing consists of devices designed to accommodate various sensor types, sizes, and testing specifications. Manufacturers, testing facilities, and researchers can successfully assess sensors' quality, accuracy, dependability, and usefulness using the proper hardware tools, enabling their successful integration into various applications.

Application Outlook

On the basis of application, the market is divided into automotive, consumer electronics, aerospace, healthcare, industrial, and others. In 2022, the consumer electronics segment dominated the market with maximum revenue share. Sensor testing in consumer electronics entails various procedures, including performance evaluation, calibration, assessment of dependability, and compatibility testing. Evaluation of performance involves testing the sensors' responsiveness, sensitivity, and precision in detecting and measuring diverse inputs. For instance, smartphone sensor testing assures precise motion detection, orientation tracking, and touch input.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.7 Billion |

| Market size forecast in 2030 | USD 2.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.2% from 2023 to 2030 |

| Number of Pages | 257 |

| Number of Table | 362 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Sensor Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. Due to its rapid industrialization, technological advancements, and expanding demand for sensors across multiple industries, the Asia-Pacific region is a promising market for sensor testing services. In this region, the demand for thorough and accurate sensor testing solutions is driven by the need for quality assurance, compliance with regulations, and dependable sensor performance. Furthermore, favorable regulatory policies for the approval of new electronic technologies and the saturation of the market in developed nations increase the interest of foreign players in increasing their presence in the Asia-Pacific region.

Free Valuable Insights: Global Sensor Testing Market size to reach USD 2.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Fortive Corporation, Advantest Corporation, Pepperl + Fuchs Group, Intertek Group PLC, TE Connectivity Ltd., National Instruments Corporation, Omega Engineering Inc. and Teradyne, Inc.

Strategies deployed in the Market

» Partnerships, Collaborations, and Agreements:

- Jun-2023: TE Connectivity Ltd. entered into a partnership with Tacterion, a company that specializes in innovative tactile sensor solutions for a wide range of applications, including robotics, healthcare, and virtual reality. Through this partnership, TE Connectivity Ltd. and Tacterion would develop connector and component solutions that seamlessly merge TE's reliable connectors with Tacterion's cutting-edge sensor technology, paving the way for remote digital equipment monitoring in Industry 4.0 environments, and enhancing predictive maintenance, condition monitoring, and safety applications.

- May-2023: National Instruments Corporation Teamed up with Applied Intuition, a software company specializing in simulation and testing solutions for autonomous vehicles and other complex systems. Through this collaboration, both companies would be able to leverage their collective knowledge to offer a comprehensive solution spanning the entire validation workflow for connected Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD), aiming to deliver an exceptional experience to their customers.

- Oct-2022: Keysight Technologies, Inc. teamed up with Analog Devices, Inc., a leading semiconductor company specializing in the design and manufacturing of high-performance analog, mixed-signal, and digital signal-processing integrated circuits. Through this collaboration, both companies would promote the utilization of phased array technology. Further, this technology plays a pivotal role in achieving widespread connectivity and sensing by streamlining the development processes involved in creating satellite communication, radar, and phased array systems.

- 2021-Oct: Fluke Corporation entered into a partnership with Everactive, a leading provider of industrial Internet of Things (IoT) solutions. Through this partnership, Fluke Corporation had created an ever-present solution that provides uninterrupted monitoring to a larger array of machines, facilitating extensive coverage throughout various manufacturing facilities.

- Jan-2021: National Instruments Corporation formed a partnership with Konrad Technologies, a global provider of automated test and measurement solutions. Through this partnership, both companies would create testing systems and solutions for the validation of autonomous driving software and hardware. Further, the companies are aimed to collaborate in providing innovative technologies that enable automotive Tier 1 suppliers and OEMs to utilize real-world road data and simulation, accelerating advancements in vehicle and passenger safety while expediting the deployment of autonomous driving (AD) on the roads.

- Jan-2021: Teradyne, Inc. teamed up with Syntiant, a technology company specializing in advanced artificial intelligence solutions. Through this collaboration, both companies would work together to accelerate the development of innovative Artificial Intelligence Neural Decision Processors, to bring this technology to the market.

- Nov-2020: Advantest Corporation teamed up with STMicroelectronics, a global semiconductor and electronics manufacturer known for producing a wide range of integrated circuits and microcontrollers. Through this collaboration, both companies created a state-of-the-art, fully automated final test cell system enhancing both equipment efficiency and quality across semiconductor test and packaging processes.

» Product Launches and Product Expansions:

- Dec-2022: Omega Engineering, Inc. introduced its latest digital pressure gauge featuring the DPG509, a device used to measure and display pressure readings in a digital format. Further, this device would be used in various industrial and automotive applications for precise pressure monitoring.

- Jul-2021: Fluke Corporation introduced Fluke 3562 Screening Vibration Sensor system, a battery less technology, extensive sensor-to-gateway communication range, and capacity to link up to 1,000 sensors with a single gateway. Further, the Fluke 3562 offers a "configure and leave" solution capable of continuous operation, even in remote or challenging locations.

» Acquisitions and Mergers:

- Jan-2023: TE Connectivity Ltd. completed the acquisition of Kries, a technology company specializing in sustainable energy solutions. Through this acquisition, TE Connectivity Ltd. would solidify TE's energy business unit standing as a prominent provider of solutions for enhancing grid reliability for utilities and those who own power networks and renewable energy infrastructure on a global scale. Further, this acquisition would enhance TE's offerings in the field of power grid monitoring, protection, and automation systems.

- Jul-2022: TE Connectivity Ltd. completed the acquisition of Linx Technologies, a provider of wireless connectivity solutions and components for IoT (Internet of Things) applications. With this acquisition, TE Connectivity Ltd. would bolster and enhance its capabilities in the IoT space, particularly in the realm of antennas and RF connectors, thus broadening TE's already extensive range of connectivity products. Further, this acquisition extends TE's supply chain reach, aligning with its ongoing efforts to expand its presence in IoT markets.

- Jul-2022: Intertek Group PLC completed the acquisition of Clean Energy Associates, LLC, a company specializing in renewable energy consulting and services. Through this acquisition, Intertek Group PLC would enhance its worldwide network of industry specialists but also the firm's existing suite of Total Quality Assurance services, encompassing product testing and certification, on-site inspections, asset management, and condition monitoring.

- Jun-2022: Advantest Corporation completed the acquisition of Collaudi Elettronici Automatizzati S.r.l. (CREA), an Italian company specializing in automated electronic testing solutions. With this acquisition, Advantest Corporation would be able to incorporate CREA's products into its portfolio, complementing its existing lineup of analog and mixed-signal test systems.

- May-2021: National Instruments Corporation completed the acquisition of monoDrive, a leading platform for developing and testing autonomous vehicle systems through high-fidelity simulation and virtual environments. Through this acquisition, National Instruments Corporation would broaden its presence in the ADAS and simulation sectors, empowering NI's transportation clientele to expedite the creation, testing, and deployment of safer autonomous systems, as the intricate design cycles for ADAS necessitate seamless transitions between simulation, lab-based, and real-world testing environments to enhance vehicle safety.

- Mar-2020: TE Connectivity Ltd. acquired First Sensor AG. A global manufacturer specializing in advanced sensor solutions and technologies for various industrial applications. Through this acquisition, First Sensor's products would be added to the product portfolio of TE Connectivity.

Scope of the Study

Market Segments Covered in the Report:

By Offering

- Hardware

- Software

By Sensor Type

- Analog Sensor

- Digital Sensor

By Application

- Consumer Electronics

- Aerospace

- Industrial

- Automotive

- Healthcare

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Keysight Technologies, Inc.

- Rohde & Schwarz GmbH & Co. KG

- Fortive Corporation

- Advantest Corporation

- Pepperl + Fuchs Group

- Intertek Group PLC

- TE Connectivity Ltd.

- National Instruments Corporation

- Omega Engineering Inc.

- Teradyne, Inc.

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Sensor Testing Market, by Offering

1.4.2 Global Sensor Testing Market, by Sensor Type

1.4.3 Global Sensor Testing Market, by Application

1.4.4 Global Sensor Testing Market, by Geography

1.5 Methodology for the research

Chapter 2. Market at a Glance

2.1 Key Highlights

Chapter 3. Market Overview

3.1 Introduction

3.1.1 Overview

3.1.1.1 Market Composition and Scenario

3.2 Key Factors Impacting the Market

3.2.1 Market Drivers

3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

4.1 KBV Cardinal Matrix

4.2 Recent Industry Wide Strategic Developments

4.2.1 Partnerships, Collaborations and Agreements

4.2.2 Product Launches and Product Expansions

4.2.3 Acquisition and Mergers

4.3 Market Share Analysis, 2022

4.4 Top Winning Strategies

4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

4.4.2 Key Strategic Move: (Mergers & Acquisitions: 2019, Feb – 2023, Jan) Leading Players

4.5 Porter Five Forces Analysis

Chapter 5. Global Sensor Testing Market, By Offering

5.1 Global Hardware Market, By Region

5.2 Global Software Market, By Region

Chapter 6. Global Sensor Testing Market, By Sensor Type

6.1 Global Analog Sensor Market, By Region

6.2 Global Digital Sensor Market, By Region

Chapter 7. Global Sensor Testing Market, By Application

7.1 Global Consumer Electronics Market, By Region

7.2 Global Aerospace Market, By Region

7.3 Global Industrial Market, By Region

7.4 Global Automotive Market, By Region

7.5 Global Healthcare Market, By Region

7.6 Global Others Market, By Region

Chapter 8. Global Sensor Testing Market, By Region

8.1 North America Sensor Testing Market

8.1.1 North America Sensor Testing Market, By Offering

8.1.1.1 North America Hardware Market, By Country

8.1.1.2 North America Software Market, By Country

8.1.2 North America Sensor Testing Market, By Sensor Type

8.1.2.1 North America Analog Sensor Market, By Country

8.1.2.2 North America Digital Sensor Market, By Country

8.1.3 North America Sensor Testing Market, By Application

8.1.3.1 North America Consumer Electronics Market, By Country

8.1.3.2 North America Aerospace Market, By Country

8.1.3.3 North America Industrial Market, By Country

8.1.3.4 North America Automotive Market, By Country

8.1.3.5 North America Healthcare Market, By Country

8.1.3.6 North America Others Market, By Country

8.1.4 North America Sensor Testing Market, By Country

8.1.4.1 US Sensor Testing Market

8.1.4.1.1 US Sensor Testing Market, By Offering

8.1.4.1.2 US Sensor Testing Market, By Sensor Type

8.1.4.1.3 US Sensor Testing Market, By Application

8.1.4.2 Canada Sensor Testing Market

8.1.4.2.1 Canada Sensor Testing Market, By Offering

8.1.4.2.2 Canada Sensor Testing Market, By Sensor Type

8.1.4.2.3 Canada Sensor Testing Market, By Application

8.1.4.3 Mexico Sensor Testing Market

8.1.4.3.1 Mexico Sensor Testing Market, By Offering

8.1.4.3.2 Mexico Sensor Testing Market, By Sensor Type

8.1.4.3.3 Mexico Sensor Testing Market, By Application

8.1.4.4 Rest of North America Sensor Testing Market

8.1.4.4.1 Rest of North America Sensor Testing Market, By Offering

8.1.4.4.2 Rest of North America Sensor Testing Market, By Sensor Type

8.1.4.4.3 Rest of North America Sensor Testing Market, By Application

8.2 Europe Sensor Testing Market

8.2.1 Europe Sensor Testing Market, By Offering

8.2.1.1 Europe Hardware Market, By Country

8.2.1.2 Europe Software Market, By Country

8.2.2 Europe Sensor Testing Market, By Sensor Type

8.2.2.1 Europe Analog Sensor Market, By Country

8.2.2.2 Europe Digital Sensor Market, By Country

8.2.3 Europe Sensor Testing Market, By Application

8.2.3.1 Europe Consumer Electronics Market, By Country

8.2.3.2 Europe Aerospace Market, By Country

8.2.3.3 Europe Industrial Market, By Country

8.2.3.4 Europe Automotive Market, By Country

8.2.3.5 Europe Healthcare Market, By Country

8.2.3.6 Europe Others Market, By Country

8.2.4 Europe Sensor Testing Market, By Country

8.2.4.1 Germany Sensor Testing Market

8.2.4.1.1 Germany Sensor Testing Market, By Offering

8.2.4.1.2 Germany Sensor Testing Market, By Sensor Type

8.2.4.1.3 Germany Sensor Testing Market, By Application

8.2.4.2 UK Sensor Testing Market

8.2.4.2.1 UK Sensor Testing Market, By Offering

8.2.4.2.2 UK Sensor Testing Market, By Sensor Type

8.2.4.2.3 UK Sensor Testing Market, By Application

8.2.4.3 France Sensor Testing Market

8.2.4.3.1 France Sensor Testing Market, By Offering

8.2.4.3.2 France Sensor Testing Market, By Sensor Type

8.2.4.3.3 France Sensor Testing Market, By Application

8.2.4.4 Russia Sensor Testing Market

8.2.4.4.1 Russia Sensor Testing Market, By Offering

8.2.4.4.2 Russia Sensor Testing Market, By Sensor Type

8.2.4.4.3 Russia Sensor Testing Market, By Application

8.2.4.5 Spain Sensor Testing Market

8.2.4.5.1 Spain Sensor Testing Market, By Offering

8.2.4.5.2 Spain Sensor Testing Market, By Sensor Type

8.2.4.5.3 Spain Sensor Testing Market, By Application

8.2.4.6 Italy Sensor Testing Market

8.2.4.6.1 Italy Sensor Testing Market, By Offering

8.2.4.6.2 Italy Sensor Testing Market, By Sensor Type

8.2.4.6.3 Italy Sensor Testing Market, By Application

8.2.4.7 Rest of Europe Sensor Testing Market

8.2.4.7.1 Rest of Europe Sensor Testing Market, By Offering

8.2.4.7.2 Rest of Europe Sensor Testing Market, By Sensor Type

8.2.4.7.3 Rest of Europe Sensor Testing Market, By Application

8.3 Asia Pacific Sensor Testing Market

8.3.1 Asia Pacific Sensor Testing Market, By Offering

8.3.1.1 Asia Pacific Hardware Market, By Country

8.3.1.2 Asia Pacific Software Market, By Country

8.3.2 Asia Pacific Sensor Testing Market, By Sensor Type

8.3.2.1 Asia Pacific Analog Sensor Market, By Country

8.3.2.2 Asia Pacific Digital Sensor Market, By Country

8.3.3 Asia Pacific Sensor Testing Market, By Application

8.3.3.1 Asia Pacific Consumer Electronics Market, By Country

8.3.3.2 Asia Pacific Aerospace Market, By Country

8.3.3.3 Asia Pacific Industrial Market, By Country

8.3.3.4 Asia Pacific Automotive Market, By Country

8.3.3.5 Asia Pacific Healthcare Market, By Country

8.3.3.6 Asia Pacific Others Market, By Country

8.3.4 Asia Pacific Sensor Testing Market, By Country

8.3.4.1 China Sensor Testing Market

8.3.4.1.1 China Sensor Testing Market, By Offering

8.3.4.1.2 China Sensor Testing Market, By Sensor Type

8.3.4.1.3 China Sensor Testing Market, By Application

8.3.4.2 Japan Sensor Testing Market

8.3.4.2.1 Japan Sensor Testing Market, By Offering

8.3.4.2.2 Japan Sensor Testing Market, By Sensor Type

8.3.4.2.3 Japan Sensor Testing Market, By Application

8.3.4.3 India Sensor Testing Market

8.3.4.3.1 India Sensor Testing Market, By Offering

8.3.4.3.2 India Sensor Testing Market, By Sensor Type

8.3.4.3.3 India Sensor Testing Market, By Application

8.3.4.4 South Korea Sensor Testing Market

8.3.4.4.1 South Korea Sensor Testing Market, By Offering

8.3.4.4.2 South Korea Sensor Testing Market, By Sensor Type

8.3.4.4.3 South Korea Sensor Testing Market, By Application

8.3.4.5 Singapore Sensor Testing Market

8.3.4.5.1 Singapore Sensor Testing Market, By Offering

8.3.4.5.2 Singapore Sensor Testing Market, By Sensor Type

8.3.4.5.3 Singapore Sensor Testing Market, By Application

8.3.4.6 Malaysia Sensor Testing Market

8.3.4.6.1 Malaysia Sensor Testing Market, By Offering

8.3.4.6.2 Malaysia Sensor Testing Market, By Sensor Type

8.3.4.6.3 Malaysia Sensor Testing Market, By Application

8.3.4.7 Rest of Asia Pacific Sensor Testing Market

8.3.4.7.1 Rest of Asia Pacific Sensor Testing Market, By Offering

8.3.4.7.2 Rest of Asia Pacific Sensor Testing Market, By Sensor Type

8.3.4.7.3 Rest of Asia Pacific Sensor Testing Market, By Application

8.4 LAMEA Sensor Testing Market

8.4.1 LAMEA Sensor Testing Market, By Offering

8.4.1.1 LAMEA Hardware Market, By Country

8.4.1.2 LAMEA Software Market, By Country

8.4.2 LAMEA Sensor Testing Market, By Sensor Type

8.4.2.1 LAMEA Analog Sensor Market, By Country

8.4.2.2 LAMEA Digital Sensor Market, By Country

8.4.3 LAMEA Sensor Testing Market, By Application

8.4.3.1 LAMEA Consumer Electronics Market, By Country

8.4.3.2 LAMEA Aerospace Market, By Country

8.4.3.3 LAMEA Industrial Market, By Country

8.4.3.4 LAMEA Automotive Market, By Country

8.4.3.5 LAMEA Healthcare Market, By Country

8.4.3.6 LAMEA Others Market, By Country

8.4.4 LAMEA Sensor Testing Market, By Country

8.4.4.1 Brazil Sensor Testing Market

8.4.4.1.1 Brazil Sensor Testing Market, By Offering

8.4.4.1.2 Brazil Sensor Testing Market, By Sensor Type

8.4.4.1.3 Brazil Sensor Testing Market, By Application

8.4.4.2 Argentina Sensor Testing Market

8.4.4.2.1 Argentina Sensor Testing Market, By Offering

8.4.4.2.2 Argentina Sensor Testing Market, By Sensor Type

8.4.4.2.3 Argentina Sensor Testing Market, By Application

8.4.4.3 UAE Sensor Testing Market

8.4.4.3.1 UAE Sensor Testing Market, By Offering

8.4.4.3.2 UAE Sensor Testing Market, By Sensor Type

8.4.4.3.3 UAE Sensor Testing Market, By Application

8.4.4.4 Saudi Arabia Sensor Testing Market

8.4.4.4.1 Saudi Arabia Sensor Testing Market, By Offering

8.4.4.4.2 Saudi Arabia Sensor Testing Market, By Sensor Type

8.4.4.4.3 Saudi Arabia Sensor Testing Market, By Application

8.4.4.5 South Africa Sensor Testing Market

8.4.4.5.1 South Africa Sensor Testing Market, By Offering

8.4.4.5.2 South Africa Sensor Testing Market, By Sensor Type

8.4.4.5.3 South Africa Sensor Testing Market, By Application

8.4.4.6 Nigeria Sensor Testing Market

8.4.4.6.1 Nigeria Sensor Testing Market, By Offering

8.4.4.6.2 Nigeria Sensor Testing Market, By Sensor Type

8.4.4.6.3 Nigeria Sensor Testing Market, By Application

8.4.4.7 Rest of LAMEA Sensor Testing Market

8.4.4.7.1 Rest of LAMEA Sensor Testing Market, By Offering

8.4.4.7.2 Rest of LAMEA Sensor Testing Market, By Sensor Type

8.4.4.7.3 Rest of LAMEA Sensor Testing Market, By Application

Chapter 9. Company Profiles

9.1 Keysight Technologies, Inc.

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Segmental and Regional Analysis

9.1.4 Research & Development Expenses

9.1.5 Recent strategies and developments:

9.1.5.1 Partnerships, Collaborations, and Agreements:

9.1.6 SWOT Analysis

9.2 Rohde & Schwarz GmbH & Co. KG

9.2.1 Company Overview

9.2.2 SWOT Analysis

9.3 Fortive Corporation (Fluke Corporation)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Segmental and Regional Analysis

9.3.4 Research & Development Expense

9.3.5 Recent strategies and developments:

9.3.5.1 Partnerships, Collaborations, and Agreements:

9.3.5.2 Product Launches and Product Expansions:

9.3.6 SWOT Analysis

9.4 Advantest Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Segmental and Regional Analysis

9.4.4 Research & Development Expenses

9.4.5 Recent strategies and developments:

9.4.5.1 Partnerships, Collaborations, and Agreements:

9.4.5.2 Acquisition and Mergers:

9.4.6 SWOT Analysis

9.5 Pepperl + Fuchs Group

9.5.1 Company Overview

9.5.2 SWOT Analysis

9.6 Intertek Group PLC

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Segmental and Regional Analysis

9.6.4 Recent strategies and developments:

9.6.4.1 Acquisition and Mergers:

9.6.5 SWOT Analysis

9.7 TE Connectivity Ltd.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Segmental and Regional Analysis

9.7.4 Research & Development Expense

9.7.5 Recent strategies and developments:

9.7.5.1 Partnerships, Collaborations, and Agreements:

9.7.5.2 Acquisition and Mergers:

9.7.6 SWOT Analysis

9.8 National Instruments Corporation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Regional Analysis

9.8.4 Research & Development Expense

9.8.5 Recent strategies and developments:

9.8.5.1 Partnerships, Collaborations, and Agreements:

9.8.5.2 Acquisition and Mergers:

9.8.6 SWOT Analysis

9.9 Omega Engineering, Inc. (Arcline Investment Management)

9.9.1 Company Overview

9.9.2 Recent strategies and developments:

9.9.2.1 Product Launches and Product Expansions:

9.9.3 SWOT Analysis

9.10. Teradyne, Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Segmental and Regional Analysis

9.10.4 SWOT Analysis

Chapter 10. Winning imperatives of Sensor Testing Market

TABLE 2 Global Sensor Testing Market, 2023 - 2030, USD Million

TABLE 3 Partnerships, Collaborations and Agreements– Sensor Testing Market

TABLE 4 Product Launches And Product Expansions– Sensor Testing Market

TABLE 5 Acquisition and Mergers– Sensor Testing Market

TABLE 6 Global Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 7 Global Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 8 Global Hardware Market, By Region, 2019 - 2022, USD Million

TABLE 9 Global Hardware Market, By Region, 2023 - 2030, USD Million

TABLE 10 Global Software Market, By Region, 2019 - 2022, USD Million

TABLE 11 Global Software Market, By Region, 2023 - 2030, USD Million

TABLE 12 Global Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 13 Global Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 14 Global Analog Sensor Market, By Region, 2019 - 2022, USD Million

TABLE 15 Global Analog Sensor Market, By Region, 2023 - 2030, USD Million

TABLE 16 Global Digital Sensor Market, By Region, 2019 - 2022, USD Million

TABLE 17 Global Digital Sensor Market, By Region, 2023 - 2030, USD Million

TABLE 18 Global Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 19 Global Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 20 Global Consumer Electronics Market, By Region, 2019 - 2022, USD Million

TABLE 21 Global Consumer Electronics Market, By Region, 2023 - 2030, USD Million

TABLE 22 Global Aerospace Market, By Region, 2019 - 2022, USD Million

TABLE 23 Global Aerospace Market, By Region, 2023 - 2030, USD Million

TABLE 24 Global Industrial Market, By Region, 2019 - 2022, USD Million

TABLE 25 Global Industrial Market, By Region, 2023 - 2030, USD Million

TABLE 26 Global Automotive Market, By Region, 2019 - 2022, USD Million

TABLE 27 Global Automotive Market, By Region, 2023 - 2030, USD Million

TABLE 28 Global Healthcare Market, By Region, 2019 - 2022, USD Million

TABLE 29 Global Healthcare Market, By Region, 2023 - 2030, USD Million

TABLE 30 Global Others Market, By Region, 2019 - 2022, USD Million

TABLE 31 Global Others Market, By Region, 2023 - 2030, USD Million

TABLE 32 Global Sensor Testing Market, By Region, 2019 - 2022, USD Million

TABLE 33 Global Sensor Testing Market, By Region, 2023 - 2030, USD Million

TABLE 34 North America Sensor Testing Market, 2019 - 2022, USD Million

TABLE 35 North America Sensor Testing Market, 2023 - 2030, USD Million

TABLE 36 North America Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 37 North America Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 38 North America Hardware Market, By Country, 2019 - 2022, USD Million

TABLE 39 North America Hardware Market, By Country, 2023 - 2030, USD Million

TABLE 40 North America Software Market, By Country, 2019 - 2022, USD Million

TABLE 41 North America Software Market, By Country, 2023 - 2030, USD Million

TABLE 42 North America Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 43 North America Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 44 North America Analog Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 45 North America Analog Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 46 North America Digital Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 47 North America Digital Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 48 North America Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 49 North America Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 50 North America Consumer Electronics Market, By Country, 2019 - 2022, USD Million

TABLE 51 North America Consumer Electronics Market, By Country, 2023 - 2030, USD Million

TABLE 52 North America Aerospace Market, By Country, 2019 - 2022, USD Million

TABLE 53 North America Aerospace Market, By Country, 2023 - 2030, USD Million

TABLE 54 North America Industrial Market, By Country, 2019 - 2022, USD Million

TABLE 55 North America Industrial Market, By Country, 2023 - 2030, USD Million

TABLE 56 North America Automotive Market, By Country, 2019 - 2022, USD Million

TABLE 57 North America Automotive Market, By Country, 2023 - 2030, USD Million

TABLE 58 North America Healthcare Market, By Country, 2019 - 2022, USD Million

TABLE 59 North America Healthcare Market, By Country, 2023 - 2030, USD Million

TABLE 60 North America Others Market, By Country, 2019 - 2022, USD Million

TABLE 61 North America Others Market, By Country, 2023 - 2030, USD Million

TABLE 62 North America Sensor Testing Market, By Country, 2019 - 2022, USD Million

TABLE 63 North America Sensor Testing Market, By Country, 2023 - 2030, USD Million

TABLE 64 US Sensor Testing Market, 2019 - 2022, USD Million

TABLE 65 US Sensor Testing Market, 2023 - 2030, USD Million

TABLE 66 US Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 67 US Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 68 US Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 69 US Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 70 US Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 71 US Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 72 Canada Sensor Testing Market, 2019 - 2022, USD Million

TABLE 73 Canada Sensor Testing Market, 2023 - 2030, USD Million

TABLE 74 Canada Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 75 Canada Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 76 Canada Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 77 Canada Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 78 Canada Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 79 Canada Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 80 Mexico Sensor Testing Market, 2019 - 2022, USD Million

TABLE 81 Mexico Sensor Testing Market, 2023 - 2030, USD Million

TABLE 82 Mexico Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 83 Mexico Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 84 Mexico Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 85 Mexico Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 86 Mexico Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 87 Mexico Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 88 Rest of North America Sensor Testing Market, 2019 - 2022, USD Million

TABLE 89 Rest of North America Sensor Testing Market, 2023 - 2030, USD Million

TABLE 90 Rest of North America Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 91 Rest of North America Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 92 Rest of North America Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 93 Rest of North America Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 94 Rest of North America Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 95 Rest of North America Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 96 Europe Sensor Testing Market, 2019 - 2022, USD Million

TABLE 97 Europe Sensor Testing Market, 2023 - 2030, USD Million

TABLE 98 Europe Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 99 Europe Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 100 Europe Hardware Market, By Country, 2019 - 2022, USD Million

TABLE 101 Europe Hardware Market, By Country, 2023 - 2030, USD Million

TABLE 102 Europe Software Market, By Country, 2019 - 2022, USD Million

TABLE 103 Europe Software Market, By Country, 2023 - 2030, USD Million

TABLE 104 Europe Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 105 Europe Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 106 Europe Analog Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 107 Europe Analog Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 108 Europe Digital Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 109 Europe Digital Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 110 Europe Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 111 Europe Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 112 Europe Consumer Electronics Market, By Country, 2019 - 2022, USD Million

TABLE 113 Europe Consumer Electronics Market, By Country, 2023 - 2030, USD Million

TABLE 114 Europe Aerospace Market, By Country, 2019 - 2022, USD Million

TABLE 115 Europe Aerospace Market, By Country, 2023 - 2030, USD Million

TABLE 116 Europe Industrial Market, By Country, 2019 - 2022, USD Million

TABLE 117 Europe Industrial Market, By Country, 2023 - 2030, USD Million

TABLE 118 Europe Automotive Market, By Country, 2019 - 2022, USD Million

TABLE 119 Europe Automotive Market, By Country, 2023 - 2030, USD Million

TABLE 120 Europe Healthcare Market, By Country, 2019 - 2022, USD Million

TABLE 121 Europe Healthcare Market, By Country, 2023 - 2030, USD Million

TABLE 122 Europe Others Market, By Country, 2019 - 2022, USD Million

TABLE 123 Europe Others Market, By Country, 2023 - 2030, USD Million

TABLE 124 Europe Sensor Testing Market, By Country, 2019 - 2022, USD Million

TABLE 125 Europe Sensor Testing Market, By Country, 2023 - 2030, USD Million

TABLE 126 Germany Sensor Testing Market, 2019 - 2022, USD Million

TABLE 127 Germany Sensor Testing Market, 2023 - 2030, USD Million

TABLE 128 Germany Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 129 Germany Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 130 Germany Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 131 Germany Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 132 Germany Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 133 Germany Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 134 UK Sensor Testing Market, 2019 - 2022, USD Million

TABLE 135 UK Sensor Testing Market, 2023 - 2030, USD Million

TABLE 136 UK Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 137 UK Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 138 UK Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 139 UK Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 140 UK Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 141 UK Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 142 France Sensor Testing Market, 2019 - 2022, USD Million

TABLE 143 France Sensor Testing Market, 2023 - 2030, USD Million

TABLE 144 France Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 145 France Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 146 France Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 147 France Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 148 France Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 149 France Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 150 Russia Sensor Testing Market, 2019 - 2022, USD Million

TABLE 151 Russia Sensor Testing Market, 2023 - 2030, USD Million

TABLE 152 Russia Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 153 Russia Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 154 Russia Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 155 Russia Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 156 Russia Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 157 Russia Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 158 Spain Sensor Testing Market, 2019 - 2022, USD Million

TABLE 159 Spain Sensor Testing Market, 2023 - 2030, USD Million

TABLE 160 Spain Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 161 Spain Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 162 Spain Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 163 Spain Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 164 Spain Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 165 Spain Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 166 Italy Sensor Testing Market, 2019 - 2022, USD Million

TABLE 167 Italy Sensor Testing Market, 2023 - 2030, USD Million

TABLE 168 Italy Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 169 Italy Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 170 Italy Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 171 Italy Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 172 Italy Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 173 Italy Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 174 Rest of Europe Sensor Testing Market, 2019 - 2022, USD Million

TABLE 175 Rest of Europe Sensor Testing Market, 2023 - 2030, USD Million

TABLE 176 Rest of Europe Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 177 Rest of Europe Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 178 Rest of Europe Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 179 Rest of Europe Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 180 Rest of Europe Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 181 Rest of Europe Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 182 Asia Pacific Sensor Testing Market, 2019 - 2022, USD Million

TABLE 183 Asia Pacific Sensor Testing Market, 2023 - 2030, USD Million

TABLE 184 Asia Pacific Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 185 Asia Pacific Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 186 Asia Pacific Hardware Market, By Country, 2019 - 2022, USD Million

TABLE 187 Asia Pacific Hardware Market, By Country, 2023 - 2030, USD Million

TABLE 188 Asia Pacific Software Market, By Country, 2019 - 2022, USD Million

TABLE 189 Asia Pacific Software Market, By Country, 2023 - 2030, USD Million

TABLE 190 Asia Pacific Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 191 Asia Pacific Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 192 Asia Pacific Analog Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 193 Asia Pacific Analog Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 194 Asia Pacific Digital Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 195 Asia Pacific Digital Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 196 Asia Pacific Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 197 Asia Pacific Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 198 Asia Pacific Consumer Electronics Market, By Country, 2019 - 2022, USD Million

TABLE 199 Asia Pacific Consumer Electronics Market, By Country, 2023 - 2030, USD Million

TABLE 200 Asia Pacific Aerospace Market, By Country, 2019 - 2022, USD Million

TABLE 201 Asia Pacific Aerospace Market, By Country, 2023 - 2030, USD Million

TABLE 202 Asia Pacific Industrial Market, By Country, 2019 - 2022, USD Million

TABLE 203 Asia Pacific Industrial Market, By Country, 2023 - 2030, USD Million

TABLE 204 Asia Pacific Automotive Market, By Country, 2019 - 2022, USD Million

TABLE 205 Asia Pacific Automotive Market, By Country, 2023 - 2030, USD Million

TABLE 206 Asia Pacific Healthcare Market, By Country, 2019 - 2022, USD Million

TABLE 207 Asia Pacific Healthcare Market, By Country, 2023 - 2030, USD Million

TABLE 208 Asia Pacific Others Market, By Country, 2019 - 2022, USD Million

TABLE 209 Asia Pacific Others Market, By Country, 2023 - 2030, USD Million

TABLE 210 Asia Pacific Sensor Testing Market, By Country, 2019 - 2022, USD Million

TABLE 211 Asia Pacific Sensor Testing Market, By Country, 2023 - 2030, USD Million

TABLE 212 China Sensor Testing Market, 2019 - 2022, USD Million

TABLE 213 China Sensor Testing Market, 2023 - 2030, USD Million

TABLE 214 China Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 215 China Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 216 China Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 217 China Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 218 China Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 219 China Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 220 Japan Sensor Testing Market, 2019 - 2022, USD Million

TABLE 221 Japan Sensor Testing Market, 2023 - 2030, USD Million

TABLE 222 Japan Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 223 Japan Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 224 Japan Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 225 Japan Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 226 Japan Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 227 Japan Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 228 India Sensor Testing Market, 2019 - 2022, USD Million

TABLE 229 India Sensor Testing Market, 2023 - 2030, USD Million

TABLE 230 India Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 231 India Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 232 India Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 233 India Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 234 India Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 235 India Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 236 South Korea Sensor Testing Market, 2019 - 2022, USD Million

TABLE 237 South Korea Sensor Testing Market, 2023 - 2030, USD Million

TABLE 238 South Korea Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 239 South Korea Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 240 South Korea Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 241 South Korea Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 242 South Korea Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 243 South Korea Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 244 Singapore Sensor Testing Market, 2019 - 2022, USD Million

TABLE 245 Singapore Sensor Testing Market, 2023 - 2030, USD Million

TABLE 246 Singapore Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 247 Singapore Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 248 Singapore Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 249 Singapore Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 250 Singapore Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 251 Singapore Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 252 Malaysia Sensor Testing Market, 2019 - 2022, USD Million

TABLE 253 Malaysia Sensor Testing Market, 2023 - 2030, USD Million

TABLE 254 Malaysia Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 255 Malaysia Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 256 Malaysia Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 257 Malaysia Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 258 Malaysia Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 259 Malaysia Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 260 Rest of Asia Pacific Sensor Testing Market, 2019 - 2022, USD Million

TABLE 261 Rest of Asia Pacific Sensor Testing Market, 2023 - 2030, USD Million

TABLE 262 Rest of Asia Pacific Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 263 Rest of Asia Pacific Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 264 Rest of Asia Pacific Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 265 Rest of Asia Pacific Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 266 Rest of Asia Pacific Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 267 Rest of Asia Pacific Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 268 LAMEA Sensor Testing Market, 2019 - 2022, USD Million

TABLE 269 LAMEA Sensor Testing Market, 2023 - 2030, USD Million

TABLE 270 LAMEA Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 271 LAMEA Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 272 LAMEA Hardware Market, By Country, 2019 - 2022, USD Million

TABLE 273 LAMEA Hardware Market, By Country, 2023 - 2030, USD Million

TABLE 274 LAMEA Software Market, By Country, 2019 - 2022, USD Million

TABLE 275 LAMEA Software Market, By Country, 2023 - 2030, USD Million

TABLE 276 LAMEA Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 277 LAMEA Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 278 LAMEA Analog Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 279 LAMEA Analog Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 280 LAMEA Digital Sensor Market, By Country, 2019 - 2022, USD Million

TABLE 281 LAMEA Digital Sensor Market, By Country, 2023 - 2030, USD Million

TABLE 282 LAMEA Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 283 LAMEA Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 284 LAMEA Consumer Electronics Market, By Country, 2019 - 2022, USD Million

TABLE 285 LAMEA Consumer Electronics Market, By Country, 2023 - 2030, USD Million

TABLE 286 LAMEA Aerospace Market, By Country, 2019 - 2022, USD Million

TABLE 287 LAMEA Aerospace Market, By Country, 2023 - 2030, USD Million

TABLE 288 LAMEA Industrial Market, By Country, 2019 - 2022, USD Million

TABLE 289 LAMEA Industrial Market, By Country, 2023 - 2030, USD Million

TABLE 290 LAMEA Automotive Market, By Country, 2019 - 2022, USD Million

TABLE 291 LAMEA Automotive Market, By Country, 2023 - 2030, USD Million

TABLE 292 LAMEA Healthcare Market, By Country, 2019 - 2022, USD Million

TABLE 293 LAMEA Healthcare Market, By Country, 2023 - 2030, USD Million

TABLE 294 LAMEA Others Market, By Country, 2019 - 2022, USD Million

TABLE 295 LAMEA Others Market, By Country, 2023 - 2030, USD Million

TABLE 296 LAMEA Sensor Testing Market, By Country, 2019 - 2022, USD Million

TABLE 297 LAMEA Sensor Testing Market, By Country, 2023 - 2030, USD Million

TABLE 298 Brazil Sensor Testing Market, 2019 - 2022, USD Million

TABLE 299 Brazil Sensor Testing Market, 2023 - 2030, USD Million

TABLE 300 Brazil Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 301 Brazil Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 302 Brazil Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 303 Brazil Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 304 Brazil Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 305 Brazil Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 306 Argentina Sensor Testing Market, 2019 - 2022, USD Million

TABLE 307 Argentina Sensor Testing Market, 2023 - 2030, USD Million

TABLE 308 Argentina Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 309 Argentina Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 310 Argentina Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 311 Argentina Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 312 Argentina Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 313 Argentina Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 314 UAE Sensor Testing Market, 2019 - 2022, USD Million

TABLE 315 UAE Sensor Testing Market, 2023 - 2030, USD Million

TABLE 316 UAE Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 317 UAE Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 318 UAE Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 319 UAE Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 320 UAE Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 321 UAE Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 322 Saudi Arabia Sensor Testing Market, 2019 - 2022, USD Million

TABLE 323 Saudi Arabia Sensor Testing Market, 2023 - 2030, USD Million

TABLE 324 Saudi Arabia Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 325 Saudi Arabia Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 326 Saudi Arabia Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 327 Saudi Arabia Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 328 Saudi Arabia Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 329 Saudi Arabia Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 330 South Africa Sensor Testing Market, 2019 - 2022, USD Million

TABLE 331 South Africa Sensor Testing Market, 2023 - 2030, USD Million

TABLE 332 South Africa Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 333 South Africa Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 334 South Africa Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 335 South Africa Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 336 South Africa Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 337 South Africa Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 338 Nigeria Sensor Testing Market, 2019 - 2022, USD Million

TABLE 339 Nigeria Sensor Testing Market, 2023 - 2030, USD Million

TABLE 340 Nigeria Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 341 Nigeria Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 342 Nigeria Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 343 Nigeria Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 344 Nigeria Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 345 Nigeria Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 346 Rest of LAMEA Sensor Testing Market, 2019 - 2022, USD Million

TABLE 347 Rest of LAMEA Sensor Testing Market, 2023 - 2030, USD Million

TABLE 348 Rest of LAMEA Sensor Testing Market, By Offering, 2019 - 2022, USD Million

TABLE 349 Rest of LAMEA Sensor Testing Market, By Offering, 2023 - 2030, USD Million

TABLE 350 Rest of LAMEA Sensor Testing Market, By Sensor Type, 2019 - 2022, USD Million

TABLE 351 Rest of LAMEA Sensor Testing Market, By Sensor Type, 2023 - 2030, USD Million

TABLE 352 Rest of LAMEA Sensor Testing Market, By Application, 2019 - 2022, USD Million

TABLE 353 Rest of LAMEA Sensor Testing Market, By Application, 2023 - 2030, USD Million

TABLE 354 Key Information – Keysight Technologies, Inc.

TABLE 355 Key Information – Rohde & Schwarz GmbH & Co. KG

TABLE 356 Key Information –fortive corporation

TABLE 357 Key Information – Advantest Corporation

TABLE 358 Key Information – Pepperl + Fuchs Group

TABLE 359 Key Information – Intertek Group PLC

TABLE 360 Key information –TE Connectivity Ltd.

TABLE 361 Key Information – National Instruments Corporation

TABLE 362 Key Information – Omega Engineering Inc.

TABLE 363 Key Information – Teradyne, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Global Sensor Testing Market, 2019 - 2030, USD Million

FIG 3 Key Factors Impacting Sensor Testing Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Mergers & acquisitions: 2019, Feb – 2023, Jan) Leading Players

FIG 8 Porter’s Five Forces Analysis – Sensor Testing Market

FIG 9 Global Sensor Testing Market share, By Offering, 2022

FIG 10 Global Sensor Testing Market share, By Offering, 2030

FIG 11 Global Sensor Testing Market, By Offering, 2019 - 2030, USD Million

FIG 12 Global Sensor Testing Market share, By Sensor Type, 2022

FIG 13 Global Sensor Testing Market share, By Sensor Type, 2030

FIG 14 Global Sensor Testing Market, By Sensor Type, 2019 - 2030, USD Million

FIG 15 Global Sensor Testing Market share, By Application, 2022

FIG 16 Global Sensor Testing Market share, By Application, 2030

FIG 17 Global Sensor Testing Market, By Application, 2019 - 2030, USD Million

FIG 18 Global Sensor Testing Market share, By Region, 2022

FIG 19 Global Sensor Testing Market share, By Region, 2030

FIG 20 Global Sensor Testing Market, By Region, 2019 - 2030, USD Million

FIG 21 SWOT Analysis: Keysight Technologies, Inc.

FIG 22 SWOT Analysis: Rohde & Schwarz GmbH & Co. KG

FIG 23 SWOT Analysis: Fortive Corporation

FIG 24 Swot Analysis: Advantest Corporation

FIG 25 SWOT Analysis: Pepperl + Fuchs Group

FIG 26 Swot Analysis: Intertek Group PLC

FIG 27 Recent strategies and developments: TE Connectivity Ltd.

FIG 28 SWOT Analysis: TE Connectivity Ltd

FIG 29 Recent strategies and developments: National Instruments Corporation

FIG 30 SWOT Analysis: National Instruments Corporation

FIG 31 SWOT Analysis: Omega Engineering Inc.

FIG 32 SWOT Analysis: Teradyne, Inc.