Global Pulse Ingredients Market Size, Share & Industry Trends Analysis Report By Type (Pulse Flour, Pulse Starch, Pulse Protein and Pulse Fibers & Grits), By Source (Chickpeas, Peas, Beans and Lentils), By Application, By Regional Outlook and Forecast, 2022 - 2028

Published Date : 31-Aug-2022 | Pages: 209 | Formats: PDF |

COVID-19 Impact on the Pulse Ingredients Market

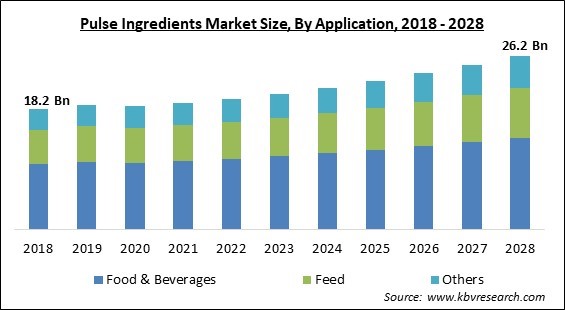

The Global Pulse Ingredients Market size is expected to reach $26.2 billion by 2028, rising at a market growth of 4.9% CAGR during the forecast period.

Edible seeds of plants in the legume family are known as pulses. Pulses are produced in a variety of shaped, sized, and coloured pods. These are low in fat and have a high protein and soluble fibre content. Additionally, it helps to lower cholesterol and regulate blood sugar levels. Ingredients from pulses are rich in vitamins and healthy minerals such as iron, zinc, and magnesium. Peas, lentils and chickpeas are examples of pulse foods.

Ingredients from pulses are utilized in a wide range of food products, such as soups, sauces, baked goods, meals, snacks, and confections. It is available in many different forms, such as protein, flour, and fibre. The main drivers of market expansion are the rising demand for products that are plant-based and gluten-free as well as the rising popularity of foods that are high in protein. A change in people's lifestyles and rising disposable money are anticipated to have a positive impact on the Pulse Ingredients Market's overall market growth.

Pulse components, especially pulse flour, are highly sought after because they provide a variety of proteins, iron, and fibres. Along with other things, pulse flour could be utilized to prepare pasta, pudding, and cookies. The market for pulse ingredients would expand as a result of growing applications for pulse flour in a number of sectors, including beverage, food, and animal feed, including products made with pulse ingredients for dog food.

Ingredients for pulses can be found as concentrates with between 55 and 60 percent protein or as flours ranging from fine to coarse made from peas, lentils, fava beans, or chickpeas. Non-GMO, gluten-free, abundant in protein, lysine, dietary fibre, and minerals, pulse components also have a low glycemic index. Emulsification, gelation, texture, water-holding, adhesion, and film formation are all provided by pulse components. They could be added to formulas to boost the protein content or to eliminate or reduce other proteins. They enhance moisture and texture when used with other gluten-free flours.

COVID-19 Impact Analysis

The food supply system has been devastated by the advent of new coronaviruses and the ensuing tight restrictions. The world's demand for components derived from pulses has dropped as a result of the closure or scaling back of the food service sector. On the other hand, sales of processed meals such snacks, breakfast cereals, bakery and confectionery, and functional beverages rose over this period, partially offsetting the decline in the foodservice sector. Ingredients from pulses have also been widely employed in processed foods. Pulse ingredients are predicted to expand both during and following the pandemic due to the industry's resilience in the face of the disease.

Market Growth Factors

Growing demand for pulse starch in numerous food and industrial usage

Pulse starch can be used to gel, texturize, bind, coat, thicken, and make films, among other things. It has been utilized in a variety of food applications, including pasta and noodles, pastry, soups & sauces, confectionery, and meat & poultry because of its multifunctionality. Additionally, it is frequently used as a binding agent in the production of vermicelli. Due to its affordability and variety of uses, pulse starch is also a possible alternative for those other starches in beverage and food applications.

Increasing adoption of processed and convenience food products

The rise in demand for comfort and ready-to-eat foods has been influenced by several factors, including the growing number of working women and nuclear families, an increased standard of living, and changing lifestyles. The market for RTE & bakery items, soups, and snacks made from pulse ingredients is driven by the growing desire for snacks. Busier lives have boosted the need for on-the-go products to decrease the time spent preparing meals. Demand for healthier products with pulse components also rises as a result of increasing demand for these products.

Market Restraining Factors

Flavour of pulse ingredients are unpleasant

Even if the use of pulse components in cuisine is growing, there is always a critical requirement to change the flavour of these nutrients. Since chickpea flour has a distinct flavour, it should not be used in baked goods like biscotti or sugar cookies. On the other side, pea flour doesn't impart flavour to baked goods. Pulses have an off flavour that is both naturally occurring and created through the harvesting, processing, and storing processes. Aldehydes, alcohols, acids, ketones, pyrazines, and derivatives of sulphur are among the substances that give some kinds of pulse components their off-flavor. The market for pulse ingredients is predicted to grow slowly due to consumer perceptions of pulses' bitter flavour.

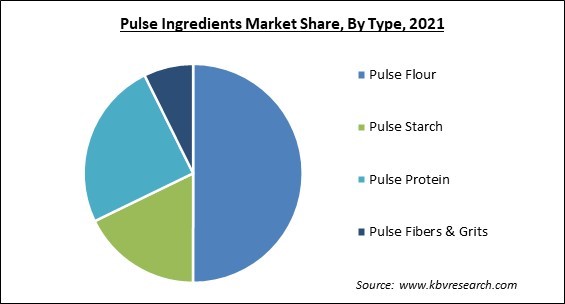

Type Outlook

On the basis of type, the pulse ingredients market is segmented into Pulse Flour, Pulse Starch, Pulse Protein and Pulse Fibers & Grits. The pulse flours segment acquired the highest revenue share in the pulse ingredients market in 2021. In India and the Middle East, pulse flours made from peas as well as chickpeas had long been favoured. Pulse flours are utilized in a wide range of food products, include drinks, sauces, bakery goods, meat products, dairy products, and confectioneries. Due to the numerous health advantages they offer, both consumers and manufacturers throughout the world are becoming interested in them.

Source Outlook

Based on source, the pulse ingredients market is divided into Lentils, Peas, Chickpeas and Beans. The peas segment garnered a significant revenue share in the pulse ingredients market in 2021. Peas are rich in minerals like phosphorus, iron, magnesium, and zinc, which promote general health. They are also well-known to help lower cholesterol and maintain blood sugar levels due to their high fibre content. Different products, including bread, snacks, soups and sauces, confectionery, pasta & noodles, and dairy, use pea-derived ingredients as key components, like pea proteins, pea starches, and pea flours.

Application Outlook

By application, the pulse ingredients market is classified into Food & Beverages, Feed and Others. The food & beverages segment procured the highest revenue share in the pulse ingredients market in 2021. Pulses can be used to increase protein content and substitute wheat flours in gluten-free compositions for pasta, baked snacks, and baked goods. For instance, pulse protein concentrates could be utilized to increase protein content and substitute up to 20% of the wheat flour in bakery formulations. The texture, volume, and flavour of bread made with pulse protein concentrates & flours should be improved using the sponge-dough technique.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 19.1 Billion |

| Market size forecast in 2028 | USD 26.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.9% from 2022 to 2028 |

| Number of Pages | 209 |

| Number of Tables | 370 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Source, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Regional Outlook

Region-wise, the pulse ingredients market is analyzed across North America, Europe, Asia Pacific and LAMEA. A possible market for pulse components is Japan, which has a sizable elderly population. This is anticipated to increase demand for food products with added protein, which will increase demand for pulse components. Due to its vast population and movement toward plant-based components, the Asia Pacific area is predicted to have a significant demand for pulse ingredients in the upcoming years.

Free Valuable Insights: Global Pulse Ingredients Market size to reach USD 26.2 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tetra Laval International S.A. (Delaval), GEA Group AG, Archer Daniels Midland Company , Ingredion, Incorporated, Batory Foods, Inc., Roquette Freres SA, The Scoular Company, Axiom Foods, Inc., Emsland Group and Dakota Dry Bean, Inc. (Dakota Ingredients).

Strategies deployed in Pulse Ingredients Market

» Partnerships, Collaborations and Mergers:

- Jul-2022: ADM entered into a Memorandum of Understanding (MoU) with Bayer, a German multinational pharmaceutical and biotechnology company. Under this agreement, ADM would offer to provide Bayer with details regarding the partner farmers & area of operations. In addition, Bayer would follow a Seed to Market approach with the involvement of sustainability elements like full package promotion of seed treatment, pesticides, and agronomic advisory with Integrated Pest Management (IPM) practices.

- Jun-2022: Batory Foods came into a commercial distribution agreement with DouxMatok. Under this agreement, Incredo Sugar would be added to Batory Foods’ comprehensive portfolio of high-quality food ingredients, unleashing a network of consumers in North America wanting to decrease sugar in baked goods and confectionery products, like snacks, cookies, cakes, chocolate, spreads, candy, and protein bars.

- Sep-2021: Batory Foods signed into an agreement with Ingredion Incorporated, a global provider of ingredient solutions to diversified industries. This agreement aimed to assist food and beverage manufacturers to receive the ingredients they require to produce and would bring their products to market.

- May-2020: Axiom Foods joined hands with The Brenntag Food & Nutrition business unit in North America. This collaboration aimed to assist the companies to fulfill the rising demand for meat and dairy alternatives.

» Product Launches and Product Expansions:

- Jun-2022: Roquette introduced a new NUTRALYS range of organic textured proteins from pea and fava for European markets. This launch would improve Roquette’s position on the protein market as a major leader for plant-based solutions and would support the company’s effort to be the best partner for consumers wishing to create new and delicious plant-based foods.

- Sep-2021: Ingredion introduced Prista, a line of pulse concentrates and flours. This latest product involves Vitessence Prista P 155 pea protein concentrate, Homecraft Prista P 101 pea flour, and Vitessence Prista P 360 fava bean protein concentrate.

- Mar-2021: Ingredion released two new additions to its plant-based portfolio, named Nebraska, VITESSENCE Pulse 1853 pea protein isolate, and PURITY P 1002 pea starch. The ingredient solutions are 100% sourced from North American farms, which is allowing food and beverage manufacturers to develop advanced plant-based food and beverages.

» Acquisitions and Mergers:

- Nov-2021: Archer Daniels Midland took over Sojaprotein, a European company specializing in non-GMO soybean ingredients. This acquisition aimed to expand ADM's plant-based and alternative-proteins market to fulfill the fast-growing demand for new protein solutions as the companies grow their nutrition business worldwide.

- Nov-2020: Ingredion took over James Cameron and Suzy Amis Cameron. This acquisition aimed to boost net sales growth, which would further expand its manufacturing capability and co-create with its consumers to serve the rising consumer demand for plant-based foods.

» Geographical Expansions:

- Apr-2022: ADM expanded its global footprints by investing $300 million in Decatur, Illinois, in alternative protein production. Through this expansion, ADM would further improve its alternative protein offerings by establishing a new, state-of-the-art Protein Innovation Center, also in Decatur.

- Mar-2022: Scoular acquired two facilities in northern Florida. This acquisition aimed to assist the company in better helping grain and livestock producers in the Southeastern U.S.

- Aug-2021: Ingredion expanded its global footprints by opening new production capabilities for flours and concentrates at its pulse-based protein facility in Vanscoy, Sask. The facility aimed to produce flours and concentrates from pulses like lentils, peas, and fava beans that are sustainably sourced from North American farms.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Pulse Flour

- Pulse Starch

- Pulse Protein

- Pulse Fibers & Grits

By Source

- Chickpeas

- Peas

- Beans

- Lentils

By Application

- Food & Beverages

- Feed

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Tetra Laval International S.A. (Delaval)

- GEA Group AG

- Archer Daniels Midland Company

- Ingredion, Incorporated

- Batory Foods, Inc.

- Roquette Freres SA

- The Scoular Company

- Axiom Foods, Inc.

- Emsland Group

- Dakota Dry Bean, Inc. (Dakota Ingredients)

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Pulse Ingredients Market, by Type

1.4.2 Global Pulse Ingredients Market, by Source

1.4.3 Global Pulse Ingredients Market, by Application

1.4.4 Global Pulse Ingredients Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Recent Strategies Deployed in Pulse Ingredients Market

Chapter 4. Global Pulse Ingredients Market by Type

4.1 Global Pulse Flour Market by Region

4.2 Global Pulse Starch Market by Region

4.3 Global Pulse Protein Market by Region

4.4 Global Pulse Fibers & Grits Market by Region

Chapter 5. Global Pulse Ingredients Market by Source

5.1 Global Chickpeas Market by Region

5.2 Global Peas Market by Region

5.3 Global Beans Market by Region

5.4 Global Lentils Market by Region

Chapter 6. Global Pulse Ingredients Market by Application

6.1 Global Food & Beverages Market by Region

6.2 Global Feed Market by Region

6.3 Global Others Market by Region

Chapter 7. Global Pulse Ingredients Market by Region

7.1 North America Pulse Ingredients Market

7.1.1 North America Pulse Ingredients Market by Type

7.1.1.1 North America Pulse Flour Market by Country

7.1.1.2 North America Pulse Starch Market by Country

7.1.1.3 North America Pulse Protein Market by Country

7.1.1.4 North America Pulse Fibers & Grits Market by Country

7.1.2 North America Pulse Ingredients Market by Source

7.1.2.1 North America Chickpeas Market by Country

7.1.2.2 North America Peas Market by Country

7.1.2.3 North America Beans Market by Country

7.1.2.4 North America Lentils Market by Country

7.1.3 North America Pulse Ingredients Market by Application

7.1.3.1 North America Food & Beverages Market by Country

7.1.3.2 North America Feed Market by Country

7.1.3.3 North America Others Market by Country

7.1.4 North America Pulse Ingredients Market by Country

7.1.4.1 US Pulse Ingredients Market

7.1.4.1.1 US Pulse Ingredients Market by Type

7.1.4.1.2 US Pulse Ingredients Market by Source

7.1.4.1.3 US Pulse Ingredients Market by Application

7.1.4.2 Canada Pulse Ingredients Market

7.1.4.2.1 Canada Pulse Ingredients Market by Type

7.1.4.2.2 Canada Pulse Ingredients Market by Source

7.1.4.2.3 Canada Pulse Ingredients Market by Application

7.1.4.3 Mexico Pulse Ingredients Market

7.1.4.3.1 Mexico Pulse Ingredients Market by Type

7.1.4.3.2 Mexico Pulse Ingredients Market by Source

7.1.4.3.3 Mexico Pulse Ingredients Market by Application

7.1.4.4 Rest of North America Pulse Ingredients Market

7.1.4.4.1 Rest of North America Pulse Ingredients Market by Type

7.1.4.4.2 Rest of North America Pulse Ingredients Market by Source

7.1.4.4.3 Rest of North America Pulse Ingredients Market by Application

7.2 Europe Pulse Ingredients Market

7.2.1 Europe Pulse Ingredients Market by Type

7.2.1.1 Europe Pulse Flour Market by Country

7.2.1.2 Europe Pulse Starch Market by Country

7.2.1.3 Europe Pulse Protein Market by Country

7.2.1.4 Europe Pulse Fibers & Grits Market by Country

7.2.2 Europe Pulse Ingredients Market by Source

7.2.2.1 Europe Chickpeas Market by Country

7.2.2.2 Europe Peas Market by Country

7.2.2.3 Europe Beans Market by Country

7.2.2.4 Europe Lentils Market by Country

7.2.3 Europe Pulse Ingredients Market by Application

7.2.3.1 Europe Food & Beverages Market by Country

7.2.3.2 Europe Feed Market by Country

7.2.3.3 Europe Others Market by Country

7.2.4 Europe Pulse Ingredients Market by Country

7.2.4.1 Germany Pulse Ingredients Market

7.2.4.1.1 Germany Pulse Ingredients Market by Type

7.2.4.1.2 Germany Pulse Ingredients Market by Source

7.2.4.1.3 Germany Pulse Ingredients Market by Application

7.2.4.2 UK Pulse Ingredients Market

7.2.4.2.1 UK Pulse Ingredients Market by Type

7.2.4.2.2 UK Pulse Ingredients Market by Source

7.2.4.2.3 UK Pulse Ingredients Market by Application

7.2.4.3 France Pulse Ingredients Market

7.2.4.3.1 France Pulse Ingredients Market by Type

7.2.4.3.2 France Pulse Ingredients Market by Source

7.2.4.3.3 France Pulse Ingredients Market by Application

7.2.4.4 Russia Pulse Ingredients Market

7.2.4.4.1 Russia Pulse Ingredients Market by Type

7.2.4.4.2 Russia Pulse Ingredients Market by Source

7.2.4.4.3 Russia Pulse Ingredients Market by Application

7.2.4.5 Spain Pulse Ingredients Market

7.2.4.5.1 Spain Pulse Ingredients Market by Type

7.2.4.5.2 Spain Pulse Ingredients Market by Source

7.2.4.5.3 Spain Pulse Ingredients Market by Application

7.2.4.6 Italy Pulse Ingredients Market

7.2.4.6.1 Italy Pulse Ingredients Market by Type

7.2.4.6.2 Italy Pulse Ingredients Market by Source

7.2.4.6.3 Italy Pulse Ingredients Market by Application

7.2.4.7 Rest of Europe Pulse Ingredients Market

7.2.4.7.1 Rest of Europe Pulse Ingredients Market by Type

7.2.4.7.2 Rest of Europe Pulse Ingredients Market by Source

7.2.4.7.3 Rest of Europe Pulse Ingredients Market by Application

7.3 Asia Pacific Pulse Ingredients Market

7.3.1 Asia Pacific Pulse Ingredients Market by Type

7.3.1.1 Asia Pacific Pulse Flour Market by Country

7.3.1.2 Asia Pacific Pulse Starch Market by Country

7.3.1.3 Asia Pacific Pulse Protein Market by Country

7.3.1.4 Asia Pacific Pulse Fibers & Grits Market by Country

7.3.2 Asia Pacific Pulse Ingredients Market by Source

7.3.2.1 Asia Pacific Chickpeas Market by Country

7.3.2.2 Asia Pacific Peas Market by Country

7.3.2.3 Asia Pacific Beans Market by Country

7.3.2.4 Asia Pacific Lentils Market by Country

7.3.3 Asia Pacific Pulse Ingredients Market by Application

7.3.3.1 Asia Pacific Food & Beverages Market by Country

7.3.3.2 Asia Pacific Feed Market by Country

7.3.3.3 Asia Pacific Others Market by Country

7.3.4 Asia Pacific Pulse Ingredients Market by Country

7.3.4.1 India Pulse Ingredients Market

7.3.4.1.1 India Pulse Ingredients Market by Type

7.3.4.1.2 India Pulse Ingredients Market by Source

7.3.4.1.3 India Pulse Ingredients Market by Application

7.3.4.2 China Pulse Ingredients Market

7.3.4.2.1 China Pulse Ingredients Market by Type

7.3.4.2.2 China Pulse Ingredients Market by Source

7.3.4.2.3 China Pulse Ingredients Market by Application

7.3.4.3 Japan Pulse Ingredients Market

7.3.4.3.1 Japan Pulse Ingredients Market by Type

7.3.4.3.2 Japan Pulse Ingredients Market by Source

7.3.4.3.3 Japan Pulse Ingredients Market by Application

7.3.4.4 South Korea Pulse Ingredients Market

7.3.4.4.1 South Korea Pulse Ingredients Market by Type

7.3.4.4.2 South Korea Pulse Ingredients Market by Source

7.3.4.4.3 South Korea Pulse Ingredients Market by Application

7.3.4.5 Singapore Pulse Ingredients Market

7.3.4.5.1 Singapore Pulse Ingredients Market by Type

7.3.4.5.2 Singapore Pulse Ingredients Market by Source

7.3.4.5.3 Singapore Pulse Ingredients Market by Application

7.3.4.6 Malaysia Pulse Ingredients Market

7.3.4.6.1 Malaysia Pulse Ingredients Market by Type

7.3.4.6.2 Malaysia Pulse Ingredients Market by Source

7.3.4.6.3 Malaysia Pulse Ingredients Market by Application

7.3.4.7 Rest of Asia Pacific Pulse Ingredients Market

7.3.4.7.1 Rest of Asia Pacific Pulse Ingredients Market by Type

7.3.4.7.2 Rest of Asia Pacific Pulse Ingredients Market by Source

7.3.4.7.3 Rest of Asia Pacific Pulse Ingredients Market by Application

7.4 LAMEA Pulse Ingredients Market

7.4.1 LAMEA Pulse Ingredients Market by Type

7.4.1.1 LAMEA Pulse Flour Market by Country

7.4.1.2 LAMEA Pulse Starch Market by Country

7.4.1.3 LAMEA Pulse Protein Market by Country

7.4.1.4 LAMEA Pulse Fibers & Grits Market by Country

7.4.2 LAMEA Pulse Ingredients Market by Source

7.4.2.1 LAMEA Chickpeas Market by Country

7.4.2.2 LAMEA Peas Market by Country

7.4.2.3 LAMEA Beans Market by Country

7.4.2.4 LAMEA Lentils Market by Country

7.4.3 LAMEA Pulse Ingredients Market by Application

7.4.3.1 LAMEA Food & Beverages Market by Country

7.4.3.2 LAMEA Feed Market by Country

7.4.3.3 LAMEA Others Market by Country

7.4.4 LAMEA Pulse Ingredients Market by Country

7.4.4.1 Brazil Pulse Ingredients Market

7.4.4.1.1 Brazil Pulse Ingredients Market by Type

7.4.4.1.2 Brazil Pulse Ingredients Market by Source

7.4.4.1.3 Brazil Pulse Ingredients Market by Application

7.4.4.2 Argentina Pulse Ingredients Market

7.4.4.2.1 Argentina Pulse Ingredients Market by Type

7.4.4.2.2 Argentina Pulse Ingredients Market by Source

7.4.4.2.3 Argentina Pulse Ingredients Market by Application

7.4.4.3 UAE Pulse Ingredients Market

7.4.4.3.1 UAE Pulse Ingredients Market by Type

7.4.4.3.2 UAE Pulse Ingredients Market by Source

7.4.4.3.3 UAE Pulse Ingredients Market by Application

7.4.4.4 Saudi Arabia Pulse Ingredients Market

7.4.4.4.1 Saudi Arabia Pulse Ingredients Market by Type

7.4.4.4.2 Saudi Arabia Pulse Ingredients Market by Source

7.4.4.4.3 Saudi Arabia Pulse Ingredients Market by Application

7.4.4.5 South Africa Pulse Ingredients Market

7.4.4.5.1 South Africa Pulse Ingredients Market by Type

7.4.4.5.2 South Africa Pulse Ingredients Market by Source

7.4.4.5.3 South Africa Pulse Ingredients Market by Application

7.4.4.6 Nigeria Pulse Ingredients Market

7.4.4.6.1 Nigeria Pulse Ingredients Market by Type

7.4.4.6.2 Nigeria Pulse Ingredients Market by Source

7.4.4.6.3 Nigeria Pulse Ingredients Market by Application

7.4.4.7 Rest of LAMEA Pulse Ingredients Market

7.4.4.7.1 Rest of LAMEA Pulse Ingredients Market by Type

7.4.4.7.2 Rest of LAMEA Pulse Ingredients Market by Source

7.4.4.7.3 Rest of LAMEA Pulse Ingredients Market by Application

Chapter 8. Company Profiles

8.1 Tetra Laval International S.A. (Delaval)

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Regional Analysis of Tetra Pak

8.1.5 Regional Analysis of Sidel

8.1.6 Regional Analysis of DeLaval

8.2 GEA Group AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.3 Archer Daniels Midland Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Acquisition and Mergers:

8.3.5.3 Geographical Expansions:

8.4 Ingredion, Incorporated

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expense

8.4.5 Recent strategies and developments:

8.4.5.1 Product Launches and Product Expansions:

8.4.5.2 Acquisition and Mergers:

8.4.5.3 Geographical Expansions:

8.5 Batory Foods, Inc.

8.5.1 Company Overview

8.5.2 Recent strategies and developments:

8.5.2.1 Partnerships, Collaborations, and Agreements:

8.6 Roquette Freres SA

8.6.1 Company Overview

8.6.2 Recent strategies and developments:

8.6.2.1 Product Launches and Product Expansions:

8.7 The Scoular Company

8.7.1 Company Overview

8.7.2 Recent strategies and developments:

8.7.2.1 Acquisition and Mergers:

8.8 Axiom Foods, Inc.

8.8.1 Company Overview

8.8.2 Recent strategies and developments:

8.8.2.1 Partnerships, Collaborations, and Agreements:

8.9 Emsland Group

8.9.1 Company Overview

8.10. Dakota Dry Bean, Inc. (Dakota Ingredients)

8.10.1 Company Overview

TABLE 2 Global Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 3 Global Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 4 Global Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 5 Global Pulse Flour Market by Region, 2018 - 2021, USD Million

TABLE 6 Global Pulse Flour Market by Region, 2022 - 2028, USD Million

TABLE 7 Global Pulse Starch Market by Region, 2018 - 2021, USD Million

TABLE 8 Global Pulse Starch Market by Region, 2022 - 2028, USD Million

TABLE 9 Global Pulse Protein Market by Region, 2018 - 2021, USD Million

TABLE 10 Global Pulse Protein Market by Region, 2022 - 2028, USD Million

TABLE 11 Global Pulse Fibers & Grits Market by Region, 2018 - 2021, USD Million

TABLE 12 Global Pulse Fibers & Grits Market by Region, 2022 - 2028, USD Million

TABLE 13 Global Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 14 Global Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 15 Global Chickpeas Market by Region, 2018 - 2021, USD Million

TABLE 16 Global Chickpeas Market by Region, 2022 - 2028, USD Million

TABLE 17 Global Peas Market by Region, 2018 - 2021, USD Million

TABLE 18 Global Peas Market by Region, 2022 - 2028, USD Million

TABLE 19 Global Beans Market by Region, 2018 - 2021, USD Million

TABLE 20 Global Beans Market by Region, 2022 - 2028, USD Million

TABLE 21 Global Lentils Market by Region, 2018 - 2021, USD Million

TABLE 22 Global Lentils Market by Region, 2022 - 2028, USD Million

TABLE 23 Global Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 24 Global Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 25 Global Food & Beverages Market by Region, 2018 - 2021, USD Million

TABLE 26 Global Food & Beverages Market by Region, 2022 - 2028, USD Million

TABLE 27 Global Feed Market by Region, 2018 - 2021, USD Million

TABLE 28 Global Feed Market by Region, 2022 - 2028, USD Million

TABLE 29 Global Others Market by Region, 2018 - 2021, USD Million

TABLE 30 Global Others Market by Region, 2022 - 2028, USD Million

TABLE 31 Global Pulse Ingredients Market by Region, 2018 - 2021, USD Million

TABLE 32 Global Pulse Ingredients Market by Region, 2022 - 2028, USD Million

TABLE 33 North America Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 34 North America Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 35 North America Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 36 North America Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 37 North America Pulse Flour Market by Country, 2018 - 2021, USD Million

TABLE 38 North America Pulse Flour Market by Country, 2022 - 2028, USD Million

TABLE 39 North America Pulse Starch Market by Country, 2018 - 2021, USD Million

TABLE 40 North America Pulse Starch Market by Country, 2022 - 2028, USD Million

TABLE 41 North America Pulse Protein Market by Country, 2018 - 2021, USD Million

TABLE 42 North America Pulse Protein Market by Country, 2022 - 2028, USD Million

TABLE 43 North America Pulse Fibers & Grits Market by Country, 2018 - 2021, USD Million

TABLE 44 North America Pulse Fibers & Grits Market by Country, 2022 - 2028, USD Million

TABLE 45 North America Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 46 North America Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 47 North America Chickpeas Market by Country, 2018 - 2021, USD Million

TABLE 48 North America Chickpeas Market by Country, 2022 - 2028, USD Million

TABLE 49 North America Peas Market by Country, 2018 - 2021, USD Million

TABLE 50 North America Peas Market by Country, 2022 - 2028, USD Million

TABLE 51 North America Beans Market by Country, 2018 - 2021, USD Million

TABLE 52 North America Beans Market by Country, 2022 - 2028, USD Million

TABLE 53 North America Lentils Market by Country, 2018 - 2021, USD Million

TABLE 54 North America Lentils Market by Country, 2022 - 2028, USD Million

TABLE 55 North America Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 56 North America Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 57 North America Food & Beverages Market by Country, 2018 - 2021, USD Million

TABLE 58 North America Food & Beverages Market by Country, 2022 - 2028, USD Million

TABLE 59 North America Feed Market by Country, 2018 - 2021, USD Million

TABLE 60 North America Feed Market by Country, 2022 - 2028, USD Million

TABLE 61 North America Others Market by Country, 2018 - 2021, USD Million

TABLE 62 North America Others Market by Country, 2022 - 2028, USD Million

TABLE 63 North America Pulse Ingredients Market by Country, 2018 - 2021, USD Million

TABLE 64 North America Pulse Ingredients Market by Country, 2022 - 2028, USD Million

TABLE 65 US Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 66 US Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 67 US Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 68 US Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 69 US Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 70 US Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 71 US Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 72 US Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 73 Canada Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 74 Canada Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 75 Canada Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 76 Canada Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 77 Canada Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 78 Canada Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 79 Canada Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 80 Canada Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 81 Mexico Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 82 Mexico Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 83 Mexico Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 84 Mexico Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 85 Mexico Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 86 Mexico Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 87 Mexico Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 88 Mexico Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 89 Rest of North America Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 90 Rest of North America Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 91 Rest of North America Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 92 Rest of North America Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 93 Rest of North America Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 94 Rest of North America Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 95 Rest of North America Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 96 Rest of North America Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 97 Europe Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 98 Europe Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 99 Europe Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 100 Europe Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 101 Europe Pulse Flour Market by Country, 2018 - 2021, USD Million

TABLE 102 Europe Pulse Flour Market by Country, 2022 - 2028, USD Million

TABLE 103 Europe Pulse Starch Market by Country, 2018 - 2021, USD Million

TABLE 104 Europe Pulse Starch Market by Country, 2022 - 2028, USD Million

TABLE 105 Europe Pulse Protein Market by Country, 2018 - 2021, USD Million

TABLE 106 Europe Pulse Protein Market by Country, 2022 - 2028, USD Million

TABLE 107 Europe Pulse Fibers & Grits Market by Country, 2018 - 2021, USD Million

TABLE 108 Europe Pulse Fibers & Grits Market by Country, 2022 - 2028, USD Million

TABLE 109 Europe Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 110 Europe Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 111 Europe Chickpeas Market by Country, 2018 - 2021, USD Million

TABLE 112 Europe Chickpeas Market by Country, 2022 - 2028, USD Million

TABLE 113 Europe Peas Market by Country, 2018 - 2021, USD Million

TABLE 114 Europe Peas Market by Country, 2022 - 2028, USD Million

TABLE 115 Europe Beans Market by Country, 2018 - 2021, USD Million

TABLE 116 Europe Beans Market by Country, 2022 - 2028, USD Million

TABLE 117 Europe Lentils Market by Country, 2018 - 2021, USD Million

TABLE 118 Europe Lentils Market by Country, 2022 - 2028, USD Million

TABLE 119 Europe Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 120 Europe Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 121 Europe Food & Beverages Market by Country, 2018 - 2021, USD Million

TABLE 122 Europe Food & Beverages Market by Country, 2022 - 2028, USD Million

TABLE 123 Europe Feed Market by Country, 2018 - 2021, USD Million

TABLE 124 Europe Feed Market by Country, 2022 - 2028, USD Million

TABLE 125 Europe Others Market by Country, 2018 - 2021, USD Million

TABLE 126 Europe Others Market by Country, 2022 - 2028, USD Million

TABLE 127 Europe Pulse Ingredients Market by Country, 2018 - 2021, USD Million

TABLE 128 Europe Pulse Ingredients Market by Country, 2022 - 2028, USD Million

TABLE 129 Germany Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 130 Germany Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 131 Germany Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 132 Germany Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 133 Germany Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 134 Germany Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 135 Germany Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 136 Germany Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 137 UK Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 138 UK Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 139 UK Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 140 UK Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 141 UK Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 142 UK Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 143 UK Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 144 UK Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 145 France Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 146 France Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 147 France Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 148 France Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 149 France Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 150 France Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 151 France Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 152 France Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 153 Russia Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 154 Russia Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 155 Russia Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 156 Russia Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 157 Russia Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 158 Russia Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 159 Russia Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 160 Russia Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 161 Spain Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 162 Spain Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 163 Spain Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 164 Spain Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 165 Spain Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 166 Spain Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 167 Spain Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 168 Spain Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 169 Italy Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 170 Italy Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 171 Italy Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 172 Italy Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 173 Italy Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 174 Italy Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 175 Italy Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 176 Italy Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 177 Rest of Europe Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 178 Rest of Europe Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 179 Rest of Europe Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 180 Rest of Europe Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 181 Rest of Europe Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 182 Rest of Europe Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 183 Rest of Europe Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 184 Rest of Europe Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 185 Asia Pacific Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 186 Asia Pacific Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 187 Asia Pacific Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 188 Asia Pacific Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 189 Asia Pacific Pulse Flour Market by Country, 2018 - 2021, USD Million

TABLE 190 Asia Pacific Pulse Flour Market by Country, 2022 - 2028, USD Million

TABLE 191 Asia Pacific Pulse Starch Market by Country, 2018 - 2021, USD Million

TABLE 192 Asia Pacific Pulse Starch Market by Country, 2022 - 2028, USD Million

TABLE 193 Asia Pacific Pulse Protein Market by Country, 2018 - 2021, USD Million

TABLE 194 Asia Pacific Pulse Protein Market by Country, 2022 - 2028, USD Million

TABLE 195 Asia Pacific Pulse Fibers & Grits Market by Country, 2018 - 2021, USD Million

TABLE 196 Asia Pacific Pulse Fibers & Grits Market by Country, 2022 - 2028, USD Million

TABLE 197 Asia Pacific Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 198 Asia Pacific Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 199 Asia Pacific Chickpeas Market by Country, 2018 - 2021, USD Million

TABLE 200 Asia Pacific Chickpeas Market by Country, 2022 - 2028, USD Million

TABLE 201 Asia Pacific Peas Market by Country, 2018 - 2021, USD Million

TABLE 202 Asia Pacific Peas Market by Country, 2022 - 2028, USD Million

TABLE 203 Asia Pacific Beans Market by Country, 2018 - 2021, USD Million

TABLE 204 Asia Pacific Beans Market by Country, 2022 - 2028, USD Million

TABLE 205 Asia Pacific Lentils Market by Country, 2018 - 2021, USD Million

TABLE 206 Asia Pacific Lentils Market by Country, 2022 - 2028, USD Million

TABLE 207 Asia Pacific Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 208 Asia Pacific Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 209 Asia Pacific Food & Beverages Market by Country, 2018 - 2021, USD Million

TABLE 210 Asia Pacific Food & Beverages Market by Country, 2022 - 2028, USD Million

TABLE 211 Asia Pacific Feed Market by Country, 2018 - 2021, USD Million

TABLE 212 Asia Pacific Feed Market by Country, 2022 - 2028, USD Million

TABLE 213 Asia Pacific Others Market by Country, 2018 - 2021, USD Million

TABLE 214 Asia Pacific Others Market by Country, 2022 - 2028, USD Million

TABLE 215 Asia Pacific Pulse Ingredients Market by Country, 2018 - 2021, USD Million

TABLE 216 Asia Pacific Pulse Ingredients Market by Country, 2022 - 2028, USD Million

TABLE 217 India Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 218 India Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 219 India Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 220 India Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 221 India Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 222 India Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 223 India Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 224 India Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 225 China Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 226 China Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 227 China Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 228 China Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 229 China Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 230 China Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 231 China Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 232 China Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 233 Japan Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 234 Japan Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 235 Japan Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 236 Japan Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 237 Japan Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 238 Japan Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 239 Japan Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 240 Japan Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 241 South Korea Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 242 South Korea Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 243 South Korea Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 244 South Korea Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 245 South Korea Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 246 South Korea Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 247 South Korea Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 248 South Korea Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 249 Singapore Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 250 Singapore Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 251 Singapore Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 252 Singapore Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 253 Singapore Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 254 Singapore Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 255 Singapore Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 256 Singapore Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 257 Malaysia Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 258 Malaysia Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 259 Malaysia Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 260 Malaysia Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 261 Malaysia Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 262 Malaysia Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 263 Malaysia Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 264 Malaysia Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 265 Rest of Asia Pacific Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 266 Rest of Asia Pacific Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 267 Rest of Asia Pacific Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 268 Rest of Asia Pacific Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 269 Rest of Asia Pacific Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 270 Rest of Asia Pacific Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 271 Rest of Asia Pacific Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 272 Rest of Asia Pacific Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 273 LAMEA Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 274 LAMEA Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 275 LAMEA Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 276 LAMEA Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 277 LAMEA Pulse Flour Market by Country, 2018 - 2021, USD Million

TABLE 278 LAMEA Pulse Flour Market by Country, 2022 - 2028, USD Million

TABLE 279 LAMEA Pulse Starch Market by Country, 2018 - 2021, USD Million

TABLE 280 LAMEA Pulse Starch Market by Country, 2022 - 2028, USD Million

TABLE 281 LAMEA Pulse Protein Market by Country, 2018 - 2021, USD Million

TABLE 282 LAMEA Pulse Protein Market by Country, 2022 - 2028, USD Million

TABLE 283 LAMEA Pulse Fibers & Grits Market by Country, 2018 - 2021, USD Million

TABLE 284 LAMEA Pulse Fibers & Grits Market by Country, 2022 - 2028, USD Million

TABLE 285 LAMEA Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 286 LAMEA Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 287 LAMEA Chickpeas Market by Country, 2018 - 2021, USD Million

TABLE 288 LAMEA Chickpeas Market by Country, 2022 - 2028, USD Million

TABLE 289 LAMEA Peas Market by Country, 2018 - 2021, USD Million

TABLE 290 LAMEA Peas Market by Country, 2022 - 2028, USD Million

TABLE 291 LAMEA Beans Market by Country, 2018 - 2021, USD Million

TABLE 292 LAMEA Beans Market by Country, 2022 - 2028, USD Million

TABLE 293 LAMEA Lentils Market by Country, 2018 - 2021, USD Million

TABLE 294 LAMEA Lentils Market by Country, 2022 - 2028, USD Million

TABLE 295 LAMEA Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 296 LAMEA Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 297 LAMEA Food & Beverages Market by Country, 2018 - 2021, USD Million

TABLE 298 LAMEA Food & Beverages Market by Country, 2022 - 2028, USD Million

TABLE 299 LAMEA Feed Market by Country, 2018 - 2021, USD Million

TABLE 300 LAMEA Feed Market by Country, 2022 - 2028, USD Million

TABLE 301 LAMEA Others Market by Country, 2018 - 2021, USD Million

TABLE 302 LAMEA Others Market by Country, 2022 - 2028, USD Million

TABLE 303 LAMEA Pulse Ingredients Market by Country, 2018 - 2021, USD Million

TABLE 304 LAMEA Pulse Ingredients Market by Country, 2022 - 2028, USD Million

TABLE 305 Brazil Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 306 Brazil Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 307 Brazil Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 308 Brazil Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 309 Brazil Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 310 Brazil Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 311 Brazil Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 312 Brazil Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 313 Argentina Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 314 Argentina Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 315 Argentina Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 316 Argentina Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 317 Argentina Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 318 Argentina Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 319 Argentina Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 320 Argentina Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 321 UAE Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 322 UAE Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 323 UAE Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 324 UAE Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 325 UAE Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 326 UAE Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 327 UAE Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 328 UAE Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 329 Saudi Arabia Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 330 Saudi Arabia Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 331 Saudi Arabia Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 332 Saudi Arabia Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 333 Saudi Arabia Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 334 Saudi Arabia Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 335 Saudi Arabia Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 336 Saudi Arabia Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 337 South Africa Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 338 South Africa Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 339 South Africa Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 340 South Africa Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 341 South Africa Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 342 South Africa Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 343 South Africa Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 344 South Africa Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 345 Nigeria Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 346 Nigeria Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 347 Nigeria Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 348 Nigeria Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 349 Nigeria Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 350 Nigeria Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 351 Nigeria Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 352 Nigeria Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 353 Rest of LAMEA Pulse Ingredients Market, 2018 - 2021, USD Million

TABLE 354 Rest of LAMEA Pulse Ingredients Market, 2022 - 2028, USD Million

TABLE 355 Rest of LAMEA Pulse Ingredients Market by Type, 2018 - 2021, USD Million

TABLE 356 Rest of LAMEA Pulse Ingredients Market by Type, 2022 - 2028, USD Million

TABLE 357 Rest of LAMEA Pulse Ingredients Market by Source, 2018 - 2021, USD Million

TABLE 358 Rest of LAMEA Pulse Ingredients Market by Source, 2022 - 2028, USD Million

TABLE 359 Rest of LAMEA Pulse Ingredients Market by Application, 2018 - 2021, USD Million

TABLE 360 Rest of LAMEA Pulse Ingredients Market by Application, 2022 - 2028, USD Million

TABLE 361 Key Information – Tetra Laval International S.A.

TABLE 362 Key Information – GEA Group AG

TABLE 363 key Information – Archer Daniels Midland Company

TABLE 364 Key Information – Ingredion, Incorporated

TABLE 365 Key information – Batory Foods, Inc.

TABLE 366 key Information – Roquette Freres SA

TABLE 367 Key Information – The Scoular Company

TABLE 368 key information – Axiom Foods, Inc.

TABLE 369 Key Information – Emsland Group

TABLE 370 Key Information – Dakota Dry Bean, Inc.

List of Figures

FIG 1 Methodology for the research

FIG 2 Global Pulse Ingredients Market Share by Type, 2021

FIG 3 Global Pulse Ingredients Market Share by Type, 2028

FIG 4 Global Pulse Ingredients Market by Type, 2018 - 2028, USD Million

FIG 5 Global Pulse Ingredients Market Share by Source, 2021

FIG 6 Global Pulse Ingredients Market Share by Source, 2028

FIG 7 Global Pulse Ingredients Market by Source, 2018 - 2028, USD Million

FIG 8 Global Pulse Ingredients Market Share by Application, 2021

FIG 9 Global Pulse Ingredients Market Share by Application, 2028

FIG 10 Global Pulse Ingredients Market by Application, 2018 - 2028, USD Million

FIG 11 Global Pulse Ingredients Market Share by Region, 2021

FIG 12 Global Pulse Ingredients Market Share by Region, 2028

FIG 13 Global Pulse Ingredients Market by Region, 2018 - 2028, USD Million

FIG 14 Recent strategies and developments: Archer Daniels Midland Company

FIG 15 Recent strategies and developments: Ingredion, Incorporated